|

市场调查报告书

商品编码

1632037

全球 LWAN -市场占有率分析、产业趋势/统计、成长预测 (2025-2030)Global LWAN - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

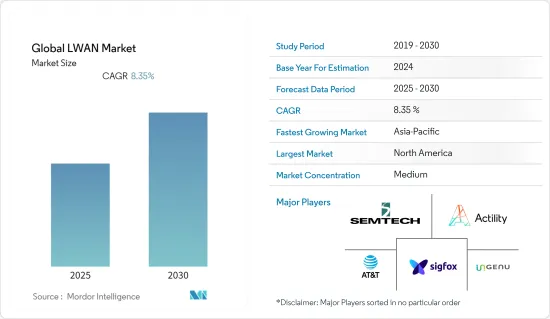

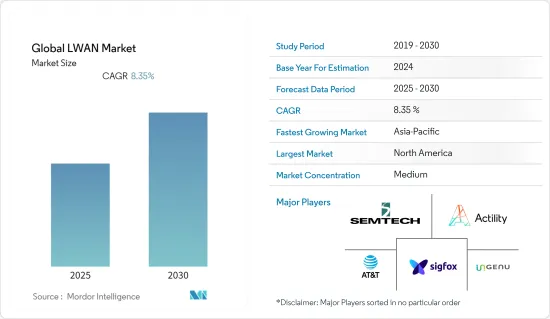

全球LWAN市场预计在预测期间内复合年增长率为8.35%

主要亮点

- 低功耗广域网路 (LPWAN) 正在成为工业IoT(IIoT) 生态系统的关键建置模组之一,大多数产业都采用工业 4.0 实践,并且部署分散在工厂各处的电池供电设备感测器已成为替代方案。到需要光速远距通讯的2G/3G/4G蜂巢式网路。 SIGFOX 是最有前景的方法之一,它是一种超窄频技术,可提供与行动电话网路类似的讯号覆盖范围,同时功耗低 1,000 倍。

- 随着环境的变化,企业正在对智慧城市的发展进行大量投资,这有望在物联网的实施中发挥重要作用。美银美林 (BAML) 全球智慧城市入门精选预测,到 2026 年,全球整体智慧城市技术和管理的投资将超过 3.48 兆美元。

- 全球许多地区的部署不断增加正在推动 LPWAN 产业的成长。例如,2022 年 3 月 15 日,支援物联网 (IoT)低功率广域网路(LPWAN) 开放 LoRaWAN 标准的全球公司协会 LoRa 联盟布,该联盟具有显着的市场吸引力。 LoRaWAN 已成为 LPWAN 领域的选择之一,现有超过 2.25 亿个 LoRa/LoRaWAN 终端节点。

- 过去两年,透过人际接触传播的新型冠状病毒肺炎(COVID-19)大流行持续影响着世界各地的许多产业。一旦感染,传播和预后会受到许多因素的影响。颗粒物 (PM) 是悬浮在空气中的固体/液体颗粒的复杂混合物,其形态、大小和成分各不相同,最近的科学研究表明,该指标与 COVID-19 的感染风险相当大。

- 物联网 (IoT) 和预警系统 (EWS) 促进了基于感测器的低功耗广域网路 (LPWAN) 的发展,用于监测室内空气污染品质 (IAQ) 并即时测量 PM 水平。由于COVID-19大流行,多个国家实施了封锁规定,导致企业LPWAN进出口活动暂停。

- 该技术面临的挑战包括遗留设备改造成本、未来的覆盖范围和可扩展性、技术共存和即时通讯,这可能会阻碍整体采用和市场。此外,网路安全性可能不够强大,无法将资料传回端点,并且可能容易受到干扰。

LWAN市场趋势

公共产业部门占据主要市场份额

- 2010 年 LoRa 和 2009 年 Sigfox 的采用预计将成为远离 FN 和 PLC 的开始。然而,公共产业行业规避风险,新技术需要时间在市场上立足。公共产业公司倾向于坚持「试验」的解决方案,尤其是在成熟市场。然而,这些技术引起了足够的关注,引发了通讯产业的强烈抵制,为LTE-M和NB-IoT的诞生铺平了道路。

- 世界各地的社区和城市正在探索物联网 (IoT) 和网路物理系统 (CPS) 等先进技术,以改善居民的生活品质。此类系统包括网路网路设备和其他与实体基础设施配合使用的支援系统。 CPS 和物联网在医疗保健、交通、公共和其他领域的应用可以推动经济成长,扩大和改善服务,并提高生活品质。

