|

市场调查报告书

商品编码

1635376

美国空气炉:市场占有率分析、产业趋势、成长预测(2025-2030)United States Air Furnaces - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

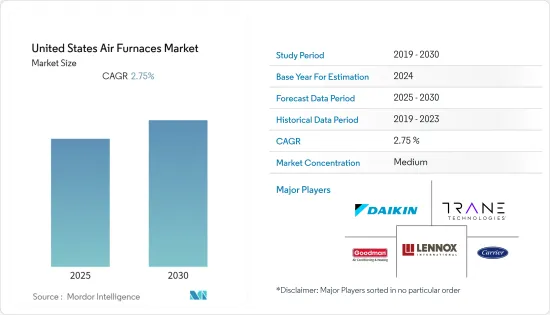

预计美国空气炉市场在预测期内的复合年增长率为 2.75%。

主要亮点

- 房地产行业投资的增加和工业化程度的提高是推动市场的主要因素。美国各地各种商业建筑和住宅的建设迅速增加,产生了对空气炉作为通用暖气设备的巨大需求。

- 在美国,能源消费量的增加以及治理机构实施的严格规则和法规正在推动对节能供暖设备的需求。此外,不断增加的能源成本也促使许多工业和商业组织在其工作场所安装这些节能係统。

- 此外,物联网(IoT)和人工智慧(AI)等先进技术的日益采用也对市场产生了积极影响。透过在空气炉中使用这些技术,您可以显着节省能源并防止设备故障。

- COVID-19大流行的影响扰乱了美国许多暖气和冷气设备製造商的供应链。此外,随着疫情的爆发,空气炉的需求也陷入停滞,因为许多住宅计划放缓,有些甚至被取消。

- 安装瓦斯炉的初始成本较高也是市场的限制因素。此外,完全淘汰石化燃料炉的政府法规的延迟预计也将阻碍市场成长。例如,根据拜登政府能源部提案的新规定,到2029年,该国将逐步淘汰非加热、低效率、非冷凝炉的生产和进口。

美国空气炉市场趋势

瓦斯发生炉占据较大市场占有率

- 燃气炉是美国最常见的空气炉,使用天然气作为主要燃料。天然气在熔炉中点燃,加热空气,然后透过管道输送到建筑物或家庭的各个部分。

- 另外,天然气炉直接产生高温燃烧气体,并用鼓风机送入加热室,因此升温快。

- 在美国,天然气是一种非常实惠的燃料来源。它也干净有效率。此外,能源之星计画要求燃气炉的AFUE(年燃料利用率)在美国南部达到90%或更高,在美国北部达到95%或更高,使其成为高效设备。

- 2021 年 1 月,Nortech World HVAC 推出了 Premium SD 系列,这是一款 95% AFUE 超低 NOx住宅炉,具有易于安装/维修的特点。这种单级上流式/卧式天然气燃烧炉以该公司的 Frigidaire (FG8SD) 和 Maytag (MGC3SD) 品牌提供。

- 天然气炉比燃油炉稍贵,但更容易维护。然而煤气发生炉存在一氧化碳洩漏的风险,因此安装一氧化碳侦测器是必要的。

快速成长的住宅终端用户领域

- 美国建筑业的成长和独立住宅需求的增加将推动住宅市场的成长。

- 美国住宅已经从疫情的影响中恢復过来,并且正在迅速復苏。美国人口普查局发布的资料显示,2022 年 2 月新屋开工住宅较去年同期成长 22%。这是自2006年以来最快的成长率。

- 美国各地区的温差导致极端的炎热和寒冷,刺激了对住宅空气炉的需求。空气炉的启动时间比水热加热系统快得多,可以快速为您的家提供舒适感。

- 使用空气炉还可以显着改善室内空气品质。许多空气炉具有加湿功能,可以消除室内空气污染物和湿度问题,从而导致财产损失和健康危害。这些因素也促进了市场的成长。

- 随着新能源规范的实施,使用节能空气炉的趋势也增加。例如,2022 年 6 月,美国能源局(DOE)提案了住宅燃气炉的新能源效率标准,该标准将显着减少温室气体排放,并帮助消费者节省更多能源费用。

