|

市场调查报告书

商品编码

1631611

美国多租户(託管)资料中心:市场占有率分析、行业趋势和成长预测(2025-2030)US Multi-Tenant (Colocation) Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

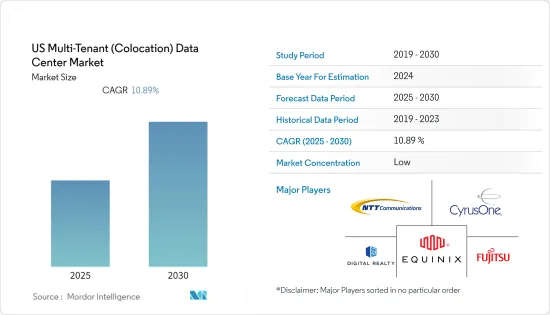

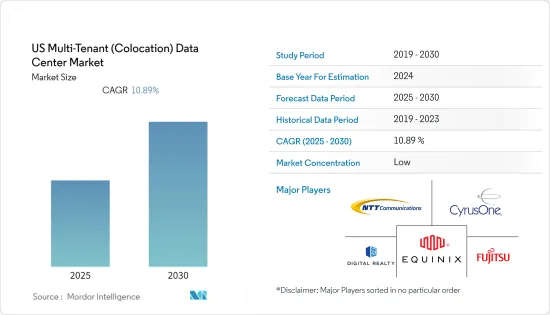

美国多租户资料中心市场预计在预测期内复合年增长率为 10.89%。

美国多租户(託管)资料中心市场预计在预测期内复合年增长率为 10.89%。

主要亮点

- 美国是资料中心数量领先的国家之一。在美国,由于主要超大规模租户的业务扩张,多租户资料中心租赁活动正在增加。

- 随着物联网和人工智慧等领域技术的快速进步,资料中心流量也不断增加。思科预计,到 2023 年,连网装置数量将从 2018 年的 27 亿增加到 46 亿。此外,预计到今年智慧型手机将占所有连网装置的 7%。

- 政府、零售、医疗保健、IT 和电信等终端用户垂直领域的快速数位化也正在扩大该国多租户市场的视野。政府的数位化战略是该国如何迈向全数位化营运的一个例子。

- 然而,对监管环境的依赖增加和严格的安全要求等挑战正在对该国的市场产生负面影响。 HIPAA 和 PCI DSS 等标准是标准查核点。

- 北维吉尼亚和硅谷等市场的空置率分别为 5.1% 和 1.6%,但电力和土地限制仍持续发挥作用。变电站交付延迟,而不是发电不足,是北维吉尼亚面临挑战的主要原因。硅谷在供电和发电方面都存在电力问题。这可能会使本已供应紧张的市场难以实现新的成长。两个市场都期望更多的垂直多层资料中心建筑来弥补所需区域有限的可开发土地。

- 疫情扰乱了託管服务供应商的建设和扩张计划。短期内,疫情为建设和扩建时间表增加了不确定性。除了封锁对劳动力的直接影响外,严格的程序准则也给业务带来了压力。

美国多租户(託管)资料中心市场趋势

医疗保健领域占有较大份额

- 医疗保健产业产生大量资料。许多医疗保健部门从临床试验和多个门诊病人记录中收集资料,并寻求从这些资料中进行有意义的分析。然而,许多参与收集此类资料的医院并没有相关基础设施。

- 因此,许多医疗保健组织面临着降低企业成本结构、提供全面合规性和高效解决方案的压力,并受到产生的资料量不断增加的限制。资料中心託管为任何公司提供了合适的节省成本的替代方案。

- 政府正在支持医疗机构向数位流程过渡。这为多租户资料中心市场创造了大量新机会。

- 2022 年 6 月,美国卫生与公众服务部 (HHS) 健康资讯科技协调员办公室 (ONC) 宣布提供 8000 万美元的公共卫生资讯学和技术劳动力承诺,以加强美国公共卫生资讯学和资料科学。发展计划(PHIT 人力资源计划)。