- 例如,在法国,Birdz 已在里昂营运 40 万个 LoRa 连接的智慧水錶,并宣布将在未来 10 年内将超过 300 万个智慧水錶连接到公共LoRaWAN 网路。在日本,NICIGAS 已安装了 850,000 个具有 Sigfox 连接的燃气表。在中国,NB-IoT 正在追踪郑州近 100 万辆电动自行车,并监控杭州余杭区住宅内的 17 万个有线烟雾侦测和警报系统。

- 许多政府机构正在积极开展新计划,以改善居民的生活品质。例如,NIST 及其合作伙伴建议并培育丛集,为智慧城市和社区开发突破性物联网 (IoT) 应用。截至目前,GCTC已招募200多个行动丛集,涉及500家企业、200多个城市和大学。这些行动集群正在美国、亚洲、非洲和欧洲提供创新。

- 2022 年 2 月,NIST 国际合作组织将为智慧城市和社区开发新框架。该框架为开发测量技术和工具奠定了基础,这些技术和工具能够在三个相互作用的分析层面上实现适应性、整合性和可扩展性:基础设施服务、技术和社区效益。

亚太市场占主要成长市场

- 市场成长是由物联网应用需求不断增长所推动的。智慧城市的发展预计将支持市场需求。知名科技公司重视策略伙伴关係关係,以提供多样化的智慧城市解决方案,包括物联网、数位转型和工业 4.0 的采用。例如,2020年9月,诺基亚与电信业者Optus签署了伙伴关係协议,为澳洲企业提供物联网软体解决方案。

- 韩国-世界银行智慧城市合作伙伴计画(P166893),俗称全球智慧城市合作伙伴计画(GSCP),是透过世界银行与韩国之间的长期伙伴关係发起的。世界银行和 MOLIT 已同意透过一项专门的智慧城市计画进行合作,最新报告《全球智慧城市合作伙伴计画第一阶段完成报告》于 2021 年 12 月发布。据其称,客户的需求集中在数位转型(数位双胞胎和工业4.0适应等技术)和智慧城市基础设施。

- 经济学人智库 (EIU) 表示,对于亚洲企业来说,数位转型的领先地位往往是来自消费者压力的结果。亚洲正在成为消费品公司寻找使其业务面向未来的方法的地方,与其他国家的同行相比,中国在数位技术方面的显着领先就证明了这一点。例如,在中国,NB-IoT 被用于监控杭州余杭区出租住宅的 17 万个连网烟雾侦测器和警报设备,以及追踪郑州近 100 万辆电动自行车。

- 由于亚太地区正在经历快速的工业化和商业化,公共和政府部门在2021年占据亚太低功率广域网路(LPWAN)市场占有率的25%以上。数位化概念正在深入人心,工业 4.0计划正在推动该地区的市场发展。

LWAN产业概况

LWAN 市场适度细分。随着物联网生态系统的发展,LPWAN等各种技术也不断发展,这正在推动参与企业投资该市场。此外,参与企业正在透过技术升级逐步进入市场。主要参与企业包括 MachineQ (Comcast)、Sigfox SA、AT&T Inc.、Actility S.A.、Semtech Corporation、Deutsche Telekom 和 Ingenu Inc.。

- 2022 年 5 月 - Semtech 与智慧城市智慧照明解决方案供应商 CITiLIGHT 合作开发照明管理系统 Velocity LMS。 VELOCITi LMS 采用 LoRaWAN 标准和 Semtech 的 LoRa 设备来远距通讯大型资料封包。

- 2022 年 5 月 - 面向企业和通讯业者的通讯技术供应商 Syniverse 和提供即时个人化体验的客户参与平台 Twilio 宣布,两家公司已达成先前宣布的策略联盟。 Twilio 向 Syniverse 普通股投资 7.5 亿美元。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第 4 章 Lewan 市场洞察

- 市场概况

- 产业相关人员分析(模组等硬体厂商、平台厂商、网路供应商、整合商、最终用户等)

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 增加网路部署

- 数位转型与工业4.0实施

- 市场问题

- 各行业的遗留设备是物联网采用的主要障碍

第六章 市场细分

- 依网路类型

- LTE-M

- NB-IoT

- 西格福克斯

- LoRa

- 其他的

- 最终用户

- 公共产业

- 智慧城市

- 消费性/智慧家居

- 产业

- 运输/物流

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- Ingenu Inc.