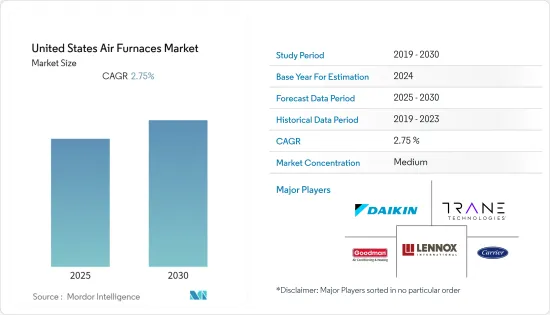

美国空气炉产业概况

美国空气炉市场竞争适中,并由重要的参与者组成。就市场占有率而言,其中几家重要营运商目前控制着市场。这些公司利用策略集体行动来增加市场占有率并提高盈利。

- 2021 年 12 月 - 大金宣布收购两家位于华盛顿的 HVAC 经销商 Thermal Supply, Inc. 和 AirReps, LLC,进一步扩大在北美的业务。

- 2021 年 8 月 - Lennox International 公司 Allied Air Enterprises 宣布推出 Ducane,这是一款 80% 两级恆扭矩 (CT) 燃气炉,实现从入门级单级产品到两级变速反应器的过渡。 80G2E 扩大了瓦斯炉产品范围。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力 - 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- COVID-19 爆发对产业的影响

第五章市场动态

- 市场驱动因素

- 加大房地产领域投资力度

- 关于暖气设备能效的严格规定

- 市场挑战

- 安装成本高

第六章 市场细分

- 按类型

- 气体

- 油

- 电

- 其他的

- 按最终用户

- 住宅

- 商业的

- 产业

第七章 竞争格局

- 公司简介

- Carrier Global Corporation

- Lennox International Inc.

- Daikin Industries, Ltd.

- Trane Technologies plc

- Goodman Manufacturing

- Fujistu General Limited

- Boyertown Furnace Co

- Rheem Manufacturing Company

- Nortek Global HVAC

- American Standard Heating & Air Conditioning

第八章投资分析

第9章市场的未来

简介目录

Product Code: 91576

The United States Air Furnaces Market is expected to register a CAGR of 2.75% during the forecast period.

Key Highlights

- The increasing investments in the real-estate sector and growth in industrialization are the primary factors driving the market. The rapid increase in the construction of different commercial and residential buildings across the United States is creating significant demand for air furnaces as a common type of heating equipment.

- Rising energy consumption along with stringent rules and regulations imposed by governing bodies is driving the demand for energy-efficient heating equipment in the United States. Additionally, increasing energy bills are also influencing many industrial and commercial organizations to install these energy-efficient systems on their working sites.

- Moreover, the increasing adoption of advanced technologies like Internet of Things (IoT) and Artificial Intelligence (AI) is also having a positive impact on the market. The usage of these technologies in air furnaces can result in major energy savings and also prevent equipment failures.

- The impacts of the COVID-19 pandemic disrupted the supply chain for many heating and cooling equipment manufacturers in the United States. Further, with the outbreak of the pandemic, many housing construction projects started to be carried on at a slower pace, while some were cancelled, which also resulted in a stagnant demand for air furnaces.

- The high upfront cost related to the installation of gas furnaces can act as a market restraint. Additionally, slow government regulations to completly phase out fossil fuel powered furnaces in the country is also expected to hinder the growth of the market. For instance, accordin to the new proposed rue from the Enegry department under the the Biden Administration by 2029, the country will phase out manufacturing and imports of non-weatherized, less efficent, non condensing furncese.

