|

市场调查报告书

商品编码

1632021

全球 PE 薄膜 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Global PE Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

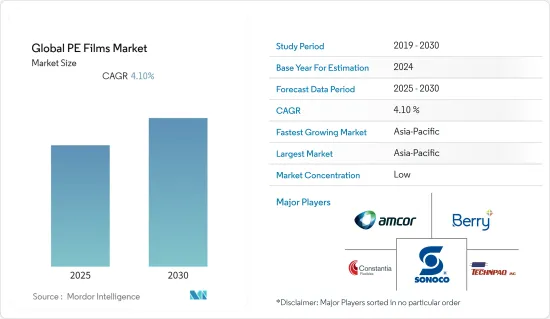

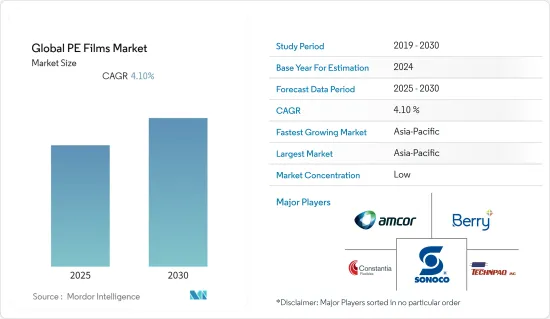

预计全球PE薄膜市场在预测期内复合年增长率为4.1%

主要亮点

- 聚乙烯(PE)薄膜是一种主要成分为碳氢化合物的塑胶薄膜。该薄膜通常用作包装、混凝土砂浆、害虫防治和防水等应用中的保护屏障。这些薄膜广泛用于许多家庭和商业应用,因为它们可重复使用,并且可以承受多年的紫外线劣化。

- 软包装产业的成长是研究市场成长的主要动力。例如,截至 2021 年 8 月,软包装是美国第二大包装领域,占美国1,770 亿美元包装市场的约 19%。 (来源软包装协会(FPA))

- 食品和饮料是PE薄膜广泛使用的另一个主要产业。例如,在食品和饮料行业,聚乙烯薄膜具有低熔点,可用于多种应用,包括店内产品的包装,例如非冷冻烘焙食品、水果和蔬菜,以及食品和饮料的托盘盖。

- 包装食品消费的增加支持了所研究市场的成长。例如,根据美国人口普查局初步估计,2022年4月美国零售和食品服务销售额为6,777亿美元,较上季成长0.9%,比2021年4月成长8.2%。

- 然而,随着消费者和品牌转向永续性和环境考虑,对纸张和可回收塑胶薄膜等永续包装解决方案的需求预计将增长,可能会对成长产生负面影响。

- COVID-19 的影响是巨大的,由于各国政府为遏制病毒传播而实施的各种法规,聚乙烯薄膜的主要最终用户(例如包装、食品和饮料、汽车和建筑)受到了不利影响。然而,随着世界大部分地区取消限制,预计市场将在预测期内再次恢復动力。

PE薄膜市场趋势

食品饮料产业占较大市场占有率

- 基于聚乙烯的柔性薄膜越来越多地被食品和饮料製造商采用,因为它们具有独特的阻隔性能,有助于延长保质期并在储存和运输过程中提供保护。此外,食品级塑胶必须遵循政府监控的严格製造工艺,以确保其可安全用于食品接触。

- 因此,厂商越来越注重开发满足上述要求的解决方案。例如,2021年7月,Nova Chemicals推出了高密度聚苯乙烯(HDPE)。该树脂可透过提高多层软包装的防潮阻隔性来开发更可回收的聚乙烯 (PE)。据该公司介绍,新树脂将多层共挤薄膜的水蒸气透过性能提高了20%,从而延长了包装食品的保存期限。

- 食品和饮料的零售对PE薄膜的需求有重大影响。例如,根据美国人口普查局的数据,美国食品和饮料零售额从 2021 年 11 月的 775.21 亿美元增加到 12 月的 846.29 亿美元。

- 不断增长的需求也鼓励供应商推出新产品,以满足食品和饮料市场不断变化的需求。例如,2022年5月,Walki集团推出了几款新产品,包括Lamibel MDO-PE,这是一种用于枕袋的无溶剂薄膜基材,由低密封LDPE和反向印刷MDO薄膜层压而成。

亚太地区成长显着

- 包装、食品和饮料以及建筑等领域的快速成长正在推动该地区对 PE 薄膜的需求。该地区城市市场的包装食品和加工食品的消费量也大幅增加。例如,根据 IBEF 的数据,食品加工产业占印度食品工业总量的 32%,预计 2025-26 年将达到 5,350 亿美元。

