|

市场调查报告书

商品编码

1632107

全球活塞帮浦市场:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Global Piston Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

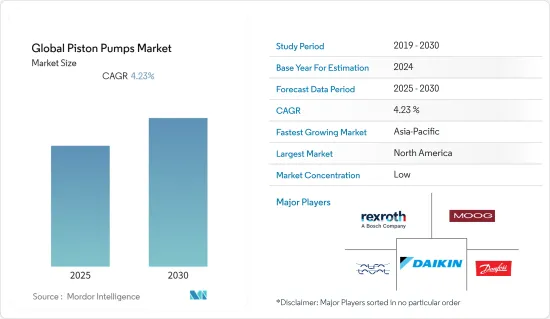

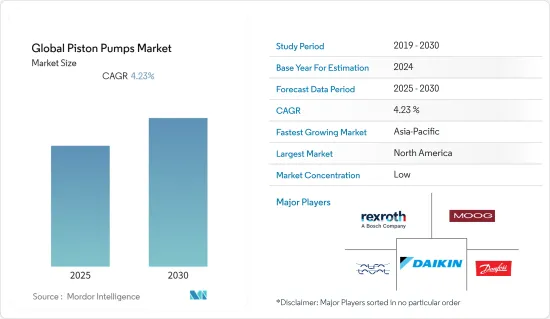

预计全球活塞泵市场在预测期内复合年增长率为 4.23%

主要亮点

- 许多製造业对活塞泵的需求是由对更高生产效率的需求所驱动的。活塞泵的多功能性使其适用于压力清洗、喷砂、涂胶、化学计量、灌封和喷漆。领先公司实施六标准差等管理系统以提高製造效率,对活塞泵的需求产生了积极影响。

- 例如,Watec 是北美轴向活塞泵的早期采用者。该公司是华盛顿州圣胡安群岛洛佩兹岛上的私人公司,于 2006 年试运行了第一台 APP 帮浦。该泵浦已运作10 多年,无需维护。该设施目前向一个小型社区供水系统供水,该系统为附近的许多住宅提供服务。

- 活塞帮浦市场受到高昂的维护和运作成本以及需要特殊设备来产生脉动流的阻碍。

- 由于 COVID-19 大流行造成的停工,活塞泵的生产已停止。因此,近几个月来活塞泵的市场扩张放缓,预计 2022 年将再次放缓。 2021年第二季活塞帮浦销售受到COVID-19的影响,由于生产活动受到限制,导致需求急剧下降。需求下降导致工业部门主要参与者减少生产。

柱塞泵市场趋势

分析显示石油天然气产业将占据主要份额

- 石油和天然气产业预计将占据终端用户市场的很大份额。碳氢化合物流体和气体的处理、生产、分配和加工都是石油和天然气产业的一部分。市场受益于新兴经济体对汽油和柴油需求的增加。人口增长以及乘用车和烹饪燃气使用的增加也正在开发该市场。

- 活塞帮浦不仅可以输送液体和压缩气体,还可以输送黏性流体和含有固体颗粒的流体。活塞泵用于泵送液体、工业加工机械、高压清洗以及使用水或油的液压系统。

- 因此,增加对该领域的投资正在提高市场成长率。例如,2022年1月,印度石油公司(IOCL)宣布计画投资700亿卢比用于城市燃气发行(CGD)业务。印度石油公司(IOC)于 2021 年 8 月宣布,将投资 1 兆印度卢比,在未来四到五年内将精製能力提高近两倍。

- 2022年4月,日本石油天然气部计划加强对上游液化天然气(LNG)计划的投资,以刺激新的发展并鼓励国内公司承购该燃料。

- 2018年,美国超越沙乌地阿拉伯,成为全球最大石油生产国。美国和其他国家生产的原油由美国炼油厂获得。原油由多家公司供应到世界市场。

亚太地区预计将录得强劲成长率

- 经分析,亚太地区在预测期内的成长率处于领先地位。快速工业化正在推动中国、印度、日本和韩国等新兴国家的市场成长。该地区不断增长的製造业以及石油和天然气使用的增加正在推动该行业的发展。中国计划在2025年将庞大的天然气管网扩展至16.3万公里,需要投资1.9兆美元。

- 由于印度政府的「印度製造」和中国政府的「中国製造2025」等政府倡议,预计未来几年製造业将会成长。因此,亚太国家製造业的快速发展预计将增加柱塞泵在工业用途上的使用,为该领域创造利润丰厚的成长潜力。

