|

市场调查报告书

商品编码

1632102

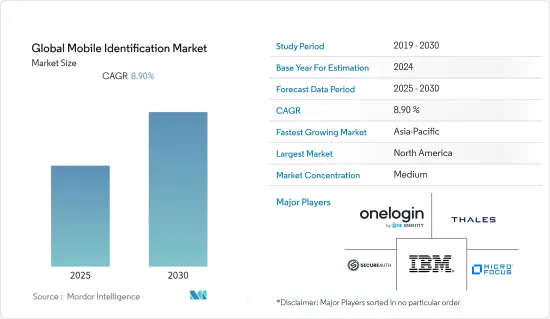

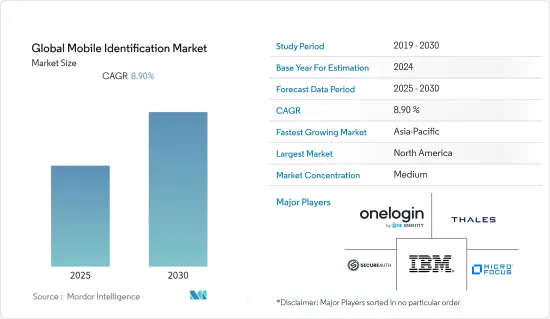

全球行动ID:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Global Mobile Identification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

全球行动ID市场预计在预测期间内复合年增长率为8.9%

主要亮点

- 移动 ID 功能在很大程度上依赖生物辨识技术。借助将相机和麦克风转换为生物识别感测器的生物识别软体,智慧型手机和平板电脑可以用作多因素身份验证设备。行动身分验证越来越受到强大的身份验证因素的支持,指纹感应器和脸部认证几乎成为现代智慧型手机的常见组件。

- 消费者市场和垂直市场都在采用行动 ID 技术。行动ID可以用来取代使用者的个人密码,保护病患在医院的医疗记录,让金融交易更加便捷安全,并帮助执法部门识别现场通缉人员。

- 按需经济 (ODE) 公司正在转向行动 ID 扫描和检验,以解决与员工和客户的资金筹措、授权、合规性和人身安全相关的问题。这种即时身份验证正在推动市场供应商提供行动、快速且易于使用的平台。它还具有智慧/连接资料库,可以更快地获得身份检验结果。

- 对于大型企业来说,购买行动身分检验解决方案更容易。然而,对于中小企业来说,缺乏预算资源是一个问题。身份检验的高昂初始成本和维护成本使得资金有限的公司起步困难。由于预算紧张,中小型企业获得银行级技术和安全解决方案的机会通常有限,这使得它们很容易成为网路犯罪分子的目标。

行动认证市场趋势

多因素身份验证有望获得显着的市场占有率

- 远端和混合工作的扩展增加了多因素身份验证在职场和消费者环境中的使用,导致公司要求对特定用户和帐户进行多因素身份验证。

- MFA 是一种身份验证机制,要求使用者提供两个或多个身份验证因素才能存取应用程式、线上帐户和 VPN 等资源。强大的身份和存取管理 (IAM) 策略必须包括多重身份验证 (MFA)。除了使用者名称和密码之外,MFA 还需要一项或多项额外的检验标准,从而降低网路攻击成功的可能性。

- 此外,MFA 透过收集进一步的资讯(元素)进行检验来运作。动态密码是消费者遇到的最典型的 MFA 因素 (OTP) 之一。 OTP 是透过电子邮件、简讯或行动应用程式发送的 4-8 位元代码。使用 OTP 时,会定期或每次发出身份验证请求时建立新代码。程式码是使用使用者首次註册时提供的种子值和递增计数器或时间值等元件建立的。

- 儘管安全性有所提高,但消费者和员工仍然认为获取包含动态密码(OTP) 的文字讯息或电子邮件的额外步骤是我在登入过程中的繁琐且多余的步骤。但随着员工接受远距工作,一些观点在整个大流行期间发生了变化。

亚太地区预计将占据主要市场占有率

- 亚太地区包括中国和印度等人口密度高的国家。该地区以其高互联网普及率和最早采用技术的地区之一而闻名。此外,随着这些新兴国家拥抱数位化,客户资料和资料通道受到损害的风险不断增加,从而增加了该地区对行动ID的需求。

