|

市场调查报告书

商品编码

1635362

亚太地区药品包装器材:市场占有率分析、产业趋势与成长预测(2025-2030)Asia-Pacific Pharmaceutical Packaging Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

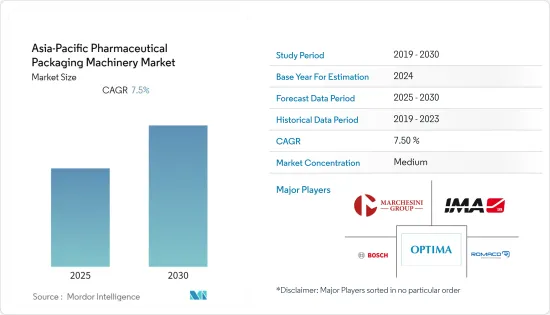

预计亚太地区药品包装器材市场在预测期内的复合年增长率为 7.5%。

主要亮点

- 药品和药物输送系统的包装在製药业中至关重要。药品包装器材为药品包装提供安全和品质。

- 药品包装是指由相容材料製成的用于储存和运输药品的包装製品。根据药物的性质,包装产品选自多种产品和材料类型,以提供识别和保护并确保封装药物的完整性。因此,药品包装器材为药品提供初级包装、二级包装、标籤和序列化解决方案。

- 由于工厂长期关闭和生产延误导致供应链中断,COVID-19 大流行的出现对市场产生了重大影响。

- 未来2-3年药品包装器材的需求将会增加。在 COVID-19 疫情期间,疫苗供应商扩大了产能以满足不断增长的需求。这种情况预计将为药品包装器材市场创造新的成长机会。

- 药品包装器材市场与药品市场有着直接的相关性。因为新药的需求不断增加,增加了对包装的需求,从而影响了所研究市场的成长。

亚太药品包装器材市场趋势

製药业安全标准和法规的存在预计将推动市场发展

- 製药业使用的药品包装器材受到严格监管,并专注于安全性和永续性。在医疗保健领域,已经颁布了可追溯法来打击假药和医疗设备。

- 药品包装器材在药品供应链中发挥着至关重要的作用。包装器材有助于确保所有药品的安全分发、追踪和识别。

- 中国对药品包装器材的需求不断增加。药品包装产品采用适合药品运送储存的材料製造。根据药品的性质,包装器材从不同的材料类型和产品类型中进行选择,以提供保护和识别并确保封装药品的完整性。

- 国家监督管理局(NMPA)数据显示,2021年我国新药认证数量再创新高。 NMPA核准新药61个,较2020年的46个增加。 「新药」是指在中国首次核准的化学药品或生物製药,不包括适应症、剂型或组合。这为药品包装器材市场创造了更多的需求。

- 该行业依赖药品包装市场遵循严格的指导方针并提供专业和先进的技术。这种情况正在推动药品包装器材供应商进行技术创新,以提供复杂的解决方案来满足最终用户的需求。

- 多家公司正在实施先进的泡壳生产线以加快生产和产量。这些自动化整合生产线预计将泡壳包装到所需的纸箱中并快速捆绑。

- 此外,一些领先的供应商已经实施了全面的解决方案,包括品质检测、生产和包装器材。这些平台包括各种设备,从序列化设备到泡壳/纸盒包装机、压平机锭剂以及追踪应用程式。这些自动化解决方案减少了人机交互,并提供对精密、无污染设备的完美控制。

预计印度在预测期内将出现显着成长

- 印度是全球非专利处方药学名药供应的领导者。印度製药业满足全球各种疫苗需求的 50% 以上、美国非专利药需求的 40% 和英国所有药品需求的 25%。

- 印度製药业的显着发展得益于多种因素,包括更严格的监管标准以及对人们健康管理和发明的重视。此外,对非处方药的需求不断增加以及精明的客户群不断增长也支持了印度市场的成长。

- 根据 2020 年 CPhI 製药指数,印度是活性药物原料药(API) 製造和委外研发机构(CRO) 化学品服务外包的主要受益者,并被视为正在经历中国的再平衡。印度已成为世界学名药和疫苗的製药製造地。例如,印度血清研究所是印度最大的疫苗生产商之一,向世界各地出口疫苗。