- IBEF表示,印度预计将为全球非经合组织国家石油消费的扩张做出重大贡献。原油进口额从2017财年的707.2亿美元大幅增加至2022财年(4月至1月)的943亿美元。截至2021年9月1日,印度的精製能力为2.489亿吨/年(MMTPA),使其成为亚洲第二大精製国。约35%的精製产能由私人公司控制。 IOC 的产能为 69.7 MMTPA,是该国最大的精製。

- 在食品和饮料领域,食品泵用于在加工和製造应用中传输、混合和分配流体和半流体成分。食品加工业中使用的帮浦由食用安全的材料製成,表面光滑,可避免细菌生长和食品污染。因此,分析食品和饮料领域的成长以刺激市场需求。

- 例如,印度政府透过食品加工工业部 (MoFPI) 正在大力增加对该国食品加工产业的外国投资。 2020-2021年进入食品加工领域的FDI金额为3.9341亿美元。 2021年4月至10月,印度加工食品和农产品出口增加了15%左右。

柱塞泵产业概况

全球活塞泵市场竞争激烈,企业规模各异。随着组织继续进行策略性投资以抵消当前的经济放缓,预计该市场将出现大量联盟、併购和收购。该市场包括博世力士乐、穆格公司、大金工业有限公司、阿法拉伐和丹佛斯等主要製造商。

- 2022 年 4 月 - 大金工业有限公司完成了对义大利油压设备製造商 Duplomatic MS SpA 股份的收购。金额为2.2亿欧元。 Duplomatic 是一家专门生产液压阀、泵浦和油缸的油压设备製造商,其客户已扩展到移动施工机械和工业机械。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章研究方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商议价能力

- 新进入的威胁

- 替代产品的威胁

- 竞争强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 自动化采用率的提高

- 製造业成长

- 市场限制

- 整个使用寿命期间的高维护成本是市场成长的挑战

第六章 市场细分

- 按类型

- 提升活塞泵

- 力柱塞泵

- 轴向柱塞泵

- 径向柱塞泵

- 按最终用户产业

- 石油和天然气

- 化学

- 饮食

- 用水和污水

- 製药

- 电力

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 其他中东/非洲

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争环境

- 公司简介

- Bosch Rexroth AG

- Moog Inc.

- DAIKIN INDUSTRIES, Ltd.

- Alfa Laval

- Danfoss

- Parker Hannifin Corp

- NACHI-FUJIKOSHI CORP.

- YUKEN KOGYO CO.,LTD

- HAWE Hydraulik SE

- Continental Hydraulics Inc.

第八章投资分析

第9章 未来趋势

简介目录

Product Code: 91347

The Global Piston Pumps Market is expected to register a CAGR of 4.23% during the forecast period.

Key Highlights

- The demand for piston pumps in many manufacturing industries has been spurred by the demand for greater production efficiency. Piston pumps are appropriate for pressure washing, abrasive blasting, bonding, chemical dosing, potting, and paint spraying due to their versatility. The demand for piston pumps has been positively impacted by major businesses implementing management systems like six sigma for increased manufacturing efficiency.

- For instance, Watec was an early adopter of axial piston pump technology in North America. For a private water facility on Lopez Island in the San Juan archipelago in Washington state, company commissioned its first APP pump in 2006. The pump has been operating without any maintenance for more than ten years. The facility currently provides water for a modest community water system that serves a number of nearby residences.

- The market for piston pumps is hampered by high maintenance and operating expenses and the need to for special equipment to produce pulsing flows.

- Piston pump manufacture was stopped because to the COVID-19 pandemic, owing to the lockdown. This has slowed the market expansion for piston pumps in recent months and is projected to do so again in 2022. Sales of piston pumps were impacted by COVID-19 in the second quarter of 2021 as demand fell precipitously as a result of limitations on production activity. Due to a drop in demand, major participants in the industrial sector reduced production.

Piston Pumps Market Trends

Oil and Gas Sector is Analyzed to hold Major Share

- The oil and gas industry is expected to hold the major share among the end-user market. Treatment, production, distribution, and processing of hydrocarbon fluids and gases are all part of the oil and gas sector. The market is benefiting from rising demand for petrol and diesel in developed economies. The market is also developing due to rising population and increased use of passenger automobiles and cooking gas.

- In addition to moving liquids and compressed gases, piston pumps are also capable of moving viscous fluids and fluids containing solid particles. Piston pumps are used for liquid pumping, industrial processing machinery, high pressure cleaning, and hydraulics with water and oil.

