|

市场调查报告书

商品编码

1635370

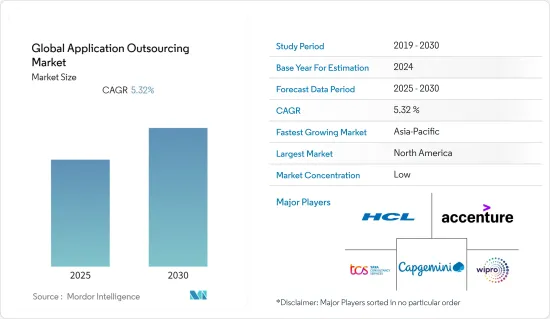

全球应用外包-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Global Application Outsourcing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计预测期内全球应用外包市场复合年增长率为5.32%

主要亮点

- IT公司透过向其他公司提供应用外包服务来外包业务。这些服务包括测试、设计和产生业务应用程式。它还包括应用程式重新设计、应用程式维护、支援、入口网站开发、资料迁移等。

- 第三方公司透过监控您的部门来照顾您的业务,避免了这项工作的负担。此外,云端运算具有成本效益,使我们的工作变得更轻鬆。银行和零售等各种终端用户已经在使用这些服务,推动了应用外包市场的成长。

- 许多公司正在寻求策略联盟来增强他们的产品和服务。例如,2022 年 5 月,IBM 与 Amazon Web Services 签订了策略合作伙伴协议,在 AWS 上提供 IBM 软体即服务。 IBM 和 AWS 的伙伴关係使客户能够快速轻鬆地存取 IBM 软体,涵盖自动化、人工智慧和资料、安全性和永续性,这些软体基于AWS 上的红帽OpenShift 服务(ROSA) 构建,在AWS上以云端原生方式运行。

- 此外,跨国公司正在增强和创新其产品,以服务更广泛的客户。例如,2022 年 5 月,IBM 加强了其全球资料平台,以应对人工智慧采用的挑战。根据 2021 年全球人工智慧采用指数,资料复杂性和资料孤岛是人工智慧采用的最大障碍。

- COVID-19 大流行对应用外包市场产生了一定影响。许多企业的封锁和在家工作的采用影响了应用外包和企业工作流程的采用。

应用外包市场趋势

BFSI 占有较大份额

- 新时代不断扩大的基本客群迫使银行、金融服务和工业 (BFSI) 努力提供更好的客户体验。再加上产业参与企业众多,转换成本已降至最低,客户可以轻鬆更换服务供应商。为了提高客户维繫并提高盈利,BFSI 部门必须为客户提供有吸引力的使用者体验和便利性。技术支援的解决方案可协助企业提供更准确、个人化的服务和更好的客户体验。

- 金融科技公司可以利用巨量资料建立全面的使用者檔案和准确的客户细分策略,以客製化服务以满足消费者的需求。可以使用先进的建模方法提供个人化服务,这些方法考虑到一个人的风险感知、年龄、性别、财务状况、位置,甚至关係状态。

- Crisil表示,IT产业预计在2022财年强劲復苏,收益成长率为11%。这项復苏将主要由银行、金融援助、保险、零售和医疗保健领域外包的增加和数位转型服务的加速所推动。 BFSI 占 IT业务收益的 28%,预计 2022 财年将成长 13-14%。

- 市场上的主要企业正在探索策略併购,以扩大其全球足迹。例如,2021 年 1 月,Tech Mahindra 以 900 万美元收购了 Payments Technology Services,扩大其在 BFSI 领域的足迹。支付技术服务为亚洲的金融服务公司提供银行和付款解决方案。

- 在这个市场上,许多参与企业正在推出各种产品开发和创新,以提高其在市场上的影响力。例如,2022 年 4 月,IBM 发布了 IBM z16,这是一种用于大规模交易处理的即时人工智慧,也是业界首个量子安全系统。 IBM z16 专门设计用于防范可能被用来破坏当前加密技术的近期威胁。

