|

市场调查报告书

商品编码

1631614

药品包装器材:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Pharma Packaging Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

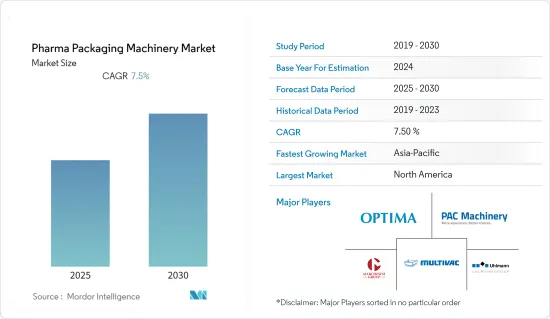

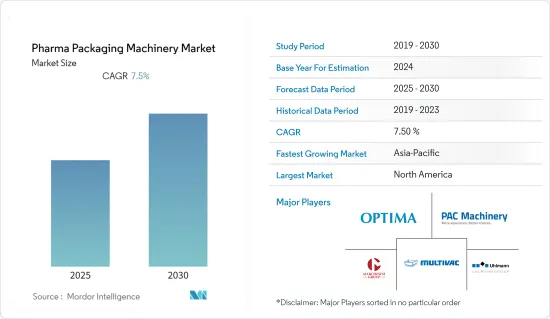

预计药品包装器材市场在预测期间内的复合年增长率为7.5%。

主要亮点

- 然而,随着 COVID-19 疫苗的供应,全球对药品包装的需求预计将在未来两到三年内增加。各个供应商正在扩大产能,以满足激增的需求。预计将增加全球製药业对包装器材的需求。

- 药品包装是采用相容材料製成的药品运送和储存的包装产品。根据药物的性质,选择各种材料类型和产品类型的包装产品,以提供保护、识别并确保封装药物的完整性。

- 由于多种因素,包括不断增加的全球监管规范以及对人口健康管理和发明的重视,世界各地的製药业都取得了显着发展。此外,对非处方药不断增长的需求和更知情的客户群也推动了市场的成长。

- 药品包装市场与药品市场有着直接的相关性。因为新药的需求不断增加,增加了对包装的需求,从而影响了所研究市场的成长。

药品包装器材市场趋势

製药业安全标准和法规的存在预计将推动市场发展

- 製药业受到严格监管,强调製造和包装过程的安全方面和永续性。整个医疗保健产业正在製定可追溯性法律,以打击假药和医疗设备。

- 例如,在美国,食品药物管理局(FDA) 负责监管药品的生产。美国食品药物管理局(FDA) 透过密切监控药品製造商是否遵守现行良好生产规范 (CGMP) 法规来确保药品品质。製药 CGMP 法规对用于製造、加工和包装药品的方法、设备和控制设定了最低要求。

- 同样,欧盟法规要求所有药品製造商在向欧盟供应产品时必须遵守欧盟良好生产规范(GMP)。製造商和进口商必须获得成员国主管机关的许可和註册。製造商和进口商定期接受欧盟主管机关或其他核准机构的检查,以检查是否符合欧盟 GMP。这些法规进一步增加了对维护良好的先进包装机械的需求,以避免产品召回。

北美占据主要市场占有率

- 由于製药业的显着成长,预计北美地区将在製药业先进包装机械的需求中占据主导地位,从而推动该地区的药品製造业。此外,美国是全球最大的製药市场,约占製药和生技市场研发支出的一半。

- 已证实,COVID-19疫苗的开发导致相关企业与包装公司签订了生产注射器和管瓶的合约。这些包装趋势正在推动包装设备市场的成长。

- 此外,随着疫苗产能的扩大,相关包装工程公司和OEM对无菌填充线的需求也随之增加。为了应对这些趋势,药品包装器材製造商正在推出完全整合的系统、具有模组化概念的即插即用解决方案。

- 此外,根据人类资料科学公司 IQVIA 的数据,全球药品销售额预计将从 2019 年的 4,910 亿美元增至 2023 年的 1.5 兆美元。美国无论是在消费或开发方面都在医药市场上占据主导地位。根据 STAT 的数据,该国处方药支出预计将在 2023 年达到 6,000 亿美元,高于 2019 年估计的 5,000 亿美元。

- 需要安全处理和安全遏制高活性药物的适当基础设施,需要特别适合高活性药物的分析能力,以及需要适当的计划管理(包括适当的实施、执行和完成)。随着该地区药品製造业的成长,这些趋势预计将推动该地区包装器材的需求。

