|

市场调查报告书

商品编码

1632045

专用消费性类比积体电路:全球市场占有率分析、产业趋势与成长预测(2025-2030)Global Application Specific Consumer Analog Integrated Circuit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

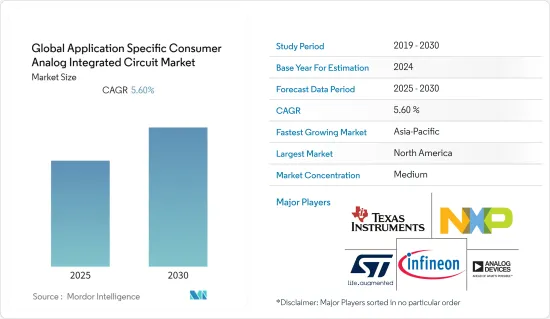

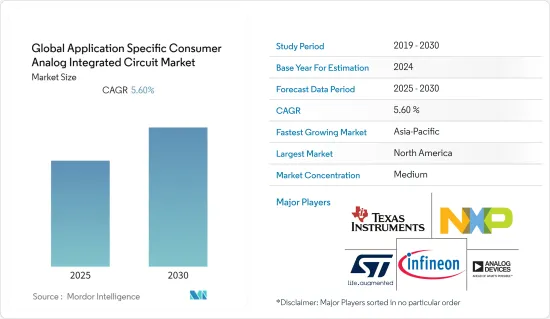

专用消费性类比积体电路的全球市场预计在预测期内复合年增长率为 5.6%。

主要亮点

- 专用类比积体电路的优点包括减少材料清单(BOM)、提高效能、增加功能、降低功耗、提高安全性、减少尺寸和重量、提高产量比率、改进IP保护、降低测试和组装成本。了可靠性。

- 製造商的大批量生产能力是专用类比积体电路市场发展的关键。儘管应用前景广阔,但由于最终用户行业继续需要大量生产,成本仍然是小型企业成长的根本障碍。

- 市场参与者正在透过缩短产品週期来开发针对特定市场的产品。製造业的这种性质也有望在扩大研究市场方面发挥重要作用。

- 此外,2020 年第一季,COVID-19 疫情的爆发严重影响了消费性类比IC供应商和分销管道的库存水准。然而,随着供应链逐步恢復以及各国政府启用财政政策以增强经济,IC产业在2020年第二季也获得了成长动力。除了这些因素之外,宅经济的兴起导致下游顾客的补货需求增加,这也是推高消费类比IC收益的因素。例如,2020年韩国对中国的行动电话和半导体产品出口分别成长7.3%和1.7%,对美国的电脑和周边设备消费类类比IC出口分别成长约25.8%。

- 此外,连网型设备与物联网(IoT)、云端运算和人工智慧(AI)的整合等各种技术突破也在推动市场发展。

特定应用的消费性类比积体电路的市场趋势

消费性电子产品渗透率的扩大支持市场成长

- 对先进消费性电子产品的需求正在迅速增长,加上智慧型手机在娱乐和游戏领域的高渗透率,预计该行业在预测期内将出现强劲的成长。平板手机等设备需求的快速成长也在推动各国下一代智慧型手机的需求发挥重要作用。

- 类比积体电路和参考设计支援下一代智慧型手机的设计。从工业电源管理和电池管理技术到可提供完美音质的新型智慧扩大机技术,类比和嵌入式产品可帮助客户更快进入市场。

- 例如,2021年5月,摩托罗拉宣布与Guru Wireless合作,推出智慧型手机远端无线充电技术,消除消费者使用充电线或充电垫片的需求。此外,腕式智慧型手机预计将获得更多接受,因为用户不需要使用智慧型手錶等其他连接装置来执行快速课程和导航等各种任务。例如,Nubia Alpha 提供了一款配备 OLED 显示器的 4 吋腕式智慧型手机,消费者可以透过该智慧型手机接受语音命令、发送简讯、拨打电话、导航等。

- 5G技术为OEM提供了扩大市场份额的机会,预计将成为推动未来成长的关键因素之一。根据爱立信的研究,到2026年,全球5G用户预计将达到35亿,全球对科技和基础设施的需求和投资也有望成长。这些趋势预计将成为未来智慧型手机市场成长的主要驱动力。

