|

市场调查报告书

商品编码

1635351

全球突波保护装置市场:份额分析、产业趋势/统计、成长预测(2025-2030)Global Surge Protection Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

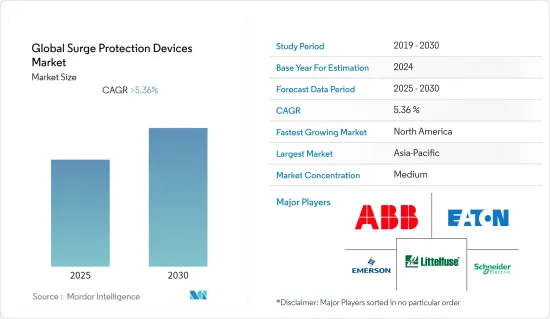

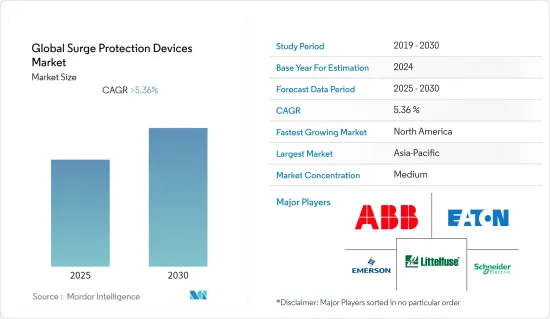

全球突波保护元件市场预计在预测期内复合年增长率将超过5.36%

主要亮点

- 全球突波保护元件市场的成长主要是由于汽车产业的快速扩张以及对具有更快的处理器、更好的功率密度和更高灵敏度的更小、更智慧的行动装置的需求不断增长。此外,汽车领域越来越多地使用电气和机械部件来提高乘客的舒适性、安全性、远端资讯处理、驾驶辅助和导航也将对市场产生积极影响。因此,这些透过防止过热和接线来提供智慧和高性能功能的设备的使用正在推动市场扩张。

- 与其他敏感电气设备一样,电动车充电器需要突波保护。电网电压波动可能导致充电埠失效。随着主要经济体加速采用电动车,对突波保护设备的需求预计将大幅成长。例如,根据印度品牌资产基金会的数据,印度21财年汽车产量为2,265万辆,其中2021年4月至10月期间生产了1,300万辆。 2022 财年第三季电动车 (EV) 销量达 5,592 辆,创下历史新高。 2021 年,印度电动车 (EV) 销量总计 329,190 辆,比前一年的 122,607 辆成长 168%。

- 开发中国家不断增长的人口水准和日益增长的经济成长正在增加对电气产品的需求。由于工业化程度的提高和可支配收入的增加,生活水准不断提高。因此,过去几年,电子产品的消费和支出急剧增加。微处理器在各种产品中的使用越来越多,以及微电子元件的日益小型化,导致设备损坏的增加。全球突波保护装置市场扩大的关键因素是越来越多的国家采用LCD、LED、笔记型电脑、洗衣机和电视等高科技产品。

- 多个国家的居家订单使电子製造和相关服务变得更加复杂。该领域的许多公司被归类为重要产品供应商,因为远端/线上工作在工厂车间的使用有限。电子製造商执行许多支援世界各地其他行业的重要业务。在这次 COVID-19 疫情期间,从组装产品到设计为基本医疗设备供电的基板,电子製造已成为经济和医疗保健领域不可或缺的一部分。

- 虽然典型的突波保护可以防止电压尖峰和突波,但它无法阻止附近雷击引起的强大且具有破坏性的电流突发。雷电产生的直流电流太大,无法被电源分接头的小型电子设备屏蔽。无论有多少电容器或电池组,如果雷击路径中有突波保护,所有雷电都会简单地掠过物体。大多数 SPD 都提供相当高水准的直流电压衝击和突波的保护。但它并不能完全保证电子设备不受损害,这是突波保护器广泛使用的一大障碍。