- 凭藉大量劳动力和WHO-GMP(品管生产规范)核准的生产原则等资源,印度在医疗药品和产品的基础製造方面比许多国家具有优势。

- 此外,印度製药公司正在吸引全球私募股权公司的大力投资,棕地製药企业的外国直接学名药%。例如,2021年8月,印度製药商Cipla Limited和印度领先的合约药品受託製造厂商(CDMO)Kemwell Biopharma宣布,他们将为全球市场开发、製造和销售生物仿製药。

- 此外,该国的製药公司正在积极提高生产能力,以应对不断增长的市场需求。例如,灿盛製药 (Centrient Pharmaceuticals) 于 2021 年 6 月宣布,已开始在其新的他汀类药物製造厂进行生产,并在印度图安萨 (Tuansa) 工厂建造了第二个专用工厂。该公司的目标是将他汀类药物的产能提高一倍,以满足对Atorvastatin和rosuvastatin原料药日益增长的需求。

- 此外,随着COVID-19疫苗的开发,合併后的公司已与一家包装公司签署了生产管瓶和注射器的协议。这种包装趋势是包装器材市场的主要成长动力之一。

- 此外,随着疫苗产能的扩大,相关包装工程公司和OEM对无菌填充线的需求也随之增加。由于这些趋势,製药包装器材製造商正在推出具有模组化概念的完全整合系统和即插即用解决方案。

亚太地区药品包装器材产业概况

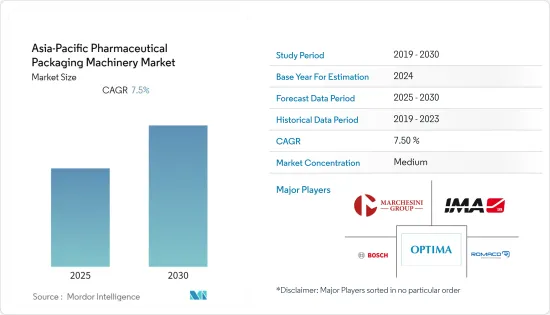

亚太地区药品包装器材市场竞争适中,由几家主要公司组成,例如: Robert Bosch GmbH、Romaco Pharmatechnik GmbH、Optima Packaging Group GmbH、Marchesini、MULTIVAC Group、PAC Machinery Group 等。 。

- 2021年10月,Marchesini集团收购了Dott Bonapace,进入小规模工业生产业务。由此,Marchesini 集团收购了 Dott.Bonapace 70% 的股份,并利用管理胶囊和栓剂等专业产品的新技术扩大了其庞大的机器园区。

- 2021 年 2 月,Promach 收购了 Serpa Packaging Solutions,该公司是一家为製药、医疗设备、营养品、食品、化妆品和个人护理市场提供装盒系统和终端包装系统的製造商。 Serpa 的加入为 Promac 的产品组合增添了自动化装盒系统,扩大了其专业的二次包装器材和生产线整合能力。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 新进入者的威胁

- 竞争公司之间的敌对关係

- COVID-19对包装器材产业的影响

- 市场驱动因素

- 主要最终用户市场的高需求

- 持续的技术发展

- 製药业安全标准与法规的影响

- 市场限制因素

- 高成本和进口关税对新客户来说是一项挑战

- 资本密集型製造流程

第五章技术概况

第六章 市场细分

- 按机器类型(概述、趋势、主要趋势、市场概述)

- 初级包装

- 无菌灌装封口设备

- 灌装旋盖设备

- 泡壳包装设备

- 其他的

- 二次包装

- 装盒设备

- 装箱包装设备

- 包装设备

- 托盘包装设备

- 其他的

- 标籤和序列化

- 瓶子和安瓿的贴标和序列化设备

- 纸箱贴标系列设备

- 其他的

- 初级包装

- 按地区(概述、趋势、主要趋势、市场前景)

- 中国

- 印度

- 日本

- 韩国

- 亚太地区其他国家

第七章 竞争格局

- 公司简介

- Robert Bosch GmbH

- Romaco Pharmatechnik GmbH

- Optima Packaging Group GmbH

- Marchesini

- Mesoblast

- IMA Industria Macchine Automatiche SpA

- MULTIVAC Group

- Ishida Co. Limited

- PAC Machinery Group

- Uhlmann Group

第八章投资分析

第九章 市场未来展望

The Asia-Pacific Pharmaceutical Packaging Machinery Market is expected to register a CAGR of 7.5% during the forecast period.

