|

市场调查报告书

商品编码

1635378

多级离心式帮浦帮浦:市场占有率分析、产业趋势、成长预测(2025-2030)Multi-Stage Centrifugal Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

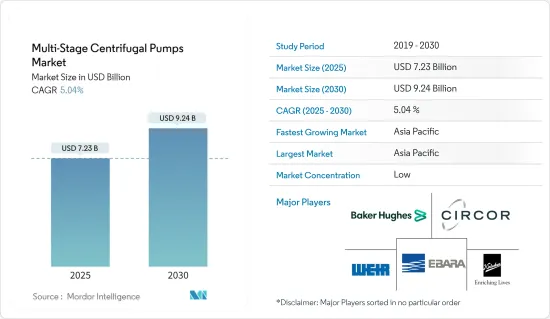

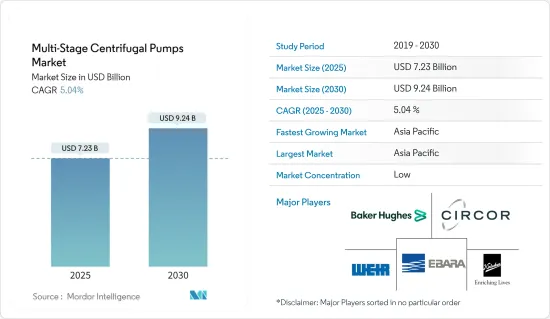

多级离心式帮浦市场规模预计到2025年为72.3亿美元,预计到2030年将达到92.4亿美元,预测期内(2025-2030年)复合年增长率为5.04%。

水处理计划的投资、石油和天然气行业的扩张以及高效节能和强大的多级离心式帮浦的可用性正在推动预测期内的市场成长。

工业环境中流体输送中多级离心式帮浦的使用推动了市场成长

主要亮点

- 多级离心式帮浦是一种将动能转换为液头的旋转装置。这些泵浦适用于炼油厂、石油生产平台、石化厂和发电厂等设施。除此之外,也用于农业、食品加工、住宅建筑、供水等。

- 具有多个叶轮的多级离心式帮浦依次增加水压,比相同尺寸的单叶轮泵获得更高的压力。此外,由于叶轮直径较小且间隙较小,这些泵浦所需的马达马力较小,从而提高了性能和效率。增加泵浦级数会增加最终排出压力。透过增加级数,这些帮浦可以逐渐获得更高的压力,同时流量在特定的每分钟转数 (RPM) 下保持恆定。这一优势正在推动多级离心式帮浦市场的成长。

全球水处理和污水管理的新兴趋势为市场创造成长机会

主要亮点

- 水处理厂对于确保社区拥有干净安全的饮用水至关重要。将水输送到处理阶段的泵浦和泵浦系统是这些业务的核心。多级泵浦(多级离心式帮浦)描述了一种高效可靠的解决方案,可满足水处理的严格要求。

- 多层泵浦用于多种应用,从向高层建筑和逆渗透(RO) 系统供水,到向锅炉、喷雾、压力清洗和其他供水系统供水。这种多功能性与水处理厂领域的扩张同时推动市场的成长。

产品的高初始成本和假冒风险是市场的主要挑战。

主要亮点

- 多级离心式帮浦的显着缺点是初始成本较高。由于所需的复杂设计和精密工程,这些泵浦比单级泵浦更昂贵。然而,在评估投资时,使用者必须权衡长期营运效益和节能效果,以证明初始成本的合理性。

- 此外,成本上升给分散的市场带来压力,使市场供应商难以与本地生产的产品和进口假货竞争。因此,消费者在购买时必须随时保持警惕,并了解产品生命週期成本的重要性。消费者不能只关注初始成本,而必须评估整个产品生命週期的成本。

自 COVID-19 以来,随着可再生能源计划的激增,特别是在聚光型太阳光电(CSP) 和地热发电厂等应用中多级离心式帮浦的使用增加。 CSP 发电厂利用集中的阳光将流体加热到极端温度。然后,多级离心式帮浦使这种加热的传输流体循环通过热交换器,以产生过热蒸气。这种蒸气为涡轮机动力来源动力,凸显了市场的成长潜力。