- SemtechCorporation

- Sigfox

- ActilityS.A

- MachineQ(Comcast)

- TWILIO INC.

- Accent Systems

- Deutsche Telekom

- AT&T

- AerisCommunications

- TE Connectivity

- Qualcomm

第八章投资分析

第9章市场的未来

The Global LWAN Market is expected to register a CAGR of 8.35% during the forecast period.

Key Highlights

- Low-Power Wide-Area Networks (LPWANs) are becoming one of the main building blocks for the Industrial IoT (IIoT) ecosystem, with most of the industries adopting Industry 4.0 practices and an alternative to 2G/3G/4G cellular networks where long-range communication at light speed is needed by battery-powered sensors spread around the factory. Among the most promising approaches, SIGFOX is an ultra-narrow band technology that allows similar signal coverage to cellular networks at one-thousandth of its power requirements.

- With the environmental changes, businesses are investing highly in smart city development, which is expected to play an important role in IoT adoption. Global Smart Cities Primer Picks, Bank of America Merrill Lynch (BAML) anticipates smart city technology and management investment to reach more than USD 3.48 trillion by 2026 globally.

- Increasing roll-outs in many parts of the world are driving the growth of the LPWAN industry. For instance, on March 15, 2022, The LoRa Alliance, the global association of companies backing the open LoRaWAN standard for the internet of things (IoT) low-power wide-area networks (LPWANs), announced significant market traction across France and Spain. LoRaWAN is already one of the preferred global choices for LPWAN, with more than 225 million LoRa/LoRaWAN end nodes.

- For the last two years, the COVID-19 pandemic has continued to impact many industries of the world as the infection spreads through person-to-person contact. Transmission and prognosis, once infected, are potentially influenced by many factors. Particulate Matter (PM) is a complex mixture of solid and/or liquid particles suspended in the air that can vary in shape, size, and composition, and recent scientific work correlate this index with a considerable risk of COVID-19 infections.

- The Internet of Things (IoT) and Early Warning Systems (EWS) have given rise to the development of Low Power Wide Area Networks (LPWAN) based on sensors, which monitor In-door Air pollution Quality (IAQ) and measure PM levels in real-time. The COVID-19 pandemic had led to the implementation of lockdown regulations across several nations resulting in disruptions in export and import activities of Enterprise LPWAN.

- Few of the challenges to this technology that may hamper the overall adoption and market include the cost of changing legacy equipment, future coverage and scalability, technology co-existence, and real-time communication. In addition, the network's security, not as robust as sending data back to endpoints, can also be prone to interference.

LWAN Market Trends

Utilities Segment will Hold the Major Share of the Market

- The introduction of LoRa in 2010 and Sigfox in 2009 was expected as the start of the shift away from FN and PLC. However, the utility industry is risk-averse, and any new technology takes time to gain a foothold in the market. The utilities tended to often stick to the 'tried and tested' solutions, especially in established markets. However, these technologies saw enough interest that they caused a reactive response from the telecommunication industry, thus paving the way for the creation of LTE-M and NB-IoT.

- Communities and cities across the globe are looking to adopt advanced technologies such as the Internet of Things (IoT) and Cyber-Physical Systems (CPS) to improve the quality of life for their residents. Such a system involves cyber-networking devices and other supporting systems working with physical infrastructure. When applied to health care, transportation, utilities, and other sectors, these CPS and IoT could promote economic growth, expand and improve services, and enhance the quality of life.

- For Instance, In France, Birdz, which already operates 400,000 LoRa-connected smart meters in Lyon, announced that it would connect over 3 million smart water meters to the Public LoRaWAN network over the next ten years. NICIGAS installed 850,000 meters of gas with Sigfox connectivity in Japan. In China, NB-IoT tracks nearly 1 million electric bikes in Zhengzhou and monitors 170,000 wired smoke detection and warning systems in rental homes in the Hangzhou Yuhang district.

- Many government agencies are actively initiating new projects to improve the life quality of residents. For instance, NIST and its partners advise and nurture Clusters in their development of groundbreaking Internet of Things (IoT) applications for smart cities and communities. The GCTC so far has recruited over 200 Action Clusters, involving 500 companies and over 200 cities and universities. Forty percent of these Clusters are outside the U.S. These Action Clusters are enabling innovation across the United States, Asia, Africa, and Europe.

