|

市场调查报告书

商品编码

1635340

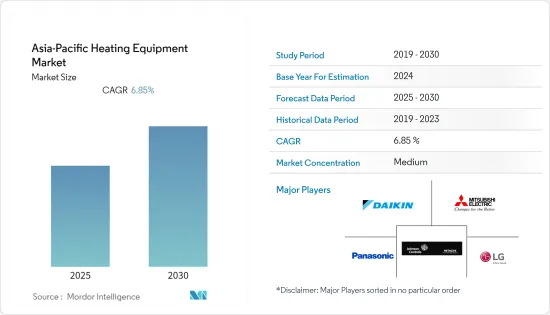

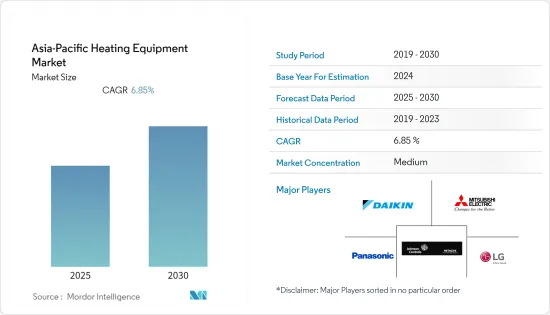

亚太地区暖气设备:市场占有率分析、产业趋势、成长预测(2025-2030)Asia-Pacific Heating Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

亚太地区暖气设备市场预计在预测期内复合年增长率为 6.85%。

主要亮点

- 预测期内暖气设备市场的成长驱动因素包括各个新兴国家建设产业的快速成长和终端用户市场的扩张。加热设备的优点包括能源效率、改善效果和使用寿命。影响市场扩张的主要原因是都市化、工业化和移民的变化,导致采用暖气设备的公司、製造设施和多用户住宅数量的增加。

- 根据国际能源总署(IEA)统计,2020年全球区域供热产量为16EJ,较2000年水准跃升30%,年复合成长率约1.3%。 2019 年至 2020 年显着成长 2.3%,主要由中国和部分韩国推动(各成长 7%)。

- 2020年和2021年的COVID-19爆发对市场成长产生了负面影响。该地区政府于 2020 年和 2021 年实施了封锁。由于终端用户活动暂停,对市场产生了负面影响。此外,由于生产放缓和供应链中断,该地区对暖气设备的需求也收紧。

- 该地区快速的都市化正在推动需求,并鼓励转向使用再生能源来源进行集中供暖和冷气。这种能源来源有助于满足不断增长的都市区能源需求、提高效率、减少排放并提供经济高效的温度控制。例如,由于都市化,中国正在北方地区迅速增加集中式系统的使用。设备高成本是亚太地区供热市场面临的一大挑战。

亚太地区暖气设备市场趋势

工业用途预计将大幅成长

- 热泵用于需要低温热量的工业製程。市售热泵可提供高达 160°C 的热量。热泵的典型工业应用包括干燥、清洗和巴氏杀菌。工业热泵通常是为特定製程需求而设计的客製化系统。

- 这些对于透过余热、工业製程的区域供热或风力发电提供的工业供暖解决方案至关重要。将製程能源重新用于热水和空间加热是实现显着节能和永续未来的一条有吸引力的捷径,推动了工业应用市场的成长。

- 为了满足工业应用中热泵日益增长的需求,公司正专注于产品开发。例如,近期,中国热泵製造商PHNIX推出了适用于工业和商业应用的新型HeatForce系列二氧化碳热泵热水系统,该系统创造性地采用了新型环保二氧化碳製冷剂。本装置可在低至-7°C的条件下保持高达4.3的高性能係数(COP)。

- 行业公司正专注于战略联盟,这将有助于他们占领更高的市场占有率并扩大在该国的影响力。此外,各国政府正迅速转向绿色建筑,这可能为市场相关人员开闢新的途径。房地产顾问公司ANAROCK预计,2022年,印度绿色建筑市场规模预计将达到350亿美元至300亿美元左右。

- 此外,快速的都市化也是DH引进的驱动因素。例如,近年来在中国,集中式系统的使用在北方地区迅速增加。日本也是亚太地区率先为寒冷地区居住引入区域供暖的国家之一。

- 目前,日本需要应对低碳化、强化城市和街区、振兴地方经济等社会议题。日本于2016年修订了《供热商业法》,开放了供热业务。根据减少二氧化碳排放的模拟计算,到2030年,日本的设备效率与2013年相比,在大都会模型中可以降低43%以上,在地方城市模型中可以降低46%以上。

中国可望创最快增速

- 可支配收入的增加、对二氧化碳排放的日益关注以及供暖和製冷系统的高消耗等因素是推动中国研究市场成长的主要因素。根据经济合作暨发展组织(OECD) 的模型,到 2060 年,印度和中国的人均收入可能会增加七倍。

- 亚太地区各国政府也与当地企业合作,进一步推动国内市场。例如,北京集中供热集团是中国重要的供热企业之一。该公司还为北京中央政府和军队、驻华使馆、大型公司和机构以及公众部署供热解决方案,并在其他省份拥有众多计划。