多级离心式帮浦市场趋势

石油和天然气产业成为最大的最终用户

- 多级离心式帮浦以其在高压下输送流体的能力而闻名,广泛应用于各个工业领域。石油和天然气行业尤其是该技术的主要采用者。这些泵浦由串联堆迭在整合外壳内的叶轮定义,擅长提供高排放压力。这一特性使其成为石油和天然气管道运输和高压注入过程等增压应用的理想选择。随着石油和天然气生产活动投资的激增,市场可望大幅成长。

- 多级离心式帮浦在液化气体的生产、运输、储存和分配中至关重要。液化气体比气态更容易运输和储存。此液化过程是透过压缩或冷却来完成的。当需要时,液化气透过释放压力重新气化并泵送到消耗单元。此外,随着世界各国对液化天然气的需求不断增加以及生产投资不断增加,预计市场机会将会扩大。

- 石油和天然气探勘活动的活性化以及生产领域投资的增加将推动市场成长。 2023年,全球石油产量达到创纪录的9,640万桶/日,高于2022年的9,420万桶/日。

- 此外,IEA透露,2023年全球上游石油和天然气投资将成长11%,达到5,280亿美元,高于前一年的4,740亿美元。据预测,到2030年,总供给能力可能接近1.14亿桶/日。鑑于这些新兴市场的发展以及多个地区勘探投资的增加,市场正处于重大机会的边缘。

- 此外,根据贝克休斯公司的数据,北美在石油和天然气钻机持有处于世界领先地位。截至 2024 年 8 月,该地区有 781 个陆上钻机,另有 23 个海上钻机。到2023年,全球石油钻机平均数量将超过1,800个。

- 有几家公司生产液化气泵,这对于液化气的生产、运输、储存和分配至关重要。这些泵浦设计有各种功能,以确保在这些不同的应用中有效地输送气体。由于 NPSH(净吸入扬程)值较低,这些帮浦在运作时不会产生气蚀,并且在吸入和吸入模式下都能保持完美的输送。 IEA表示,随着世界逐渐从严重的能源危机中復苏,全球天然气市场正在发生变化,供应和需求都受到影响。这种动态有望推动该领域的成长。

- 根据IEA预测,2024年全球天然气需求预计将成长2.5%,相当于增加1,000亿立方公尺(bcm)。与 2023 年气温升高相反,预计 2024 年冬季将更加寒冷,导致住宅和商业领域的供暖需求增加。根据能源实验室资料,2023年全球液化天然气贸易量量达5,490亿立方公尺。从1970年到2023年,这个数字大幅增加至5,460亿立方公尺。此外,到2023年,美国将成为全球领先的液化天然气出口国。

预计亚太地区将占据主要市场占有率

- 快速的都市化、工业发展、人口增长以及对水资源短缺的日益担忧正在刺激亚太地区对水和废水处理的投资增加。

- 2024年6月,水处理技术服务领域知名公司威立雅旗下子公司威立雅水务技术有限公司在中国运作了第一座离子交换再生设施。该设施配备了最尖端科技,可有效回收用过的离子交换树脂,并彰显了威立雅对资源优化和永续性的承诺。

- 2024年1月,新加坡Koastal集团子公司Koastal Eco Industries签署了一份价值430万美元的工程、采购和施工(EPC)合同,在越南南部西宁省安装一座污水处理厂。该设施的处理能力为每天 15,000 立方米,将处理来自 Thanh Thanh Kong工业区的所有污水,该工业区是 TTC 集团股份公司 (JSC) 集团及其同名公司的计划。

- 此外,澳洲领先的能量饮料品牌 V Energy 将于 2024 年 9 月在三得利大洋洲位于昆士兰州伊普斯威奇的新多种饮料製造工厂首次生产。该占地 17 公顷的场地计划于 2025 年中期全面运作,将成为三得利多元化产品组合(其中包括 40 多个品牌)的中央製造和分销中心。

- 2024 年 5 月,Aurobindo Pharma 的子公司 TheraNym Biologics Pvt Ltd 与 Merck Sharp & Dohme Singapore 签订了一份主服务协议,专注于生技药品的契约製造。该协议自 2024 年 5 月起生效,允许 TheraNym 为国内和国际市场生产生技药品。此外,TheraNym 计划投资 100 亿印度卢比在印度特伦甘纳邦建立生技药品生产工厂。

