|

市场调查报告书

商品编码

1632109

齿轮帮浦 -市场占有率分析、产业趋势/统计、成长预测 (2025-2030)Gear Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

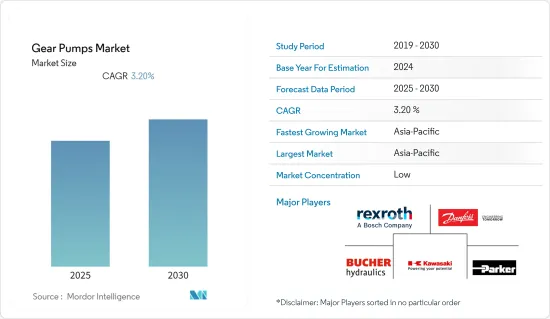

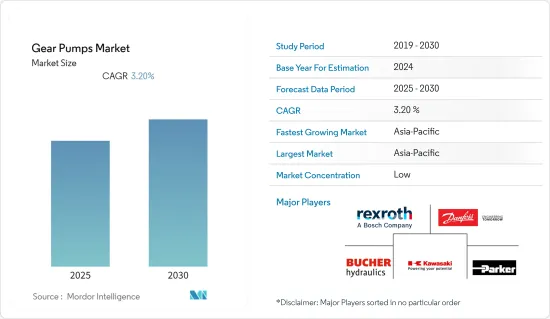

齿轮泵市场预计在预测期内复合年增长率为 3.2%

主要亮点

- 各种最终用户对用户友好且低维护的泵送解决方案的需求不断增长,这是齿轮泵市场成长的关键驱动力。此外,随着全球建筑业的快速扩张,未来对齿轮帮浦的需求可能会扩大。

- 由于石油和天然气需求激增,石油和天然气探勘不断增加,推动了齿轮泵市场的成长。然而,齿轮泵运作过程中产生的噪音是阻碍该产业发展的主要因素。

- 此外,使用齿轮泵的石化製造商专注于满足石化产品不断增长的需求,从而导致併购和产能扩张。例如,阿布达比国家石油公司和信实工业公司已同意在阿布达比鲁韦斯建造新的石化联合企业。该厂年产氯碱94万吨、二氯乙烯110万吨、PVC 36万吨。

- 该行业的供应商也致力于透过产品进步来提高其市场占有率。例如,Oberdorfer 为糖厂枫糖压滤机和枫糖奶油机提供高效可靠的 NL4,000L 和 NL9,000L 无铅外嚙合齿轮帮浦。

- COVID-19 影响了泵浦製造业,流行病法规阻碍了各行业的业务,减少了对齿轮泵浦的需求。此外,大流行限制的放鬆导致工业活动增加,促进了市场成长。

齿轮帮浦市场趋势

化学石化工业成长显着

- 齿轮泵是石化行业的重要组成部分。用于生产原油、柴油、润滑油、沥青和沥青。它也用于运输危险材料,如硅酸钠、混合化学品、酸、聚合物和异氰酸酯。

- 汽车、包装、家居用品和医疗设备等各种应用对石化产品的需求不断增长,是推动该领域製造商提高全球产能的关键因素。例如,2022年5月,巴拉特石油公司(BPCL)宣布将在未来五年内投资3兆印度卢比用于石化计划,以扩大其石化产能,在充满活力的行业中保持竞争力,并为未来做好准备。

- 此外,石化产品生产企业继续与政府和其他主要企业进行併购和合资。 2021年12月,中国石油天然气集团公司(CNPC)开始建造连接尼日和贝南的州际原油管线。一旦完工,这条全长1,950公里的管道计划于2022年将第一批原油从尼日尔阿加德姆盆地输送到贝南塞梅港。

- 根据BASF统计,2021年各地区化学品产量均成长,全球平均成长率达6.1%。这高于新冠疫情大流行前的平均水平,代表着疫情衰退后的强劲復苏,当时全球整体化学品产量在 2020 年下降了 0.4%。

- 随着製造商提高产品产量,对化学品的需求不断增长。美国工业理事会预计,2021年化学品需求将成长3.9%,因为建筑、塑胶製品和食品的需求将足以弥补2020年的亏损。

亚太地区预计将保持强劲成长

- 中国、印度和日本等国家的工业活动正在增加,导致对原油和化学品等产品的需求成长。预计2019年至2025年,中国将带动亚太地区原油精製能力大幅成长。

- 由于全国汽车持有量的增加导致需求增加,中国的石油消费呈现显着成长。此外,为满足中国油气需求,加强国内能源供应,中国自然资源部宣布开放油气产业外商直接投资。目的是允许外国公司在国内勘探和生产石油和天然气。 2021年2月,中海油宣布资本支出总额为154.6亿美元,目标净产量为545-5.55亿桶油当量(Mboe)。