突波保护器市场趋势

住宅领域是推动市场的因素之一

- 为了满足不断增长的客户需求和住宅领域的崛起,市场参与企业正在将新功能融入现有产品并开发新产品来满足客户需求。例如,西门子的新型BoltShield QSPD系列突波保护器专为住宅应用而设计,针对内部和外部发生的突波提供最佳保护。出于成本和空间的考虑,许多建筑物只有一个SPD,位于主要输入负载中心。这违背了 IEEE 在整个建筑内安装连锁SPD 的建议。

- 根据挪威统计局的数据,挪威住宅量从 2022 年 4 月的 1,929 套增加到 5 月的 2,777 套。此外,2022 年 1 月,挪威斯塔万格向瑞典建设公司Skanska 授予了价值 8,550 万美元(7.5 亿挪威克朗)的新城市开发合约。斯塔万格的 Storhaugneighborhood 将接收 LervikQuarter 开发计划。占地26,000平方米,将兴建停车场、小学、幼儿园、办公室、杂货店、多功能厅等设施。建设计划的增加预计将推动暖通空调设备市场的成长。住宅计划的增加将推动市场。

- 欧盟拥有英国、法国、德国、丹麦、瑞士、卢森堡、比利时和其他斯堪地那维亚国家等富裕国家,是世界上人均收入和国内生产总值最高的国家之一。根据国际货币基金组织的数据,2020年欧盟国内生产总值151,670亿美元,预计2026年将达到211,830亿美元。该地区的人均收入也很高,有七个欧洲国家位居世界前七名。正因为如此,欧洲公民有能力在突波保护设备上花费更多。

- 根据美国人口普查局的数据,截至 2021 年 5 月,经季节性已调整的,每年颁发的建筑许可证为 1,681,000 套私人住宅。这比 2020 年 5 月的值高出 34.9%。住宅单元数量的增加为突波保护装置市场提供了成长机会。

- 儘管孟买的房地产成本是全国最高的,但目前有几个因素使在该市住宅成为一个可行的选择。印度最新的房地产调查显示,该国前七大城市的住宅销售量达到58,920套,比2020年第一季成长超过29%。这明显高于新冠疫情前的水平,显示经济正在改善。 2021年第一季,7个城市新建住宅,较上季成长18%,较去年同期成长51%。印度排名前七的城市分别是国家首都区(NCR)、孟买都会区(MMR)、班加罗尔、浦那、海得拉巴、清奈和加尔各答。住宅领域的显着成长可能是调查市场背后的动力。

亚太地区占主要市场份额

- 中国、台湾、日本和亚太地区其他地区则构成了亚太地区突波保护元件市场的其他次族群。经济的持续成长和都市化进程的不断加快导致医院、办公室、大型零售店和剧院的建设不断扩大。亚太国家政府正在支持机场基础设施的发展和智慧城市的建设。因此,旅游业、智慧城市计划和建设活动的增加正在推动该地区住宅、商业和工业领域对突波保护装置的需求。

- 政府加大力度降低能源消耗是采用智慧建筑解决方案的关键驱动力之一。例如,美国中经济与安全审查委员会估计,2023年中国将在智慧城市相关政府活动上花费389.2亿美元。这些变化也显示了国家使用突波保护技术的意愿。

- 影响所研究市场的关键趋势是对智慧製造实践的关注。 IBEF资料显示,印度政府制定了雄心勃勃的目标,到2025年将製造业对国内生产总值(GDP)的贡献从16%提高到25%。智慧先进製造和快速转型中心 (SAMARTH) Udyog Bharat 4.0倡议旨在提高印度製造业对工业 4.0 的认识,并使相关人员能够应对智慧工厂的挑战。