- 2024年10月,Google宣布将投资10亿美元在泰国建置资料中心。此前,谷歌云端在同一周签署了向马来西亚提供主权云端服务的多年协议。此外,2024年5月,Google已经在东南亚大举动作,为其资料中心投资20亿美元。水处理、建筑、化工以及食品和饮料领域的此类发展预计将推动多级离心式帮浦市场的成长。

多级离心帮离心式帮浦产业概况

多级离心式帮浦市场是一个竞争激烈的领域,全球和地区多个参与企业都在争夺注意力。儘管该市场对新参与企业的进入障碍很高,但一些新参与企业正在推动市场发展。

Kirloskar Brothers Limited、Baker Hughes Company 和 Xylem Inc. 等市场领导利用成熟的分销网络,对市场具有重大影响力。

与主要供应商相关的品牌 ID 验证已成为全球市场上各种产品的代名词。这些公司透过专注于市场扩张和收购来不断扩大业务。此外,市场上的许多供应商都专注于研究和开发,以探索未开发的领域并建立可持续的伙伴关係关係。我们的地域扩大策略也是如此。

支持市场成长的是节能、可靠、高效的多级离心式帮浦的开发,这加剧了市场供应的竞争。总体而言,所研究市场中供应商之间的竞争敌意很高,预计在预测期内仍将如此。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19副作用和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 新兴国家对用水和污水管理的高需求

- 加强创新技术的整合以高效运作产品

- 市场问题

- 来自灰色市场参与企业和无组织产业的竞争加剧

第六章 市场细分

- 按类型

- 水平泵浦

- 立式泵浦

- 按最终用户产业

- 石油和天然气

- 化学

- 饮食

- 用水和污水

- 製药

- 发电

- 金属/矿业

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Kirloskar Brothers Limited

- Baker Hughes Company

- Circor International Inc.

- Ebara Corporation

- The Weir Group

- Grundfos Holding

- Pentair Inc.

- Sulzer Ltd

- Tsurumi Manufacturing Co. Ltd

- Wilo SE

- Xylem Inc.

- KSB SE & Co. KgaA

第八章投资分析

第9章市场的未来

The Multi-Stage Centrifugal Pumps Market size is estimated at USD 7.23 billion in 2025, and is expected to reach USD 9.24 billion by 2030, at a CAGR of 5.04% during the forecast period (2025-2030).

Investments in water treatment projects, expansion of the oil and gas industries, and the availability of highly energy-efficient and powerful multi-stage centrifugal pumps are driving market growth during the forecast period.

The Usage Of Multi-stage Centrifugal Pumps In Transporting Fluids At Industrial Sites Is Driving The Market Growth

Key Highlights

- A multi-stage centrifugal pump is a rotating device that transforms kinetic energy into a liquid head. These pumps find applications in facilities like refineries, oil production platforms, petrochemical plants, and power plants. Beyond these, they're also utilized in agriculture, food processing, residential construction, and water supply.

- Equipped with multiple impellers, multi-stage centrifugal pumps elevate water pressure sequentially, achieving higher pressures than their single impeller counterparts of the same size. Furthermore, with smaller impeller diameters and tighter clearances, these pumps demand less motor horsepower, enhancing both performance and efficiency. More stages in a pump result in a higher final discharge pressure. While adding stages allows these pumps to achieve progressively higher pressures, the flow rate remains constant at a specific revolutions per minute (RPM). This advantage is propelling the growth of the multi-stage centrifugal pump market.

The Emerging Trend Of Water Treatment And Wastewater Management Worldwide Creates A Growth Opportunity For The Market

Key Highlights

- Water treatment plants are pivotal in ensuring communities access clean and safe drinking water. The pumps and pumping systems transporting water through the treatment stages are central to these operations. Multi-stage pumps, or multi-stage centrifugal pumps, provide efficient and reliable solutions tailored to the rigorous demands of water treatment.

- Multi-stage pumps find diverse applications, from supplying water to high-rise buildings and reverse osmosis (RO) systems to feeding boilers, spraying, high-pressure cleaning, and other waterworks. This versatility bolsters the market's growth, paralleling the global expansion of water treatment plants.

