|

市场调查报告书

商品编码

1632090

计量帮浦:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Metering Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

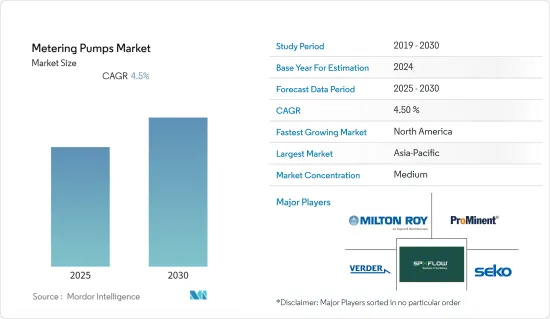

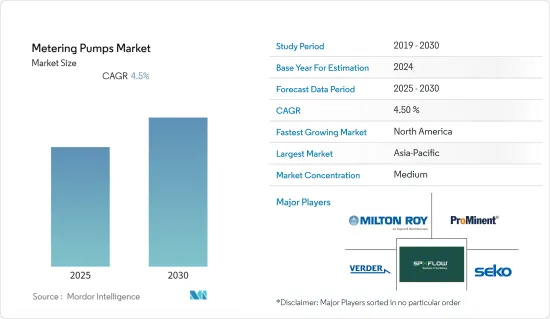

计量泵市场预计在预测期内复合年增长率为4.5%

主要亮点

- 具有多种性质和特性的化学品几乎可用于每个行业。然而,如果在没有适当控制的情况下使用,化学物质(通常以高浓度采购和储存)可能会对人类和环境造成危害。因此,在製造过程中准确地分散化学物质非常重要。在化学加工和石化产业中,计量帮浦越来越多地用于计量溶剂、酸等。

- 2022年3月,沙乌地阿拉伯王储穆罕默德·本·萨勒曼(MBS)签署了一项价值100亿美元的在中国精製和石化联合体的协议。此外,沙乌地阿拉伯也承诺向巴基斯坦投资200亿美元,并寻求对印度精製业进行额外投资。这些投资预计将支持亚太地区研究市场的成长。

- 联合国 (UN) 估计有 22 亿人无法获得清洁饮用水,并且每年用水量增加 1%。此外,估计超过80%的污水未经处理就排放到环境中。根据联合国《世界水发展报告》,製造业目前使用了 19% 的淡水,预计到 2050 年将上升至 24%。全球人口的成长和製造业的扩张加剧了对经过处理的清洁水的迫切需求。这些因素正在推动计量帮浦在海水淡化、污水、污水处理等领域的应用。

- 此外,一些公司正在为工业和製造业领域创新综合产品。例如,2022年6月,蓝白推出了工业应用的FLEXFLO A5大容量蠕动帮浦。该泵是全封闭的,易于配置,并且无需外部控制设备即可运行。它具有易于阅读的大型 5 显示器、简单直观的触控萤幕控制和图标驱动的选单导航。 A5 的远端控制讯号选项包括脉衝、4-20mA、Modbus TCP、EtherNet/IP 和 PROFIBUS,以增强关键称重传输应用的监控和自动化。

- 然而,计量帮浦市场受到COVID-19大流行和供需失衡的显着影响。由于世界各地炼油厂产能减少、生产停顿、供应链中断以及扩建计划延后,疫情导致计量帮浦的需求减少。

计量帮浦的市场趋势

水处理领域预计将推动市场成长

- 污水厂的整个流程都需要计量帮浦来实现絮凝、絮凝、消毒等多种功能。在这些过程中使用计量泵的主要原因之一是可以灵活地轻鬆设定注射或排放液体所需的速度。

- 计量泵常用于水处理,将化学添加剂泵入水中以改善水质。应用的添加剂范围从阻垢剂到氧化还原剂再到非氧化性除生物剂。水处理厂中的化学注入系统可以处理各种流体、化学物质以及黏性和腐蚀性物质。

- 2021年3月,联合国成员国召开「落实2030年议程中与水有关的目标和具体目标」高级别会议,指出为到2030年实现永续发展目标6,与水有关的目标需要动员1.7万亿美元的额外投资用于基础建设。为了实现这一目标,成员国呼吁政府与包括私营部门和慈善组织在内的各种相关人员之间建立新的伙伴关係,并广泛采用创新技术和方法。

- 此外,2022年4月,生态环境部宣布,中国要改善广大农村地区污水处理,将农村生活污水处理率从2020年的28%提高到2025年的40%。因此,鼓励政府组织、市场组织和村民共同努力实现目标。此举是中国推动乡村振兴的一部分。人们相信,全球区域层面的此类倡议将为所研究市场的成长提供有利可图的机会。