- 亚太地区其他国家的食品加工业也出现了类似的趋势。例如,根据美国农业部的数据,2021年日本食品加工产业的总产值达到2,164亿美元。

- PE 薄膜在建筑业中也发挥着重要作用,因为它们用于覆盖特定空间并保护有价值的设备和机械。由于多个地区政府注重升级公共基础设施,亚太地区的建设活动大幅增加。

- 例如,根据越南统计总局的数据,2021年建筑业对越南GDP的贡献率为5.95%,2020年为6.19%。

PE薄膜产业概况

由于存在多个区域和国际参与企业,全球 PE 薄膜市场竞争非常激烈。市场上的供应商专注于新产品开发并在区域和全球扩大业务。市场上营运的主要企业包括 AmcorFlexibles、BerryGlobalInc、ConstantiaFlexibles 和 SonocoProductsCompany。

- 2022 年 4 月 - 埃克森美孚宣布 Exceed S 高性能聚乙烯 (PE) 树脂商业化。据该公司称,它在加工过程中需要的配方更少,可以提供更简单、更轻的薄膜配方,并且在食品、农业和工业应用中具有相同的耐用性。

- 2021 年 11 月 - 法国领先包装公司 Reborn Group 宣布在其位于 Aujou-les-Bains 的工厂推出法国第一条聚乙烯 (PE) 薄膜脱墨生产线。凭藉这条新的脱墨生产线,该公司将解决塑胶薄膜回收过程中印刷油墨的挑战。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对调查市场的影响

第五章市场动态

- 市场驱动因素

- 朝着更轻的重量和更小的尺寸发展

- 主要在食品和饮料领域以及 mPE 等技术创新领域扩大最终用户群

- 市场问题

- 来自 BOPP 薄膜等替代品的激烈竞争

- 向永续替代品过渡

- 市场机会

第六章 市场细分

- 按类型

- LDPE

- 高密度聚苯乙烯

- LLDPE

- 其他的

- 按用途

- 包装膜

- 袋/麻袋

- 用于建筑

- 农业

- 医疗保健

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他地区(拉丁美洲和中东非洲)

第七章 竞争格局

- 公司简介

- Amcor Flexibles

- Berry Global Inc

- Constantia Flexibles LLC

- INDEVCO Plastics

- Sonoco Products Company

- Technipaq, Inc.

- Emerald Packaging Inc.

- PPC Flexible Packaging

- ZacrosAmerica Inc.

- ProAmpac Intermediate, Inc.

- American Packaging Corporation

- Polymer Packaging Inc.

第八章投资分析

第9章 市场的未来

The Global PE Films Market is expected to register a CAGR of 4.1% during the forecast period.

Key Highlights

- Polyethylene (PE) film is essentially a plastic film made primarily of hydrocarbons. The films are commonly used as a protective barrier in applications such as packaging, concrete & mortar, exterminating, and even pest control and waterproofing. As these films can be reused and can stand up to UV degradation for several years, they are extensively used for a number of household and commercial applications.

- The growth of the flexible packaging industry is significantly driving the growth of the studied market. For instance, as of August 2021, flexible packaging was the second largest packaging segment in the U.S., garnering about 19% of the USD 177 billion U.S. packaging market. (Source: Flexible Packaging Association (FPA))

- Food and beverage is another major industry wherein PE films are used extensively. For instance, in food & beverage industry, Polyethylene films are used for various applications such as packaging in-store products such as non-frozen baked products, fruits & vegetables, and tray covers for delivery of baked food products due to their low melting point.

- The increasing consumption of packaged food is supporting the growth of the studied market. For instance, according to the U.S. Census Bureau's advance estimates, U.S. retail and food services sales for April 2022 were USD 677.7 billion, an increase of 0.9 percent from the previous month and 8.2 percent above April 2021.

- However, with consumers and brands shifting more towards sustainability and environmental friendliness, the demand for sustainable packaging solutions such as paper and recyclable plastic films is expected to grow, which in turn will negatively impact the growth of the studied market.

- A significant impact of COVID-19 has been observed on the studied market, as the major end-users of polyethylene films such as packaging, food & beverages, automotive, and construction were negatively impacted due to various restrictions imposed by the governments to curb the spread of the virus. However, with the restrictions being lifted almost across every part of the world, the market is expected to regain traction during the forecast period.

