|

市场调查报告书

商品编码

1635360

远端监控与控制:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Remote Monitoring and Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

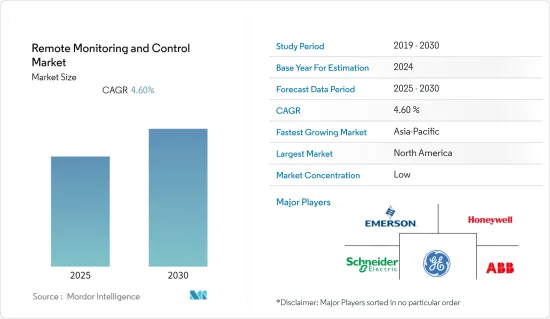

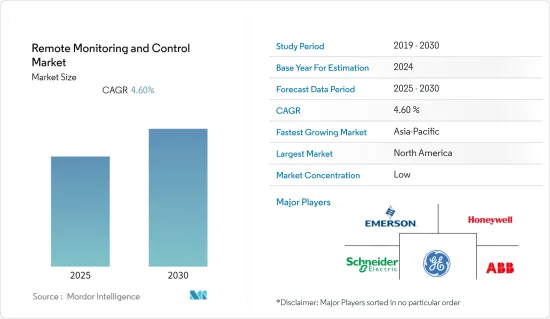

预计远端监控市场在预测期内的复合年增长率为 4.6%。

主要亮点

- 远端监控对于预测性维护实务非常重要,可以避免非计划性停机和设备故障。使用物联网感测器、控制阀和速度驱动器等各种设备追踪、分析和控制马达、泵浦和输送机等关键资产的状况和性能。我们主动的品管方法还可以在流程中更早识别和防止缺陷,从而降低成本和废弃物,同时实现最高生产力和可重复性。

- 由于 SCADA 与现场设备和行动解决方案(如智慧型手机、平板电脑和其他解决方案)的集成,对製程控制应用的需求迅速增加,导致石油和天然气、发电、和化学品正在增加。

- 此外,透过在工业製程控制中利用远端监控和控制系统最佳利用可能会在预测期内推动市场发展。然而,实施解决方案的难度是远端监控市场的限制因素。

- 由于政府的限制,COVID-19 大流行增加了对工业流程的效率、生产力和安全性的关注。这迫使企业创新解决方案,以在困难时期保持弹性,而远端监控系统的使用有助于他们更好地控制生产过程并获得更好的流程效率。

远端监控市场趋势

快速成长的用水和污水行业

- 用水和污水行业的製程控制解决方案透过整合来自所有工厂区域和系统(包括远端 SCADA 系统)的资料,提供工厂的全面视图。此类解决方案使工厂运营商能够应对不断变化的条件并提高工厂安全性和运作。

- 市场上的供应商(例如 ABB Ltd.)为海水淡化、抽水、配水灌溉、工业水处理、污水处理、水道和海岸保护等水处理提供远端製程控制解决方案。此外,随着人口的快速增长和都市化,现有的供水系统面临压力。因此,一些国家的政府正在重建现有的供水系统,并大力投资新计画。

- 例如,2021年12月,加拿大和不列颠哥伦比亚省政府间事务、基础设施和地区事务部长宣布,将共同为不列颠哥伦比亚省的四个计划提供超过1920万美元的资金,以支持饮用水和污水基础设施。

- 此外,2021 年 7 月,美国农业部 (USDA) 宣布将投资 3.07 亿美元,对 34 个州和波多黎各的农村饮用水和污水基础设施进行现代化改造。政府对用水和污水基础设施的投资正在推动远端监控市场的成长。

亚太地区成长率显着

- 由于发电、化学、水和用水和污水管理行业投资的增加,亚太地区远端监控市场预计将显着成长。例如,2021年11月,亚洲开发银行(ADB)核准了1.61亿美元贷款,支持乌兹别克塔什干州开发综合污水管理系统。

- 该地区的能源挑战也推动了许多行业采用远端监控,进一步推动市场成长。根据国际能源总署(IEA)报告(2022),亚太地区电力需求将从 2020 年的最低 2% 增长至 2021 年 8%,其中大部分由中国和印度推动。

- 中国的控制系统正在各个领域涌现,包括发电、石油和天然气、用水和污水管理以及市政。随着资讯科技与工业的深度融合以及物联网的快速发展,网路化控制系统正成为我国工业自动化的发展趋势。

- 此外,中国、印度和日本等新兴国家的工业化程度不断提高,以及这些行业倾向于製程自动化,透过引入先进的监控系统来降低能源消耗并提高製程效率,进一步推动了市场的成长。

远端监控产业概况

远端监控市场竞争激烈且分散。市场供应商专注于扩大其全球基本客群。公司正在利用策略联合措施来增加市场占有率和盈利。主要参与者包括艾默生电气、霍尼韦尔国际和施耐德电机。市场的主要发展如下。

- 2021年12月——横河电机发布了“OpreX託管服务-云端版”,这是利用横河电机提供的云端平台支援OT/IT现场资产远端监控和维护的解决方案。透过可视化每个设备的性能、可靠性和安全性等资讯来监控整个工厂系统。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 工业自动化需求不断成长

- 对製程工业远端系统管理的工业移动性的需求不断增长

- 市场挑战

- 高成本、安装复杂

第六章 市场细分

- 按类型

- 解决方案

- 现场设备

- 按最终用户产业

- 石油和天然气

- 发电

- 化学

- 金属/矿业

- 用水和污水

- 饮食

- 製药

- 纸浆/造纸製造

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Emerson Electric Co.

