|

市场调查报告书

商品编码

1632066

欧洲商用车远端资讯处理:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Commercial Vehicle Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

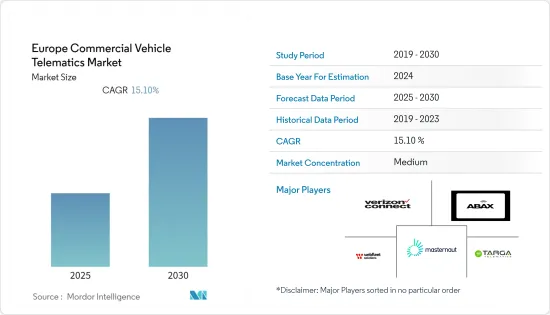

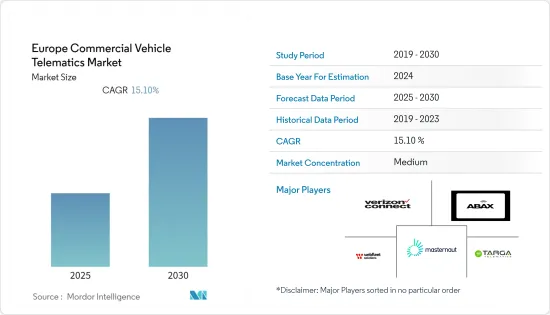

欧洲商用车远端资讯处理市场预计在预测期内复合年增长率为 15.1%。

主要亮点

- 如今,大多数联网汽车都配备了感测器,可以产生有价值的资料,帮助车队管理者保持平稳运行,并帮助汽车製造商提供个人化的客户体验。凭藉更先进的功能和技术,商用车现在正在利用先进的技术,导致越来越多的技术和软体巨头进入汽车行业。

- 由于远端资讯处理产业是由车辆需求驱动的,对商场卡车、皮卡车和其他轻型商用车的需求不断增加,以及对安全管理解决方案、保险远端资讯处理和车辆追踪系统的需求不断增加,预计将推动市场成长。

- 通勤的便利性导致了商用车的激增,例如皮卡车、轻型卡车和其他轻型商用车。例如,物流业和电子商务业务的成长正在增加商用车的产量,预计将推动该地区商用车远端资讯处理市场的成长。

- 此外,车辆远端资讯处理解决方案赋予驾驶员责任感。透过这些解决方案,可以定期检查和监控效能。此外,车辆远端资讯处理系统包括侦测感测器。这些感应器提醒车主注意一些安全功能。车主逐渐意识到各种安全隐患,例如超速、停车标誌违规侦测、车道偏离警告、前方碰撞警告等,这正在推动我们正在推动的市场成长。

- 市场领先公司期待利用电动车 (EV) 引入市场带来的机会。

欧洲商用车远端资讯处理市场趋势

对连网卡车的需求不断增长

- 轻型商用车产量的增加有助于连网卡车市场的进一步扩大。远端资讯处理技术有助于优化各种因素,例如燃料使用和卡车维护。

- 此外,人工智慧、机器学习、ADAS(高级驾驶员辅助系统)等商用车行业新兴技术的高采用率以及自动驾驶卡车需求的不断增长对市场成长产生了积极影响。

- 目标商标产品製造商 (OEM)、供应商、软体和分析企业、经销商和车队都受益于连网卡车市场的稳定成长。虽然这些解决方案有点昂贵,而且车队对作为车队管理系统 (FMS) 一部分的远端资讯处理的了解有限,但将大量资料分析转化为可操作解决方案的前景对我来说太有吸引力了。

- 现代卡车车队可以透过使用连网汽车和程序来显着提高效率。以前,车队只查看车辆的 GPS资料等即时资料点,但感测器技术和行动电话频宽的进步使得更精细的资料管理能够提高车辆的运作。

德国市场成长显着

- 技术进步以及与车辆和乘客安全相关的政府政策等因素预计将推动该国对车辆远端资讯处理解决方案的需求。此外,提供远端资讯处理产品和服务的各种参与者的出现、消费者对道路安全意识的提高以及车队所有者对远端资讯处理的日益采用,正在推动该国市场对远端资讯处理解决方案的需求。

