|

市场调查报告书

商品编码

1632044

越南的设施管理:市场占有率分析、产业趋势、成长预测(2025-2030)Vietnam Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

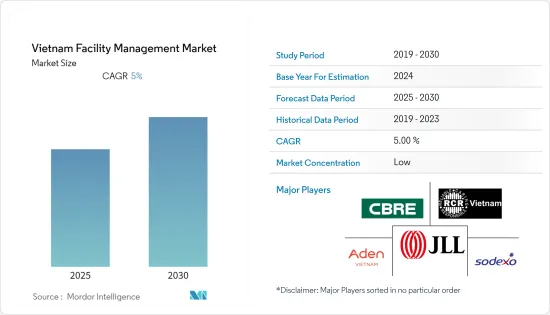

越南的设施管理市场预计在预测期内复合年增长率为 5%。

主要亮点

- 根据国际货币基金组织2021年10月更新的预测,越南GDP成长率预计在2022年达到6.6%,2023年达到6.8%。 GDP 强劲成长是越南设施管理市场的潜在驱动因素之一。

- 纺织、食品、家具、塑胶、造纸、旅游和通讯等都是越南主要的国有部门。农业占GDP的14.8%,工业占33.7%,服务业占41.6%,显示日本对工业和服务业的依赖程度较高。

- 清洁仍然是越南最好、最频繁的外包建筑服务之一,大流行期间对消毒的需求推动了其边际增长。这是疫情期间唯一呈现正成长的调频服务业。

- 仲量联行和世邦魏理仕利用其在越南 FM 业务中的房地产专业知识,在市场竞争中处于领先地位。其他公司,如埃顿服务公司和 Atalian/Unicare 也面临着一场硬仗,并可能在预测期内增加市场占有率。其他本土调频公司也有望提高其市场地位。

- 仲量联行和世邦魏理仕利用其在越南FM业务的房地产专业知识,在竞争中领先市场。 ADEN Services 和 Atalian/Unicare 等其他参与者也面临着一场艰苦的战斗,并且可能会在预测期内增加市场占有率。其他本土调频公司也有望提高其市场地位。

- 设施管理组织针对 COVID-19 疫情采取了多种应对措施。对人员流动的限制导致计划工作减少,并减缓了许多客户现场的活动。因疫情而关闭对仲量联行、世邦魏理仕、RCR Resolve FM Vietnam、索迪斯和亚丁等主要行业参与者产生了负面影响。

越南设施管理市场趋势

工业部门预计将经历显着成长。

- 仲量联行房地产服务公司的最新报告显示,越南的支持性外国直接投资(FDI)政策、政治稳定和稳健的经济成长使越南成为对外国投资者有吸引力的投资地点。他也表示,越南是东南亚最大的外国投资目的地。

- 2022 年 5 月,Sovico Corporation 与 JERA 合作评估为越南发电工程供应液化天然气 (LNG) 的可行性。 Service 和 JERA 将考虑建立伙伴关係,以公平的价格提供清洁、可靠和高效的能源,以满足该地区不断增长的能源需求。

- 越南已成为高科技投资中心,三星、微软、英特尔和LG投资晶片和智慧型手机的生产、研发。 2021年3月,总理发布第10/2021/QD-TTg号决定,详细说明了高科技公司的定义标准,该决定于2021年4月30日生效。该法适用于生产高科技产品或提供高科技服务的越南公司。

- 越南的配套产业吸引了大部分外国直接投资(FDI)流向南部省市的工业(IP)。例如,2021年,本土智慧财产权吸引了配套产业和其他製造业企业的资本和投资计划11亿美元,占总资本和投资计划的80%以上。

- 据计画投资部(MPI)称,越南仍然是对日本企业最具吸引力的投资目的地之一,特别是越南总理范明贞于2021年11月访问日本,投资金额监督120亿美元。项金额达1000日圆的重大合作协议,其中大部分将于2022年支付。

- 此外,两国总理将促进日本和越南企业之间的商业合作,并推动涉及两国的倡议,包括数位转型、生产基地多元化以及支持产业的发展,以打造有弹性的全球供应链。加强投资。

服务业可望大幅成长

- RCR Vietnam 于 2022 年 4 月推出的上锁挂牌 (LOTO) 是一种安全程序,可确保维护前的实际开关和隔离。正确完成 LOTO 程序还可以保护工人免受危险的能量释放、严重的身体伤害和死亡。

- 随着越南经济的巨大成长,人们的生活方式和思考方式正在发生根本性的变化。儘管无包装食品在市场上仍然随处可见,但近年来越来越多的超级市场开始提供包装水果、肉类和鱼类。此外,消费者已经习惯了在空调空调的购物中心购物的便利、舒适和安全。因此,随着越南发展成为一个更复杂的社会,对安全和保障的需求不断增加。