- 2021年3月,OPPO在以「Featureing You」为主题的虚拟活动中宣布在区域推出首款全5G新Reno5系列,包括Reno5 Pro 5G、Reno5 5G和Reno5 Z智慧型手机。这款智慧型手机在人像影片和摄影方面是迄今为止最好的,具有出色的视讯质量,可以捕捉您的所有回忆。此类产品开发可以为新兴市场带来机会。

亚太地区市场预计将出现高速成长

- 由于快速的都市化和工业化,亚太地区的经济状况有所改善。印度、中国和韩国是该地区少数快速成长的经济体,其整体经济和GDP成长率在过去十年中显着提高。结果,奢侈品和先进技术的支出激增。

- 低成本智慧型手机设备的激增和服务计画成本的下降是推动亚太地区消费性电子市场(尤其是智慧型手机普及率)的两个主要原因。例如,根据工业和资讯化部的数据,到2021年,中国每100人拥有约116部行动电话,而2020年每100人拥有112部行动电话。

- 此外,2021年亚太移动经济宣布,2020年终,将有16亿人订阅行动服务,占该地区人口的近60%。到 2025 年,新增用户预计将达到 18 亿(占该地区人口的 62%),接近 2 亿。大部分成长将来自南亚,预计到 2025 年印度将占新用户的一半以上。

- 此外,数位化的提高导致多个亚太国家对智慧型设备的需求激增。该地区有多家高性能智慧型电视製造商,包括三星电子和SONY,并且它们的普及正在加速。由于亚太地区的需求不断增长,这些公司正在推出新的智慧型电视。

- 例如,2021年8月,华为在中国推出了有史以来最大的智慧型电视。 98 吋 LCD 超高清 4K(3840 x 2160 像素)显示器具有 120Hz 更新率、AiMaxCinema 支援和 DCI-P3 色域。音讯部分,支援DTS和杜比双解码。对此类新兴国家的探索为扩大研究市场提供了有利机会。同时,该地区对相机和穿戴式装置的需求不断增长也推动了市场需求。

特定应用消费性类比积体电路产业概述

全球专用消费模拟积体电路市场是一个适度分散的市场,主要参与者包括德克萨斯公司、德克萨斯公司和意法半导体。快速的技术进步、高成本以及消费者偏好的频繁变化预计将威胁到预测期内公司的成长。

- 2022 年 2 月 - 麻省理工学院 (MIT) 的研究人员开发了一种专用积体电路 (ASIC) 晶片,可在物联网设备中实现,以防御基于功率的旁道攻击。该晶片基于一种称为阈值计算的特定计算类型。它不是在真实资料上运行神经网络,而是先将资料分割成自己的随机分量。在累积最终结果之前,网路以随机顺序对随机组件独立运行。

- 2021 年 6 月 - 台湾 IC 设计公司报告对 2021 年第三季智慧型手机出货量持乐观态度,尤其是中国品牌即将推出支援 5G 的新机型。大多数IC厂商预计第三季订单量较上季成长超过10%,5G晶片预估普遍高于4G应用,因此相关厂商的收益也将大幅成长。类比IC厂商也声称,他们的2021年5G晶片出货量目标保持不变,因为他们预计全球5G行动电话出货量将在2021年和2022年呈指数级增长。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 价值链分析

- COVID-19 市场影响评估

- 技术简介

第五章市场动态

- 市场驱动因素

- 消费性电子产品(笔记型电脑、相机、穿戴式装置等)的渗透率提高

- 半导体的小型化

- 物联网和人工智慧的进步

- 市场限制因素

- 特定应用的类比类比IC设计的复杂度不断增加

第六章市场细分(专用类比IC销售的全球收益和出货量的详细覆盖)

- 按地区

- 北美洲

- 亚太地区

- 中国

- 韩国

- 日本

- 台湾

- 亚太地区其他国家

- 欧洲

- 世界其他地区

第七章 竞争格局

- 公司简介

- Texas Instruments Incorporated

- Analog Devices Inc.

- Infineon Technologies AG

- STMicroelectronics

- NXP Semiconductors

- Microchip Technology Inc.