- 一些河川高污染水平的主要原因是未经许可的聚居地未使用的污水以及污水处理厂排放的处理后的污水品质差。各国已推出多项措施来解决此问题。例如,2022 年 3 月,由德里首席部长 Arvind Kejriwal 主持的国家清洁恒河任务 (NMCG) 与德里 Jal 委员会举行了审查会议,以振兴亚穆纳河新水处理厂的细节。抽取5.64 亿公升处理过的水。

预计亚太地区将占据主要市场占有率

- 根据《美国能源资讯与钦佩》通报,印度原油产量从2022年1月的604.20 BBL/D/1K增加至2月的605.10 BBL/D/1K(1,000桶/日)。此外,印尼原油产量从2022年1月的616 BBL/D/1K增加至2月的670 BBL/D/1K。这些地区石油工业的成长可能会推动所研究的市场。

- 公司之间为增加石油产量和扩大在亚太地区的业务而进行的合作可以为当地参与企业创造机会,以加强产品系列併满足客户需求。

- 根据国家统计局数据,2021年我国氮磷钾肥产量总合5,544万吨。此外,根据印度品牌资产基金会的数据,到 2025 年,印度化学和石化产业的总投资预计将达到 8 兆印度卢比(1,073.8 亿美元)。 2021年12月,化学产品产量903,002吨,石化产品产量1,877,907吨。化学工业如此巨大的投资预计将促进计量泵市场的成长。

- 2022年4月,印度与日本关于分散式生活污水管理的合作备忘录获得印度总理主持的联合内阁事后核准。日本环境部将推动交通部、Jal Shakti 部以及水资源、河流开发和恆河復兴部(DoWR、RD&GR)的工作。执行部将设立管理委员会(MC),设计具体合作活动并监督其实施。印度希望透过与日本合作创建“分散式生活污水管理”,并利用净化槽技术确保处理后污水的高效再利用。此类政府倡议预计将显着推动市场。

- 过去十年,工业部门在新兴市场快速扩张,在已开发和成熟市场稳定成长。行业公司正在努力满足新兴经济体对计量泵不断增长的需求。快速的工业化、不断提高的生活水准、庞大的人口和廉价的劳动力等因素日益引起人们对亚太地区的关注。由于预计在整个预测期内建造新的製造设施,对计量帮浦的需求预计将会增加。

计量帮浦产业概况

全球计量帮浦市场是一个适度分散的市场,主要企业包括 Milton Roy Company、PSG (Dover Corporation)、Mcfarland-Tritan LLC 和 Seco SPA。为了保持市场竞争,市场参与企业正在创新先进的产品,以满足客户的特定需求。

- 2022 年 3 月 - Graco 扩展了其 SoloTech 软管帮浦产品线,包括用于卫生应用的型号和用于工业设备的其他尺寸。此帮浦用于输送卫生应用中的浆料、固态、磨料,或工业设备中的腐蚀性、磨料或敏感液体。

- 2021 年 8 月 - 沃森马洛流体技术集团推出 Qdos 输送波技术 (CWT) 帮浦。该泵扩展了蠕动泵技术的功能,并且比传统的管式设计具有更长的使用寿命。 Qdos CWT 帮浦在水处理应用中提供高水准的化学计量精度。此帮浦将次氯酸钠等化学物质引入后氯化循环,而不会过量。封闭式 CWT 泵头极为安全,因为它们提供准确、线性和可重复的流量,并最大限度地减少操作员接触化学品的机会。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 价值链分析

- 评估 COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 化工厂需求广泛

- 关于污水处理的严格规定

- 市场限制因素

- 需要经常维护

- 客製化需求不断增加(根据流体特性频繁更改设计)

第六章 市场细分

- 按类型

- 隔膜

- 活塞/柱塞

- 其他(蠕动帮浦、旋转帮浦)

- 按最终用户

- 石油和天然气

- 水处理

- 化学处理

- 药品

- 饮食

- 其他(纸浆、纤维)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Milton Roy Company(Ingersoll Rand)

- PSG(Dover Corporation)

- Mcfarland-Tritan LLC

- Seko SPA

- Grundfos Holding A/S

- LEWA(Nikkiso Co. Ltd.)

- ProMinent GmbH

- Seepex GmbH

- SPX Flow Technology Norderstedt GmbH

- GRACO, INC.

