|

市场调查报告书

商品编码

1631623

东南亚太阳能 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Southeast Asia Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

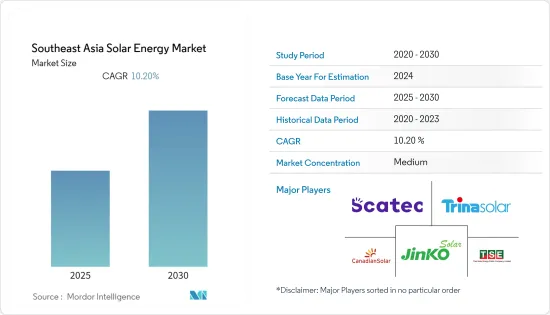

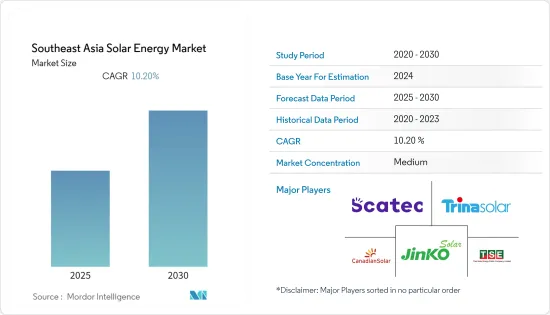

东南亚太阳能市场预计在预测期内复合年增长率为10.2%

主要亮点

- 从中期来看,增加采用可再生能源以减少碳排放以及光伏组件价格下降等因素将推动太阳能市场的发展。

- 另一方面,水力发电等替代可再生技术的采用正在增加,预计将阻碍研究期间的市场成长。

- 政府对可再生能源的支持措施和太阳能设备的技术进步预计将增加太阳能公司在未来几年在该地区安装太阳能发电厂的机会。

- 由于电力需求不断增长、可再生能源装置增加以及与国家电网的连接,越南预计将成为东南亚最大的市场。

东南亚太阳能市场趋势

太阳能发电可望主导市场

- 东南亚是成长最快、利润丰厚的太阳能市场之一,也是全球太阳能产业成长最有希望的地区之一。

- 2022 年 7 月,东南亚清洁能源公司和承包工程、采购、施工和试运行(EPCC)服务供应商Solarvest Holdings Berhad 宣布将参与马来西亚大型太阳能发电计画 (LSS) 的四个计划。 Solar 订购了93MW 先进的薄膜光伏(PV) 太阳能板。

- 该地区太阳能产业的成长是由不断增长的电力需求、该地区丰富的太阳能资源以及支持可再生能源的倡议所推动的。

- 该地区的政策制定者正在努力确保能源产业走上一条安全、负担得起的长期道路。这包括让人们更容易投资太阳能和基础设施。

- 根据国际可再生能源机构的数据,2022年泰国总设备容量为3,060兆瓦。随着可再生能源和绿色能源需求的增加,太阳能发电能力预计将在预测期内增加。

- 2022年7月,越南工业部(MOIT)向总理提交了风电和太阳能发电工程过渡进程的报告。在这项研究中,MOIT提出了各种建议,直接解决突出的风能和太阳能发电工程以及与风能和太阳能发电工程开发相关的挑战。

- 因此,考虑到上述因素和即将开展的计划,太阳能发电预计将在研究期间在市场上占据重要地位。

越南主导市场

- 2030年,越南的能源需求预计每年增长10%以上,需要电力容量增加一倍。越南政府正迅速实现能源结构多元化,包括计划增加可再生能源发电量。

- 由于地理条件优越,越南太阳能生产潜力大,年日照时数为1600至2700小时,平均太阳直接辐射量为每平方公尺4至5千瓦时/天。太阳能发电工程还拥有良好的电网基础设施、政府激励措施和标准购电协议(PPA)。

- 2022年,越南太阳能发电装置容量将达到18.5GW,较2021年成长9.8%。越南太阳能发电市场的巨大热潮得益于2017年推出的极具吸引力的上网电价补贴(FIT)以及2020年委託的多个大型太阳能发电工程。

- 2023年6月,法国能源管理公司GreenYellow越南子公司GreenYellow宣布完成Dong Anh Chainsaw的750KWp屋顶太阳能发电工程。该计划是GreenYellow越南最大的屋顶太阳能发电工程。这些太阳能板将安装在越南河内东英县Dong Anh C&F工厂的屋顶上,每年发电量将超过100万千瓦时。

- 因此,这些计划的运作预计将在研究期间振兴越南太阳能产业。

东南亚太阳能产业概况

东南亚太阳能市场适度细分。市场主要企业(排名不分先后)包括阿特斯阳光电力公司、晶科能源控股公司、天合光能有限公司、泰国太阳能公共有限公司和Scatec ASA。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 东南亚太阳能装置容量及预测至2028年(单位:GW)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 增加可再生能源的采用以减少碳排放

- 太阳能模组价格下降

- 抑制因素

- 更多采用水力发电等替代性可再生技术

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 市场类型

- 太阳能

- 聚光型太阳光电

- 地区

- 越南

- 印尼

- 菲律宾

- 泰国

- 马来西亚

- 其他东南亚地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Canadian Solar Inc.

- JinkoSolar Holding Co. Ltd.

- Trina Solar Limited

- Thai Solar Energy Public Company Limited

- Scatec ASA

- Vena Energy Solar Pte Ltd.

- Blue Solar Co., Ltd.

