|

市场调查报告书

商品编码

1631628

电源分接头:市场占有率分析、产业趋势、成长预测(2025-2030)Power Strip - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

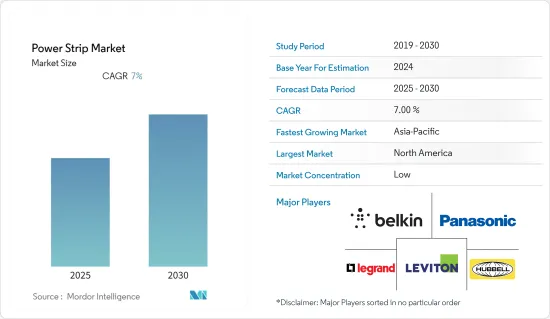

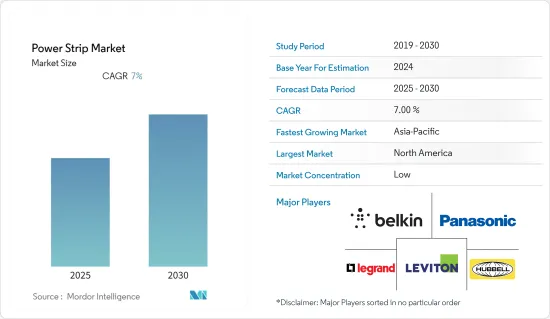

预计电源分接头市场在预测期内复合年增长率为 7%

主要亮点

- 当您需要的地方没有插座时,电源分接头非常有用。有时您需要同时运行多个电器产品,但没有足够的插座来容纳它们。在这种情况下,电源分接头对于连接和使用所有设备至关重要。电源分接头便携且方便,因此您可以在任何地方使用它们。

- 电源分接头透过侦测连接到电源分接头插座的装置何时处于空閒状态来帮助您节省能源。当设备停止运作时,电源分接头会在指定时间内侦测到该装置并断开插座的电源。相信这样会节省更多的能源,降低分机的耗电量。预计电源分接头将透过减少待机功耗和有效能源浪费来节省更多能源。

- 对稳定供电和节能的需求不断增长是电源分接头产业的主要驱动因素。许多家用电子电器产品即使在关闭时也会继续消耗电力,这种现象称为「吸血鬼负载」。根据美国能源局国家可再生能源实验室 (NREL) 的数据,吸血鬼负载使美国家庭平均每年平均成本增加约 200 美元。这些浪费的能源本来可以为大约 1100 万户家庭供电。

- 整体而言,全球电源分接头市场较为分散,全球多家家电製造商及众多中小企业提供多种电源分接头产品,以满足各细分市场终端用户的多样化需求。由于安装类型和应用的多样性,电源分接头产品需要不同的规格。 WiFi、USB等技术的整合为市场增加了大量的产品差异化,这有望有望有利于中小企业占领大量市场占有率。

- COVID-19 的爆发一直是电源分接头市场的主要驱动因素。在家工作导致对笔记型电脑和桌上型电脑的需求激增,因为办公室工作人员和学生被迫快速创建家庭办公室来完成在家工作和线上学习。消费性电子市场正在经历快速成长,随着通讯和远端工作成为常态,这种需求预计将持续下去。由于住宅应用中电子设备密度的增加,对电源分接头的需求增加,这一趋势对电源分接头市场产生了积极影响。

- 预计电源分接头市场将受到严格的规则和法规的阻碍。电源分接头製造商在製造产品时必须满足多项标准和合规性。这些规则可能因国家/地区而异。所有电子设备和设备必须符合其製造地区监管机构制定的要求。因此,製造商面临重大挑战,因为在一个地区合规的电源分接头可能在另一个地区不合规。

电源分接头市场趋势

住宅电子设备增加

- 疫情前的市场环境也呈现家用电子电器市场的稳定成长。例如,2020 年 1 月,消费者技术协会 (美国) 预测美国消费科技零售额将为 4,220 亿美元,较 2019与前一年同期比较(YOY) 成长 4%。该收入包括智慧型手机、笔记型电脑和电视等传统家用电子电器产品的销售,以及串流媒体服务和新兴技术的收入。此外,2021年7月,CTA预测,2021年美国科技零售收入将达4,870亿美元。