Initial High Cost Of The Product And The Risk Of Counterfeiting Are The Major Challenges In The Market

Key Highlights

- Multi-stage centrifugal pumps have a notable drawback with their higher initial cost. Due to their intricate design and the demand for precision engineering, these pumps are more expensive than their single-stage counterparts. However, when evaluating the investment, users must weigh the long-term operational advantages and energy savings that can counterbalance this upfront expense.

- Moreover, increasing costs are putting pressure on the fragmented market, making it difficult for the market vendors to compete with locally produced and imported counterfeit products. Consequently, consumers must remain vigilant about their purchases and grasp the significance of the product-life-cycle cost. Consumers must evaluate expenses throughout a product's life cycle rather than concentrating solely on the upfront cost.

Post-COVID-19, the surge in renewable energy projects has opened avenues for the market, particularly with the rising use of multi-stage centrifugal pumps in applications like concentrated solar power (CSP) and geothermal plants. In CSP plants, sunlight is concentrated to heat a fluid to extreme temperatures. Multi-stage centrifugal pumps then circulate this heated transfer fluid through heat exchangers, generating superheated steam. This steam powers turbines, underscoring the market's growth potential.

Multi-Stage Centrifugal Pumps Market Trends

Oil and Gas Industry to be the Largest End User

- Multistage-centrifugal pumps, known for their capability to transfer fluids at elevated pressures, find extensive use across various industrial sectors. Notably, the Oil and Gas industry stands out as a primary adopter of this technology. Defined by their series-stacked impellers within a unified casing, these pumps excel in delivering heightened discharge pressures. This attribute renders them ideal for boosting applications, including the pipeline transportation of oil and gas and high-pressure injection processes. As investments in oil and gas production activities surge, the market is poised for significant growth.

- Multistage-centrifugal pumps are crucial during the production, transport, storage, and distribution of liquefied gases. Liquefied gases can be transported and stored more easily than in their gaseous state. This liquefaction process is achieved through compression or cooling. When there's demand, the liquefied gas is regasified by releasing pressure and then delivered to consuming units using pumps. Moreover, the increasing demand for liquefied gases across various countries in the world and increased investments in production will enhance the market opportunities.

- Heightened oil and gas exploration activities, coupled with escalating investments in production fields, are set to propel the market's growth. In 2023, global oil production achieved a record high of 96.4 million barrels per day, marking an increase from 94.2 million barrels per day in 2022.

- Furthermore, the IEA highlighted a notable 11% rise in global upstream oil and gas investments for 2023, amounting to a substantial USD 528 billion, a jump from the previous year's USD 474 billion. Projections indicate that total supply capacity could be near 114 million barrels a day by 2030. Given these significant developments and the rise in exploration investments across multiple regions, the market stands on the brink of substantial opportunities.

- Further, according to Baker Hughes, North America leads the world in hosting oil and gas rigs. As of August 2024, the region boasted 781 land rigs and an additional 23 offshore rigs. In 2023, the global count of oil rigs surpassed 1,800 units on average.

- Several companies manufacture liquefied gas pumps, essential for the production, transport, storage, and distribution of liquefied gases. These pumps, designed with various features, ensure effective gas conveyance across these diverse applications. Thanks to their low NPSH (Net Positive Suction Head) values, these pumps operate without cavitation, maintaining full conveyance in both suction and intake modes. According to IEA, the global gas market is transitioning as the world slowly recovers from a significant energy crisis, impacting both supply and demand. Such dynamics are poised to fuel growth in this segment.

- According to IEA, in 2024, global gas demand is projected to rise by 2.5%, equating to an increase of 100 billion cubic meters (bcm). With a colder winter anticipated in 2024, contrasting the mild temperatures of 2023, there's an expected uptick in demand for space heating across both residential and commercial sectors. Data from the Energy Institute reveals that in 2023, the global trade volume for liquefied natural gas reached 549 billion cubic meters. Notably, from 1970 to 2023, this figure saw a substantial increase of 546 billion cubic meters. Furthermore, in 2023, the United States emerged as the dominant player, being the world's leading LNG exporting nation.

