|

市场调查报告书

商品编码

1635367

世界工业帮浦 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Global Industrial Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

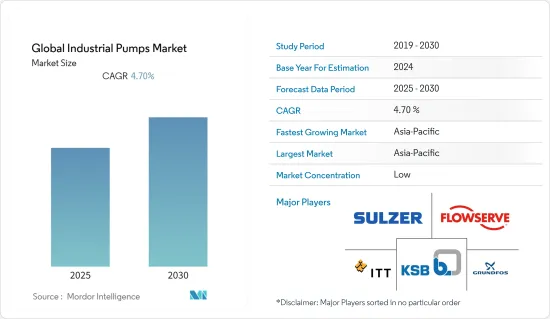

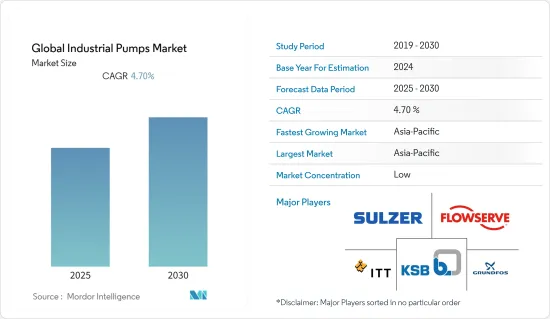

预计全球工业泵市场在预测期内复合年增长率为 4.7%

主要亮点

- 工业泵主要用于恶劣和重型应用。由于能源需求不断增长,石油和天然气行业的探勘活动增加,以及对现有污水处理厂升级的重视,推动了市场的成长。这被认为是由于饮用水供应有限、人们对饮用受污染水的有害影响的认识不断增强以及对环境的日益关注所致。

- 印度计划在 2030 年将 40% 的能源来自可再生能源。为了实现这些能源生产目标,製造商在政府的支持下正在大力投资研究市场。例如,2022-23 年联盟预算强调包容性成长和福祉。新兴国家计划为国家成长和发展提供世界一流的现代化基础设施和物流协同效应。对于泵浦业来说,泵浦製造商将受益于国防国内采购比例的增加,以及PLI的额外拨款用于生产高效能太阳能组件。

- 市场也见证了不同供应商之间的各种伙伴关係和协作,促进了市场的成长。例如,2022 年6 月,面向全球基础设施市场提供流量控制产品和服务的领先供应商福斯公司(Flowserve Corporation) 宣布,专注于浸入式冷却技术的高效能运算解决方案领先供应商TMGcore, Inc.宣布,已签署向德克萨斯州供应泵的合约。

- 泵浦製造商 KSB Ltd. 也于 2021 年 4 月向印度核能发电有限公司供应了主锅炉给水泵 BFP (RHD-350) 和增压泵浦-BP (YNK 350-620)。 (交付)。 KSB Ltd. 为 700 MW 印度加压重水反应器(PHWR) 製造了一台泵,从而实现了一个重要的里程碑,进一步丰富了其已包括各种核能应用泵的产品线。

- 在 COVID-19 爆发和由此导致的封锁期间,工业部门的需求大幅下降。由于财务状况相当不稳定的中小企业和组织倒闭,2020年和2021年整体工业产能下降,消费领域整合。例如,最大的工业泵浦製造商之一福斯公司由于最终用户对泵浦的需求减少,营业利润从 3.87 亿美元大幅下降至 2.5 亿美元。

工业泵浦市场趋势

用水和污水占很大份额

- 用水和污水处理公共产业通常是最大的能源消耗者,平均占总能源消耗的 30% 至 40%。因此,在水务系统中实施节能措施已成为必然选择。此外,美国环保署估计,美国3% 到 4% 的电力消耗量用于向公民提供清洁饮用水和管理污水。

- 各国政府正在其地区进行各种投资,以改善水基础设施。例如,2021年11月,美国总统签署了《基础设施投资和就业法案》(IIJA),拨款1.2兆美元用于美国的基础建设,包括水管升级和清洁饮用水,并包括550亿美元的回收项目投资。

- 此外,中国也公布了新的污水回用指南,并决定到2025年将必须回用标准处理的污水比例提高到25%。这进一步证明了中国雄心勃勃,不再扩大处理能力,而是更重视处理后废水的品质。作为这项努力的一部分,中国计划在未来五年内建造和升级8万公里的污水收集管道。

- 2022 年 3 月,福斯公司宣布与戈润建立合作关係,协助您解决最具挑战性的用水和污水处理问题。戈润在世界各地开发和供应先进的用水和污水处理设施,福斯公司为全球基础设施市场提供流量控制产品和服务。

- 此外,根据美国水务协会(AWWA)的一项调查,升级和更新老化的用水和污水是供水领域的重大挑战,65.2%的受访者同意这项挑战。

亚太地区占主要市场占有率

- 该地区对工业泵的需求主要是由于水基础设施投资的增加以及供水和卫生系统的不断扩大而推动的。因此,泵浦越来越多地应用于各种最终用途行业,包括化学和污水处理厂、采矿、食品和饮料、纸浆和造纸以及发电等一般行业。