- Watson-Marlow Fluid Technology Group(Spirax-Sarco Engineering)

- Verder Group

- IDEX Corporation

- Blue-White

第八章投资分析

第9章 未来展望

简介目录

Product Code: 91226

The Metering Pumps Market is expected to register a CAGR of 4.5% during the forecast period.

Key Highlights

- Chemicals, having various properties and characteristics, find applications in almost all industries. However, if used without adequate control, chemicals (often procured and stored in high concentrations) can cause harm to people and the environment. Hence, it is important to ensure that chemicals are precisely dispersed in the manufacturing process. The chemical processing and petrochemical industries are witnessing increased employment of metering pumps for injection of solvents, acids, etc.

- In March 2022, Saudi Crown Prince Mohammed bin Salman (MBS) cemented a USD 10 billion deal for a refining and petrochemical complex in China. Further, the kingdom pledged an investment of USD 20 billion in Pakistan and sought to make additional investments in India's refining industry. Such investments would boost the growth of the studied market in the Asia Pacific region.

- The United Nations (UN) estimates that 2.2 billion people lack access to clean drinking water and that annual water use is rising by 1%. Additionally, it is predicted that more than 80% of wastewater is released into the environment untreated. The manufacturing sector currently utilizes 19 % of fresh water, and by 2050, that percentage is expected to rise to 24 %, according to the UN World Water Development Report. The pressing requirement for treated, clean water is being accelerated by the increasing global population and expanding manufacturing sector. These factors encourage the employment of metering pumps for desalination, wastewater and sewage treatments, etc.

- Further, several companies are innovating comprehensive products to cater to the industrial and manufacturing sectors. For instance, in June 2022, blue-white introduced FLEXFLO A5 high-volume peristaltic metering pump for industrial applications. It is a fully enclosed and easily configurable pump that does not require external control devices to operate. It features a large 5 display for easy viewing with simple and intuitive touchscreen controls and icon-driven menu navigation. The A5 remote control signal options include Pulse, 4-20mA, Modbus TCP, EtherNet/IP, and PROFIBUS for enhanced supervision and automation for critical metering and transfer applications.

- However, the market for metering pumps was harshly impacted by the COVID-19 pandemic and supply-demand imbalance. Due to the pandemic, there has been a drop in refinery throughput, a halt in manufacturing, disruption of the supply chain, and the postponement of expansion projects worldwide, which has resulted in a decrease in demand for metering pumps.

Metering Pumps Market Trends

Water Treatment Segment is Expected to Drive the Market's Growth

- The entire process in a wastewater plant needs a dosing/metering pump for various functions like coagulation, flocculation, disinfection, etc. One of the main reasons for using metering pumps for these processes is their flexibility in allowing easy setting of the required rate at which the liquids are injected or discharged.

- Metering pumps are often used in water treatment to feed chemical additives into the water to enhance water quality. The additives applied range from scale inhibitors to redox agents to non-oxidizing biocides. Chemical dosing systems for water treatment plants can handle various fluids, chemicals, and viscous and corrosive materials.

- In March 2021, at a high-level meeting on the 'Implementation of the Water-related Goals and Targets of the 2030 Agenda', UN Member States noted that achieving SDG (Sustainable Development Goals) 6 by 2030 would require mobilizing an additional USD 1.7 trillion investment in water-related infrastructure. To make this happen, Member States are calling for new partnerships between governments and a diverse group of stakeholders, including the private sector and philanthropic organizations, and the wide dissemination of innovative technology and methods.

- Further, in April 2022, the Ministry of Ecology and Environment announced that China would improve sewage treatment in its vast rural areas, with the aim of the rural life sewage treatment rate reaching 40% in 2025 from 28% in 2020. Therefore, government organizations, market entities, and villagers would be encouraged to join hands to achieve the goal. The move was a part of China's efforts to push forward rural vitalization. Such initiatives at a global and regional level would offer lucrative opportunities for the growth of the studied market.

- The main reasons behind high pollution levels in several rivers are the untapped wastewater from unauthorized colonies and poor quality of treated wastewater discharged from wastewater treatment plants (WWTPs). Various nations are launching numerous initiatives to tackle this problem. For instance, in March 2022, a review meeting of the National Mission for Clean Ganga (NMCG) along with the Delhi Jal Board, chaired by Chief Minister Arvind Kejriwal, Chief Minister of Delhi, reported the details of a new water treatment plant to rejuvenate the river Yamuna, with a capacity pump out 564 million liters of treated water daily.

Asia Pacific Region is Expected to hold a Significant Market Share

- According to US Energy Information and Admiration, Crude Oil Production in India increased to 605.10 BBL/D/1K(1000 Barrels per day) in February from 604.20 BBL/D/1K in January of 2022. Furthermore, Crude Oil Production in Indonesia increased to 670 BBL/D/1K in February from 616 BBL/D/1K in January of 2022. Such oil industry growth in different regions may drive the studied market.