- 这私人公司医疗保健公司已确认与多租户资料中心提供者合作,以利用新的云端和空间管理功能。 2022 年 2 月,SunGard Availability Services 宣布为 NYU Langone Health 建成託管资料中心。该 1MW 设施占地面积5,000 平方英尺,拥有 2N 冗余,并采用 Vertiv 的 DSE 高效能资料中心冷却解决方案。该资料中心使纽约大学朗格尼分校能够更有效地管理空间、电力和支出。该医疗中心现在还可以存取公共云端和 SaaS 提供者。

云端应用程式的日益普及推动了市场

- 由于技术的应用和消费者对云端的日益关注,国内对云端基础的解决方案的需求正在迅速增长。该技术允许用户从远端位置存取资料。

- 越来越多的企业意识到将资料迁移到云端以节省成本和资源的重要性,而不是建置和维护本地基础设施,这推动了对云端基础的解决方案的需求。因此,云端基础的客服中心服务的采用正在增加。

- 公有云支出越来越多地被各种类型的企业使用,现在已成为 IT 预算中的关键项目。 37% 的公司每年在云端上的支出超过 1,200 万美元,80% 的公司在云端上的支出超过 120 万美元。中小型企业工作负载较少且规模较小,因此云端成本较低。然而,与去年相比,53% 的小型企业支出超过 120 万美元,高于 38%。

- 根据 Flexera 2022 年云端状况报告,多家公司一致认为,由于 COVID-19 大流行的影响,云端使用量可能会超出目前计画的使用量。由于线上使用量的增加,企业面临着满足日益增长的需求的压力,导致当今云端基础的应用程式需要过剩的容量。超过 59% 的企业预计云端使用量将大幅超出计划,约 50% 的中小企业 (SME) 预计云端使用量将会增加。

- 儘管 COVID-19 大流行改变了许多业务模式,但大多数受访者将企业成长和转型视为云端采用的主要驱动力。云端还在帮助企业应对封闭环境和不一致的IT基础设施、实现更快的开发并提高上市速度、敏捷性和应对力方面发挥了关键作用。

美国多租户(託管)资料中心产业概况

由于参与者众多,资料中心託管市场呈现碎片化状态。市场上的知名参与者包括 Digital Realty Trust, Inc.、NTT Communications、IBM Corporation、CyrusOne、Fujitsu Americas Inc. 和 Equinix Networks。而且,面对激烈的竞争,许多市场参与者采取了联盟、发展等各种策略来维持自己的地位并提高市场渗透率。

2023 年 1 月,Equinix 成为第一家透过扩大资料中心内的动作温度范围来降低总功耗的託管资料中心营运商。 Equinix 正在製定全球热力营运蓝图,以实现更有效率的冷却并减少碳排放,同时维持高端营运环境。随着供应链永续性成为现代企业环境倡议不可或缺的一部分,Equinix 预计将帮助成千上万的客户减少其资料中心营运中的范围 3 碳排放。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 对多租户资料中心产业的影响

- 多租户供应商对超大规模资料中心的主要投资分析

第五章市场动态

- 市场驱动因素

- 透过更多采用云端服务来振兴市场

- 由于批发资料中心多租户空间的成长(低基数),需求增加

- 越来越重视遵守资料法规和多租户设施的高成本效率正在促进中小型企业的采用

- 市场限制因素

- 取决于监管状况和严格的安全要求

第六章 市场细分

- 按解决方案类型

- 批发多租户

- 零售多租户

- 按组织规模

- 小型企业

- 大公司

- 按行业分类

- BFSI

- 製造业

- 资讯科技/通讯

- 医疗保健与生命科学

- 政府机构

- 娱乐和媒体

- 其他最终用户产业

第七章 竞争格局

- 公司简介

- Digital Reality Trust, Inc.

