|

市场调查报告书

商品编码

1632075

拉丁美洲 BOPP 薄膜:市场占有率分析、产业趋势、成长预测(2025-2030 年)Latin America BOPP Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

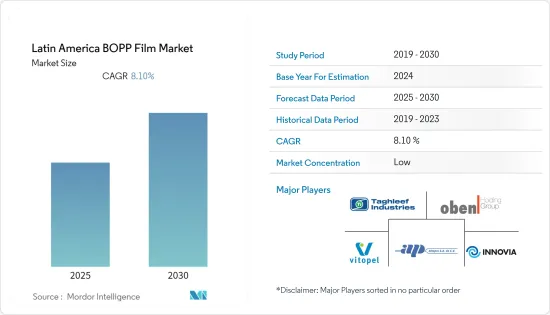

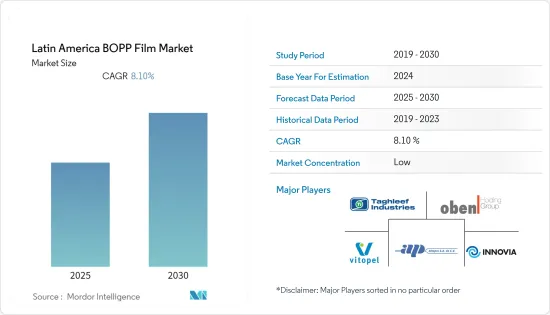

拉丁美洲 BOPP 薄膜市场预计在预测期内复合年增长率为 8.1%。

主要亮点

- BOPP 薄膜越来越多地用于包装、标籤和层压等应用。延长产品保质期以及维持产品品质、美观和永续性的需求日益增长,是推动产业供应商采用 BOPP 薄膜的主要因素。

- BOPP 薄膜因其良好的产量比率(IML 橙皮效应的最小密度为 0.55)和 PP 容器的可回收性而成为标籤的首选。由于软质包装产业的扩张,BOPP 薄膜在全球范围内需求强劲。

- 此外,BOPP薄膜是一种优异的电绝缘材料,具有超过700MV/m的极高击穿电场,因此它已被用于电容器,并且主要作为电容器由聚合物而商业化。

- 领先的供应商正在创新新产品,并考虑到对永续解决方案的需求。例如,2021 年 7 月,Innovia 薄膜开发了 Rayoface QBD,这是一种独特设计的基于 BOPP 的空化薄膜,适用于家庭和个人护理、食品和饮料产品以及我所做的其他消费包装商品等感压标籤应用。

- 近年来,消费者开始关注废弃塑胶对环境的影响。其中包括对产品中的化学物质可能渗入地下水以及大量塑胶最终进入垃圾掩埋场和海洋的担忧。作为回应,薄膜製造商正在从其产品中去除许多化学物质,生产更薄规格的薄膜,并释放衬垫以减少整体塑胶使用量。

- 与全球许多其他产业一样,薄膜材料供应链也受到了 COVID-19 疫情的影响。疫情带来了相当大的挑战,改变了消费行为,导致供应商根据市场的变化调整需求。

拉丁美洲BOPP薄膜市场趋势

软包装需求不断成长

- 由于该地区食品工业的显着增长,包装需求主要由该行业驱动,该地区的食品公司正在采用 BOPP 解决方案作为其包装需求的一部分。随着需求的增加,地区製造商正在扩大产能。

- 消费者对包装解决方案和健康益处的认识不断增强,健康考量主要推动了对软包装的需求。此外,对已调理食品和已调理食品的日益依赖也增加了该地区对软包装的需求,特别是在零嘴零食领域。

- 由于需求不断增长,许多公司正在扩大在巴西的业务。 Grupo Lantero 最近在巴西圣保罗开设了一家平方公尺的新工厂,以支持其运营并在同一地点製造刚性和软质塑胶包装。

- 此外,随着肉类需求的快速增长,预计在预测期内该地区用于肉类包装的 BOPP 薄膜的使用将会扩大。例如,根据经济合作暨发展组织(OECD)的一项研究,阿根廷是世界第三大肉类消费国,而巴西则排名第六。

巴西预计将占较大市场占有率

- 该地区对包装食品不断增长的需求正在增加该行业对 BOPP 包装的需求。巴西和墨西哥是该地区需求成长的主要贡献者。

- 乳製品、零嘴零食和糖果零食是BOPP薄膜的主要最终用户。调气包装技术和高压加工等技术进步正在增加 BOPP 薄膜在肉类、家禽、水果和蔬菜中的使用。

- 随着国内食品和饮料产业的发展,对包装的需求不断增加,全部区域采用BOPP解决方案作为其包装需求的一部分。随着需求的增加,地区製造商正在扩大产能。

拉丁美洲BOPP薄膜产业概况

由于国内外企业透过合作、併购和产品创新扩大在该地区的影响力,市场竞争加剧,拉丁美洲 BOPP 薄膜市场正在走向碎片化。

- 2021 年 12 月 - Oben Holding 集团成员 OPP Film Columbia 购买了 BOBST K5 4050 宽幅镀膜机,使该集团的 BOBST 镀膜机总数达到 9 台,结束了 15 年前开始的牢固合作关係。 OPP Film Columbia 是 Oben Holding Group 的一个新部门,去年开始在一条新薄膜生产线上生产 BOPP。 BOBST K5 4050已于今年10月运作,将采用AluBond製程生产BOPP和BOPET薄膜,生产高阻隔、高附着力薄膜。

- 2021 年 11 月 - Innovia 薄膜开发并推出了 Rayoface QBD,这是一种专为感压标籤(PSL) 应用而设计的专有 BOPP 基膜。该薄膜目前有 60 微米(240 万)和 65 微米(260 万)两种规格,一侧经过电晕处理。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 市场挑战/限制

- COVID 影响评估-19

第六章 市场细分

- 按最终用户产业

- 软包装

- 食物

- 非食品

- 工业的

- 层压板

- 胶水

- 冷凝器

- 其他最终用户(按行业)

- 软包装

- 按地区

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

第七章 竞争格局

- 公司简介

- Biofilm(Taghleef Industries(Ti))

- Opp Film(Oben Holding Group)

- Altopro SA de CV

- Vitopel

- Innovia Films

- Premix Brazil

- Polo Films

第八章 市场未来展望

简介目录

Product Code: 91178

The Latin America BOPP Film Market is expected to register a CAGR of 8.1% during the forecast period.