- In February 2022, NIST International Collaboration will develop a new framework for smart cities and communities. The framework provides the basis for developing measurement methods and tools that allow for adaptability, integration, and extensibility at three interacting levels of analysis: infrastructure services, technologies, and community benefits.

Asia Pacific market Accounts to Hold Major Growing Market

- The market growth is attributed to the rising demand for IoT applications. Smart city development is expected to support the market demand. Prominent technology enterprises are emphasizing strategic partnerships to deliver diverse smart city solutions like IoT, digital transformation, and the adoption of industry 4.0. For instance, in September 2020, Nokia signed a partnership agreement with Optus, a telecommunications company, to provide IoT software solutions for Australian enterprises.

- The Korea-World Bank Smart City Partnership Program (P166893), more widely known as the Global Smart City Partnership Program (GSCP), was launched through a long-standing partnership between the World Bank and Korea. The Bank and MOLIT agreed to collaborate through a dedicated program on smart cities, for which the latest report was published in December 2021 called GLOBAL SMART CITY PARTNERSHIP PROGRAM PHASE 1 COMPLETION REPORT, according to which the demanding nature of the client is focused on digital transformation ( technologies like digital twin and adaptation of industry 4.0 ), and smart city infrastructure.

- According to the Economist Intelligence Unit (EIU), for companies in Asia, leadership in digital transformation is often the result of consumer pressure. Asia is becoming the place where consumer companies are figuring out how to make their business future-proof, which becomes evident as China is leapfrogging its peers elsewhere when it comes to digital technology. For instance, in China, NB-IoT monitors 170,000 connected smoke detection and alarm devices in rental homes in the Yuhang district of Hangzhou and is used to track close to 1 million electric bikes in Zhengzhou.

- The public and government sector segment held more than 25% of Asia Pacific low power wide area network (LPWAN) market share in 2021 as the region is witnessing rapid industrialization and commercialization. The concept of digitization is gaining traction, and Industry 4.0 projects are driving the market across the region.

LWAN Industry Overview

The LWAN market is moderately fragmented. With the increase in the IoT ecosystem, various technologies are also evolving, such as LPWAN, which drives the players to invest in the market. Moreover, the players are entering the market gradually with technological upgradation. Some of the key players include MachineQ(Comcast), Sigfox SA, AT&T Inc., ActilityS.A., Semtech Corporation, Deutsche Telekom, and Ingenu Inc., among others.

- May 2022 - Semtech collabrated with CITiLIGHT, provider of smart lighting solutions for smart cities, for its Velocity LMS lighting management system. VELOCITi LMS features the LoRaWAN standard and Semtech's LoRa devices to communicate large packets of data over a long range.

- May 2022 - Syniverse, a communications technology provider to enterprises and carriers, and Twilio the customer engagement platform that drives real-time, personalized experiences, announced that the companies have closed on their previously announced strategic partnership. Twilio invested USD 750 million for common equity in Syniverse.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 LWAN MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis (Modules and other hardware vendors, platform vendors, network provider, integrators, end-users etc.)

- 4.3 Industry Attractiveness -Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Network Rollouts

- 5.1.2 Digital Transformation and Industry 4.0 Practices

- 5.2 Market Challenges

- 5.2.1 Legacy Equipment Across Industries is a Major Barrier to Adopting IoT

6 MARKET SEGMENTATION

- 6.1 By Network Type

- 6.1.1 LTE-M

- 6.1.2 NB-IoT

- 6.1.3 Sigfox

- 6.1.4 LoRa

- 6.1.5 Other Technologies

- 6.2 End-User

- 6.2.1 Utilities

- 6.2.2 Smart City

- 6.2.3 Consumer/Smart Homes

- 6.2.4 Industrial

- 6.2.5 Transportation and Logistics

- 6.2.6 Other End-users

- 6.3 By Region

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ingenu Inc.

- 7.1.2 SemtechCorporation

- 7.1.3 Sigfox

- 7.1.4 ActilityS.A

- 7.1.5 MachineQ(Comcast)

- 7.1.6 TWILIO INC.

- 7.1.7 Accent Systems

- 7.1.8 Deutsche Telekom

- 7.1.9 AT&T

- 7.1.10 AerisCommunications

- 7.1.11 TE Connectivity

- 7.1.12 Qualcomm