- 亚太地区COVID-19病例数量不断增加,导致各种活动受到限制,对该地区的工业泵浦市场产生了重大影响。泵浦消耗量的下降加上有限的建设活动阻碍了市场的成长。然而,随着限制的放鬆,市场预计将在未来几年内復苏。

- 此外,随着工业化和都市化的不断发展,加上能源需求的增加,预计未来对矿物的需求将大幅增加,从而刺激工业泵在亚太地区的采用。

- 2021 年 11 月 - 阿特拉斯·科普柯宣布完成对印度 HHV Pumps 的收购。该公司设计和製造用于多种行业的真空泵和系统,包括化学、製药和电力设备。

工业泵业概况

全球工业泵市场上企业之间的竞争正在加剧。该市场由阿特拉斯·科普柯和威尔集团等多家主要公司组成。然而,随着技术创新的不断加强,许多公司正在透过赢得新契约和开发新市场来扩大其市场份额。

- 2021 年 6 月 - 关键任务流量创造和工业解决方案的全球供应商英格索兰公司 (Ingersoll Rand Inc.) 宣布以 4.315 亿欧元收购正排量泵製造商 seepex GmbH。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 污水管理日益受到关注

- 新兴经济体强劲的工业化和快速的都市化

- 市场问题

- 高成本和相容性问题

第六章 市场细分

- 按类型

- 正位移

- 隔膜

- 活塞

- 齿轮

- 长袍

- 渐进空洞

- 拧紧

- 叶片

- 蠕动帮浦

- 离心式帮浦

- 轴流式

- 径向流

- 混流

- 正位移

- 按最终用户产业

- 石油和天然气

- 化学

- 饮食

- 用水和污水

- 製药

- 金属/矿业

- 建造

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 北美洲

第七章 供应商市场占有率

第八章 竞争格局

- 公司简介

- Flowserve Corporation

- Grundfos Holding AS

- KSB AG

- ITT Inc.

- Sulzer Ltd

- Ebara Corporation

- Weir Group PLC

- Schlumberger Ltd

- Baker Hughes Company

- Clyde Union Inc.

- Dover Corporation

- SPP Pumps Inc.

- Wilo Mather & Platt Pumps Pvt. Ltd

- Xylem Inc.

- General Electric Company

- SPX Flow Inc.

- Danfoss AS

- Ruhrpumpen Group(A Corporacion EG Company)

第九章投资分析

第十章投资分析市场的未来

简介目录

Product Code: 91551

The Global Industrial Pumps Market is expected to register a CAGR of 4.7% during the forecast period.

Key Highlights

- Industrial pumps are primarily used in harsh or heavy-duty applications. Growing exploration activities in the oil and gas sector because of the escalating energy demand and the increasing emphasis on upgrading existing wastewater treatment plants contribute to market growth. This could be due to the limited availability of potable water, raising awareness about the harmful impacts of drinking contaminated water, and growing environmental concerns.

- India is planning to derive 40% of its energy from renewable sources by 2030, which is at 15% currently. To achieve these energy manufacturing goals, manufacturers, with the government's help, are making significant investments in the market studied. For instance, the Union Budget 2022-23 emphasized inclusive growth and welfare. The PM Gati Shakti plans to provide world-class modern infrastructure and logistics synergy for the growth and development of the country. For the pump industry, an increased share of domestic procurement in defense and additional allocation of PLI for high-efficiency solar module manufacturing would benefit the respective manufacturers of pumps.

- The market is also witnessing various partnerships and collaborations among various vendors that is augmenting the market growth. For instance, in June 2022, Flowserve Corporation, a leading provider of flow control products and services for global infrastructure markets, announced a contract to supply pumps to TMGcore, Inc., a Texas-based leading provider of high-performance computing solutions specializing in liquid immersion cooling technology.

- Additionally, a primary boiler feed water pump, BFP (RHD-350), and Booster Pump-BP (YNK 350-620) were supplied by the pump manufacturer KSB Ltd in April 2021 to the Nuclear Power Corporation of India Ltd. (NPCIL). By creating the pump for the 700 MW Indian Pressurized Heavy Water Reactors (PHWRs) and adding it to its product line, which already includes a variety of pumps for nuclear application, KSB Ltd. achieved a significant milestone.

- Demand in the industrial sector was noticeably lower during the COVID-19 outbreak and the ensuing lockdown. The entire industrial manufacturing capacity was decreased, and the consumer sectors were consolidated in 2020 and 2021 due to the closure of smaller companies and organizations with a rather precarious financial state. For instance, the decreased demand for pumps from end-users caused Flowserve Corporation, one of the largest manufacturers of industrial pumps, to see a significant decline in operating income from USD 387 million to USD 250 million.