- 2022年5月,TCS宣布BaNCS云端产品套件使金融服务公司能够加速数位化,并启用云端原生功能来推动成长和转型。

亚太地区预计将出现显着成长

- 对 BFSI 的需求不断增长以及数位转型的趋势预计将推动该地区的市场成长。该地区各国政府正在大力投资数位转型。例如,电子和资讯技术部 (MeitY) 宣布数位印度计画的预算支出为 1,067.618 亿印度卢比(去年预算为 638.80 亿印度卢比)。

- 随着医疗保健服务支出的增加以及政府医疗保健计划的成本转移到医疗保健来源,对医疗保健外包的需求正在增加。该地区正在涌现许多整合多家医院的新计划,增加了外包的需求。

- 医院也开始使用第三方服务来获取诊断影像结果和医生的病例记录,这有望繁荣医疗外包市场。据中华人民共和国财政部公告,2021年,我国卫生健康公共支出总额约1.92兆元。

应用外包产业概况

应用外包市场竞争激烈,国内外参与企业活跃。国际参与企业透过与当地参与企业联盟在每个国家开展业务。随着市场预计将扩大并提供更多机会,预计将有更多参与企业很快进入市场。市场上的一些主要参与企业包括 Wipro、IBM 和埃森哲。近期市场发展趋势如下。

- 2022 年4 月- 塔塔咨询服务(TCS) 将其作为BFSI 客户的领先转型合作伙伴的经验与Microsoft 的金融服务云解决方案以及庞大的Microsoft 认证顾问人才库相结合,帮助客户实现创新和重新构想,以满足市场需求。

- 2022 年 4 月 - TCS 与加拿大支付局建立战略伙伴关係关係,以支持该国的业务转型和即时铁路 (RTR) 的实施。这个新的即时付款系统将允许加拿大人在几秒钟内发起付款并收到不可撤销的资金。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- BFSI 需求增加

- 更加重视客户维繫和参与

- 迈向数位转型

- 市场限制因素

- 安全和隐私问题

第六章 市场细分

- 按最终用户产业

- BFSI

- 医学生命科学

- 媒体娱乐

- 物流/运输

- 其他的

- 按地区

- 北美洲

- 美国

- 中国

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Accenture

- Wipro

- TCS

- Capgemini

- CSC

- HCL

- IBM Global Services

- Infosys

- NTT Data

- ATOS SE

第八章投资分析

第9章市场的未来

简介目录

Product Code: 91562

The Global Application Outsourcing Market is expected to register a CAGR of 5.32% during the forecast period.

Key Highlights

- IT companies provide application outsourcing services to other companies to outsource their business operations. These services involve testing, designing, and production of business applications. The assistance includes application re-engineering, application maintenance, support, web portal development, and data migration.

- Third-party companies take care of the businesses by monitoring business functions to avoid the burden of doing that work. Moreover, cloud computing has made the job easier, as it is cost-effective. Various end-users like banking, retail, and others are already using these services, driving the growth of the application outsourcing market.

- Various companies are looking for strategic partnerships to enhance their products and services. For instance, in May 2022, IBM signed a strategic collaboration agreement with Amazon Web Services to deliver IBM Software-as-a-Service on AWS. The partnership between IBM and AWS will provide clients with quick and easy access to IBM Software that spans automation, AI and data, security and sustainability capabilities, is built on Red Hat OpenShift Service on AWS (ROSA), and runs cloud-native on AWS.

- Furthermore, companies globally are looking to enhance and innovate their products to provide services to a broader customer base. For instance, in May 2022, IBM enhanced its Global Data Platform to address the challenges related to AI adoption. As per the Global AI Adoption Index 2021, data complexity and data silos are the top barriers to AI adoption.

- The Covid - 19 pandemic has moderately impacted the application outsourcing market. Lockdown and adoption of work from home by many companies have affected the adoption of application outsourcing and workflow of enterprises.

Application Outsourcing Market Trends

BFSI to have a significant share

- The growing base of new-age customers is compelling the banking, Financial Services, and Industrial Industry (BFSI) to redirect their efforts to provide a better customer experience. A minimal switching cost coupled with multiple players in the industry has made it easier for the customers to change their service providers easily. For higher customer retention and better profitability, the BFSI sector must offer its customers an engaging user experience and convenience. Technology-enabled solutions help companies deliver more accurate and personalized services and a superior customer experience.