- 推动消费性电子产品未来成长的关键因素包括对智慧型手机、运算设备、人工智慧和语音辨识等新技术的需求不断增加。许多电子设备的更换週期和价格下降预计将鼓励持续消费。

- 根据国际劳工组织(2020)的数据,在家工作的员工数量预计将增加 3 亿,而根据 Lalani 和 Lee 在世界经济论坛(2020)上的报导,大约 13 亿学生将在工作我从家里开始线上学习。休閒也已转向数位活动,需要升级显示器、游戏机、电视和其他小工具等电子设备。

- 由于 COVID-19 大流行导致全球停工和居家令,许多公司被迫过渡到远距工作。随着在家工作的兴起以及支援在家工作的电子产品的购买,家用电子电器市场最初经历了快速成长。

- 随着住宅和办公室使用越来越多的电子设备,连接它们的插座数量也在增加。电源分接头可以透过一个插座支援多个设备。此外,突波保护也越来越多地被使用,因为它提供了电源分接头的优点,并保护连接到电源分接头的设备免受大于设备可处理电压的电源突波的影响。

亚太地区预计将经历显着成长

- 亚太地区的电网大部分是上世纪设计的,并不是为了应对太阳能和风力发电的波动和波动特性而建造的。可再生能源给电网营运商带来了挑战,因为其发电量全天和季节性波动很大,扰乱了供需情况。结果是该地区突然突波电涌。突波保护电源分接头可以帮助抑制这种情况并保护您的电气和电子设备。根据世界经济论坛的数据,亚洲的目标是到 2025 年,23% 的初级能源来自可再生能源。因此,该区域具有很大的突波保护潜力。

- 受新冠肺炎 (COVID-19) 大流行影响,亚太地区的家用电子电器产品销售额略有下降,但预计到 2022 年将恢復并继续成长。亚太地区有许多新兴经济体,其家用电子电器产品拥有量较低,但消费支出不断上升,提供了丰富的成长机会。

- 由于一些市场对智慧型电视、液晶电视和OLED电视的持续需求,该地区的家庭影片产业表现良好。在印度,Netflix 和 MX Player 等本地和国际参与企业的串流内容的兴起正在推动对智慧电视的需求。随着都市化进程的加快和人均电子设备数量的迅速增加,平均住宅面积变得越来越小,亚太地区对电源分接头的需求预计将增长。

- 国内企业正在加大在电源分接头市场的布局,扩大整体市场份额。松下安佳、德力西电气等国内小型企业以需求为导向,提供与国际企业相比价格合理的产品。

- 自疫情爆发以来,教育领域对亚太地区桌上型电脑和笔记型电脑销售的成长做出了重大贡献。桌上型电脑和笔记型电脑已经分发,以支援向线上学习的过渡,预计未来教室将变得混合。目前的教室和住宅需要安装增建基建设施来容纳个人电脑和笔记型电脑。这种设置预计将推动对家具配电装置 (FPDU) 和可拆卸电源分接头(RPT) 的需求。

电源分接头行业概况

电源分接头市场似乎竞争激烈且细分,有参与企业。由于产品差异化有限以及区域市场参与企业的低价策略,预计未来几年供应商之间的参与度将会加强。

- 2022 年 8 月-Meross 宣布修改了 4 出 HomeKit电源分接头,并发布了该产品的新改进版本。该设备可透过 2.4GHz Wi-Fi 与 Apple HomeKit、Amazon Alexa、Google Home 和 SmartThings 整合。

- 2021 年 9 月 - Tripp Lite 宣布为非医疗环境提供具有抗菌保护的突波保护。先前,Tripp Lite 的抗菌突波保护产品线仅提供专为医疗机构设计的型号。这款突波保护器的塑胶外壳具有抗菌特性,可抑制细菌、真菌、霉菌、病毒和霉菌的生长。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 对稳定供电和节能的需求不断增加

- 住宅电子设备增加

- 市场问题

- 严格的规章制度

第六章 市场细分

- 依安装类型(定性分析)

- 家具配电单元 (FPDU)

- 多出口组件

- 可重新定位电源分接头(RPT)

- 按用途

- 普通型(通用)

- 特殊保护(突波保护、防水保护等)

- 智慧电源分接头(USB、WiFi等)

- 按最终用户

- 工业的

- 商业的

- 住宅

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- Tripp Lite(Eaton Corporation)

- Legrand SA

- Schneider Electric

- Koninklijke Philips NV

- ABB Ltd

- Hubbell Incorporated

- Belkin International, Inc.