Key Highlights

- Packaging pharmaceutical products and drug delivery systems are essential in the pharmaceutical industry. Pharmaceutical packaging machinery provides safety and quality in packaging pharmaceutical products.

- Pharmaceutical packaging refers to packaging products made by utilizing compatible materials that are used for the storage and transfer of drugs. Depending on the nature of the drug, packaging products are selected from a range of product types and material types to provide identification and protection and ensure the enclosed drug product's integrity. Thus, pharmaceutical packaging machinery offers primary packaging, secondary packaging, and labeling and serialization solutions for pharmaceuticals.

- The emergence of the COVID-19 pandemic has significantly impacted the market due to disruptions in the supply chain owing to extended factory closures and delayed production.

- The demand for pharmaceutical packaging machinery will increase over the next two to three years. During COVID-19, the vaccine suppliers have expanded their capacity to meet the rising demand. This scenario is expected to create new growth opportunities in the pharmaceutical packaging machinery market.

- The pharmaceutical packaging machinery market has a direct correlation with the pharmaceutical market. Any changes in demand for pharmaceutical drugs will positively impact the packaging machinery markets, as higher demand for new drugs leads to a greater need for packaging, thereby impacting the growth of the studied market.

APAC Pharmaceutical Packaging Machinery Market Trends

The Presence of Safety Standards & Regulations in the Pharmaceutical Industry Expected to Drive the Market

- The Pharmaceutical packaging machinery used in the pharmaceutical sector is heavily regulated and emphasizes safety and sustainability. Traceability legislations across the healthcare sector have been established to counter counterfeit drugs and medical devices.

- Pharmaceutical packaging machinery plays an integral role in the wider pharmaceutical supply chain. Packaging machinery helps to ensure all pharmaceutical products are safely distributed, tracked, and identified.

- The demand for Pharmaceutical packaging machinery is growing in China. Pharmaceutical packaging products are made using compatible materials to transfer and store drugs. Depending upon the nature of the drug, packaging machinery is chosen from a range of material types and product types, providing, protection and identification and ensuring the enclosed drug product's integrity.

- According to National Medical Products Administration (NMPA), the number of new drug approvals in China hit a high record in 2021. 61 new drugs were approved by NMPA, up from 46 in 2020. "New drug" is defined in this article as new chemical drugs or new biological products approved for the first time in China, excluding any new indications, new dosage forms, or a new combination of approved drugs. This will create more demand for the pharmaceutical Packaging Machinery Market.

- The industry depends on the pharmaceutical packaging market, which follows strict guidelines and offers specialized, advanced technologies. The scenario is propelling providers of pharmaceutical packaging machinery to work on innovations to deliver sophisticated solutions to cater to end-users' needs.

- Several companies have introduced advanced blister lines to accelerate production and output. These automated, integrated lines are expected to package blisters into desirable cartons and bundle them quickly.

- Furthermore, some leading vendors have introduced holistic solutions involving quality inspection, production, and packaging machinery. These platforms involve various equipment, from serialization units to blister/carton packaging machinery and tablet presses to trace and track applications. These automated solutions reduce human-machine interactions and impeccably control high-precision, contamination-free equipment.

India is Expected to Register a Significant Growth During the Forecast Period

- India is leading in providing generic pharmaceuticals (generic drugs) globally. Indian pharmaceutical sector supplies over 50% of global demand for various vaccines, 40% of generic demand in the U.S., and 25% of all medicine in the U.K. Globally.

- In India, The pharmaceutical industry has evolved considerably, owing to various factors that include the growth in regulatory norms and focus on population health management and invention. In addition, the increase in the demand for over-the-counter medicines and a more informed customer base are also driving the market growth in India.

- According to the CPhI Pharma Index 2020, India is viewed as the primary beneficiary of active pharmaceutical ingredient (API) manufacturing and contract research organization (CRO) chemistry services outsourcing, rebalancing away from China. India has become a global pharmaceutical manufacturing hub for generic drugs and vaccines. For Instance, the Serum Institute of India is one of the largest vaccine manufacturers in India, exporting vaccines worldwide.

- India has a superior advantage, over many countries, in the basic manufacturing of medical drugs and products due to resources, such as a large workforce and WHO-GMP (Good manufacturing practices)-approved production principles.