Key Highlights

- These films are being increasingly adopted in the applications such as packaging, labeling, and lamination. The rising need to extend the shelf life of the products and maintenance of product quality, aesthetics and sustainability are some of the significant factors that propel the industry's vendors to adopt BOPP films.

- BOPP films are preferred in labeling because of their yield benefit (Lowest density of 0.55 for IML orange peel effect) and recyclability with PP containers. BOPP Films has a strong global demand driven by expanding flexible packaging industry.

- In addition, the BOPP films are getting used in capacitors as BOPP is a good electrical insulating material with a very high breakdown electric field above 700MV/m, which makes it a mostly commercialized polymer in capacitors.

- The key vendors are innovating new products keeping the demand for sustainable solutions in mind. For instance, in July 2021, Innovia films developed a uniquely engineered cavitated BOPP base film, Rayoface QBD, for pressure-sensitive labeling applications such as Household and Personal Care, Food and Beverage, and other consumer packaged goods sectors.

- Consumers have been more concerned about the environmental impact of discarded plastics in recent years. This includes concerns about chemicals in items that can leak into groundwater and the sheer volume of plastics that end up in landfills and the ocean. In response, film suppliers have removed numerous chemicals from their products, producing thinner gauged films and releasing liners to lower the total amount of plastic used.

- The supply chain for film materials was impacted by the Covid-19 epidemic like many other worldwide sectors. The epidemic has caused considerable challenges, and changes in consumer behavior, which has led suppliers to tailor needs to shift within the market.

Latin America BOPP Film Market Trends

Growing Demand of Flexible Packaging

- As the food industry in the region is growing significantly, the demand for packaging is driven substantially by the industry, and food enterprises across the region are adopting BOPP solutions as a part of their packaging needs. With the growing demand, regional manufacturers are expanding their production capabilities.

- Consumer awareness about packaging solutions and health benefits is increasing, and health considerations primarily drive the demand for flexible packaging. Also, increased reliance on ready-to-eat and prepared food create the need for flexible packaging in the region, especially in the snack segments.

- Many corporations are expanding their operations in Brazil in response to rising demand. Recently Grupo Lantero established a new 7,000 square meter plant in Sao Paulo, Brazil, to support its operations and manufacture rigid and flexible plastic packaging at the same location.

- Furthermore, the use of BOPP films for packaging meat is expected to grow during the forecast period in the region as the demand for meat is increased rapidly. For instance, according to a survey by the Organization for Economic Cooperation and Development (OECD), Argentina stands as the world's third-largest consumer, and Brazil is the sixth in the meat sector.

Brazil is Expected to Hold Significant Market Share

- The growing demand for packaged food in the region is augmenting the demand for BOPP packaging in the industry. Brazil and Mexico are among the significant contributors to the demand growth in the region.

- Dairy, snacks, and confectionery products are the major end users of BOPP films. The technological advancements in packaging technology, such as modified atmosphere and high-pressure processing, have increased the use of BOPP films for meat, poultry, fruits, and vegetables.

- As the food and beverage industry in the country is growing, the demand for packaging is on the rise, and food enterprises across the region are adopting BOPP solutions as part of their packaging needs. With the growing demand, regional manufacturers are expanding their production capabilities.

Latin America BOPP Film Industry Overview

Latin America BOPP films market is moving toward a fragmented market as the competition in the market is intensifying owing to the presence of domestic and international players, which are increasing their presence in the region through collaboration, merger & acquisition, and product innovation.

- December 2021 - OPP Film Colombia, a part of Oben Holding Group, has purchased a BOBST K5 4050 wide web metallizer, taking the total number of BOBST metallizers across the Group to nine, cementing the relationship between the two companies, which began 15 years ago. A new division of Oben Holding Group, OPP Film Colombia, began producing BOPP on its new film line last year. The BOBST K5 4050 has been in operation since October this year and will produce BOPP and BOPET films using the AluBond process to produce a high barrier, high adhesion film.

- November 2021 - Innovia films has developed and launched a uniquely engineered cavitated BOPP base film, Rayoface QBD, designed for pressure-sensitive labeling (PSL) applications. The film is available today at 60 microns (2.4 mils) and 65 microns (2.6 mils) and is corona treated on one side.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Challenges/Restraints

- 5.3 Assesment of Impact of COVID -19

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Flexible Packaging

- 6.1.1.1 Food

- 6.1.1.2 Non-Food

- 6.1.2 Industrial

- 6.1.2.1 Lamination

- 6.1.2.2 Adhesives

- 6.1.2.3 Capacitors

- 6.1.3 Other End-user Verticals

- 6.1.1 Flexible Packaging

- 6.2 By Geography

- 6.2.1 Brazil

- 6.2.2 Argentina

- 6.2.3 Mexico

- 6.2.4 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Biofilm (Taghleef Industries (Ti))

- 7.1.2 Opp Film (Oben Holding Group)

- 7.1.3 Altopro S.A. de CV

- 7.1.4 Vitopel

- 7.1.5 Innovia Films

- 7.1.6 Premix Brazil

- 7.1.7 Polo Films

8 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219