- 根据工业和内贸促进部统计,2021财年印度建筑开发业获得约4.2亿美元的外国直接投资资本。如此大量的投资流入预计将显着推动突波保护装置市场的发展。

- 预计工业领域在预测期内将发展更快。汽车和电气设备是工业 4.0 计画的目标,促进远距离诊断、远端维护和远端资料收集。这些活动正在迅速增加对资料中心、伺服器和通讯系统的需求。随着电子技术的使用,对此类关键设备保护解决方案的需求不断增加。这推动了工业领域对突波保护设备的需求,预计将在整个预测年度扩大市场的潜在收益来源。

突波保护器产业概况

全球突波保护装置市场由几家主要参与者适度整合。这些公司不断投资于策略联盟和产品开发,以占领更多的市场占有率。近期市场趋势如下。

- 2022 年 6 月 - Infinite Electronics 旗下品牌、射频和资料突波保护、滤波和接地解决方案市场领导者PolyPhaser 宣布,Infinite Electronics 旗下品牌、射频和资料突波保护、滤波和接地解决方案市场参与企业PolyPhaser解决方案,将防止雷电和其他重大电气变化引起的电磁脉衝(EMP) 和突波,引入新的 1/4 波射频突波保护,以保护您的设备免受影响。新型 QWP-DMDF-ER 同轴突波保护支援 555 MHz 至 4.5 GHz 的频率,并减少直流突波。这种宽频效能非常适合 CBRS 网路、蜂巢式网路、DAS、紧急应变系统和公共系统等应用。

- 2021 年 7 月 - Leviton 现在为当前和未来的 Leviton Load Center 客户提供简单的插入式解决方案,为他们最近推出的四款新型 1 型突波保护断路器提供高效的突波保护。 2020 年美国电气规范 (NEC) 第 230.67 条要求,为住宅提供的所有服务都必须配备与设备整合或位于设备附近的 1 型或 2 型突波保护装置。这些新断路器符合此要求。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 电子设备保护系统的需求增加

- 持续的电能品质问题

- 市场限制因素

- 安装的额外费用

第六章 市场细分

- 按类型

- 硬连线

- 外挂

- 行程式码

- 按放电电流

- 10KA以下

- 10~25KA

- 25KA以上

- 按最终用户

- 工业的

- 商业的

- 住宅

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- ABB Ltd

- Eaton Corporation, Plc.

- Emersen Electric Co.

- Schneider Electric Se

- Littelfuse, Inc.

- Legrand

- Leviton Manufacturing Company, Inc.

- Tripp Lite

- Hubbell Incorporated

- Belkin International

第八章投资分析

第9章市场的未来

简介目录

Product Code: 91504

The Global Surge Protection Devices Market is expected to register a CAGR of greater than 5.36% during the forecast period.

Key Highlights

- The global market for surge protection devices is growing primarily as a result of the automobile industry's quick expansion and the rising need for small, smart portable appliances with quicker processors, better power densities, and more sensitivity. Additionally, the market is being positively impacted by the growing use of electrical and mechanical components in the automotive sector to enhance comfort, safety, and telematics for passengers as well as driver assistance and navigation. Accordingly, the usage of these devices to give intelligent and high-performance functionalities by preventing overheating and wiring is fueling market expansion.

- Similar to any sensitive electrical equipment, EV chargers also require surge protection. Voltage fluctuations within the power grid can render charging ports useless. With the accelerated growth in adoption of EVs across major economies, the demand for surge protection devices is expected to see significant growth. For instance, According to Indian Brand Equity Foundation, In FY21, India produced 22.65 million cars annually, with 13 million built between April and October 2021. Sales of electric vehicles (EVs) hit a new high of 5,592 units in the third quarter of FY22. Overall, 329,190 electric vehicles (EVs) were sold in India in 2021, representing a 168% YoY increase over the 122,607 units sold the previous year.