- 中国不仅拥有最多的人口,也是最高的二氧化碳排放。由于二氧化碳排放量大和空气污染问题,中国强烈渴望转型为绿色能源体系。目前,煤炭占中国建筑供暖所需能源的大部分。国际能源总署(IEA)表示,中国拥有世界上最大的区域供暖系统,超过2亿中国公民可以从绿色供暖中受益匪浅。中国许多城市希望实施二氧化碳减排计划,但缺乏充分发挥绿色区域供暖潜力所需的实际理解和有利的法律环境。

- 2021年7月,在此基础上,丹麦能源总署与UNEP DTU伙伴关係同意在中国区域供热方面进行更密切的合作。此次合作的目的是透过加速绿色转型并在监管框架条件下共用丹麦的专业知识,帮助中国履行在《巴黎协定》下的承诺。

- 此外,中国建筑业的成长正在加强对暖气设备市场的需求。住宅及城乡建设部(住建部)发布通知,将在「十四五」计画中实施2020年都市更新行动。政府希望提高中国城市的生活水准。这就是为什么这个城市更新计画致力于让城市变得更环保、更有效率。

- 中国建筑业的产能不断扩大,对工程服务的需求也不断增加。住建部资料显示,2021年,我国工程监督、造价顾问等工程咨询服务收入达265亿美元。

亚太供暖设备产业概况

暖气设备市场竞争激烈,众多企业进入市场。从市场占有率来看,目前少数主要企业占据市场主导地位。DAIKIN INDUSTRIES、江森自控日立空调和Honeywell国际是加热设备市场上的主要企业。

- 2021 年 11 月Honeywell表示,浙江盾安环境将透过生产相容的 HVAC 组件系列,支持 HVAC 产业向 Solstice N41 (R-466A) 的过渡。盾安生产用于住宅和商用空调、热泵以及冷冻和冷却系统的冷冻阀门、热交换器和压力容器。

- 2021 年 9 月 - 代傲表计在中国洛阳开设了一个新的智慧供热实验室。透过研究院,该公司旨在为当地客户提供更有效的服务,加快智慧暖气创新,并布局中西部地区的业务。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 价值链/供应链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 该地区智慧城市的发展

- 都市化和工业化进程

- 市场限制因素

- 设备成本高

第六章 市场细分

- 按类型

- 锅炉/散热器/其他加热器

- 热泵

- 按最终用户

- 住宅

- 商业的

- 产业

- 按国家/地区

- 中国

- 日本

- 韩国

- 印度

- 其他国家

第七章 竞争格局

- 公司简介

- Daikin Industries Limited

- Mitsubishi Electric Corp

- Panasonic Corporation

- LG Electronics Inc.

- Johnson Controls-Hitachi Air Conditioning

- Whirlpool Corp.

- Danfoss A/S

- ROBERT Bosch GmbH

- Emerson Electric Co.

- ANHUI MISOURI ECO-ENERGY SOLUTION CO., LTD.

第八章投资分析

第9章 未来趋势

简介目录

Product Code: 91432

The Asia-Pacific Heating Equipment Market is expected to register a CAGR of 6.85% during the forecast period.

Key Highlights

- Significant drivers of the heating equipment market's growth over the projection period include the burgeoning construction industry in various emerging economies and the expanding end-user markets. A few advantages of heating equipment are energy efficiency, better outcomes, and lifespan. A few key reasons impacting the market's expansion are changes in urbanization, industrialization, and migration, which have increased the number of enterprises, manufacturing facilities, and residential complexes that employ heating equipment.

- According to International Energy Agency (IEA), global district heating production was 16 EJ of heat in 2020, jumping 30% from the 2000 level at an annual compound growth rate of around 1.3%. The striking 2.3% increase from 2019 to 2020 was prompted mainly by China and partially by Korea (7% growth each).

- The COVID-19 outbreak in 2020 and 2021 had a negative impact on the market's growth. Lockdowns were imposed on the region's governments in 2020 and 2021. As end users' activities were suspended, this had a negative effect on the market. Additionally, production has slowed down, and the supply chain has been disrupted, putting a strain on the region's demand for heating equipment.

- Rapid urbanization in the region is driving the demand and pushing to switch to renewable energy sources for centralized heating and cooling, which can help meet rising urban energy needs, improve efficiency, reduce emissions and provide cost-effective temperature control. For instance, driven by urbanization, China has rapidly increased its use of centralized systems in its northern regions. The Asia Pacific heating Market is facing a significant challenge due to the high costs of the equipment.

APAC Heating Equipment Market Trends

Industrial is Expected to Grow at a Signficant Rate

- Heat pumps are used for industrial processes that require low-temperature heat. Commercially available heat pumps can provide heat up to 160°C. Typical industrial applications for heat pumps include drying, washing, and pasteurization. Industrial heat pumps are most often bespoke systems designed for specific process needs.

- These are essential in industrial heating solutions, supplied by either surplus heat, district heating from the industrial processes, or wind power. Re-using the process energy for hot water and space heating is an attractive shortcut to significant energy savings and a sustainable future, thus driving the market growth in industrial applications.