药品包装器材产业概况

随着全球各种机械供应商的出现,全球药品包装器材市场的竞争格局适度分散。机械供应商正在参与策略性投资和合作伙伴关係以实现成长。

- 2021 年 2 月 - Promac 收购了 Serpa Packaging Solutions,这是一家为製药、医疗设备、营养品、食品、化妆品和个人护理市场提供装盒和终端包装系统的製造商。 Serpa 的加入为 ProMach 的产品组合带来了自动化包装系统,扩展了其专业的二次包装器材和生产线整合能力。

- 2020 年 10 月 - 合约包装和临床供应服务提供者Sharp Corporation宣布对设施产能投资 1000 万美元,以直接支持生技药品和注射市场的客户需求。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 市场驱动因素

- 主要最终用户市场的高需求

- 持续的技术开发

- 製药业安全标准与法规的影响

- 市场限制因素

- 高成本和进口关税对新客户来说是一项挑战

- 资本密集型製造流程

- COVID-19对包装器材产业的影响

- 技术简介

第五章市场区隔

- 按机器类型

- 初级包装

- 无菌灌装封口设备

- 灌装旋盖设备

- 泡壳包装机

- 其他的

- 二次包装

- 装盒机设备

- 装箱包装设备

- 包装设备

- 托盘包装机

- 其他的

- 标籤和序列化

- 瓶子和安瓿的贴标和序列化设备

- 纸箱贴标/系列设备

- 其他的

- 初级包装

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- Syntegon Technology GmbH(Robert Bosch GmbH)

- Romaco Holding GmbH

- Optima Packaging Group GmbH

- Marchesini Group SPA

- Mesoblast Limited

- IMA Industria Macchine Automatiche SpA

- MULTIVAC Group

- Ishida Co. Limited

- PAC Machinery Group

- Uhlmann Group

- Accutek Packaging Equipment Companies, Inc.

- Vanguard Pharmaceutical Machinery, Inc.

- MG2 srl

第七章 市场投资机会及未来前景

简介目录

Product Code: 72345

The Pharma Packaging Machinery Market is expected to register a CAGR of 7.5% during the forecast period.

Key Highlights

- However, the global demand for pharmaceutical packaging is expected to increase for the next two to three years for the COVID-19 vaccine supply. Various vendors have been expanding their capacity to meet the surge in demand. This is expected to increase the demand for packaging machinery for the pharmaceutical industry globally.

- Pharmaceutical packaging is packaging products made using compatible materials for the transfer and storage of drugs. Based on the nature of the drug, packaging products are chosen from a range of material types and product types, provide protection, identification, and ensure the enclosed drug product's integrity.

- The pharmaceutical industry across the world has evolved considerably, owing to various factors that include the growth in regulatory norms worldwide and focus on population health management and invention. In addition, the growth in the demand for over-the-counter medicines and a more informed customer base is also driving the growth of the market.

- The pharmaceutical packaging market has a direct correlation with the pharmaceutical market. Any changes in demand for pharmaceutical drugs will impact the packaging market positively, as higher demand for new drugs leads to a greater need for packaging, thereby impacting the growth of the studied market.

Pharmaceutical Packaging Machinery Market Trends

The Presence of Safety Standards & Regulations in the Pharmaceutical Industry Expected to Drive the Market

- The pharmaceutical industry is highly regulated and is emphasizing the safety and sustainability aspects of manufacturing and packaging processes. Traceability legislations across the healthcare sector have been established to counter counterfeit drugs and medical devices.

- For instance, the US Food and Drug Administration (FDA) regulates the manufacturing of drugs in the United States. It ensures the quality of drug products by carefully monitoring drug manufacturers' compliance with its Current Good Manufacturing Practice (CGMP) regulations. The CGMP regulations for drugs have set the minimum requirements for the methods, facilities, and controls used in the manufacturing, processing, and packaging of a drug.

- Similarly, the EU regulations mandate all pharmaceutical manufacturers to comply with the EU Good Manufacturing Practices (GMP), if they want to supply products to the EU. The manufacturers and importers must be authorized and registered by a competent authority from a member state. The manufacturers and importers are regularly inspected by an EU competent authority or other approved authority to check the compliance with the EU GMP. Hence, the presence of such regulations further necessitates the need for well-maintained and advanced packaging machinery to avoid product recalls.