- 从收益来看,疫情期间越南市场以软服务为主。该国清洁和保全服务需求的增加是由房地产等行业的成长、零售和商业空间需求的增加、外国直接投资的增加以及商业活动的活性化所推动的。

- 2022年5月,韩国第二大银行新韩金融集团同意收购越南电商新兴企业公司Tiki 10%的股权,使其成为该公司第三大股东。

越南设施管理产业概况

越南的设施管理市场是一个分散的市场。这是一个竞争激烈的市场,主导的参与者并不多。

- 2022年1月-亚丁集团进驻Autoflight上海总部,两家公司签署谅解备忘录,在智慧空中交通与物流领域合作。该协议表明,两家公司基于 AutoFlight 的 eVTOL(电动垂直起降)技术和亚丁集团的数位化专业知识以及由中国和亚太地区1,500 家客户组成的全球网路合作开发新的零碳解决方案,并建立了框架。

- 2021 年 11 月 - 世邦魏理仕集团(NYSE:CBRE)与 Turner & Townsend Holdings Limited 完成了一项交易,其中 CBRE 收购了 Turner & Townsend 60% 的股份,并宣布与该公司建立策略伙伴关係。世邦魏理仕的多元化策略沿着四个方面发展:资产类型、业务线、客户和地理。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- COVID-19 对设施管理产业的影响

第五章市场动态

- 市场驱动因素

- 越南鼓励外国直接投资(FDI)的政策推动工业部门成长

- 服务业推动越南经济成长

- 市场限制因素

- 资料外洩和安全威胁增加

第六章 市场细分

- 按设施管理类型

- 自有设施管理

- 外包设施管理

- 单调频

- 捆绑调频

- 综合调频

- 透过提供

- 硬体维修

- 软调频

- 按最终用户

- 商业的

- 学术的

- 公共/基础设施

- 产业

- 其他的

第七章 竞争格局

- 公司简介

- CBRE Group Inc.

- Jones Lang LaSalle Incorporated

- RCR Vietnam

- Sodexo Inc.

- ADEN Vietnam

- ATALIAN Global Services

- Savills Vietnam

- AEON Delight

- PMC

- P. Dussmann Co. Ltd

第八章投资分析

第9章 未来趋势

简介目录

Product Code: 90920

The Vietnam Facility Management Market is expected to register a CAGR of 5% during the forecast period.

Key Highlights

- GDP growth in Vietnam is predicted to reach 6.6 % in 2022 and 6.8 % in 2023, according to updated IMF forecasts from October 2021, subjected to post-pandemic global economic recovery. The strong growth in GDP is one of the potential drivers for the Vietnam Facility Management market.

- Textiles, food, furniture, plastics, paper, tourism, and telecommunications are all major state-owned sectors in Vietnam. Agriculture accounted for 14.8% of GDP, Industry 33.7%, and Services 41.6%, indicating that the economy is heavily reliant on industry and service sectors, which provides opportunities for Facility Management Services.

- Cleaning remains one of Vietnam's best and most frequently outsourced building services, and sanitization demand during a pandemic drives its marginal increase. The only FM service segment exhibited positive growth during the pandemic.

- The Companies JLL and CBRE led the market in terms of competition, leveraging their real estate expertise in their FM operations in Vietnam. Other players, such as ADEN Services and Atalian/Unicare, are putting up a tough fight, and their market share may grow during the forecast period. Other local FM companies are also likely to enhance their market positions.

- The Companies JLL and CBRE led the market in terms of competition, leveraging their real estate expertise in their FM operations in Vietnam. Other players, such as ADEN Services and Atalian/Unicare, are putting up a tough fight, and their market share may grow during the forecast period. Other local FM companies are also likely to enhance their market positions.

- Facilities management organizations have experienced a diverse response to the COVID-19 outbreak. The restrictions on people's movement resulted in a drop in project work and a slowdown in activity at numerous client sites. The pandemic lockdown had a negative impact on significant industry participants such as JLL, CBRE, RCR Resolve FM Vietnam, Sodexo, Aden, and others.

Vietnam Facility Management Market Trends

Industrial Sector is Expected to Witness Significant Growth

- According to the latest report by JLL real estate services firm, Vietnam has become an attractive location for foreign investors due to the country's policies supporting foreign direct investment (FDI), political stability, and robust economic growth. Also stated, Vietnam is one of Southeast Asia's top foreign investment destinations.

- In May 2022, Sovico Corporation partnered with JERA to assess the feasibility of delivering liquefied natural gas (LNG) for power projects in Vietnam. Service and JERA will look at forming a partnership to provide clean, reliable, and efficient energy at a reasonable price to meet the region's expanding energy demands.