- Honeywell International Inc.

- Schneider Electric SE

- General Electric Co.

- ABB Ltd.

- Rockwell Automation, Inc.

- Yokogawa Electric Corporation

- Endress+Hauser AG

第八章投资分析

第9章市场的未来

简介目录

Product Code: 91538

The Remote Monitoring and Control Market is expected to register a CAGR of 4.6% during the forecast period.

Key Highlights

- Remote monitoring is important in predictive maintenance practices to avoid unplanned downtime and equipment failures. Various instruments such as IoT sensors, control valves, and speed drives are used to track, analyze and control the status and performance of critical assets like motors, pumps, conveyors, and others. It also enables a proactive quality control approach to identify and prevent defects much earlier in the process for peak production rates and repeatability alongside reduced costs and waste.

- The demand for process control applications is growing rapidly with the integration of SCADA using field instruments and mobility solutions such as smartphones, tablets, and other solutions leading to the growth of the remote monitoring and control market in the industries such as oil & gas, power generation, chemical, and others.

- Furthermore, the optimum utilization of assets with the use of remote monitoring and control systems in the industrial process control may propel the market over the forecast period. However, the difficulty in implementing the solutions is restraining the Remote Monitoring and Control Market.

- The Covid-19 pandemic has increased the concern for efficiency, productivity, and safety of industrial processes due to the restrictions implied by the government. It forced companies to innovate solutions to stay resilient during a challenging time, which helps in achieving better control over production processes and gaining better process efficiency with the use of remote monitoring and control systems.

Remote Monitoring and Control Market Trends

Water and Wastewater Industry to Grow Rapidly

- The process control solutions of water and wastewater industry provides comprehensive view of the plant by integrating data from all plant areas and systems, including remote SCADA systems. With such solutions plant operators get response to the changing conditions and improve plant safety and uptime.

- The vendors in the market, such as ABB Ltd., provide remote process control solutions for the water processes like desalination, water pumping, distribution irrigation, industrial water treatment, wastewater treatment, waterways, and coastal protection. Further, the existing water systems are strained with the rapidly growing population and urbanization. Thus, the government in several countries is working on restructuring existing water systems and investing heavily in new projects.

- For instance, in December 2021, the Intergovernmental Affairs, Infrastructure, and Communities Ministers of Canada and British Columbia announced more than USD 19.2 million in joint funding for four projects in British Columbia to support drinking water and wastewater infrastructure and to upgrade the existing wastewater treatment facilities or constructs new drinking water facilities to enhance water capacity, comply with provincial standards, improve surface water quality, and protect the surrounding environment.

- Furthermore, in July 2021, the United States Department of Agriculture (USDA) announced that it is investing USD 307 million to modernize rural drinking water and wastewater infrastructure in 34 states and Puerto Rico. Such investments in the water and wastewater treatment infrastructure by the governments are providing thrust for the growth of remote monitoring and control market.

Asia Pacific to Register a Significant Growth Rate

- The Remote Monitoring and Control market in Asia-Pacific region is expected to grow significantly owing to the rising investments in power generation, chemical, water and wastewater management industries. For instance, in November 2021, The Asian Development Bank (ADB) approved a USD 161 million loan to help develop an integrated wastewater management system in Tashkent Province in Uzbekistan that will improve access to reliable water supply and sanitation services.

- The energy concern in the region is also boosting the adoption of the remote monitoring and control across many industries, hence further driving the market growth. According to the International Energy Agency (IEA) report 2022, the electricity demand in 2021 is increased by 8% from a low of 2% in 2020 in the Asia Pacific region and mostly driven by China and India, both up around 10%.

- The control systems in China have emerged across various fields, like the power generation, oil and gas, water and wastewater management and municipal sectors. Due to the deep integration of information technology and industry and the rapid development of the Internet of Things, the networked control system is becoming the development trend of industrial automation in China.

- Moreover, the growing industrialization in the region across developing countries such as China, India, and Japan and the inclination of these industries towards automation for their processes to reduce energy consumption and increase process efficiency with the implementation of advanced monitoring and control systems are further propelling the market growth.

Remote Monitoring and Control Industry Overview

The Remote Monitoring and Control Market is competitive and is fragmented by nature. The market vendors are focusing on expanding their customer base across globally. The companies are leveraging strategic collaborative initiatives to increase market share and profitability. Key players are Emerson Electric Co., Honeywell International Inc., Schneider Electric SE, and others. Key developments in the market are -

- December 2021 - Yokogawa Electric Corporation released OpreX Managed Service - Cloud edition, solution that supports remote monitoring and maintenance of OT/IT field assets using a cloud platform provided by Yokogawa. By visualizing information on each device's performance, reliability, and security for the entire plant system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Industrial Automation

- 5.1.2 Increased Demand for Industrial Mobility for Remotely Managing the Process Industry

- 5.2 Market Challenges

- 5.2.1 High Cost and Compliacted in Installation

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions

- 6.1.2 Field Instruments

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Power Generation

- 6.2.3 Chemical

- 6.2.4 Metals & Mining

- 6.2.5 Water and Wastewater

- 6.2.6 Food & Beverages

- 6.2.7 Pharmaceuticals

- 6.2.8 Pulp & Paper

- 6.2.9 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Honeywell International Inc.

- 7.1.3 Schneider Electric SE

- 7.1.4 General Electric Co.

- 7.1.5 ABB Ltd.

- 7.1.6 Rockwell Automation, Inc.

- 7.1.7 Yokogawa Electric Corporation

- 7.1.8 Endress+Hauser AG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219