- The demand for electrical products is growing as a result of rising population levels and expanding economic growth in developing countries. The level of living has elevated due to increased industrialisation and an increase in disposable money. Consequently, during the past few years, consumption and spending on electronic goods have increased dramatically. The rising use of microprocessors in a wider range of products and the ongoing shrinking of microelectronic components are both to blame for the rise in equipment damage. The main drivers of the expansion of the global market for surge protection devices are the rising nations' adoption of high-tech products such as LCD, LED, laptops, washing machines, and televisions.

- The stay-at-home orders issued across multiple countries have further complicated electronics manufacturing and related services. With remote/online work only having limited applications on the factory floor, many businesses in this field have been classified as essential product providers. Electronics manufacturers carry out many critical tasks that support other industries around the world. From product assembly to circuit board designs that power necessary medical equipment, electronics manufacturing has been an integral part of the economy and the healthcare space during this COVID-19 outbreak.

- Common surge protectors can prevent voltage spikes and surges, but they cannot block the powerful, catastrophic burst of current caused by a nearby lightning strike. With a small electronic gadget inside a power strip, direct lightning current is simply too large to shield. No matter how many capacitors and battery banks are present, if the surge protectors are in the route of a lightning strike, all lightning will simply flash over the object. The majority of SPDs offer a respectable level of protection against a direct voltage strike or surge. They cannot completely guarantee against harm to any electronic equipment, which poses a severe obstacle to the widespread use of surge protection devices.

Surge Protection Devices Market Trends

Residential Segment is one of the Factor Driving the Market

- To meet the increasing demand of the customers and the rise in the residential sector is driving the market players to incorporate new features in the existing product or develop new products to meet the customer demands. For example, Siemens, The new BoltShield QSPD series of surge protection is specially made for residential applications and offers the finest defense against both internally and externally generated surges. Due to cost and space concerns, many buildings only have one SPD, which is situated in the primary incoming load center. This contravenes IEEE recommendations, which call for cascading SPDs throughout the building.

- According to Statistics Norway, Housing Starts in Norway increased to 2777 units in May from 1929 units in April of 2022. Furthermore, in January 2022, The Norwegian municipality of Stavanger gave Swedish construction company Skanska a USD 85.5 million (NOK750 million) contract to develop a new municipal town center. The Storhaugneighborhood of Stavanger will receive the LervikQuarter development project. The 26,000m2 structure will have parking places, a primary school, a kindergarten, offices, a grocery shop, a multipurpose hall, and other amenities. Increasing construction projects like this will enhance the HVAC equipment market's growth. An increase in residential projects will drive the market.

- With affluent countries like the United Kingdom, France, Germany, Denmark, Switzerland, Luxembourg, Belgium, and other Scandinavian countries EU has one of the highest per capita income and GDP in the world. According to IMF, the European Union Gross Domestic Product in 2020 was USD 15,167 billion and is expected to reach USD 21,183 billion by 2026. The region's per capita income is also high, with seven European countries being in the top seven in the world. This allows the European citizens to spend higher on Surge protection devices.

- According to the United States Census Bureau, as of May 2021, the private housing authorized by building permits was at a seasonally adjusted annual rate of 1,681,000. The value was 34.9% above the May 2020 rate. The increase in residential units creates growth opportunities for the Surge protection device market.

- Even though Mumbai has one of the highest real estate costs in the nation, several factors are currently in play that has made buying a home in this city a practical alternative. A recent real estate study in India found that home sales in the country's top seven cities exceeded Q1 2020 by more than 29 percent, totaling 58,920 units. This is significantly higher than pre-COVID levels, indicating an economic improvement. In the seven cities, 62,130 residential units were constructed in the first quarter of 2021, an increase of 18% from the previous quarter and 51% year over year. The top seven cities in India are National Capital Region (NCR), Mumbai Metropolitan Region (MMR), Bengaluru, Pune, Hyderabad, Chennai, and Kolkata. Such a huge increase in the residential sector will drive the studied market.