- 该国的汽车远端资讯处理是由安全和安保解决方案推动的。随着智慧交通系统和自动驾驶技术的发展,汽车乘客的安全要求将会提高。此外,各国政府也要求增加汽车乘客安全功能的数量。

- 在德国,非公路用车越来越多地采用远端资讯处理系统是一个显着的市场趋势。由于生产率和效率的提高、对非公路用车辆资料分析的需求增加以及减少与维修和维护相关的运营费用的需要,推动了这些车辆对远端资讯处理解决方案的日益接受。

- 此外,一些汽车协会正在对全国非公路用车辆可用的主要远端资讯处理解决方案进行标准化,并推广其在这些车辆中的使用。

欧洲商用车远距资讯处理产业概况

由于众多参与者的参与,欧洲商用车远端资讯处理市场竞争适度。儘管市场随着技术的发展而变化,但传统技术仍占据主要份额。

- 2021 年 5 月 - Webfleet Solutions 将业务扩展到匈牙利。 Webfleet Solutions 提供针对当地商务车队市场需求量身订製的解决方案和服务。此次扩张增强了 WebFleet Solutions 在欧洲运输领域的市场占有率,该领域有超过 20 万辆重型商用车 (HCV) 透过该公司的车队管理解决方案 WEBFLEET 连线。

- 2021 年 6 月 - 福特透过推出福特远程资讯处理 Essentials,为欧洲车队运营商执行时间联网正常运行时间,福特远程信息处理Essentials 是一款免费的新型车队管理工具,旨在帮助提高联网商用车生产力- 扩展系统。

- 2021 年 6 月 - Investindustrial 同意收购义大利科技公司 Targa Telematics,该公司为行动营运商提供远端资讯处理、智慧运输和数位物联网平台解决方案。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 对连网卡车的需求不断增长

- 利用资料和历史资料降低燃料成本

- 市场限制因素

- 通讯技术带来的安全和隐私问题

第六章 市场细分

- 按类型

- 解决方案

- 车队追踪和监控

- 司机管理

- 保险远端资讯处理

- 安全与合规

- 车联网解决方案

- 其他的

- 按服务

- 解决方案

- 按提供者类型

- OEM

- 售后市场

- 按地区

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 其他的

第七章 竞争格局

- 公司简介

- Navistar International Corporation

- Volvo Trucks Corporation

- Ford Motor Company

- Hino Motors Ltd

- General Motors Company

- PTC Inc.

- Trimble Inc.

- Fleetmatics Pvt.Ltd

- Lytx Inc.

- Tata motors Ltd

第八章投资分析

第9章 未来趋势

简介目录

Product Code: 91072

The Europe Commercial Vehicle Telematics Market is expected to register a CAGR of 15.1% during the forecast period.

Key Highlights

- Most connected vehicles nowadays are provided with sensors that generate valuable data used by fleet managers for smooth operations and supporting automakers in delivering personalized customer experiences. With more advanced features and technologies, commercial vehicles are now utilizing advanced technologies, resulting in the entry of more technology and software giants into the automotive industry.

- As the telematics sector is dependent on vehicle demand, increased demand for mall trucks, pick-up vans, and other light commercial vehicles alongside the growing demand for safety management solutions, insurance telematics, and fleet tracking systems is set to boost the market growth rate.

- Due to the ease of commute, commercial vehicles such as pick-up vans, small trucks, and other light commercial vehicles are rapidly increasing. For instance, the rise in logistic industries and e-commerce businesses has resulted in an increase in commercial vehicle production, which is expected to boost the growth of the commercial vehicle telematics market in the region.

- Further, the vehicle telematics solutions provide drivers with a sense of responsibility. The performance is regularly examined and monitored with these solutions. In addition, vehicle telematics systems include detecting sensors. Several safety features are alerted to the car owner by these sensors. Vehicle owners are becoming aware of various safety hazards, including exceeding speed limits, detecting stop sign breaches, having lane-drifting warnings, warnings on forwarding collisions, and more, which is driving the market growth.

- The leading players in the market are looking forward to leveraging the opportunities presented by the introduction of electric vehicles (EVs) in the market.