US Air Furnaces Market Trends

Gas Furnaces to Hold a Major Market Share

- Gas-fired furnaces are the most common type of air furnaces in the US and utilize natural gas as their primary source of fuel. The natural gas is ignited in the furnace, warming up the air, which is then distributed through ducts to various parts of a building or the home.

- Further, owing to the direct generation of high-temperature combustion gas, which is directed through a heating chamber by using an air blower, a natural gas furnace heats up quickly.

- Natural gas is a very affordable fuel source in the United States. It is also clean and efficient. Moreover, gas furnaces are required to have a minimum AFUE (Annual Fuel Utilization Efficiency) rating of 90% in Southern US and 95% in Northern US, as per Energy Star, making them high-efficiency appliances.

- In January 2021, Nortek Global HVAC launched the premium SD Series, a 95% AFUE, ultra-low NOx residential furnace that offers easy installation/service features. The single-stage, upflow/horizontal, natural gas-fired furnaces are available from the company's Frigidaire (FG8SD) and Maytag (MGC3SD) brands.

- While natural gas furnaces can be slightly more expensive than oil furnaces, they are easier to maintain. However, gas furnaces carry the danger of carbon monoxide leaks, making it necessary to install carbon monoxide detectors.

Residential End-User Sector to Grow Significantly

- The growth in the US construction sector coupled with the rise in the demand for independent houses fuels the market growth in the residential sector, as air furnaces are extensively used in residential buildings to regulate the temperature in winter and summer by providing consistent air circulations.

- The US housing sector is picking up at a fast rate, recovering from the effects of the pandemic. As per the data released by the US Census Bureau, new home construction starts in February 2022 increased by 22% compared with the same period in the previous year. This is the fastest growth rate in building since 2006.

- Temperature variations in U.S. regions result in extreme hot or cold weather, which stimulates the demand for residential air furnaces. Air furnaces have much faster start times, as compared to hydronic heating systems, and can quickly provide comfort to the entire home.

- The use of air furnaces can also improve indoor air quality significantly. Many furnaces are equipped with humidification, which allows for the removal of a lot of indoor air contaminants and humidity problems that can cause property damage and health problems. These factors also contribute to the market growth.

- The trend of using energy-efficient air furnaces is also growing with the implementation of new energy norms. For instance, in June 2022, the US Department of Energy (DOE) proposed new energy-efficiency standards for residential gas furnaces that would significantly reduce greenhouse gas emissions and provide more savings for consumers on their energy bills.

US Air Furnaces Industry Overview

The United States Air Furnaces Market is moderately competitive and consists of some influential players. In terms of market share, some of these important actors currently manage the market. These businesses are leveraging strategic collaborative actions to improve their market percentage and enhance their profitability.

- December 2021 - Daikin announced the acquisition of two Washington-based HVAC distributors, Thermal Supply, Inc. and AirReps, LLC., further expanding its presence in North America.

- August 2021 - Allied Air Enterprises, a Lennox International company, expanded its gas furnace offering with the Ducane, Concord and Allied 80G2E, an 80% two-stage constant torque (CT) gas furnace that provides a progression from entry-level single-stage product to two-stage variable speed furnaces.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porters 5 Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Outbreak on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Investments in the Real-Estate Sector

- 5.1.2 Strignent Regulations Regarding Energy Efficiecy of Heating Devices

- 5.2 Market Challenges

- 5.2.1 High Cost of Installation

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Gas

- 6.1.2 Oil

- 6.1.3 Electric

- 6.1.4 Others

- 6.2 By End-User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Carrier Global Corporation

- 7.1.2 Lennox International Inc.

- 7.1.3 Daikin Industries, Ltd.

- 7.1.4 Trane Technologies plc

- 7.1.5 Goodman Manufacturing

- 7.1.6 Fujistu General Limited

- 7.1.7 Boyertown Furnace Co

- 7.1.8 Rheem Manufacturing Company

- 7.1.9 Nortek Global HVAC

- 7.1.10 American Standard Heating & Air Conditioning

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219