- Therefore the growing investments in the sector are boosting the market growth rate. For instance, in January 2022, Indian Oil Corp. Ltd. (IOCL) announced plans to invest INR 7,000 crore in its city gas distribution (CGD) business. Indian Oil Corp (IOC) announced an investment of INR 1 lakh crore in August 2021 to nearly triple its refining capacity over the next 4-5 years.

- In April 2022, the Japan Ministry of Oil and Gas stated that country plans to step up its investment role in upstream projects for liquefied natural gas (LNG) to spur new development and boost fuel offtake by its companies.

- In 2018, the United States surpassed Saudi Arabia as the world's leading crude oil producer, a position it held until 2020. Crude oil generated in the United States and other countries is obtained by US oil refineries. Crude oil is supplied to the global market by a variety of companies.

Asia Pacific is Expected to Register the Major Growth Rate

- Asia Pacific is analyzed to grow at major rate during the forecast period. Rapid industrialisation is increasing market growth in rising economies such as China, India, Japan, and South Korea, among others. The industry is being propelled forward by the region's rising manufacturing sector, and the increasing use of oil and gas. China plans to extend its giant gas pipeline grids to 163,000 kilometres by 2025, necessitating a USD1.9 trillion investment.

- The manufacturing industry is anticipated to increase in the next years as a result of government efforts such as "Make in India" by the Indian government and "Made in China 2025" by the Chinese government. Therefore, it is projected that the rapid development of the manufacturing sector in several Asia-Pacific nations will expand the use of piston pumps for industrial reasons, creating lucrative growth possibilities for the sector.

- As stated by IBEF, India is anticipated to be a significant contributor to global non-OECD petroleum consumption growth. Crude oil imports increased dramatically from USD 70.72 billion in FY17 to USD 94.3 billion in FY22 (April to January). India's oil refining capacity was 248.9 million metric tonnes per annum (MMTPA) on September 1, 2021, making it Asia's second-largest refiner. About 35% of total refining capacity was controlled by private businesses. With a capacity of 69.7 MMTPA, IOC is the largest domestic refiner.

- In the food and beverage sectors, food pumps are used to transfer, mix, and dosage fluid and semi-fluid ingredients in processing and production applications. Pumps used in the food processing industry are made from materials that are safe for consumption, and they have smooth surfaces to avoid bacterial growth and food contamination. Therefore the growing food and beverage sector is analyzed to boost the demand for the market.

- For instance, the Indian government is making signficant effort to increase foreign investment in the country's food processing sector through the Ministry of Food Processing Industries (MoFPI). The amount of FDI that entered the food processing sector in 2020-21 was USD 393.41 million. From April to October, 2021 India's exports of processed food and agricultural products increased by almost 15%.

Piston Pumps Industry Overview

The Global Piston Pumps Market is competitive with the presence of diverse firms of different sizes. This market is anticipated to encounter a number of partnerships, mergers, and acquisitions as organizations continue to invest strategically in offsetting the present slowdowns that they are experiencing. The market comprises key manufacturers including Bosch Rexroth, Moog Inc., Daikin Industries, Ltd., Alfa Laval, Danfoss among others.

- April 2022- With the Italian manufacturer of hydraulic equipment Duplomatic MS S.p.A, Daikin Industries, Ltd. recently completed a share acquisition agreement. The transaction will cost EUR 220 million. Duplomatic is a manufacturer of hydraulic equipment that specialises in hydraulic valves, pumps, and cylinders and has expanded its clientele to include mobile construction equipment and industrial machines.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Force Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Automation

- 5.1.2 Growing Manufactruing Sector

- 5.2 Market Restraints

- 5.2.1 High Maintenance Cost Over the Entire Lifespan is Challenging the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Lift Piston Pump

- 6.1.2 Force Piston Pump

- 6.1.3 Axial Piston Pump

- 6.1.4 Radial Piston Pump

- 6.2 By End-user Industries

- 6.2.1 Oil & Gas

- 6.2.2 Chemicals

- 6.2.3 Food & Beverage

- 6.2.4 Water & Wastewater

- 6.2.5 Pharmaceutical

- 6.2.6 Power

- 6.2.7 Others

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.4.1 Latin America

- 6.3.4.2 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bosch Rexroth AG

- 7.1.2 Moog Inc.

- 7.1.3 DAIKIN INDUSTRIES, Ltd.

- 7.1.4 Alfa Laval

- 7.1.5 Danfoss

- 7.1.6 Parker Hannifin Corp

- 7.1.7 NACHI-FUJIKOSHI CORP.

- 7.1.8 YUKEN KOGYO CO.,LTD

- 7.1.9 HAWE Hydraulik SE

- 7.1.10 Continental Hydraulics Inc.

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219