|

市场调查报告书

商品编码

1632078

世界同步马达 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Global Synchronous Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

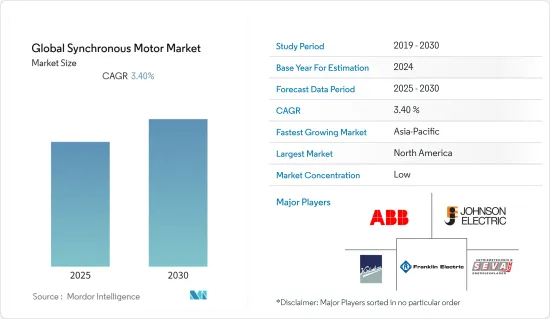

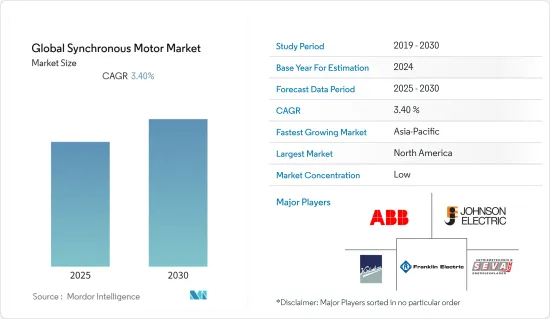

预计全球同步马达市场在预测期内复合年增长率为 3.4%

主要亮点

- 根据国际能源总署(IEA)统计,马达约占全球电力消耗的一半。AC马达被认为是工业领域的重要部件。AC马达为各种工业应用提供动力,包括输送机、搅拌机、泵浦、风扇、起吊装置和破碎机。

- 在北美等地区,人们越来越关注提高排放标准以保护环境,并且高度关注提高马达效率。 IE5 是朝这个方向制定的少数未来标准之一。

- Kollmorgen 是一家领先的设计商、开发商和製造商,为各种工业、航太和国防以及消费应用提供独特的运动控制产品和服务,我们很自豪能够提供Pacific Scienceific 的ST/SN 系列和Superior Electric 两个品牌。产品还提供四种不同的框架尺寸,包括 NEMA 23、34、42 和 66。

- 2021 年 1 月,Bison Gear and Engineering Corp. 宣布推出其紧凑高效的 VFsync 系列永磁交流同步 (PMAC) 马达。 VFsync 生产线专为各种应用而设计,包括输送机系统、温室设备、装瓶设备、装袋设备、包装机以及工业泵浦和搅拌机。

- COVID-19 对市场成长有负面影响,主要是由于离散製造业的停工。 COVID-19 对市场成长有负面影响,主要是因为个别製造业的停工。下降的主要原因是运输设备以及石油和煤炭产品的销售下降。机械业销售额增幅最大,其次是木製品和化工业。

- COVID-19 的爆发和各地区的封锁规定影响了资本投资和工业活动。为应对新冠肺炎 (COVID-19) 引发的全球景气衰退,金属、采矿和发电等终端用户行业的几家公司因限制措施而关闭了生产基地。

同步马达市场趋势

电动车需求的成长正在推动市场成长

- 现代的重大技术进步增加了为汽车、石油和天然气以及发电等各种最终用户行业开发马达的机会。

- 在同步马达中,转子以与磁场相同的速度旋转。该马达具有很大的低速扭矩,非常适合城市驾驶。同步马达的另一个优点是结构紧凑、重量轻。

- 2022年1月,BMW开发出无磁第五代马达。该马达作为三相交流同步马达运行,将为 BMW iX m60动力来源。该马达描述了一种结合了灵敏度和高科技电动车技术的解决方案,可在不使用稀土矿物的情况下提高效率。

- 2022 年 2 月,Quantron 发布了 CIZARIS 12 EV,这是一款总长 12 公尺的新型全电动公车。它将Quantron合作伙伴CATL的磷酸锂铁锂电池与中央同步马达结合,确保高达370公里的高续航里程。

- 此外,2021 年 10 月,瑞士电动车新兴企业Piech Automotive 开始测试电动跑车 GT。该车配备三台同步马达,一前一后轴,系统功率据称为450kW。

亚太地区预计将出现显着成长

- 日本是亚太地区转型为先进工业经济的先驱。工业4.0版本正在以更快的速度被采用。日本也已成为自动化产品的製造地,供应国际市场以及亚太地区的其他区域市场。

- 日本是机械製造和汽车工业的领先国家之一。日本的材料和製造业主要包括林产品、石油和天然气、金属和采矿等领域。日本拥有规模庞大、先进的製造业。日本製造的产品因其高品质、耐用性和精緻的设计而备受推崇。丰田、本田、三菱等日本汽车製造商是全球最大的汽车製造商之一,日本是第三大汽车製造商。

