|

市场调查报告书

商品编码

1632089

世界木模板系统 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Global Wooden Formwork Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

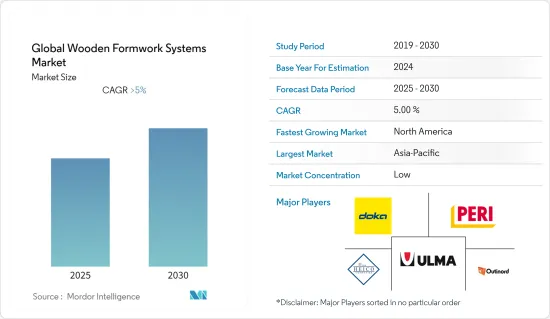

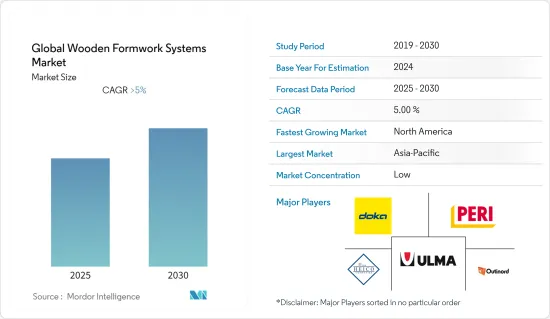

全球木模板系统市场预计在预测期内将以超过 5% 的复合年增长率成长

主要亮点

- COVID-19 的爆发为房地产和建筑施工带来了许多问题,特别是模板系统中使用的硬体。为阻止病毒传播而采取的封锁措施导致建筑供应链停滞。

- 这些系统由各种零件组成,例如模板、夹具、接头和支架。通常使用木质模板,因为胶合板和木质百叶窗更便宜且更容易获得。

- 木模板系统,也称为骨架或过道,使用木板或木材来创建临时或永久的走道或骨架。模板用于保护工人免受天空影响,并允许他们安全地爬到需要施工的表面上,例如在公共产业工作期间重新砌筑建筑物墙壁或覆盖管道。

- 杉木是市场上最受欢迎的滑梯类型,因为它保持相同的尺寸并且不允许水进入。然而,由于建筑业需求的增加,木质滑梯的市场正在迅速扩大。预计松木滑梯市场的成长速度将慢于其他滑梯。按地区划分,北美领先滑梯市场,其次是欧洲。由于印度和中国等国家的需求增加,预计亚太地区未来几年将呈现最快的成长速度。

木模板系统市场趋势

建筑业成长带动市场需求

未来几年,全球建筑业预计将稳定引入更多资金。预计到2030年,其规模将是2020年的两倍多。未来几年,由于新兴市场建设计划的增加,建筑市场可能会成长。 2022年3月,澳洲政府公布了预算,承诺额外支出179亿澳元(约134亿美元)用于该国的基础设施计划。此外,澳洲政府也承诺额外支出55亿美元(约74亿澳元)用于水利基础建设。印度商业建筑业在经历了因疫情造成的两年停滞后,预计将于 2022 年恢復强劲成长轨迹。

建设公司正在印度各地启动众多全新的商业建筑计划。在马来西亚,除了大型基础设施计划的復兴外,政府还寻求根据第十二个马来西亚计划向人们提供经济适用住宅。结果,几个新的住宅计划核准。 2022 年 6 月,马来西亚 Residensi Wilayah Keluarga计划核准兴建约 68,000 栋住宅。特别是,根据第12个马来西亚计划,政府的目标是在国内提供50万套经济适用住宅。

2022年2月,法国成为全球第一个与中国合作建造七个关键基础建设计划的国家。法中将在非洲、东南亚和东欧共同建造七个重大基础设施计划,总价值17亿美元。法国正在为世界各地的重大建设计划提供资金,并鼓励其他国家为法国的基础设施计划提供资金。瑞士2022年5月表示可能投资法国基础建设计划,特别是法国莱茵线。沙乌地阿拉伯正在该国不同地区启动许多新的住宅计划,以使人们更容易购买自己的住房。沙乌地阿拉伯正在建造一个项目,在七个主要城市建造 15 万套住宅,其中包括沙乌地阿拉伯西部的利雅德、麦地那和红海西部的吉达港,作为让至少三分之二的公民能够居住的计划的一部分自己的住宅已经开始了。根据产业协会预测,2021年建筑市场总规模预计为8.2兆美元,预计2030年将增加至14.4兆美元。建筑业的巨大成长可能是人们想要购买木模板系统的重要原因。

负面环境影响可能为市场带来挑战

儘管世界上大多数建筑物都使用木框架,但世界各地的森林正在被砍伐。世界各地的人类社会数千年来一直使用木材作为建筑材料。由于木材是唯一具有生物学重要性的建筑材料,我们自然倾向于认为在建筑中使用木材对环境有利。事实是,使用木材的环境效益是复杂的。儘管木材是一种天然产品,但干燥和加工过程中需要消耗大量能源。