- NTT Communications

- Equinix Networks

- Fujitsu Americas Inc.(Fujitsu Ltd)

- CyrusOne

- Rackspace Inc.

- IBM Corporation

- Internap Corporation

- Coresite Reality Corporaton

- CenturyLink Inc.

- Quality Technology Services

- KDDI Corporation

第八章投资分析

第九章 市场机会及未来趋势

The US Multi-Tenant Data Center Market is expected to register a CAGR of 10.89% during the forecast period.

The United States multi-tenant (colocation) data center market is expected to register a CAGR of 10.89% during the forecast period.

Key Highlights

- The United States is one of the major countries in terms of the number of data centers. The multi-tenant data center leasing activity in the United States has been increasing due to the expansion activities of some of the major hyperscale tenants operating there.

- The growing data center traffic, in parallel to the rapid technology advancements in areas such as IoT and Artificial Intelligence, among others, is leading to an increase in the data traffic in the country. According to Cisco forecasts, there will be 4.6 billion networked devices by 2023, rising from 2.7 billion in 2018. In addition, smartphones are expected to account for 7% of all networked devices by the current year.

- The rapid digitization in end-user verticals such as government, retail, healthcare, IT, and Telecom is also expanding the horizon for the multi-tenant market in the country. The government's digitization strategy is an example that the country is moving towards complete digital operations.

- However, challenges such as a heightened dependence on the regulatory landscape & stringent security requirements have adversely impacted the market in the country. The standards such as HIPAA, PCI DSS, and others prevail as standard checkpoints.

- Markets like Northern Virginia and Silicon Valley, with 5.1% and 1.6% vacancy rates, respectively, are still impacted by electricity and land constraints. Delays in the delivery of the substations are the leading cause of the challenges Northern Virginia is experiencing, not a lack of power production. Both delivery-side and generation-side electricity problems exist in Silicon Valley. This could make it difficult for new growth in a market where supply is already constrained. Both markets expect more vertical, multi-story data center buildings to compensate for the limited amount of developable land in necessary districts.

- The pandemic resulted in disruptions in construction & expansion plans for colocation service providers. In the short term, the pandemic has created uncertainty regarding construction and expansion timelines. With a direct effect on labor due to lockdowns, the allied crunch caused in the operations was also partly due to stringent guidelines of procedures.

US Multi-Tenant (Colocation) Data Center Market Trends

Healthcare Sector Accounts for Significant Share

- The healthcare industry generates enormous amounts of data. Many healthcare departments are collecting data from clinical trials and several outpatient records to analyze and derive meaningful analysis from such data. However, most hospitals involved in such data collection are not equipped with relevant infrastructure.

- As a result, many healthcare institutes face pressure to reduce a company's cost structure, to deliver full regulatory compliance and efficient solutions, with constraints about the increasing amount of data generated. Datacenter collocation provides a suitable alternative to enable cost-saving means for any firm.

- The government has supported the growing transition of healthcare facilities to adopt digital processes. This has presented an influx of new opportunities for the market of multi-tenant data centers.

- In June 2022, the United States Department of Health and Human Services (HHS) Office of the National Coordinator for Health Information Technology (ONC) announced the establishment of a USD 80 million Public Health Informatics & Technology Workforce Development Program (PHIT Workforce Program) to strengthen US public health informatics and data science.

- Privatized healthcare companies are observed partnering with multi-tenant data center providers to leverage new cloud and space management capabilities. In February 2022, Sungard Availability Services announced the completion of a colocation data center for NYU Langone Health. The 1MW facility has 5,000 square feet of raised floor space, 2N redundancy, and utilizes Vertiv's DSE High-Efficiency data center cooling solution. The data center helped NYU Langone manage its space, power, and spending more effectively. It also allowed the medical center to access public clouds and SaaS providers.