Asia Pacific Holds the Major Share of the Market

- The china, taiwan, japan,and rest of the region make up the other subgroups of the asia pacific surge protection devices market. The construction of hospitals, offices, huge retail stores, and theatres has expanded as a result of continued economic growth and growing urbanization. The governments of Asia Pacific nations support the growth of airport infrastructure and the creation of smart cities. Thus, increased tourism, smart city projects, and construction activities are driving the demand for surge protection devices in the region's residential, commercial, and industrial sectors

- The increasing government initiatives to reduce energy consumption has been one of the primary factors for adopting smart building solutions. For instance, the U.S.- China Economic and Security Review Commission estimates that in 2023, China will spend USD 38.92 billion on government activities related to smart cities. These changes also reveal a country's willingness to use surge protection technology.

- A significant trend impacting the market studied is the focus on smart manufacturing practices. According to the data from IBEF, the Government of India set an ambitious target of increasing manufacturing output contribution to 25% of Gross Domestic Product (GDP) by 2025, from 16%. The Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog Bharat 4.0 initiative aim to enhance awareness about Industry 4.0 within the Indian manufacturing industry and help stakeholders address challenges related to the smart factory.

- According to the Department for Promotion of Industry and Internal Trade (India), India's construction development industry received around USD 420 million in foreign direct investment equity during the fiscal year 2021. The market for surge protection devices will be greatly boosted by such a sizable inflow of investments.

- During the projected period, the industrial segment is anticipated to develop faster. Vehicles and electrical equipment are being subjected to the Industry 4.0 program to facilitate remote diagnostics, remote maintenance, and remote data collection. Due to these activities, the need for data centers, servers, and communication systems has surged. The demand for protective solutions for such vital equipment has grown along with the use of electronic technology. This is fueling the industrial segment's need for surge protection devices, which is anticipated to expand the market's potential revenue sources throughout the projected year.

Surge Protection Devices Industry Overview

The global surge protection device market is moderately consolidated, with the presence of a few major companies. The firms are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- June 2022 - A new quarter-wave RF surge protector has been made available by PolyPhaser, an Infinite Electronics brand and a market player in RF and data surge protection, filtering, and grounding solutions, to protect equipment from electromagnetic pulses (EMPs) and power surges brought on by lightning or other significant electrical changes. The new QWP-DMDF-ER coaxial surge protector supports frequencies from 555 MHz to 4.5 GHz and reduces DC surge. For applications such as CBRS networks, cellular networks, DAS, emergency response systems, and public safety systems, this broadband performance makes it ideal.

- July 2021 - In order to assist current and potential Leviton Load Center customers deliver efficient surge protection for their entire home utilising a straightforward plug-on solution, Leviton recently announced the release of four new Type-1 Surge Protective Circuit Breakers. Article 230.67 of the 2020 National Electrical Code (NEC) mandates that all services supplying dwelling units be equipped with a Type 1 or Type 2 surge protective device, either as an integral part of the equipment or situated immediately nearby. These new breakers are made to comply with this requirement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Electronic Device Protection Systems

- 5.1.2 Consistent Power Quality Problems

- 5.2 Market Restraints

- 5.2.1 Additional Cost for Installation

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hard-Wired

- 6.1.2 Plug-In

- 6.1.3 Line Cord

- 6.2 By Discharge Current

- 6.2.1 Upto 10KA

- 6.2.2 10KA-25KA

- 6.2.3 Above 25KA

- 6.3 By End User

- 6.3.1 Industrial

- 6.3.2 Commercial

- 6.3.3 Residential

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Eaton Corporation, Plc.

- 7.1.3 Emersen Electric Co.

- 7.1.4 Schneider Electric Se

- 7.1.5 Littelfuse, Inc.

- 7.1.6 Legrand

- 7.1.7 Leviton Manufacturing Company, Inc.

- 7.1.8 Tripp Lite

- 7.1.9 Hubbell Incorporated

- 7.1.10 Belkin International

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219