其中大部分可以从树木本身的生物量中获得,但这需要对工厂进行投资,这在一个广泛分散于许多小型生产商的行业中并不总是可行的。木材也是毁林的一个主要因素。从世界天然森林中提取的木材大约有三分之一用于製造木製品。在森林砍伐比例最大的国家,木製品约占总量的 10%。森林砍伐和森林劣化是气候变迁和生物多样性丧失的重要驱动因素,而气候变迁和生物多样性丧失是我们这个时代的两大环境挑战。森林,特别是热带森林,储存了大量的碳。当森林遭到破坏时,其中的碳就会释放到大气中,加速全球暖化。

联合国粮食及农业组织 (FAO) 估计,1990 年至 2020 年间,因森林砍伐而损失的森林面积达 4.2 亿公顷,面积比欧盟 (EU) 还要大。就净面积损失(森林砍伐面积与新种植或再生森林面积之差)而言,粮农组织估计同期全球损失了约 1.78 亿公顷森林。森林砍伐约占吸热排放总量的 10%,约相当于 6 亿辆汽车一年的排放。在建筑中使用木材的这种负面影响可能会成为市场成长的限制因素。

钢材等替代材料环保、可回收且耐用。我们可以减少砍伐,保护森林,减少或阻止全球暖化和温室效应。中小型建筑商可能无力使用钢骨模板,因为安装成本更高,这有助于减少建筑废弃物。木材容易取得、价格低廉且易于加工。另一方面,钢铁材料需要焊工和复杂的焊接设备。因此,儘管木材有一些负面影响,但它仍然广泛应用于建筑业,特别是结构领域。

木模板系统产业概况

全球木模板系统市场区隔且竞争激烈。竞争和价格战不断加剧,新的投资者和开发人员正在进入市场。此外,木模板的需求和供应都在增加。市场上营运的一些主要企业包括 Doka、PERI、ULMA、Acro、The Heico Companies LLC 和 MEVA Systems Inc。世界各地建设计划的增加使得新参与企业更容易进入市场。儘管如此,这些规模较小的参与企业仍面临着来自规模较大的老牌参与企业的激烈竞争。大型市场参与企业提供广泛的产品,以便与其他参与企业竞争。新兴企业寻求透过整合创新产品和技术来进入市场。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 市场限制因素

- 市场机会

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 政府法规和措施

- 该领域的技术发展

- COVID-19 对市场的影响

第五章市场区隔

- 按幻灯片类型

- 杉木

- 木头

- 松木

- 合板

- 按用途

- 大楼

- 运输

- 工业设施

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东/非洲

- 其他的

第六章 竞争状况

- 市场集中度概览

- 公司简介

- Doka

- PERI

- ULMA

- Acrow

- The Heico Companies LLC

- Outinord

- MFE Formwork Technology Sdn.Bhd

- Urtim Formwork and Scaffolding Systems

- Waco International

- MEVA Systems Inc*

第七章 市场的未来

第8章附录

The Global Wooden Formwork Systems Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- The COVID-19 outbreak caused a lot of problems in real estate and building construction, especially with the hardware used in formwork systems.The lockdowns that were put in place to stop the spread of the virus slowed down the construction supply chain.This hurt the market for wooden formwork systems, which led to less demand and less money for companies in the market.

- Most of this growth is due to more money being put into infrastructure projects and more construction projects being started.Formwork systems made of wood are used to control the shape and size of buildings as they are being built or rebuilt.These systems are composed of a number of different parts, including forms, clamps, joints, and supports. Most wooden formwork systems are made of wood because it is strong enough to stand up to the forces that are put on it during construction but also flexible enough to fit the shapes of buildings.Wooden formwork is more in use because plywood and wood shutters are cheaper and more accessible.

- Wooden formwork systems, also called scaffolds or catwalks, are made from wooden boards and timbers to make temporary or permanent walkways or scaffolds. The formwork can be used to protect workers from the sky and help them get up safely on a surface that needs to be built, like repointing the bricks in a building's wall or covering pipes while doing utility work, etc.

- China fir is the most popular type of slide on the market because it stays the same size and doesn't let water in. But the market for slides made of wood is growing faster because there is more demand from the building industry. The market for pine wood slide types is expected to grow at a slower pace as compared to other slide types due to a lack of awareness among buyers about its advantages. In terms of geography, North America leads the slide-type market, then Europe. Asia Pacific is expected to witness the fastest growth rate in the next few years owing to increased demand from countries such as India and China.

Wooden Formwork Systems Market Trends

Growing Construction Industry to Fuel the Demand in the Market

Over the next few years, the construction industry around the world is expected to steadily bring in more money. In 2030, it is projected to be more than twice as big as it was in 2020. Over the next few years, the construction market is likely to grow because there are more building projects in emerging markets. In March 2022, when the Australian government released its budget, it promised to spend another AUD 17.9 billion (USD 13.4 billion) on infrastructure projects in the country.In addition, the Australian government has promised to spend another USD 5.5 billion or AUD 7.4 billion on building water infrastructure.After a two-year slump caused by a pandemic, India's commercial construction industry is on a strong growth path in 2022.