- Johnsolar Energy Co. Ltd.

- LONGi Green Energy Technology Co Ltd.

- Solarie Energy

第七章市场机会与未来趋势

- 政府对可再生能源和太阳能设备技术进步的支持措施

简介目录

Product Code: 72378

The Southeast Asia Solar Energy Market is expected to register a CAGR of 10.2% during the forecast period.

Key Highlights

- Over the medium term, factors such as increasing renewable energy installation to reduce carbon emissions and the decreasing price of solar PV modules drive the market for solar Energy.

- On the other hand, the increasing adoption of alternative renewable technologies like hydropower is expected to hinder market growth during the study period.

- Nevertheless, supportive government policies towards renewable Energy and technological advancements in solar energy equipment are expected to increase the opportunity for solar energy companies to install solar PV plants in the region during the upcoming years.

- Vietnam is expected to be the largest market in Southeast Asia due to its increasing demand for electricity and the rising number of renewable energy installations, and their connection to the country's grid.

Southeast Asia Solar Energy Market Trends

Solar Photovoltaic Expected to Dominate the Market

- Southeast Asia is one of the lucrative solar energy markets with the fastest growth and one of the most promising places for the solar photovoltaic industry to grow worldwide.

- In July 2022, Solarvest Holdings Berhad, a Southeast Asia clean energy company and turnkey engineering, procurement, construction, and commissioning (EPCC) service provider, ordered 93 MW of advanced thin-film photovoltaic (PV) solar panels from First Solar for use in their four projects in Malaysia's Large Scale Solar Program (LSS).

- Some things that have helped the solar power industry grow in the region are the rising need for electricity, the many solar resources in the area, and the policies supporting renewable energy.

- Also, policymakers in different countries in the region have been working harder to make sure the energy sector has a safe, affordable, and long-term path. This includes making things easier for people to invest in solar power generation and infrastructure.

- According to the International Renewable Energy Agency, the total solar PV installed capacity accounted for 3060 MW in Thailand in 2022. The solar PV capacity is expected to grow in the forecast period as demand for renewable power and greener energy increases.

- In July 2022, the Ministry of Industry and Trade (MOIT) of Vietnam submitted a report to the Prime Minister on the process for transitional wind and solar power projects. The MOIT presented various recommendations in this study to directly address challenges for outstanding wind and solar power projects and the development of wind and solar power projects.

- Thus, owing to the above factors and upcoming projects are taken into account, solar PV is expected to be a significant part of the market during the study period.

Vietnam to Dominate the Market

- The energy demand in Vietnam is projected to increase by more than 10% annually through 2030 and requires power capacity to double; the Vietnamese government is moving quickly to diversify its energy mix, including plans to generate more power from renewable sources.

- Based on its favorable geographical conditions, Vietnam has a high potential for solar energy production, with 1,600-2,700 sunlight hours per year and an average direct normal irradiance of 4-5 kWh per sqm per day. The country also has a well-developed grid infrastructure, government incentives, and a standardized power purchase agreement (PPA) for solar power projects.

- In 2022, Vietnam's total installed solar photovoltaic (PV) capacity reached 18.5 GW, representing an increase of 9.8% compared to 2021. This huge rush in the Vietnamese solar PV market can be attributed to the attractive feed-in-tariff (FIT) rates introduced in 2017 and a few large-scale solar projects commissioned in 2020.

- In June 2023, GreenYellow Vietnam, a subsidiary of French energy management company GreenYellow, announced to completion of a 750 KWp rooftop solar power project for Dong Anh Chainsaw. This project is the largest rooftop solar power project for GreenYellow Vietnam. The solar panels were installed on the roof of Dong Anh C&F's factory in Dong Anh District, Hanoi, Vietnam, and they will generate over 1,000,0000 KWh of electricity per year.

- Therefore, commissioning these projects is likely to boost the sector in Vietnam during the study period.

Southeast Asia Solar Energy Industry Overview

The Southeast Asia Solar Energy Market is moderately fragmented. Some of the major players in the market (in no particular order) include Canadian Solar Inc., JinkoSolar Holding Co. Ltd., Trina Solar Limited, Thai Solar Energy Public Company Limited, and Scatec ASA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Southeast Asia Solar Energy Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Renewable Energy Installation to Reduce the Carbon Emission

- 4.5.1.2 The Decreasing Price of Solar PV Modules

- 4.5.2 Restraints

- 4.5.2.1 Increasing Adoption of Alternative Renewable Technologies like Hydropower

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Solar Photovoltaic

- 5.1.2 Concentrated Solar Power

- 5.2 Geography

- 5.2.1 Vietnam

- 5.2.2 Indonesia

- 5.2.3 Philippines

- 5.2.4 Thailand

- 5.2.5 Malaysia

- 5.2.6 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Canadian Solar Inc.

- 6.3.2 JinkoSolar Holding Co. Ltd.

- 6.3.3 Trina Solar Limited

- 6.3.4 Thai Solar Energy Public Company Limited

- 6.3.5 Scatec ASA

- 6.3.6 Vena Energy Solar Pte Ltd.

- 6.3.7 Blue Solar Co., Ltd.

- 6.3.8 Johnsolar Energy Co. Ltd.

- 6.3.9 LONGi Green Energy Technology Co Ltd.

- 6.3.10 Solarie Energy

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Supportive Government Policies Towards Renewable Energy and Technological Advancements in Solar Energy Equipment

02-2729-4219

+886-2-2729-4219