Growing Adoption of Cloud Applications is Expected to Drive the Market

- The demand for cloud-based solutions in the country is surging due to the growing application of technology and consumer propensity toward the cloud. This technology allows the user to access the data from remote locations.

- The increasing realization among companies about the importance of saving money and resources by moving their data to the cloud rather than building and maintaining on-premise infrastructure is driving the demand for cloud-based solutions. Hence, the adoption of cloud-based contact center services is increasing with new.

- Public cloud spending has increased for businesses of all kinds due to increased usage, and it is now a sizeable line item in IT budgets. Enterprises reported spending over USD 12 million annually in 37% of cases and over USD 1.2 million in clouds in 80% of cases. SMBs would have cheaper cloud costs since they have fewer and smaller workloads. However, 53% of SMBs spent more than $1.2 million compared to last year, an increase from 38%.

- According to the Flexera 2022 State of the Cloud Report, several enterprises agreed that their cloud usage might exceed the planned use at present, owing to the impact of the COVID-19 pandemic. Enterprises are forced to meet increased demand as online usage grows, resulting in the need for the extra capacity required for current cloud-based applications. Over 59% of enterprises expect their cloud usage to be significantly higher than planned, and about 50% of small- and medium-sized enterprises (SMEs) expect their cloud usage to escalate.

- Even though the COVID-19 pandemic changed many business paradigms, most respondents cited company growth and transformation as the main forces behind cloud adoption. Cloud also played a crucial part in assisting businesses to survive lockdown situations and inconsistent IT infrastructure, allowing them to develop more quickly and improve speed to market, agility, and responsiveness.

US Multi-Tenant (Colocation) Data Center Industry Overview

The data center colocation market is fragmented due to the presence of many players. Some of the prominent players in the market include Digital Realty Trust, Inc., NTT Communications, IBM Corporation, CyrusOne, Fujitsu Americas Inc., and Equinix Networks, among others. Moreover, in the face of intense competition, many market players are adopting various strategies to maintain their position and increase their market penetration, such as partnerships and developments. Recent developments include:

In January 2023, Equinix, Inc. became the first colocation data center operator to commit to reducing its total power consumption by increasing the operating temperature ranges within its data centers. Equinix is developing a global roadmap for thermal operations to achieve more efficient cooling and reduce carbon impacts while maintaining its high-end operating environment. As supply chain sustainability becomes an essential aspect of modern businesses' environmental initiatives, it is expected to enable thousands of Equinix customers to reduce their Scope 3 carbon emissions associated with data center operations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on Multi-tenant Data Center Industry

- 4.5 Analysis of key investments made by multi-tenant providers in hyperscale data centers

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Cloud Services is expected to flourish the market

- 5.1.2 Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base)

- 5.1.3 Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 5.2 Market Restraints

- 5.2.1 Dependence on Regulatory Landscape & Stringent Security Requirements

6 MARKET SEGMENTATION

- 6.1 By Solution type

- 6.1.1 Wholesale Multi-tenant

- 6.1.2 Retail Multi-tenant

- 6.2 By Size of the organization

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By End-user Vertical

- 6.3.1 BFSI

- 6.3.2 Manufacturing

- 6.3.3 IT and Telecom

- 6.3.4 Healthcare & Lifesciences

- 6.3.5 Government

- 6.3.6 Entertainment and Media

- 6.3.7 Other End-user Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Digital Reality Trust, Inc.

- 7.1.2 NTT Communications

- 7.1.3 Equinix Networks

- 7.1.4 Fujitsu Americas Inc. (Fujitsu Ltd)

- 7.1.5 CyrusOne

- 7.1.6 Rackspace Inc.

- 7.1.7 IBM Corporation

- 7.1.8 Internap Corporation

- 7.1.9 Coresite Reality Corporaton

- 7.1.10 CenturyLink Inc.

- 7.1.11 Quality Technology Services

- 7.1.12 KDDI Corporation