- 而且,2021年7月,印度政府允许同一领域的许多领域100%外国直接投资(FDI),包括天然气、石油产品和炼油厂,以满足该国不断增长的需求。

- 亚太国家的建筑业正在经历显着成长。中国在很大程度上是由经济成长支持的住宅和商业建筑业的众多发展所推动的。在国内,香港住宅委员会推出多项措施推动保障住宅建设。当局的目标是在截至 2030 年的十年内交付 301,000 套公共住宅。建筑领域的此类发展正在推动油漆和涂料行业对齿轮泵的需求。

- 此外,齿轮泵也应用于食品和饮料行业,特别是在输送脂肪、油、巧克力、糖和糖浆、糖蜜等时的转移操作和压力建立。因此,食品和饮料製造的增加预计将进一步推动所研究市场的需求。

齿轮帮浦产业概况

由于齿轮泵的各种新创新、收购、合併等,齿轮泵市场本质上正在走向细分。市场上的主要企业包括博世力士乐股份公司、丹佛斯和布赫液压有限公司。市场的主要发展如下:

- 2021 年 12 月 - 岛津製作所宣布推出新开发的齿轮帮浦「Serenade SRP 300 系列」。此齿轮帮浦采用低噪音设计,与先前的型号相比,噪音降低高达 30%。在过去的四年里,岛津公司一直致力于开发一种使用电动马达作为驱动源的齿轮泵,以降低油压设备的噪音。

- 2021 年 10 月 - Hyreco 推出了一系列新的外嚙合齿轮泵,适用于土木机械、施工机械、农业机械、林业机械和市政机械等行动应用。新系列有两个组,称为HY1和HY2,与HY2组结合的低噪音版本和铸铁本体版本也在开发中,有些已经在生产中。新泵浦将在义大利北部帕尔马工厂生产,该工厂于 2021 年开始运作。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 石油和天然气产业需求不断成长

- 石化、化学工业快速成长

- 市场限制因素

- 替代解决方案的可用性

第 6 章 细分

- 按类型

- 外面嚙合齿轮泵

- 内嚙合齿轮泵

- 按最终用户产业

- 石油和天然气

- 化学

- 饮食

- 製药

- 电力

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 义大利

- 法国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东/非洲

- 北美洲

第七章 供应商市场占有率

第八章 竞争格局

- 公司简介

- Bosch Rexroth AG

- Danfoss

- Bucher Hydraulics GmbH

- Parker Hannifin Corporation

- Kawasaki Heavy Industries Ltd

- Bailey International

- Hydac International GmbH

- Eaton Corporation Plc

- Marzocchi Pompe SpA

- Gemma Automotive

第九章投资分析

第十章投资分析市场的未来

简介目录

Product Code: 91350

The Gear Pumps Market is expected to register a CAGR of 3.2% during the forecast period.

Key Highlights

- The increasing demand from various end-users for user-friendly, low-maintenance pump solutions is the primary driving force for the rise of the gear pump market. Furthermore, with the rapidly expanding construction sector worldwide, the demand for gear pumps is likely to grow in the future.

- The rapidly growing demand for oil and gas has continuously increased exploration of oil and gas, pushing the gear pump market growth. However, the production of noise during the working of gear pumps is a major restraint on the growth of the industry.

- Moreover, the petrochemical product manufacturing companies that use gear pumps in their operations are focusing on catering to increased demand for petrochemical products, for which companies are undergoing mergers & acquisitions and capacity expansions. For instance, Abu Dhabi National Oil Company and Reliance Industries have agreed to build a new petrochemical complex in Ruwais, Abu Dhabi. This plant will generate 940,000 tons of Chlor-alkali, 1.1 million tons of ethylene dichloride, and 360,000 tons of PVC annually.

- The vendors in the industry are also focusing on increasing their presence in the market with advancements in the products. For instance, Oberdorfer is providing NL4000L & NL9000L lead-free external gear pumps that are efficient and reliable for sugarhouse maple sugar filter presses and maple cream machinery.

- The Covid-19 has affected the pump manufacturing industry as the pandemic restrictions hampered the different industry operations that reduced demand of gear pumps. Furthermore, the relaxation of pandemic limitations has resulted in an upsurge in industrial activity, which has aided market growth.

Gear Pumps Market Trends

Chemical and Petrochemical Industry to Grow Significantly

- Gear pumps are essential components of the petrochemical industry. They are employed in the production of crude oil, diesel oil, lubricating oil, pitch, and bitumen. They are also used to carry hazardous substances such as sodium silicate, mixed chemicals, acids, polymers, isocyanates, and others.