North America Hold a Significant Market Share

- The North American region is expected to dominate the market in terms of demand for advanced packaging machinery for the pharma industry, owing to the significant growth of the pharmaceutical industry in the region, thereby driving the manufacturing of drugs in the region. Also, the United States is the largest market for drugs worldwide and accounts for about half of the R&D expenditure in the pharmaceutical and biotechnology markets.

- It is observed that the development of COVID-19 vaccines has led the allied companies to set up agreements with packaging companies for manufacturing syringes and vials. Such packaging trends acts as a major driver of growth in the packaging equipment market.

- Also, expanding capacities for vaccines has led the allied packaging engineering companies and OEMs witness an increasing demand for aseptic filling lines. in a response to such trends, pharaceutical packaging machinery players are launching fully integrated systems, plug-and-play solutions with modular concepts.

- Furthermore, according to IQVIA, a human data science company, pharmaceutical sales worldwide are anticipated to reach USD 1.5 trillion in 2023 from USD 491 billion in 2019. The United States dominates the pharmaceutical market, both in consumption and development. According to STAT, prescription drug spending in the nation is considered to add up to USD 600 billion by 2023, up from an estimated USD 500 billion in 2019.

- The need to have proper infrastructure for the safe handling and safe containment of highly potent drugs, as well as the need for suitable analytical capabilities, particularly for high potency drugs, proper project management (that includes proper induction, running, and completion) highlight the need for R&D. Such trends are expected to boost the demand for packaging machinery in the region, with the growing manufacturing of drugs in the region.

Pharmaceutical Packaging Machinery Industry Overview

The competitive landscape of the global pharmaceutical packaging machinery market is moderately fragmented with the emergence of various machinery providers across the globe. The machinery providers are involved in strategic investments and partnerships for growth.

- February 2021 - ProMach acquired Serpa Packaging Solutions, a manufacturer of cartoning and end of line packaging systems for the pharmaceutical, medical device, nutraceutical, food, cosmetics, and personal care markets. The addition of Serpa brings automated cartoning systems into ProMach's portfolio and expands its specialized secondary packaging machinery and line integration capabilities.

- October 2020 - Sharp, a provider of contract packaging and clinical supply services announced an investment of USD 10 million in equipment capabilities to directly support client demand in the biologics and injectables market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 High Demand in Key End-user Markets

- 4.4.2 Ongoing Technological Developments

- 4.4.3 Impact of Safety Standards & Regulations in the Pharmaceutical Industry

- 4.5 Market Restraints

- 4.5.1 High Costs and Import Duties Pose a Challenge for New Customers

- 4.5.2 Capital Intensive Manufacturing Process

- 4.6 Impact of COVID-19 on the Packaging Machinery Industry

- 4.7 TECHNOLOGY SNAPSHOT

5 MARKET SEGMENTATION

- 5.1 By Machinery Type

- 5.1.1 Primary Packaging

- 5.1.1.1 Aseptic Filling and Sealing Equipmen

- 5.1.1.2 Bottle Filling and Capping Equipment

- 5.1.1.3 Blister Packaging Equipment

- 5.1.1.4 Others

- 5.1.2 Secondary Packaging

- 5.1.2.1 Cartoning Equipment

- 5.1.2.2 Case Packaging Equipment

- 5.1.2.3 Wrapping Equipment

- 5.1.2.4 Tray Packing Equipment

- 5.1.2.5 Others

- 5.1.3 Labelling and Serialization

- 5.1.3.1 Bottle and Ampule Labelling and Serialization Equipment

- 5.1.3.2 Carton Labelling and Serialization Equipment

- 5.1.3.3 Others

- 5.1.1 Primary Packaging

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Syntegon Technology GmbH (Robert Bosch GmbH)

- 6.1.2 Romaco Holding GmbH

- 6.1.3 Optima Packaging Group GmbH

- 6.1.4 Marchesini Group SPA

- 6.1.5 Mesoblast Limited

- 6.1.6 I.M.A Industria Macchine Automatiche S.p.A

- 6.1.7 MULTIVAC Group

- 6.1.8 Ishida Co. Limited

- 6.1.9 PAC Machinery Group

- 6.1.10 Uhlmann Group

- 6.1.11 Accutek Packaging Equipment Companies, Inc.

- 6.1.12 Vanguard Pharmaceutical Machinery, Inc.

- 6.1.13 MG2 s.r.l.

7 INVESTMENT OPPORTUNITIES AND FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219