Europe Commercial Vehicle Telematics Market Trends

Growing Demand For The Connected Trucks

- The increasing production of light commercial vehicles is helping to propel the connected truck market further. Telematics technology aids in the optimization of a variety of elements, including fuel usage, truck maintenance, and so on.

- Furthermore, the high adoption rate of modern technologies in the commercial vehicle industry, such as AI, machine learning, advanced driver assistance systems, and others, as well as the growing demand for autonomous trucks, are positively impacting the market's growth.

- Original equipment manufacturers (OEMs), suppliers, software and analytics businesses, dealers, and fleets benefit from the connected truck market's steady rise. While these solutions are a little expensive, and fleets have a limited understanding of telematics as part of fleet management systems (FMS), the prospect of turning enormous data analytics into actionable solutions is too appealing for fleets.

- The modern truck fleet's use of connected vehicles and procedures could result in significant efficiency gains. Previously, a fleet would have just watched immediate data points like vehicle GPS data, but advances in sensor technology and cellular bandwidth allow more detailed data management to improve vehicle uptime.

Germany to Account For Significant Market Growth

- Factors such as technological advancements and government policies related to vehicle and passenger safety are expected to boost the country's demand for vehicle telematics solutions. Furthermore, the presence of various players offering telematics products and services, coupled with the rising awareness among consumers about road safety and increasing adoption of telematics by fleet owners, is propelling the demand for telematics solutions in the country's market.

- The country's automotive vehicle telematics is driven by safety and security solutions. Automobile passenger safety demand will rise as intelligent transportation systems and automated driving technologies evolve. Furthermore, the government has mandated that the number of passenger safety features in automobiles be increased.

- In Germany, the rising deployment of telematics systems in off-highway vehicles is a prominent trend in the market. The growing acceptance of telematics solutions in these vehicles is due to their increased productivity and efficiency, the growing demand for off-highway vehicle data analysis, and the need to reduce the operational expenses connected with their repair and maintenance.

- Furthermore, several automotive associations have standardized the major telematics solutions available for off-highway vehicles across the country, stimulating their usage in these vehicles.

Europe Commercial Vehicle Telematics Industry Overview

The Europe Commercial Vehicle Telematics Market is moderately competitive due to various players in the market. The market is transforming with the evolution of technologies, but conventional technology will continue to hold the major share.

- May 2021 - Webfleet Solutions has expanded its operations into Hungary. Now, the company will offer tailored solutions and services to meet the needs of the local business fleet market; hence the expansion reinforces Webfleet Solutions' European market will be Prominent in the transport sector, with more than 200,000 heavy commercial vehicles (HCVs) connected through its fleet management solution WEBFLEET.

- June 2021 - Ford expanded its connected uptime system to European fleet operators by introducing Ford Telematics Essentials, a complimentary new fleet management tool designed to help increase the productivity of connected commercial vehicles.

- June 2021 - Investindustrial agreed to acquire Targa Telematics, an Italian technology company that offers solutions in telematics, smart mobility, and digital IoT platforms for mobility operators.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porters Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for the Connected Trucks

- 5.1.2 Reduction of Fuel Costs with Real Time and Historical data

- 5.2 Market Restraints

- 5.2.1 Security and Privacy Concerns Due To Communication Technology

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions

- 6.1.1.1 Fleet Tracking & Monitoring

- 6.1.1.2 Driver Management

- 6.1.1.3 Insurance Telematics

- 6.1.1.4 Safety & Compliance

- 6.1.1.5 V2X solutions

- 6.1.1.6 Others

- 6.1.2 Services

- 6.1.1 Solutions

- 6.2 By Provider Type

- 6.2.1 OEM

- 6.2.2 Aftermarket

- 6.3 Geography

- 6.3.1 Germany

- 6.3.2 France

- 6.3.3 United Kingdom

- 6.3.4 Italy

- 6.3.5 Spain

- 6.3.6 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Navistar International Corporation

- 7.1.2 Volvo Trucks Corporation

- 7.1.3 Ford Motor Company

- 7.1.4 Hino Motors Ltd

- 7.1.5 General Motors Company

- 7.1.6 PTC Inc.

- 7.1.7 Trimble Inc.

- 7.1.8 Fleetmatics Pvt.Ltd

- 7.1.9 Lytx Inc.

- 7.1.10 Tata motors Ltd

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219