PE Films Market Trends

Food & Beverage Industry to Hold Significant Market Share

- Food and beverage product manufacturers are increasingly adopting polyethylene-based flexible films because they offer distinct barrier properties that help with longer shelf life and better protection during the storage and transportation phase. Additionally, food-grade plastics must follow stringent, government-monitored manufacturing processes to ensure they are safe for food contact.

- Hence, the vendors are increasingly focusing on developing solutions to fulfill the above requirements. For instance, in July 2021, a high-density polyethylene (HDPE) was introduced by Nova Chemicals. The resin enables the development of more recyclable polyethylene (PE) by offering an improved moisture barrier for multilayer flexible packaging. According to the company, the new resin delivers up to a 20% increase in water-vapor transmission performance in multilayer coextruded films, which increases the shelf life of packaged foods.

- The retail sales of food and beverage products have significantly impacted the demand for PE films. For instance, according to the US Census Bureau, the retail sales of food and beverage stores in the United States increased from USD 77,521 million in November 2021 to USD 84,629 million in December 2021.

- The growing demand also encourages the vendors to launch new products to serve the changing need of the food & beverage market. For instance, in May 2022, Walki Group launched several new products, including Lamibel MDO-PE, a film-based material for pillow pouches made of solvent-free laminated with low sealing LDPE and reverse printed MDO-film.

Asia Pacific to Register Significant Growth

- The rapid growth of sectors such as packaging, food & beverage, and construction is driving the demand for PE films in the region. The consumption of packaged and processed food has also increased significantly in the urban markets of the area. For instance, the food processing sector accounts for 32% of the entire food industry in India and is expected to reach USD 535 billion by 2025-26, according to IBEF.

- A similar trend has been observed in the food processing industry of other countries in the APAC region. For instance, according to the United States Department of Agriculture, the total production value of the Japanese food-processing sector amounted to USD 216.4 billion in 2021.

- PE films also play an essential role in the construction industry as they are used to cover specific spaces and protect valuable equipment and machinery. As the Asia Pacific region is witnessing a significant rise in construction activities with several regional governments focusing on upgrading their public infrastructure, the sector is expected to drive the growth of the studied market.

- For instance, according to the General Statistics Office of Vietnam, the construction sector's contribution to Vietnam's GDP amounted to 5.95 percent and 6.19 percent for 2021 and 2020, respectively.

PE Films Industry Overview

The Global PE Films Market is competitive, owing to the presence of several players operating their businesses within regional and international boundaries. Vendors operating in the market are broadly focusing on new product development and on expanding their footprint both on a local as well as a global scale. Some of the major players operating in the market include Amcor Flexibles, Berry Global Inc, Constantia Flexibles, and Sonoco Products Company.

- April 2022 - ExxonMobil announced the commercialization of its Exceed S performance polyethylene (PE) resins, which according to the company, requires less blending during processing and can offer simpler and lighter film formulations with the same durability for food, agricultural, and industrial applications.

- November 2021 - Reborn group, one of the leading packaging firm in France, announced that it is set to launch France's first film de-inking line for polyethylene (PE) films at its site in Ogeu-les-Bains. With its new de-inking line, the company will seek to address the challenge of printing inks in the plastic film recycling process.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Studied Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Move Towards Light Weighting & Downgauging

- 5.1.2 Growing End-User Base Specifically in the Food & Beverage Segment, and Innovations Such as mPE

- 5.2 Market Challenges

- 5.2.1 High Competition from Alternatives Such as BOPP Film

- 5.2.2 Move Towards Sustainable Alternatives

- 5.3 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 LDPE

- 6.1.2 HDPE

- 6.1.3 LLDPE

- 6.1.4 Other Types

- 6.2 By Application

- 6.2.1 Packaging Films

- 6.2.2 Bags & Sacks

- 6.2.3 Construction

- 6.2.4 Agriculture

- 6.2.5 Healthcare

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World (Latin America and Middle East & Africa)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Flexibles

- 7.1.2 Berry Global Inc

- 7.1.3 Constantia Flexibles LLC

- 7.1.4 INDEVCO Plastics

- 7.1.5 Sonoco Products Company

- 7.1.6 Technipaq, Inc.

- 7.1.7 Emerald Packaging Inc.

- 7.1.8 PPC Flexible Packaging

- 7.1.9 ZacrosAmerica Inc.

- 7.1.10 ProAmpac Intermediate, Inc.

- 7.1.11 American Packaging Corporation

- 7.1.12 Polymer Packaging Inc.