Construction companies have started a number of brand-new commercial construction projects across India. Alongside the revival of key infrastructure projects in Malaysia, the government is also looking to provide people with affordable housing under the 12th Malaysia Plan. Consequently, several new housing projects have received approval in the country. In June 2022, nearly 68,000 homes received construction approval under the Residensi Wilayah Keluarga Malaysia project. Notably, under its 12th Malaysian Plan, the government aims to provide 500,000 affordable homes in the country.

In February 2022, France became the first country to partner with China in building seven key infrastructure projects globally. France and China will jointly build USD 1.7 billion worth of seven key infrastructure projects across Africa, Southeast Asia, and Eastern Europe. France is putting money into important building projects around the world, and the country is also trying to get other countries to put money into infrastructure projects in France. Switzerland said in May 2022 that it might invest in infrastructure projects in France, especially the French Rhine Line. Saudi Arabia has started a number of new housing projects in different parts of the country to make it easier for people to buy their own homes. As part of its strategy to boost the ownership of houses to at least two-thirds of the Kingdom's people, Saudi Arabia launched projects to build 150,000 houses in seven key cities, such as Riyadh, Medina in western Saudi Arabia, and the western Red Sea port of Jeddah. According to an industry group, the construction market as a whole was worth USD 8.2 trillion in 2021 and is expected to be worth USD 14.4 trillion by 2030. This huge growth in the building industry will be a big reason why people want to buy wooden formwork systems.

Negative Environmental Impact Might Create Challenges for the Market

Even though timber framing has been used in most buildings around the world, forests have been cut down all over the world. Human societies around the world have used timber as a building material for thousands of years. As wood is the only significant biological building material, we are naturally inclined to believe that using wood in construction is good for the environment. As a matter of fact, the environmental benefits of using timber are not straightforward: although it is a natural product, a large amount of energy is used to dry and process it.

Much of this can come from the biomass of the tree itself, but that requires investment in plants, which is not always possible in an industry that is widely distributed among many small producers. Wood is also a major driver of deforestation. About a third of the wood extracted from natural forests worldwide is used for timber products. In the countries that account for most of the deforestation, wood products contribute about 10% of the total. Deforestation and forest degradation are important drivers of climate change and biodiversity loss, the two key environmental challenges of our time. Forests, especially tropical forests, store enormous amounts of carbon. When forests are destroyed, that carbon is released into the atmosphere, accelerating global warming.

The Food and Agriculture Organization of the United Nations (FAO) estimates that 420 million hectares of forest - an area larger than the European Union - were lost to deforestation between 1990 and 2020. In terms of net area loss (the difference between the area of forest cleared and the new surface of forests planted or regenerated), the FAO estimates that the world lost around 178 million hectares of forest cover in the same period of time, which is an area triple the size of France. Deforestation accounts for around 10% of total heat-trapping emissions-roughly the same as the yearly emissions from 600 million cars. This negative impact of using wood in construction may become a restraint on market growth.

Alternatives like steel are better for the environment, can be recycled, and can last for a long time. They can cut down on logging, save forests, and reduce or stop global warming and greenhouse effects. Even though using steel formwork helps cut down on construction waste, it costs a lot to set up, so small and medium-sized building contractors may not be able to afford to use it. Timber is easy to get, cheap, and easy to work with. Steel, on the other hand, needs welders and complicated welding equipment. So, even though wood has some bad effects, it is still used a lot in the building industry, especially in the structural sector.

Wooden Formwork Systems Industry Overview

The global wooden formwork systems market is fragmented and highly competitive. Competition and pricing have increased strongly, and new investors and developers have entered the market. Moreover, both the demand and supply of wooden formwork are increasing. Some key players operating in the market include Doka, PERI, ULMA, Acro, The Heico Companies LLC, MEVA Systems Inc., etc. The increasing number of construction projects across the globe makes it easier for new players to enter the market. Still, these small players face fierce competition from established major players. The major players in the market mostly offer a wide range of products to have a competitive edge over other players. Start-ups try to break into the market with innovative products and technology integration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Market Opportunities

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Government Policies and Regulations

- 4.8 Technological Developments in the Sector

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Slide Type

- 5.1.1 China Fir

- 5.1.2 Timber

- 5.1.3 Pine Wood

- 5.1.4 Plywood

- 5.2 By Application

- 5.2.1 Buildings

- 5.2.2 Transportation

- 5.2.3 Industrial Facilities

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.5 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Doka

- 6.2.2 PERI

- 6.2.3 ULMA

- 6.2.4 Acrow

- 6.2.5 The Heico Companies LLC

- 6.2.6 Outinord

- 6.2.7 MFE Formwork Technology Sdn.Bhd

- 6.2.8 Urtim Formwork and Scaffolding Systems

- 6.2.9 Waco International

- 6.2.10 MEVA Systems Inc*