- Fintechs may utilize big data to build thorough user-profiles and precise client segmentation strategies, allowing them to customize their services to their consumers' demands. Personalized services can be provided using advanced modeling approaches that take into account a person's risk perception, age, gender, financial circumstances, location, and, in some instances, relationship status.

- As per Crisil, the IT Industry will post a strong recovery with revenue growth of 11% in FY 2022. The recovery will be led by increasing outsourcing and accelerating digital transformation services, mainly in banking, financial assistance, insurance, retail, and healthcare. BFSI, which accounts for 28% of IT service revenue, will grow 13-14% in FY 2022.

- Major companies in the market are looking for strategic mergers and acquisitions to expand their global footprints. For instance, in January 2021, Tech Mahindra acquired Payments Technology Services for USD 9 million to expand its footprints in the BFSI sector. Payments Technology Services provides banking and payments solutions to financial services firms in Asia.

- Many players in the market are coming up with various product development and innovations to stronghold their market presence. For instance, in April 2022, IBM announced its IBM z16, a real-time AI for transaction processing at scale and the industry's first quantum-safe system. IBM z16 is specifically designed to help protect against near-future threats that might be used to crack today's encryption technologies.

- In May 2022, TCS announced its BaNCS Cloud product suite would enable financial services firms with cloud-native capabilities to accelerate digitization and drive their growth and transformation.

Asia-Pacific is expected to show a significant growth

- The increasing demand for BFSI and the move toward digital transformation are expected to drive market growth in the region. The governments in the area are rigorously investing in digital transformation. For instance, the Ministry of Electronics and Information Technology (MeitY) has announced a budget outlay of INR 10,676.18 crore for the Digital India program, INR 6,388 crore in the last year's budget.

- The rising need for healthcare outsourcing results from increased spending on healthcare services, and the expense of government healthcare programs has shifted to healthcare sources. Numerous new multi-strength hospital projects have come up in the region, boosting the requirement for outsourcing.

- Also, Hospitals have begun to utilize third-party services to understand imaging results or records of doctor's case notes which are set to create a booming effect in the healthcare outsourcing market. As per the Ministry of Finance of the People's Republic of China, In 2021, total public expenditure on health care and hygiene in China amounted to about 1.92 trillion yuan.

Application Outsourcing Industry Overview

The application outsourcing market is highly competitive, with several local and international players active. International participants operate in the countries through partnerships with local players. With the Market expected to broaden and yield more opportunities, more players will enter the market soon. Key players operating in the market include Wipro, IBM, and Accenture, among others. The recent developments in the market are -

- April 2022 - Tata Consultancy Services will combine its experience as a leading transformation partner for BFSI clients with its Microsoft Cloud for Financial Services solutions and its large talent pool of Microsoft-certified consultants to enable clients to innovate and reimagine their businesses to meet the evolving market, customer and regulatory needs.

- April 2022 - TCS has entered into a strategic partnership with payments Canada to transform its operations and help implement the Real-Time Rail (RTR). This new real-time payments system will allow Canadians to initiate payments and receive irrevocable funds in seconds.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased demand from BFSI

- 5.1.2 Growing emphasis on customer retention & engagement

- 5.1.3 Move towards digital transformation

- 5.2 Market Restraints

- 5.2.1 Security & Privacy-related concerns

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 BFSI

- 6.1.2 Healthcare and Lifesciences

- 6.1.3 Media and Entertainment

- 6.1.4 Logistics & Transportation

- 6.1.5 Other Categories

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 China

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 India

- 6.2.3.2 China

- 6.2.3.3 Japan

- 6.2.3.4 South Korea

- 6.2.3.5 Rest of APAC

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Accenture

- 7.1.2 Wipro

- 7.1.3 TCS

- 7.1.4 Capgemini

- 7.1.5 CSC

- 7.1.6 HCL

- 7.1.7 IBM Global Services

- 7.1.8 Infosys

- 7.1.9 NTT Data

- 7.1.10 ATOS SE

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219