- With Samsung, Microsoft, Intel, and LG investing in chip and smartphone production as well as R&D, Vietnam has become a high-tech investment hub. In March 2021, the prime minister released Decision No.10/2021/QD-TTg, which detailed the criteria for defining high-tech businesses and went into effect on April 30, 2021. This law relates to companies in Vietnam that produce high-tech products or provide high-tech services.

- Supporting industries in Vietnam attracted a significant portion of foreign direct investment (FDI) into industrial parks (IPs) in the southern provinces and cities. For instance, in 2021, Local IPs attracted $1.1 billion in capital and investment projects in the supporting industry and other manufacturing companies, accounting for more than 80% of total capital and investment projects.

- According to the Ministry of Planning and Investment(MPI), Vietnam continues to be one of the most attractive investment destinations for Japanese companies, especially after Vietnamese Prime Minister Pham Minh Chinh's November 2021 visit to Japan, during which he oversaw the signing of 25 major cooperation agreements worth up to USD12 billion, much of which will be disbursed in 2022.

- Furthermore, the two prime ministers agreed to boost commercial collaborations between Japanese and Vietnamese enterprises and to strengthen the investment environment for businesses by cooperating in areas such as digital transformation, diversification of the production base, and growth of supporting industries toward resilient global supply chains, which include both nations and are crucial to economic revitalization.

Service Sector is Expected to Witness Significant Growth

- In April 2022, Lockout - Tagout (LOTO) is a safety procedure introduced by RCR Vietnam that ensures practical switching on or off and isolation before maintenance. Workers can also be protected from unsafe energy discharges, significant physical harm, or death by properly completing LOTO procedures.

- With the country's tremendous economic expansion, people's lifestyles and attitudes change radically in Vietnam. While unpackaged food remains widely available at markets, more and more supermarkets have begun to provide packaged fruit, meat, and fish in recent years. Consumers are also becoming more accustomed to the convenience, comfort, and security that come with shopping in air-conditioned malls. As a result, as Vietnam evolves into a more sophisticated society, the demand for safety and security is continuously increasing.

- In terms of revenue generation, soft services dominated the market in Vietnam during the Pandemic. The rise in demand for cleaning and security services in the country has been fueled by growth in sectors such as real estate, increased demand for retail and commercial spaces, increased foreign direct investment, and increased commercial activities.

- In May 2022, Shinhan Financial Group, South Korea's second-largest bank, agreed to acquire a 10% investment in Tiki, a Vietnamese e-commerce startup, making it the company's third-largest shareholder.

Vietnam Facility Management Industry Overview

The Vietnam Facility Management Market is a fragmented market. It is a highly competitive market without many dominant players present in the market.

- January 2022 - Aden Group joined AutoFlight at its Shanghai headquarters, where the two firms signed a Memorandum of Understanding (MoU) for engagement in the domains of smart air mobility and logistics. The agreement establishes a framework for the two firms to collaborate on new and zero-carbon solutions based on AutoFlight's eVTOL (electric Vertical Take-Off and Landing) technology and Aden Group's digitalization expertise worldwide network of 1,500 customers in China and the APAC region.

- November 2021 - CBRE Group, Inc. (NYSE: CBRE) and Turner & Townsend Holdings Limited announced the transaction in which CBRE purchased a 60% ownership interest in Turner & Townsend and formed a strategic partnership with the company had been completed. CBRE's diversification strategy advanced in four dimensions: asset types, lines of business, clients, and geographies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact of COVID-19 on the Facility Management Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Vietnam policies Encouraging Foreign Direct Investment (FDI) Drives the Growth in Industrial Sector

- 5.1.2 Service Sector Drives the Growth in Vietnam

- 5.2 Market Restraints

- 5.2.1 Increased instances of Data Breaches and Security Threats

6 MARKET SEGMENTATION

- 6.1 By Type of Facility Management Type

- 6.1.1 In-house Facility Management

- 6.1.2 Outsourced Facility Mangement

- 6.1.2.1 Single FM

- 6.1.2.2 Bundled FM

- 6.1.2.3 Integrated FM

- 6.2 By Offerings

- 6.2.1 Hard FM

- 6.2.2 Soft FM

- 6.3 By End-User

- 6.3.1 Commercial

- 6.3.2 Institutional

- 6.3.3 Public/Infrastructure

- 6.3.4 Industrial

- 6.3.5 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CBRE Group Inc.

- 7.1.2 Jones Lang LaSalle Incorporated

- 7.1.3 RCR Vietnam

- 7.1.4 Sodexo Inc.

- 7.1.5 ADEN Vietnam

- 7.1.6 ATALIAN Global Services

- 7.1.7 Savills Vietnam

- 7.1.8 AEON Delight

- 7.1.9 PMC

- 7.1.10 P. Dussmann Co. Ltd

8 INVESTMENT ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219