- Due to the growing demand for heat pumps in industrial applications, players are focusing on product development. For instance, recently, PHNIX, a manufacturer of heat pumps in China, launched a new HeatForce series Co2 heat-pump water-heating system for industrial and commercial applications, with the creative use of a new eco-friendly CO2 refrigerant. The unit can maintain a high coefficient of performance (COP) of up to 4.3 under the low-temperature condition of -7°C.

- Industry players are laying high emphasis on forming a strategic alliance, which may aid the companies in garnering higher market share and boost their presence across the country. Moreover, the government is rapidly heading toward green buildings, which may create new avenues for market players. According to ANAROCK, a property consultant, the green building market in India is expected to reach a value of about USD 35-30 Billion by 2022.

- In addition, rapidly increasing urbanization is another driving factor for adopting DH. For instance, in recent years, China rapidly increased its use of centralized systems in its northern regions. Japan is another major country in the Asia-Pacific region that is adopting district heating for parts residing in colder weather conditions.

- At present, Japan must respond to social issues, such as low carbonization, strengthening of cities and blocks, and revitalizing local economies. The country's heat supply business was liberalized by revising the Heat Supply Business Law in 2016. According to a low-carbon simulation calculation of CO2 emissions, it is possible to reduce the efficiency of equipment in Japan by 2030 by 43% or more compared to 2013 in the large city model and 46% or more in the local city model.

China is Expected to Register the Fastest Growth Rate

- Factors such as rising disposable income, growing concern for CO2 emission, and high consumption of heating and cooling systems are some of the major factors driving the studied market growth in China. According to the Organization for Economic Cooperation and Development (OECD) models, India and China may witness a seven-fold increase in income per capita by 2060.

- The governments in the Asia Pacific region are also collaborating with a local companies, further boosting the domestic market. For instance, the Beijing District Heating Group is one of the significant heating enterprises in China. The company also deployed its heating solutions for the central Beijing government and army, embassies in China, large enterprises and institutions, and the public and owns numerous projects in other provinces.

- In addition to having the greatest population, China also produces the most CO2. China is strongly motivated to transition to a more environmentally friendly energy system because of the country's significant CO2 emissions and air pollution problems. Today, coal accounts for most of the energy needed to heat buildings in China. The International Energy Agency (IEA) stated that China has the largest district heating system in the world, and more than 200 million Chinese citizens may potentially benefit greatly from green heating. Many Chinese cities desire to adopt CO2-saving projects but lack the practical understanding and favorable legal environment needed to operate green district heating to its full potential.

- In July 2021, based on this, the Danish Energy Agency and UNEP DTU Partnership agreed to collaborate more closely on district heating in China. The cooperation aims to accelerate the green transition and assist China in upholding its commitments under the Paris Agreement by sharing Danish expertise under regulatory framework conditions.

- Further, the growing construction sector in the country is bolstering the demand for the heating equipment market. The Ministry of Housing and Urban-Rural Development (MOHURD) published a notice for implementing Urban Renewal Actions in 2020 as part of China's 14th Five-Year Plan. The government wants to improve the standard of urban living in China. Therefore this urban regeneration initiative strives to create greener, more efficient cities.

- The capacity of China's construction sector has expanded, which has benefited the need for engineering services. Data from MOHURD indicates that in 2021, China generated USD26.5 billion in income from engineering consulting services such as engineering supervision and cost consultancy.

APAC Heating Equipment Industry Overview

The Heating equipment market is quite competitive and consists of significant players. In terms of market share, a few prominent players currently dominate the market. Daikin Industries Ltd., Johnson Controls - Hitachi Air Conditioning Company, and Honeywell International, Inc. are some of the leading players operating in the Heating Equipment market.

- November 2021-Honeywell stated that Zhejiang DunAn Artificial Environment Co., Ltd (DunAn Environment) will support the HVAC industry's transition to Solstice N41 (R-466A) by producing a compatible product range of HVAC components. DunAn manufactures refrigeration valves, heat exchangers, and pressure vessels for residential and commercial air conditioners, heat pumps, and refrigeration and freezing systems.

- September 2021-Diehl Metering has opened a new Smart Heating Laboratory in Luoyang, China. The company aims to serve local clients more effectively, speed up innovation in smart heating, and organize operations in Central and West China through the lab.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Smart Cities in the Region

- 5.1.2 Rising Urbanization and Industrialization

- 5.2 Market Restraints

- 5.2.1 High Costs of Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Boilers/Radiators/Other Heaters

- 6.1.2 Heat Pumps

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 South Korea

- 6.3.4 India

- 6.3.5 Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin Industries Limited

- 7.1.2 Mitsubishi Electric Corp

- 7.1.3 Panasonic Corporation

- 7.1.4 LG Electronics Inc.

- 7.1.5 Johnson Controls-Hitachi Air Conditioning

- 7.1.6 Whirlpool Corp.

- 7.1.7 Danfoss A/S

- 7.1.8 ROBERT Bosch GmbH

- 7.1.9 Emerson Electric Co.

- 7.1.10 ANHUI MISOURI ECO-ENERGY SOLUTION CO., LTD.

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219