- 许多公司正在采用新技术来提高年产量。例如,2021年1月,在轧延北方生产原铜的北方铜业决定增产,公司选择ABB安装由电压模组马达组成的电气和自动化系统。

- 2021 年 6 月,韩国财政部长宣布计划设立 5,000 亿韩元(4.48 亿美元)的基金,以支持下一代汽车领域的研究、开发和资本投资。汽车製造商正在加速下一代汽车的开发和生产,包括自动驾驶汽车和氢动力汽车。政府计划今年累计2,826亿韩元,帮助汽车零件企业转型下一代汽车的业务组合。预计此类案例将在预测期内推动同步马达的成长。

同步马达产业概况

全球同步马达市场企业之间的竞争日益激烈。该市场由 ABB、德昌电机、西门子等各种大公司组成。从市场占有率来看,目前这些大公司占据市场主导地位。然而,随着技术创新的不断增加,许多公司正在透过赢得新契约和开发新市场来扩大其市场份额。

- 2021 年 4 月 - 雅马哈汽车开发了一款新型马达Hyper-EV,最大输出功率为 469 BHP。马达源自油冷800伏特内建永磁同步马达。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 对高能源效率的需求不断增长

- HVAC 应用中对马达的需求增加

- 电动车的扩张

- 市场问题

- 更昂贵的先进电动引擎系统

第 6 章 细分

- 按类型

- 同步交流AC马达

- 直流励磁转子

- 永久磁铁

- 磁滞马达

- 马达马达

- 同步交流AC马达

- 按最终用户产业

- 石油和天然气

- 化工/石化

- 发电

- 用水和污水

- 发电

- 金属/矿业

- 饮食

- 离散製造业

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 义大利

- 法国

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲/纽西兰

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 智利

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东/非洲

- 北美洲

第七章 供应商市场占有率

第八章 竞争格局

- 公司简介

- Johnson Electric

- Kirloskar Electric Co. Ltd.

- ABB India Limited

- Franklin Electric Co.Inc.

- SEVA-tec GmbH

- Dunkermotoren GmbH

- BEN Buchele Elektromotorenwerke GmbH

- Junghanns & Kolosche GmbH

- Siemens AG

- ROTEK GmbH & Co.KG

第九章投资分析

第十章投资分析市场的未来

简介目录

Product Code: 91191

The Global Synchronous Motor Market is expected to register a CAGR of 3.4% during the forecast period.

Key Highlights

- According to the International Energy Agency (IEA), electric motors account for about half of the global electricity consumption. AC motors are considered a component integral to the industrial sector. AC motors power various industrial applications, such as conveyors, mixers, pumps, fans, hoists, and crushers.

- With the increasing focus on improving the emission criteria for environment support in regions such as North America, there has been a high focus on improving the efficiency of the motors. IE5 is one of the several futuristic standards set in this direction.

- Kollmorgen, a major player engaged in the design, development, and manufacture of proprietary motion control products and services for diverse industrial, aerospace and defense, and consumer product applications, offers two brands of AC synchronous motors in the Pacific Scientific ST/SN Series and Superior Electric products. Products in four frame sizes, such as NEMA 23, 34, 42, and 66, are also available.

- In Jan 2021, Bison Gear and Engineering Corp. announced the release of its compact and efficient VFsync line of Permanent Magnet AC Synchronous (PMAC) motors. The VFsync line is designed for various applications, including conveyor systems, greenhouse equipment, bottling equipment, bagging equipment, packaging machines, and industrial pumps and mixers.

- COVID-19 has negatively impacted the market growth, mainly due to stoppage in discrete manufacturing industry operations. Much of the decline was attributable to lower transportation equipment sales and petroleum and coal products. The machinery industry posted the largest sales gain, followed by the wood product and chemical industries.

- The COVID-19 outbreak and the lockdown restriction imposed across the regions have affected capital investments and industrial activities. Following the global economic recession led by COVID-19, several enterprises operating in the end-user industries, including metal and mining, and power generation, shut down their production sites due to lockdown restrictions.

Synchronous Motor Market Trends

Rising Demand for Electric Vehicles is Expected to Drive the Market Growth

- The substantial technological advances in the modern era have opened up opportunities to develop electric motors for various end-user industries, such as automotive, oil and gas, power generation, and other industries.

- In a synchronous motor, the rotor turns at the same speed as the magnetic field. The motor provides high low-speed torque, making it ideal for urban driving. Another major advantage that a synchronous motor offers is that it can be compact and low weight.