- Further, India's pharmaceutical manufacturing organization has been strongly attracting investment from global private equity firms, which is driven by relaxations offered by the government, such as increasing the foreign direct investment (FDI) limit from 49% to 74% in brownfield pharma ventures and a thriving generic drugs market. For Instance, in August 2021, Cipla Limited, an Indian drugmaker, and Kemwell Biopharma, a large pharmaceutical contract manufacturing organization (CDMO) located in India, announced the signing of a joint venture agreement to develop, manufacture, and distribute biosimilars for the worldwide market.

- Furthermore, pharma companies in the country are actively increasing their manufacturing capacities due to increased demand in the market. For Instance, in June 2021, Centrient Pharmaceuticals announced that it had started manufacturing at its new statins manufacturing facility by building its second dedicated unit in the Toansa site in India. The company aims to double its statins production capacity to meet the growing demand for Atorvastatin and Rosuvastatin Active Pharmaceutical Ingredients.

- Moreover, it is observed that the development of COVID-19 vaccines has led the combined companies to set up agreements with packaging companies for manufacturing vials and syringes. Such packaging trends act is one of the major growth drivers in the packaging machinery market.

- Also, expanding vaccine capacities have led the allied packaging engineering companies and OEMs to witness increasing demand for aseptic filling lines. As a result of such trends, pharmaceutical packaging machinery players are launching completely integrated systems and plug-and-play solutions with modular concepts.

APAC Pharmaceutical Packaging Machinery Industry Overview

The Asia-Pacific Pharmaceutical Packaging Machinery Market is moderately competitive and consists of several major players such as Robert Bosch GmbH, Romaco Pharmatechnik GmbH, Optima Packaging Group GmbH, Marchesini, MULTIVAC Group, PAC Machinery Group, etc. In terms of market share, few major players currently dominate the market. Mergers and acquisitions among pharmaceutical packaging machinery industries drive the market's growth.

- In October 2021, Marchesini Group acquired Dott. Bonapace and entered the small industrial production business. With this move, Marchesini Group acquired 70% of the shares in Dott. Bonapace expanded its vast machine park with novel technologies that manage special products such as capsules and suppositories.

- In February 2021, ProMach acquired Serpa Packaging Solutions, a manufacturer of cartoning and end-of-line packaging systems for the pharmaceutical, medical device, nutraceutical, food, cosmetics, and personal care markets. The addition of Serpa brings automated cartoning systems into ProMach's portfolio and expands its specialized secondary packaging machinery and line integration capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of Substitute Products

- 4.3.4 Threat of New Entrants

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Packaging Machinery Industry

- 4.5 Market Drivers

- 4.5.1 High demand in key end-user markets

- 4.5.2 Ongoing technological developments

- 4.5.3 Impact of Safety Standards and Regulations in the pharmaceutical industry

- 4.6 Market Restraints

- 4.6.1 High costs and import duties pose a challenge for new customers

- 4.6.2 Capital Intensive manufacturing process

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Machinery Type (Overview, Forecasts, Key Trends and Market Outlook)

- 6.1.1 Primary Packaging

- 6.1.1.1 Aseptic Filling and Sealing Equipment

- 6.1.1.2 Bottle Filling and Capping Equipment

- 6.1.1.3 Blister Packaging Equipment

- 6.1.1.4 Others

- 6.1.2 Secondary Packaging

- 6.1.2.1 Cartoning Equipment

- 6.1.2.2 Case packaging Equipment

- 6.1.2.3 Wrapping Equipment

- 6.1.2.4 Tray Packing Equipment

- 6.1.2.5 Others

- 6.1.3 Labelling and Serialization

- 6.1.3.1 Bottle and Ampule Labelling and Serialization Equipment

- 6.1.3.2 Carton Labelling and Serialization Equipment

- 6.1.3.3 Others

- 6.1.1 Primary Packaging

- 6.2 By Region (Overview, Forecasts, key Trends and Market Outlook)

- 6.2.1 China

- 6.2.2 India

- 6.2.3 Japan

- 6.2.4 South Korea

- 6.2.5 Rest of APAC

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Robert Bosch GmbH

- 7.1.2 Romaco Pharmatechnik GmbH

- 7.1.3 Optima Packaging Group GmbH

- 7.1.4 Marchesini

- 7.1.5 Mesoblast

- 7.1.6 I.M.A Industria Macchine Automatiche S.p.A

- 7.1.7 MULTIVAC Group

- 7.1.8 Ishida Co. Limited

- 7.1.9 PAC Machinery Group

- 7.1.10 Uhlmann Group