Industrial Pumps Market Trends

Water and Wastewater to Hold a Significant Share

- Water and wastewater treatment utilities are typically the largest energy consumers, averaging 30% to 40% of the total energy consumed. This makes implementing energy-efficiency measures in water sector systems an inevitable option. Further, EPA estimates that 3% to 4% of the US electricity consumption will be consumed to provide clean drinking water to its citizens and manage wastewater.

- The governments are making various investments across the regions to improve the water infrastructure. For instance, in November 2021, the United States president signed the Infrastructure Investment and Jobs Act (IIJA) that allocated USD 1.2 trillion for the infrastructure in the United States, including USD 55 billion for water pipe upgrades and investments in clean drinking water and water recycling programs.

- Moreover, China published new guidelines for wastewater reuse, raising the proportion of sewage that must be treated to reuse standards to 25% by 2025. This further proves the country's ambition to transition from capacity expansion to a greater emphasis on treated effluent quality. As part of the effort, China aims to construct and upgrade 80,000km of wastewater collection pipelines over the next five years.

- In March 2022, Flowserve Corporation announced its partnership with Gradiant to help address the most challenging water and wastewater treatment problems. Gradiant develops and delivers advanced water and wastewater treatment facilities worldwide, whereas Flowserve Corporation is a provider of flow control products and services for the global infrastructure markets.

- Further, according to a survey conducted by American Water Works Association (AWWA), renewal and replacement of aging water and wastewater is the primary issue in the water sector, with 65.2% respondents agreeing to the issue.

Asia Pacific to Hold Significant Market Share

- The demand for industrial pumps in the region is essentially driven by increasing investments towards water infrastructure, with continuous expansion in water supply and sanitation systems access. This has led to an increase in the utilization of pumps across a range of end-use industries such as chemical and wastewater treatment plants, and general industries including mining, food and beverages, pulp and paper manufacturing, and power generation.

- The growth in the number of COVID-19 cases across the Asia Pacific region and the consequent restrictions imposed on various activities have significantly impacted the industrial pumps market in the region. A decline in the consumption of pumps coupled with the restriction on construction activities hampered the market growth. However, with restrictions easing up, the market is expected to recover in the coming years.

- Moreover, with the increasing rate of industrialization and urbanization, coupled with the growing need of energy, the demand for minerals is expected to rise significantly in the years ahead, which would fuel the adoption of industrial pumps in the Asia Pacific region.

- November 2021 - Atlas Copco announced to complete the acquisition of India-based HHV Pumps. The company is engaged in design and manufacturing of vacuum pumps and systems for applications used across an array of industries, including chemical and pharmaceutical, and electrical power equipment.

Industrial Pumps Industry Overview

The Global industrial pumps market is witnessing a rise in competitiveness among companies. The market consists of various major players, such as Atlas Copco and The Weir Group PLC. However, with increasing technology innovations, many companies are increasing their market presence by securing new contracts and tapping new markets.

- June 2021 - Ingersoll Rand Inc., a global provider of mission-critical flow creation and industrial solutions, has announced the acquisition of a positive displacement pump manufacturer, seepex GmbH, for EUR 431.5 million.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Focus on Waste Water Management

- 5.1.2 Strong Industrialization and Rapid Urbanization in Emerging Economies

- 5.2 Market Challenges

- 5.2.1 High Cost and Compatibility Issues

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Positive Displacement

- 6.1.1.1 Diaphragm

- 6.1.1.2 Piston

- 6.1.1.3 Gear

- 6.1.1.4 Lobe

- 6.1.1.5 Progressive Cavity

- 6.1.1.6 Screw

- 6.1.1.7 Vane

- 6.1.1.8 Peristaltic

- 6.1.2 Centrifugal Pump

- 6.1.2.1 Axial Flow

- 6.1.2.2 Radial Flow

- 6.1.2.3 Mixed Flow

- 6.1.1 Positive Displacement

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemicals

- 6.2.3 Food & Beverage

- 6.2.4 Water & Wastewater

- 6.2.5 Pharmaceutical

- 6.2.6 Metal and Mining

- 6.2.7 Construction

- 6.2.8 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle-East and Africa

- 6.3.1 North America

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Flowserve Corporation

- 8.1.2 Grundfos Holding AS

- 8.1.3 KSB AG

- 8.1.4 ITT Inc.

- 8.1.5 Sulzer Ltd

- 8.1.6 Ebara Corporation

- 8.1.7 Weir Group PLC

- 8.1.8 Schlumberger Ltd

- 8.1.9 Baker Hughes Company

- 8.1.10 Clyde Union Inc.

- 8.1.11 Dover Corporation

- 8.1.12 SPP Pumps Inc.

- 8.1.13 Wilo Mather & Platt Pumps Pvt. Ltd

- 8.1.14 Xylem Inc.

- 8.1.15 General Electric Company

- 8.1.16 SPX Flow Inc.

- 8.1.17 Danfoss AS

- 8.1.18 Ruhrpumpen Group (A Corporacion EG Company)

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219