- Onsemi

- Renesas Electronics Corporation

- Skywork Solutions Inc.

- Maxim Integrated Products Inc.

第八章投资分析

第9章 未来展望

The Global Application Specific Consumer Analog Integrated Circuit Market is expected to register a CAGR of 5.6% during the forecast period.

Key Highlights

- The advantages of application-specific analog integrated circuits include decreased BOM (bill-of-materials), enhanced performance, better functionality, lesser power consumption, improved security, reduced size and weight, better yields, enhanced IP protection, decreased test and assembly costs, and better reliability.

- The mass-production abilities of manufacturers are key to the evolution of the application-specific consumer analog integrated circuit market. Despite their encouraging applications, costs remain a fundamental barrier to growth for small players, as end-user industries continue to demand high-volume manufacturing.

- The players in the market are responding to this by shortening product cycles concerning product development of niche specialties. This nature of manufacturing is also anticipated to play a vital role in expanding the studied market.

- Further, in Q1 of 2020, the COVID-19 outbreak severely impacted the inventory levels for the consumer analog IC vendors and distribution channels. However, as the supply chain gradually recovered in the Q2 of 2020, and as various governments enabled fiscal policies to strengthen the economy, the IC sector also gained momentum. These factors, combined with the rise of the stay-at-home economy, led to an increased restocking demand from downstream clients, providing a boost to Consumer analog IC revenue. For instance, in 2020, mobile phones and semiconductor products exports from South Korea to China rose by 7.3% and 1.7%, while exports of Consumer Analog IC for computers and peripherals to the US rose by about 25.8% and 95.9%, respectively.

- Additionally, various technological breakthroughs, such as integrating connected devices with the Internet of Things (IoT), cloud computing, and artificial intelligence (AI), are also driving the market.

Application Specific Consumer Analog Integrated Circuit Market Trends

The Increasing Penetration of Consumer Electronics Would boost the Market Growth

- With the rapidly increasing demand for advanced consumer electronics, coupled with the high adoption of smartphones in the entertainment and gaming sector, the industry is anticipated to witness a significant growth rate during the forecast period. The surging demand for devices such as phablet has also played a crucial role in the demand for the next-generation smartphones across the nations.

- Analog integrated circuits and reference designs enable users to create next-generation smartphone designs. From industry power management and battery management technology to new smart amp technology that provides perfect sound quality, analog, and embedded products will provide customers get to market faster.

- For instance, in May 2021, Motorola announced a partnership with Guru Wireless to introduce remote wireless charging technology for smartphones to eliminate the need for consumers to use charging cables ad charging pads. Furthermore, the wrist Smartphone is also expected to gain more traction as users do not have to use another connected device such as the smartwatch to perform various tasks such as quick class, and navigation, among others. For instance, Nubia Alpha offers a 4-inch wrist smartphone with an OLED display for consumers to pass voice commands, text, call, and navigate, among others, without the hassle of carrying a separate smartphone and a connected smartwatch for quick accessibility.

- The 5G technology is expected to act as one of the major factors providing the OEMs with opportunities to expand their market presence, thereby fostering growth in the future. According to a study by Ericsson, the global 5G subscriptions are expected to reach 3.5 billion by 2026, and the global demand and investment in technology and infrastructure are also expected to gain traction. Such trends are expected to act as major drivers for the growth of the smartphone market in the future.

- In March 2021, at a virtual event themed 'Featuring You,' OPPO announced the regional launch of its new, first-ever, all-5G Reno5 series comprising Reno5 Pro 5G, Reno5 5G, and Reno5 Z smartphones. It is equipped to deliver significantly good portrait videography and photography and superior video quality to capture every memory. Such product developments may create an opportunity for the studied market.

The Asia-Pacific Region is Expected to Witness a High Market Growth

- The economic conditions of Asia-Pacific have improved as a result of rapid urbanization and industrialization. India, China, and South Korea, a few rapidly growing economies in the region, exhibited a significant improvement in their economies and overall GDP growth in the past decade. This has resulted in a surge in spending on high-end goods and advanced technology.