- In Jan 2022, BMW developed a magnet-free-fifth-generation motor, which operates as a three-phase AC synchronous motor and will be used to power BMW iX m60. The motor will provide a solution that combines sensibility with high-tech EV technology to improve efficiency without using rare earth minerals.

- In Feb 2022, Quantron unveiled its new twelve-meter-long, all-electric bus, CIZARIS 12 EV. The lithium iron phosphate batteries from Quantron's partner CATL were combined with a central synchronous motor to ensure a high range of up to 370 kilometers.

- Moreover, in October 2021, Piech Automotive, a swiss electric car start-up, started testing its GT electric sports car. The car is powered by three-synchronous motors, one at the front and a tow at the rear axle, which are said to have a system output of 450 kW.

Asia-Pacific is Expected to Show a Significant Growth

- Japan has been a pioneer in transforming into an advanced industrial economy in the Asia-Pacific region. The Industrial version 4.0 is being adopted at a faster pace. The country has also emerged as a manufacturing hub for automation products and supplies them to other regional markets in the Asia-Pacific region, alongside international markets.

- Japan has been one of the major countries in the manufacturing of machinery and automotive industries. Japan's materials and manufacturing industries primarily include different fields, forest products, oil and gas, metals, and mining. The country has a large and highly advanced manufacturing industry. The manufactured products from the country enjoy a high reputation for their high quality, durability, and sophistication. The Japanese automakers, such as Toyota, Honda, and Mitsubishi, are among the biggest automakers around the globe, and Japan is the third-largest automaker.

- Various companies are adopting new technologies to boost their annual outputs. For instance, in January 2021, Northern Copper Industry Co. Ltd, a company producing raw material copper stock in North China, selected ABB for the installation of an electrical and automation system comprising the company's high voltage modular motor to optimize the production capacity of the company to garner the annual output of 5000 ton of rolled copper strip and foil production.

- In June 2021, South Korea's finance minister announced that the country plans to create a KRW 500 billion (USD 448 million) fund to support research, development, and facility investments in the next-generation vehicle sector. Automakers have been accelerating the development and production of next-generation automobiles, including autonomous and hydrogen-fuelled vehicles. The government plans to allocate KRW 282.6 billion this year to help auto parts firms to transform their business portfolios for next-generation automobiles. Such instances are expected to drive the growth of Synchronous motors over the forecasted period.

Synchronous Motor Industry Overview

The global synchronous motor market is witnessing a rise in competitiveness among companies. The market consists of various major players, such as ABB Ltd., Johnson Electric, and Siemens AG. In terms of market share, these significant players currently dominate the market. However, with increasing technology innovations, many companies are increasing their market presence by securing new contracts and tapping new markets.

- April 2021 - Yamaha Motor has developed a new electric Hyper-EV electric motor with a maximum power output of 469 BHP. The electric motor comes from an oil-cooled 800 volt Interior Permanent Magnet Synchronous Motor.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for High Energy Efficiency

- 5.1.2 The growing demand for electric motors used in HVAC applications

- 5.1.3 Increasing Adoption of Electric Vehicles

- 5.2 Market Challenges

- 5.2.1 Costlier advanced electric engine systems

6 SEGMENTATION

- 6.1 By Type

- 6.1.1 Synchronous AC Motors

- 6.1.1.1 DC Excited Rotor

- 6.1.1.2 Permanent Magnet

- 6.1.1.3 Hysteresis Motor

- 6.1.1.4 Reluctance Motor

- 6.1.1 Synchronous AC Motors

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical & Petrochemical

- 6.2.3 Power Generation

- 6.2.4 Water & Wastewater

- 6.2.5 Power Generation

- 6.2.6 Metal & Mining

- 6.2.7 Food & Beverage

- 6.2.8 Discrete Industries

- 6.2.9 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 France

- 6.3.2.5 Russia

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia & New Zealand

- 6.3.3.6 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Chile

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle-East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Turkey

- 6.3.5.4 Rest of Middle-East and Africa

- 6.3.1 North America

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Johnson Electric

- 8.1.2 Kirloskar Electric Co. Ltd.

- 8.1.3 ABB India Limited

- 8.1.4 Franklin Electric Co.Inc.

- 8.1.5 SEVA-tec GmbH

- 8.1.6 Dunkermotoren GmbH

- 8.1.7 BEN Buchele Elektromotorenwerke GmbH

- 8.1.8 Junghanns & Kolosche GmbH

- 8.1.9 Siemens AG

- 8.1.10 ROTEK GmbH & Co.KG

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219