- 思科预计,到 2023 年,网路用户渗透率将达到 72%,而 2018 年为 52%。此外,广泛的平均通讯速度达到157.1Mbps,刺激了市场的成长。报告还称,到 2023 年,亚太地区网路用户总数将从 2018 年的 27 亿增加到 31 亿。

- 此外,亚太地区是GDP成长最快的地区之一,吸引了现有公司的扩张和新兴企业的进入。预计这将增加对行动身份验证解决方案以防止资料外洩的需求。

- 此外,随着疫情日益迫使人们和企业数位化成为新常态,该地区的数位交易数量呈指数级增长。然而,这些为用户提供更大便利的趋势已经在这些平台上打开了多个安全网关,以避免资料外洩。

行动ID产业概况

全球行动 ID 市场竞争适中,有大量区域和全球参与企业。主要参与企业包括 OneLogin、Thales Group、SecureAuth Corporation、Micro Focus 和 IBM Corporation。

- 2022 年 6 月 - 存取管理和身份验证公司 SecureAuth 宣布发布 Arculix,这是一个结合了编配、高级无密码技术和持续身份验证的平台。此新一代平台可用作完整的端到端解决方案,或透过提供与业界标准身分提供者的整合来补充现有的 IAM 投资。

- 2022 年 2 月 - HUMBL, Inc. 收购了行动身分和区块链代币化平台 BizSecure。该公司收购了 BizSecure 的员工和咨询资源。 HUMBL, Inc. 将透过建立一个名为 HUMBL 区块链服务的新商业部门,利用这些资源来实施区块链企业和政府解决方案。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 由于严格的法规和合规性需求而采用解决方案

- 在企业采用 BYOD 趋势

- 市场问题

- 实施行动身分验证解决方案时的预算限制

第六章 市场细分

- 通过认证

- 单因素身份验证

- 多重身份验证

- 按成分

- 生物识别

- 非生物特征识别

- 按服务

- 按发展

- 云

- 本地

- 按用途

- 资讯科技/通讯

- 零售

- 医疗保健

- 政府/国防

- 银行

- 旅游/酒店

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东/非洲

- 拉丁美洲

第七章 竞争格局

- 公司简介

- OneLogin(One Identity LLC.)

- Thales Group

- IDEMIA

- Okta

- SecureAuth Corporation

- Trend Micro Incorporated

- F-Secure

- Sophos Ltd.

- Telesign

- Regula

- IBM Corporation

- 42Gears Mobility Systems Pvt Ltd.

- Micro Focus

第八章投资分析

第9章市场的未来

简介目录

Product Code: 91316

The Global Mobile Identification Market is expected to register a CAGR of 8.9% during the forecast period.

Key Highlights

- Mobile ID largely relies on biometric technology to function. Any smartphone or tablet can be used as a multi-factor authentication device with the help of biometric software that converts cameras and microphones into biometric sensors. Mobile identity is increasingly supported by strong authentication factors, with fingerprint sensors and facial recognition becoming almost common components of modern smartphones.

- Consumer and vertical markets both employ mobile identification technologies. It can be used to replace a user's personal passwords or to protect a patient's medical records in a hospital; it can make financial transactions more convenient and secure, or allow law enforcement agents to identify wanted persons in the field; it can open a door, or notify a doctor if a patient requires medical attention.

- The On-Demand Economy (ODE) companies are shifting towards mobile ID scanning and verification to solve problems related to financing, licensing, compliance, and the personal safety security of both employees and customers. This instant identity verification has triggered the market vendors to offer a mobile, fast, and easy-to-use platform. They also feature smart/connected databases for quicker identity verification results.

- For large enterprises, it is easier to purchase mobile identity verification solutions. However, for SMEs, it becomes an issue due to insufficient resources in terms of budget. The high initial costs and maintenance of identity verification make it difficult for companies bootstrapped with limited capital. Due to budget restraints, SMBs typically have limited access to bank-grade technology and security solutions, making them an easy target for cybercriminals.

Mobile Identification Market Trends

Multi-Factor Authentication Expected to Witness Significant Market Share

- The expansion of remote and hybrid work has increased the usage of multifactor authentication in the workplace and consumer contexts, prompting organizations to make it mandatory for certain users and accounts.