- The proliferation of low-cost smartphone devices and dropping service plan costs are two key reasons driving consumer electronics market growth, especially smartphone adoption across the Asia Pacific. For instance, according to the Ministry of Industry and Information Technology, In 2021, there were around 116 mobile phone subscriptions per one hundred inhabitants in China, an increase from 112 mobile phone subscriptions per one hundred inhabitants in 2020.

- Further, according to The Mobile Economy Asia Pacific 2021, published by The Mobile Economy Asia Pacific 2021, By the end of 2020, 1.6 billion people subscribed to mobile services, representing nearly 60% of the region's population. There would be almost 200 million new subscribers by 2025, taking the total number of subscribers to 1.8 billion (62% of the region's population). Much of the growth is predicted to come from South Asia, with India accounting for more than half of new subscribers by 2025.

- Further, due to the advent of digitization, several countries in the Asia Pacific are witnessing a spike in demand for smart devices. The existence of multiple high-performance smart TV manufacturers in the region, such as Samsung Electronics and Sony Corporation, is accelerating their adoption. These companies are launching new smart TVs in the Asia Pacific in response to the rising demand in the region.

- For instance, in August 2021, Huawei launched its biggest smart TV yet in China. The 98-inch LCD Ultra HD 4K (3840 x 2160 pixels) display comes with a 120Hz refresh rate, AiMaxCinema support, and DCI-P3 color gamut. In the audio department, it offers support for DTS and Dolby dual decoding. Such developments provide lucrative opportunities for the proliferation of the studied market. Simultaneously, an increase in demand for cameras and wearables in the region is also driving the demand for the studied market.

Application Specific Consumer Analog Integrated Circuit Industry Overview

The global application-specific consumer analog integrated circuit market is a moderately fragmented market with the presence of major players like Texas Instruments Incorporated, Texas Instruments Incorporated, Texas Instruments Incorporated, STMicroelectronics, etc. The rapid technological advancements, high costs of research and development, and frequent changes in consumer preferences are expected to threaten the growth of the companies during the forecast period.

- February 2022 - Researchers at MIT developed an application-specific integrated circuit (ASIC) chip that can be implemented on the internet of things devices to defend against power-based side-channel attacks. The team's chip is based on a particular type of computation known as threshold computing. Rather than holding a neural network operating on actual data, the data is first to split into unique, random components. The network operates on the random components individually, in a random order, before accumulating the final result.

- June 2021 - Taiwan-based IC design houses reported that they are optimistic about their shipments for smartphone applications in the third quarter of 2021 due to the upcoming rollouts of new 5G-enabled models, particularly by Chinese brands. Most IC vendors expect their order volumes to increase by over 10% sequentially in the third quarter, and revenues of related vendors will also see significant increases as quotes for 5G chips are generally higher than those for 4G applications. The analog IC vendors also insisted that their shipment targets of 5G chips for 2021 remain unchanged as they expect global 5G phone shipments to grow exponentially in 2021 and 2022.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of Covid-19 on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Penetration of consumer electronics (laptops, cameras, wearables, etc)

- 5.1.2 Miniaturization of semiconductors

- 5.1.3 Advancements in Internet of Things and Artificial Intelligence

- 5.2 Market Restraints

- 5.2.1 Increasing Design Complexity of Application Specific Analog IC

6 MARKET SEGMENTATION (The segmentation comprises an in-depth coverage on the global revenue generated from the sale of application specific consumer analog ICs, along with the unit shipments.)

- 6.1 By Geography

- 6.1.1 North America

- 6.1.2 Asia-Pacific

- 6.1.2.1 China

- 6.1.2.2 South Korea

- 6.1.2.3 Japan

- 6.1.2.4 Taiwan

- 6.1.2.5 Rest of APAC

- 6.1.3 Europe

- 6.1.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Texas Instruments Incorporated

- 7.1.2 Analog Devices Inc.

- 7.1.3 Infineon Technologies AG

- 7.1.4 STMicroelectronics

- 7.1.5 NXP Semiconductors

- 7.1.6 Microchip Technology Inc.

- 7.1.7 Onsemi

- 7.1.8 Renesas Electronics Corporation

- 7.1.9 Skywork Solutions Inc.

- 7.1.10 Maxim Integrated Products Inc.