- The collaboration between firms to increase their oil production and expand their presence in the APAC region may create an opportunity for the local players to enhance their product portfolio and meet the customers' needs.

- According to the National Bureau of Statistics of China, in 2021, a total of 55.44 million tons of nitrogen, phosphate, and potash fertilizer will be produced in China. Furthermore, according to India Brand Equity Foundation, by 2025, it is anticipated that investments in the Indian chemicals and petrochemicals sector will total INR 8 lakh crore (USD 107.38 billion). In December 2021, chemical output totaled 903,002 MT, while petrochemical production totaled 1,877,907 MT. Such huge investments in the chemical industry will enhance the metering pump market growth.

- In April 2022, The Memorandum of Cooperation (MoC) between India and Japan in Decentralized Domestic Wastewater Management received the ex-post facto approval of the Union Cabinet, which is presided over by the Prime Minister of India. Japan's Ministry of the Environment will advance the MoC, the Ministry of Jal Shakti, and the Department of Water Resources, River Development, and Ganga Rejuvenation (DoWR, RD&GR). The executive departments will establish a Management Council (MC) to design specific collaborative activities and oversee their implementation. India hopes to create a "Decentralized Domestic Wastewater Management" through this partnership with Japan and use Johkasou technology to guarantee the efficient reuse of treated wastewater. Such Government initiatives will significantly drive the market.

- The industrial sector has experienced rapid expansion in developing regions and stable growth in developed/mature markets over the past ten years. Participants in the industry are striving to meet the increasing demand for metering pumps in developing economies. Factors like rapid industrialization, rising living standards, sizable population, and cheap labor contribute to the increasing focus on the APAC region. The need for metering pumps is anticipated to increase as new manufacturing facilities are expected to be built throughout the forecast period.

Metering Pumps Industry Overview

The Global Metering Pumps Market is a moderately segmented market with significant players like Milton Roy Company, PSG (Dover Corporation), Mcfarland-Tritan LLC, Seko S.P.A, etc. To stay competitive, the market players are innovating advanced products to cater to the specific requirements of their customers.

- March 2022 - Graco expanded its SoloTech hose pump line, which now includes models for hygienic applications and additional sizes for industrial installations. The pumps are intended for slurries, solids, and abrasives in hygienic applications or to pump caustic, abrasive, or sensitive fluids in industrial installations.

- August 2021 - The Watson-Marlow Fluid Technology Group launched the Qdos Conveying Wave Technology (CWT) pump, which extends the capabilities of peristaltic pump technology and offers longer service life than traditional tube-based designs. Qdos CWT pumps provide high levels of chemical dosing accuracy in water treatment applications. The pumps introduce chemicals, including sodium hypochlorite, for post-chlorination cycles without needing to overdose. The sealed CWT pump head delivers accurate, linear, and repeatable flow and is very safe as it minimizes operator exposure to chemicals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Extensive Demand from Chemical Plants

- 5.1.2 Stringent Regulations for Wastewater Treatment

- 5.2 Market Restraints

- 5.2.1 Requirement of Frequent Maintenance

- 5.2.2 Growing Customization Demands (Frequent Modification in Design Required according to Fluid Properties)

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Diaphragm

- 6.1.2 Piston/Plunger

- 6.1.3 Others (peristaltic pumps, rotary pump)

- 6.2 By End-User

- 6.2.1 Oil & Gas

- 6.2.2 Water Treatment

- 6.2.3 Chemical Processing

- 6.2.4 Pharmaceuticals

- 6.2.5 Food & Beverage

- 6.2.6 Others (pulp & paper, Textile)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdm

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle-East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle-East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Milton Roy Company (Ingersoll Rand)

- 7.1.2 PSG (Dover Corporation)

- 7.1.3 Mcfarland-Tritan LLC

- 7.1.4 Seko S.P.A

- 7.1.5 Grundfos Holding A/S

- 7.1.6 LEWA (Nikkiso Co. Ltd.)

- 7.1.7 ProMinent GmbH

- 7.1.8 Seepex GmbH

- 7.1.9 SPX Flow Technology Norderstedt GmbH

- 7.1.10 GRACO, INC.

- 7.1.11 Watson-Marlow Fluid Technology Group (Spirax-Sarco Engineering)

- 7.1.12 Verder Group

- 7.1.13 IDEX Corporation

- 7.1.14 Blue-White

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219