- MFA is an authentication mechanism that requires a user to give two or more verification factors to access a resource such as an application, an online account, or a VPN. A strong identity and access management (IAM) policy must include multifactor authentication (MFA). MFA needs one or more extra verification criteria in addition to a username and password, which reduces the chances of a successful cyber attack.

- Further, MFA operates by collecting further information for verification (factors). One-time passwords are one of the most typical MFA factors that consumers encounter (OTP). OTPs are four to eight-digit codes sent via email, SMS, or a mobile app. When using OTPs, a fresh code is created on a regular basis or whenever an authentication request is made. The code is created using a seed value supplied to the user when they first register and another component, such as an incremented counter or a time value.

- Despite the added security, consumers and employees have seen the extra step of obtaining a text message or email with a one-time password (OTP) as a burdensome and redundant step in the login process. However, as employees have embraced remote work, some perspectives have evolved throughout the pandemic.

Asia Pacific Expected to Witness Significant Market Share

- The Asia-Pacific region is home to densely populated countries, such as China and India. The region is well known for being the fastest adopter of technology with increasing internet penetration. Also, as these emerging economies adopt digitalization, the risk of breach of customer data and data channels is increasing, due to which the demand for mobile identification is increasing in the region.

- According to Cisco estimates, the internet user penetration is expected to reach 72% in 2023 compared with 52% in 2018. Also, broad average speeds can reach 157.1 Mbps, fueling the market's growth. Also, the report states that Asia-Pacific will have 3.1 billion total internet users by 2023, which is an increase from 2.7 billion internet users in 2018.

- Further, Asia-Pacific is one of the fastest-growing regions in terms of GDP, which induced expansion of the existing corporates and the addition of new startups. It created the demand for fast, secure, and paperless digital transactions across these growing corporates, which is expected to increase the need for mobile identity verification solutions to prevent data breaches.

- Moreover, due to the pandemic, people and businesses have increasingly resorted to digitalization as the new normal, which has tremendously increased the number of digital transactions in the region. However, these trends offering greater convenience to the users have opened several gateways for security across these platforms to avoid data breaches.

Mobile Identification Industry Overview

The Global Mobile Identification Market is moderately competitive, with a considerable number of regional and global players. Key players include OneLogin, Thales Group, SecureAuth Corporation., Micro Focus, and IBM Corporation.

- June 2022 - SecureAuth, access management, and authentication announced the release of Arculix, a platform that combines orchestration, advanced passwordless technology, and continuous authentication. The next-generation platform can be used as a complete end-to-end solution or to supplement existing IAM investments by providing integration with any industry-standard identity provider.

- February 2022 - HUMBL, Inc. acquired BizSecure, a mobile identification and blockchain tokenization platform provider. The company acquired BizSecure employees and consulting resources. HUMBL, Inc. will utilize these resources to introduce blockchain corporate and governmental solutions by forming a new commercial division called HUMBL Blockchain Services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porters Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of Solution Through Stringent Regulations and Need For Compliance

- 5.1.2 Adoption of BYOD Trends in Enterprises

- 5.2 Market Challenges

- 5.2.1 Budgetary Constraints During the Adoption of Mobile Identity Verification Solutions

6 MARKET SEGMENTATION

- 6.1 By Authentication

- 6.1.1 Single-factor Authentication

- 6.1.2 Multi-Factor Authentication

- 6.2 By Component

- 6.2.1 Biometric

- 6.2.2 Non-biometric

- 6.2.3 Services

- 6.3 By Deployment

- 6.3.1 Cloud

- 6.3.2 On-premise

- 6.4 By Application

- 6.4.1 IT & Telecom

- 6.4.2 Retail

- 6.4.3 Healthcare

- 6.4.4 Government and Defense

- 6.4.5 Banking

- 6.4.6 Travel and Hospitality

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Middle East and Africa

- 6.5.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 OneLogin (One Identity LLC. )

- 7.1.2 Thales Group

- 7.1.3 IDEMIA

- 7.1.4 Okta

- 7.1.5 SecureAuth Corporation.

- 7.1.6 Trend Micro Incorporated

- 7.1.7 F-Secure

- 7.1.8 Sophos Ltd.

- 7.1.9 Telesign

- 7.1.10 Regula

- 7.1.11 IBM Corporation

- 7.1.12 42Gears Mobility Systems Pvt Ltd.

- 7.1.13 Micro Focus

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219