- Leviton Manufacturing Co., Inc.

- Panasonic Corporation

- Delixi Electric

- Falconer Electronics, Inc.

- Cyber Power Systems, Inc.

第八章投资分析

第9章市场的未来

简介目录

Product Code: 72432

The Power Strip Market is expected to register a CAGR of 7% during the forecast period.

Key Highlights

- Power strips are useful when electrical sockets are unavailable in the required area. There are instances when multiple appliances must operate simultaneously, yet there aren't enough sockets to accommodate them. In that case, power strips are essential for connecting all devices for use. These power strips are portable and conveniently handy, which makes them flexible for usage at any location.

- The use of power strips aids in energy saving by detecting idle devices connected to power strip sockets. When a device becomes motionless, the power strip detects it within a predetermined time frame and disconnects power from the socket. This is supposed to help save even more energy and reduce the extension's power consumption. Power strips are predicted to save more energy by reducing standby power loss and active energy waste.

- Growing demand for steady power supply and energy saving are major drivers for the power strip industry. Many consumer electronics continue to use power even when switched off, known as a "Vampire Load." According to the National Renewable Energy Laboratory (NREL) of the U.S. Department of Energy, vampire load adds up to around USD 200 in yearly average costs for an average home in the United States. This wasted energy could have powered about 11 million homes.

- Overall, Global Power Strip Market is fragmented, as several global electrical companies and many small and medium enterprises provide a range of power strip products to cater to the varying needs of the vast end-user sectors. Citing the variety in installation type and usage, there is demand for various specifications in power strip products. Integration of technologies such as WiFi, USB, etc., is adding a large pool of product differentiation in the market, which is expected to benefit small and medium enterprises to get a significant market share.

- The COVID-19 pandemic has been a major driver for the power strip market. Work from home resulted in a surge in demand for laptops and desktops as office workers and students were forced to quickly create home offices to telecommute or complete their online studies. The consumer electronics market experienced exponential growth, and this demand is expected to continue as telecommunications and remote work become the norm. This trend positively impacted the power strip market by increasing demand for power strips due to the increased density of electronic equipment in residential applications.

- The power strip market is predicted to be hampered by stringent rules and regulations. Power strip manufacturers must meet several standards and compliances when producing their products. These rules may differ from one country to another country. Every electronic device or equipment should meet the requirements established by the regulatory authorities in the region in which it is made. As a result, manufacturers face a significant issue because a power strip that meets the compliances of one region may not meet the compliances of another.

Power Strip Market Trends

Increasing Number of Electronics Devices in Residential Applications

- Prior to the pandemic, market conditions also indicated steady growth in the consumer electronics market. For instance, in January 2020, the Consumer Technology Association (CTA) predicted that the United States consumer technology retail revenue would be USD 422 billion, a 4% year-on-year (YOY) growth compared to 2019. This revenue included sales from traditional consumer electronics revenue powerhouses like smartphones, laptops, and televisions, along with income from streaming services and emerging technologies. Moreover, in July 2021, CTA predicted the U.S. technology retail revenue to hit USD 487 billion in 2021.

- Major drivers of future consumer electronics growth include the growing demand for smartphones, computing devices, artificial intelligence, and new technologies such as voice recognition. The replacement cycles and dropping prices of many electronic devices are expected to encourage continued consumption.

- The number of employees working from home was projected to increase by 300 million, according to the International Labour Organization (2020), and approximately 1.3 billion students started online learning from home, according to World Economic Forum's article by Lalani and Li (2020). Recreational activities have also shifted towards digital activities, requiring electronic equipment upgrades like monitors, game consoles, televisions, and other gadgets.

- Due to the global shutdowns and stay-at-home orders from the COVID-19 pandemic, many businesses were forced to transition to remote work. The consumer electronics market initially experienced a surge due to purchasing electronic products that support work from home at the start of the stay-at-home orders.

- With all the electronic devices that are used in residential and offices, the requirement for the number of electrical outlets to plug them is also increasing. Power strips enable a single outlet to handle multiple devices. Moreover, surge protectors are also increasingly used as they provide the benefits of a power strip and protect devices plugged into it from power surges greater in voltage than the devices can handle.