- The rising demand for petrochemicals in various applications such as automobiles, packaging, household goods, and medical equipment is a key factor encouraging the manufacturers operating in this segment to increase their global production capacity. For instance, in May 2022, Bharat Petroleum Corporation Limited (BPCL) is expanding its petrochemical capacity and has planned a large investment of INR 30,000 crores in petrochemical projects in the next five years to remain competitive in the dynamic industry and be future-ready.

- Furthermore, companies engaged in manufacturing petrochemical products continuously undergo mergers and acquisitions and joint ventures with governments and other key players. In December 2021, China National Petroleum Corporation (CNPC) commenced the construction of an interstate crude pipeline connecting Niger and Benin. The 1950 kilometers pipeline is expected to transmit the first oil shipment in 2022 from the Agadem basin, Niger, to Port Seme, Benin, after its completion.

- According to BASF, in 2021 chemical production rose in all regions and the global average reached 6.1 percent. This is above average for the years before the covid pandemic and represents a strong rebound following the pandemic recession, where overall global chemical production contracted by 0.4% in 2020.

- The demand for chemicals is strengthening as manufacturers ramp up the production of goods. The American Chemistry Council expected the demand for chemicals by 3.9% in 2021, as demand from construction, plastic goods, and food will more than make up their 2020 deficits.

Asia Pacific is Expected to Hold Major Growth

- The countries like China, India and Japan are witnessing an increase in industrial activities, inducing growth in demand for crude oil and chemicals, among others. China is expected to account for significant growth in crude oil refining capacity between 2019 and 2025 in Asia-Pacific.

- China's oil consumption has seen significant growth with rising demand from the increasing automotive fleet across the country. Furthermore, to meet the county's oil and gas demand and boost domestic energy supplies, China's Ministry of Natural Resources announced the opening of foreign direct investments in the oil and gas industry. It aims to allow foreign companies to explore for and produce oil and gas in the country. In February 2021, CNOOC announced a total capital expenditure of USD 15.46 billion, with targeted net production of 545-555 million barrels of oil equivalent (Mboe).

- Furthermore, in July 2021, the government of India allowed 100% Foreign Direct Investment (FDI) in many segments of the sector, including natural gas, petroleum products, and refineries, among others, to cater to the increasing demand in the country.

- The construction sector in the countries of Asia Pacific is experiencing massive growth. China has been majorly driven by numerous developments in the residential and commercial construction sectors supported by the growing economy. In China, the housing authorities of Hong Kong launched several measures to push-start the construction of low-cost housing. The officials aim to provide 301,000 public housing units in 10 years till 2030. Such developments in construction sector is propelling the demand for gear pumps in paints and coatings industry.

- Moreover, the gear pumps find their application in the food and beverage industry for transfer tasks or pressure build-up, especially when conveying oils, fats, chocolate, sugars and syrups, molasses, etc. Thus, an increase in food and beverage manufacturing is further expected to propel the demand for the market studied.

Gear Pumps Industry Overview

The Gear Pumps market is moving towards fragmented in nature due to various newer innovations in gear pumps, acquisitions, mergers, etc. The key players in the market are Bosch Rexroth AG, Danfoss, Bucher Hydraulics GmbH, and others. Key developments in the market are -

- December 2021 - Shimadzu Corporation has released the newly developed Serenade SRP 300 series of gear pumps. These gear pumps feature a low-noise design that reduces noise by up to 30 % in comparison to previous models. For the last 4 years, Shimadzu has been involved in developing these gear pumps to support the need for low-noise hydraulic equipment by switching to electric motors as the drive source.

- October 2021 - Hydreco introduced a new range of external gear pumps for mobile applications, such as earthmoving machinery, construction equipment, agricultural, forestry and municipal machines. There are two groups in the new range, called HY1 and HY2; two other versions are under development, and partly already in production, both linked to group HY2: a low noise version and one with a cast iron body. The new pump range is produced at the company's plant in Parma, Northern Italy, which has been inaugurated in 2021.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from Oil & Gas Industry

- 5.1.2 Rapidly Growing Petrochemical and Chemical Industry

- 5.2 Market Restraints

- 5.2.1 Availability of Alternative Solutions

6 SEGMENTATION

- 6.1 By Type

- 6.1.1 External Gear Pumps

- 6.1.2 Internal Gear Pumps

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical

- 6.2.3 Food & Beverage

- 6.2.4 Pharmaceutical

- 6.2.5 Power

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 France

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia

- 6.3.3.6 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Turkey

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 North America

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Bosch Rexroth AG

- 8.1.2 Danfoss

- 8.1.3 Bucher Hydraulics GmbH

- 8.1.4 Parker Hannifin Corporation

- 8.1.5 Kawasaki Heavy Industries Ltd

- 8.1.6 Bailey International

- 8.1.7 Hydac International GmbH

- 8.1.8 Eaton Corporation Plc

- 8.1.9 Marzocchi Pompe S.p.A.

- 8.1.10 Gemma Automotive

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219