|

市场调查报告书

商品编码

1631597

全球热转印标籤市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Global Thermal Transfer Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

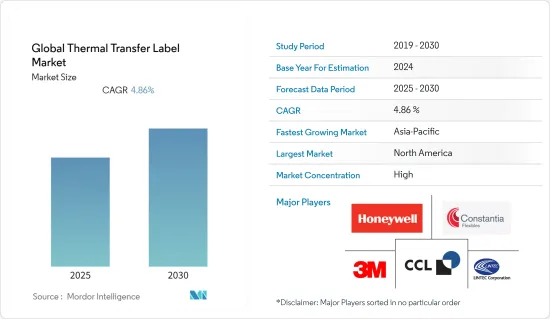

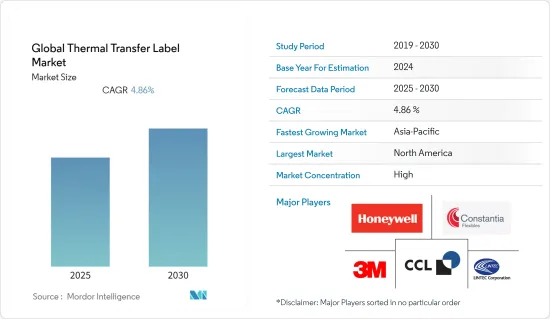

预计全球热转印标籤市场在预测期间的复合年增长率为 4.86%。

主要亮点

- 热转印标籤为短寿命应用提供了便利性和可靠性,以合理的列印速度提供低成本、高品质的条码。

- 银色聚酯热转印标籤和白色聚酯热转印标籤在长期户外耐久性标籤、化学桶标籤、焊接后电路基板製造、元件追踪标籤等方面具有很高的采用率。

- 此外,医疗保健产业对药品和疫苗的需求不断增长也推动了热转印标籤的采用。它是列印各种产品资讯的最佳选择,包括食品和饮料、医疗保健、零售标籤、追踪和运输行业。

- 该技术仍在研究大规模生产和扩大市场使用。缺乏列印对比度讯号、读取率低以及条码死点等挑战为市场带来了多项挑战。

热转印标籤市场趋势

医疗保健预计将录得强劲成长率

- 保健品标籤极为重要,因为标籤包含药物、用途、有效期限、配方和批号等资讯。药品标籤受到世界各国政府严格的规范和法规的控制。

- 许多标籤公司提供医疗保健产品标籤,包括芬欧蓝泰标籤和 CCL Industries。例如,芬欧蓝泰标籤为注射器、安瓿、静脉输液瓶、药筒、笔、管瓶和试管等小容量容器提供标籤,并使用可用于玻璃和塑胶容器的坚固标籤黏合剂。发光黏合剂选项是检测检测系统中检测缺失标籤的完美解决方案。

- 此外,公司正在投资研发活动,以产品系列多样化。例如,2021 年 5 月,全球大型公司的行动、标籤和 POS 印表机製造商 BIXOLON America Inc. 推出了新的 RFID 标籤印表机系列,以支援医疗保健等各种类型的小批量和大批量标籤应用。推出热转印桌上型印表机「XD5-40tR」。

在预测期内,北美将占据主要市场占有率

- 美国对标籤製造商的大部分需求来自食品和饮料行业。据估计,食品和饮料领域占北美使用的标籤的一半以上。

- 根据 FDA 的规定,包装和加工食品需要营养标籤,而且标籤检视很重要。 《食品安全现代化法案》要求消费者包装产品至少标识产品的供应商和目的地(消费者的零售店除外)并监控产品的通路,这是强制性的。

- 热转印聚酯是市场上最优选使用的标示材料。 FLEXcon 生产由高达 30% 的消费后废弃物(PCW) 製成的超级压光牛皮纸离型纸。该公司的 THERMLfilm NEXgen 标籤基材为符合 UL 的标籤应用提供了多种功能,包括与许多传统印刷方法(例如 UV、乳液和 TTR 印刷能力)的兼容性。

- 北美疫情危机持续,医疗设备、药品、疫苗等需求快速成长。

热转印标籤产业概况

热转印标籤市场竞争激烈,有大量全球和区域参与者。这些参与者占据了很大的市场份额,并致力于在全球范围内扩大基本客群。这些参与者正专注于研发活动、策略联盟以及其他有机和无机成长策略,以在预测期内保持在市场环境中。

- 2021 年 3 月,Mactac 透过专为仓库应用和工业标籤设计的反光膜扩展了 Lintec 标籤材料产品组合,从而实现了远距条码扫描。该薄膜由嵌入玻璃珠的聚酯材料製成,可在最远 50 英尺的距离内进行远距条码扫描。逆反射膜具有长期的室内耐久性和长达2年的室外耐久性。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 在销售成长的推动下,医疗保健产业对热转印标籤的需求增加

- 材料的进步预计将推动电子、食品和饮料行业的需求,特别是聚酯标籤。

- 扩大网上销售

- 市场挑战

- 缺乏能够承受恶劣气候条件的产品

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 市场机会

- 产业供应链分析

- 行业标准和法规

- 热转印标籤市场概况

- COVID-19 对热转印标籤市场的影响

第五章市场区隔

- 按材质

- 纸

- 聚酯纤维

- 聚丙烯

- 其他材料

- 按最终用户产业

- 饮食

- 卫生保健

- 物流/运输

- 工业产品

- 半导体/电子产品

- 按行业分類的其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他地区(拉丁美洲和中东非洲)

第六章 竞争状况

- 公司简介

- CCL Industries LLC

- 3M Company

- Lintec Corporation

- Constantia Flexibles

- Honeywell International

- Ricoh Holdings

- Zebra Corporation

- SATO Group

第七章 市场展望

简介目录

Product Code: 72150

The Global Thermal Transfer Label Market is expected to register a CAGR of 4.86% during the forecast period.