Asia Pacific is Expected to Witness a Significant Growth

- Asia Pacific's electricity grids were primarily designed in the previous century, which were not built to accommodate the variability and fluctuations that characterize solar and wind energy. Renewables pose challenges for grid operators as their output fluctuates wildly throughout the day and between seasons, disrupting the supply and demand scenarios. This results in sudden power surge situations in the region. It can be controlled, and electrical and electronic devices can be saved by using surge protector power strips. According to the World Economic Forum, Asia has targeted to generate 23% of its primary energy from renewable sources by 2025. Hence, the region poses a large potential for surge protectors.

- Although the sales of consumer electronics in the Asia Pacific marginally declined due to the COVID-19 pandemic, it is projected to catch up by 2022 and continue to grow. The Asia Pacific region includes many emerging economies that have lower consumer electronics ownership rates and increasing consumer spending, creating plenty of opportunities for growth.

- The home video sector in the region is performing well due to the sustained demand for smart TVs, LCD TVs, and OLED TVs in selected markets. The rise of streaming content by domestic and international players such as Netflix and MX Player in India is boosting demand for smart TVs. As the average house size is getting smaller amid rising urbanization and rapid growth in per capita electronic devices, demand for power strips is expected to grow in the Asia Pacific.

- Domestic companies are expanding their presence and overall market share in the power strip market. Companies such as Anchor by Panasonic, Delixi electric, and other small domestic companies are focusing on the demand and providing their products at reasonable costs compared to international players.

- The education segment has been a significant contributor to the growth of desktop and laptop sales in Asia-Pacific since the pandemic. Desktops and laptops are distributed to support a transition to online learning, and classrooms are expected to have a hybrid nature in the future. The setup for the additional infrastructure of PCs and laptops is required to be accommodated in the current classroom and residential settings. This setup is expected to boost the demand for Furniture Power Distribution Units (FPDUs) and Relocatable Power Taps (RPTs).

Power Strip Industry Overview

Due to the presence of a large number of global as well as regional market players, the power strip market seems to be highly competitive and fragmented. The level of engagement among the vendors is expected to strengthen in the following years due to the limited product differentiation and the underpricing strategy of regional market players.

- August 2022 - Meross announced that it has revised its four-way HomeKit power strip and released a new and improved version of the same. The device can be integrated into Apple HomeKit, Amazon Alexa, Google Home, and SmartThings via 2.4GHz Wi-Fi.

- September 2021 - Tripp Lite announced offering surge protectors with antimicrobial protection for non-medical environments. Earlier, Tripp Lite's antimicrobial surge protectors product line featured only models designed for healthcare facilities. The plastic housing of these surge protectors has antimicrobial properties that help resist the growth of bacteria, fungi, mold, viruses, and mildew.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Steady Power Supply and Power Saving

- 5.1.2 Increasing Number of Electronics Devices in Residential Applications

- 5.2 Market Challenges

- 5.2.1 Stringent Rules and Regulations

6 MARKET SEGMENTATION

- 6.1 By Installation Type (Qualitative Analysis)

- 6.1.1 Furniture Power Distribution Units (FPDUs)

- 6.1.2 Multioutlet Assemblies

- 6.1.3 Relocatable Power Taps (RPTs)

- 6.2 By Application

- 6.2.1 Common Type (General Purpose)

- 6.2.2 Special Protection (Surge Protection, Waterproof Protection, etc.)

- 6.2.3 Smart Power Strips (USB, WiFi, etc.)

- 6.3 By End-User

- 6.3.1 Industrial

- 6.3.2 Commercial

- 6.3.3 Residential

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tripp Lite (Eaton Corporation)

- 7.1.2 Legrand SA

- 7.1.3 Schneider Electric

- 7.1.4 Koninklijke Philips N.V.

- 7.1.5 ABB Ltd

- 7.1.6 Hubbell Incorporated

- 7.1.7 Belkin International, Inc.

- 7.1.8 Leviton Manufacturing Co., Inc.

- 7.1.9 Panasonic Corporation

- 7.1.10 Delixi Electric

- 7.1.11 Falconer Electronics, Inc.

- 7.1.12 Cyber Power Systems, Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219