Key Highlights

- >

- It offers ease and reliability for short-life applications and delivers low-cost quality barcodes at reasonable print speeds. These characteristics make thermal transfer technology a choice for transit product identification and tracking labels for parcel distribution and outer case and pallet markings.

- Silver polyester thermal transfer labels and white polyester thermal transfer labels are witnessing high adoption in long-term outdoor durable labels, chemical drum labels, post-solder circuit board making, and part tracking labels.

- Furthermore, the mounting demand for medicines and vaccines in the healthcare industry also facilitated the adoption of thermal transfer labels. They are the best choice for printing information on various products in the food and beverages, healthcare, retail label, tracking, and transportation industries.

- This technology is yet to be studied further for mass production and extended use in the market. Problems, such as insufficient print contrast signal, poor scanning read rates, and dead spots on barcodes, have created some challenges for the market.

Thermal Transfer Label Market Trends

Healthcare is Expected to Register Significant Growth Rate

- Labeling healthcare products is vital, as labels contain information about drugs, their usage, lifetime, formulation, and lot number. Drug labeling is governed by stringent norms and regulations by the respective governments.

- Many labeling players, such as UPM Raflatac and CCL Industries, are providing Labeling for healthcare products. For instance, UPM Raflatac offers labeling for small volume containers, such as syringes, ampoules, IV bottles, cartridges, pens, vials, and test tubes, by robust label adhesives that can be used on any glass or plastic containers. Luminescent adhesive options are the perfect solution for detecting missing labels with a detection inspection system.

- Moreover, companies are investing in research and development activities to diversify their product portfolio. For instance, in May 2021, BIXOLON America Inc., a leading global Mobile, Label, and POS Printer manufacturer, announced the launch of its NEW RFID label printers line-up, the XD5-40tR, a thermal transfer desktop label printer to deal with various types of low and high volume labeling applications such as healthcare.

North America will Hold the Significant Market Share During the Forecast Period

- Label manufacturers in the United States experience most of the demand from the food and beverage segments. According to the estimates, the food and beverage segment accounts for more than half of the labels used in North America.

- According to the FDA, packaged and processed food items must have nutritional labeling that makes labeling important. The Food Safety Modernization Act mandates Consumer packaged goods to be able to, at minimum, identify the immediate supplier and recipient (other than retailers to consumers) of a product to monitor the path of their products.

- Thermal transfer polyester is the best-preferred label material that is used in the market. FLEXcon produces supercalendered kraft release liner made from up to 30% post-consumer waste (PCW). Its THERMLfilm NEXgen line of durable label substrates with several features for UL-compliant labeling applications, including compatibility with many conventional print methods, including UV and emulsion and TTR printability.

- In the ongoing crisis due to pandemics in North America, there has been a rapid rise in the demand for medical equipment, medicines, and vaccines that make the label market more sophisticated with increased adoption of thermal transfer labels as its time to market is lesser than other forms of labels.

Thermal Transfer Label Industry Overview

The thermal transfer label market is highly competitive, with a significant number of global and regional players. These players account for a considerable share in the market and focus on expanding their client base worldwide. These players focus on the research and development activities, strategic alliances, and other organic and inorganic growth strategies to stay in the market landscape over the forecast period.

- In March 2021, Mactac expanded its Lintec labelstock portfolio with retro-reflective films designed for warehouse applications and industrial labeling, enabling long-range barcode scanning. The films are constructed from a polyester material embedded with glass beads that enable long-range barcode scanning from up to 50 ft distance. Retro-reflective films feature long-term indoor durability and up to two years of outdoor durability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in the Demand for Thermal Transfer Labels in the Healthcare Industry Aided by Growth in Volume Sales

- 4.2.2 Material Advancements, Specifically in the Case of Polyester-based Labels Expected to Drive the Demand in the Electronics and Food and Beverages Sector

- 4.2.3 Growing Online Sales

- 4.3 Market Challenges

- 4.3.1 Lack of Products with Ability to Withstand Harsh Climatic Condition

- 4.4 Porters Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Market Opportunities

- 4.6 Industry Supply Chain Analysis

- 4.7 Industry Standards and Regulations

- 4.8 Overview of Thermal Labeling Market

- 4.9 Impact Of COVID-19 on the Thermal Transfer Label Market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Paper

- 5.1.2 Polyester

- 5.1.3 PP

- 5.1.4 Other Materials

- 5.2 By End-user Industry

- 5.2.1 Food and Beverages

- 5.2.2 Healthcare

- 5.2.3 Logistics and Transportation

- 5.2.4 Industrial Goods

- 5.2.5 Semiconductor and Electronics

- 5.2.6 Other End-user Verticals

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World (Latin America and Middle East & Africa)

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 CCL Industries LLC

- 6.1.2 3M Company

- 6.1.3 Lintec Corporation

- 6.1.4 Constantia Flexibles

- 6.1.5 Honeywell International

- 6.1.6 Ricoh Holdings

- 6.1.7 Zebra Corporation

- 6.1.8 SATO Group

7 MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219