Asia Pacific is Expected to Hold Significant Market Share

- Rapid urbanization, industrial growth, a rising population, and heightened concerns about water scarcity are fueling the expansion of investments in water and wastewater treatment across the Asia-Pacific region.

- In June 2024, Veolia Water Technologies, a subsidiary of Veolia and a prominent player in water treatment technologies and services, inaugurated its inaugural ion exchange regeneration facility in China. Equipped with cutting-edge technology, the facility efficiently recycles spent ion exchange resins, underscoring Veolia's commitment to resource optimization and sustainability.

- In January 2024, Koastal Eco Industries Co., Ltd., part of Singapore's Koastal Group, inked a USD 4.3-million EPC (engineering, procurement, and construction) contract to establish a wastewater treatment plant in Tay Ninh, a southern province of Vietnam. This facility, boasting a daily capacity of 15,000 cubic meters, will handle all wastewater from the Thanh Thanh Cong Industrial Zone, a project of the TTC Group Joint Stock Company (JSC) conglomerate and its namesake company.

- Additionally, in September 2024, V Energy, Australia's leading energy drink brand, became the inaugural beverage produced at Suntory Oceania's newly established multi-beverage manufacturing facility in Ipswich, Queensland. Set to be fully operational by mid-2025, this expansive 17-hectare site, boasting carbon neutrality, is poised to serve as the central manufacturing and distribution hub for Suntory's diverse portfolio, encompassing over 40 brands.

- In May 2024, Aurobindo Pharma's subsidiary, TheraNym Biologics Pvt Ltd, inked a master service agreement with Merck Sharp & Dohme Singapore, focusing on the contract manufacturing of biologicals. This agreement, effective from May 2024, empowers TheraNym to manufacture biologicals for both domestic and international markets. Additionally, TheraNym is set to invest INR 1,000 crore in establishing a biologics manufacturing facility in Telangana, India.

- In October 2024, Google unveiled a USD 1 billion investment for building a data center in Thailand, aiming to address the surging demands for cloud storage and AI tools in Southeast Asia (SEA). This announcement followed closely on the heels of Google Cloud's multi-year agreement to deliver sovereign cloud services to Malaysia, made in the same week. Additionally, in May 2024, Google had already made a significant move into SEA with a USD 2 billion investment for another data center. Such developments in water treatment, construction, chemicals, and food and beverage sectors are expected to drive growth in the multi-stage centrifugal pumps market.

Multi-Stage Centrifugal Pumps Industry Overview

The multi-stage centrifugal pump market comprises several global and regional players vying for attention in a contested space. Although the market studied poses high barriers to entry for new players, several new entrants have gained traction.

Market leaders, such as Kirloskar Brothers Limited, Baker Hughes Company, Xylem Inc., and others, have a considerable influence on the overall market, with access to well-established distribution networks.

The brand identity associated with the major vendors has become synonymous with various product offerings in the global market. These firms have continuously expanded their operational scales by focusing on market expansions and acquisitions. Furthermore, many vendors in the market are dedicating their R&D efforts to capturing unexplored domains and forming partnerships for sustainability. The same is true for geographic expansion strategies.

Market growth is supported by the development of highly energy-efficient, reliable, and operationally productive multi-stage centrifugal pumps, which increase competition in the market's supply side. Overall, the intensity of competitive rivalry among the vendors in the market studied is expected to be high and remain the same over the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Demand for Water and Wastewater Management in Developed Countries

- 5.1.2 Growing Integration of Innovative Technologies to Efficiently Operate Product

- 5.2 Market Challenges

- 5.2.1 Increased Competition from Grey Market Players and Unorganized Sector

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Horizontal Pumps

- 6.1.2 Vertical Pumps

- 6.2 By End-User Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemicals

- 6.2.3 Food and Beverage

- 6.2.4 Water and Wastewater

- 6.2.5 Pharmaceutical

- 6.2.6 Power Generation

- 6.2.7 Metal and Mining

- 6.2.8 Other End-User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kirloskar Brothers Limited

- 7.1.2 Baker Hughes Company

- 7.1.3 Circor International Inc.

- 7.1.4 Ebara Corporation

- 7.1.5 The Weir Group

- 7.1.6 Grundfos Holding

- 7.1.7 Pentair Inc.

- 7.1.8 Sulzer Ltd

- 7.1.9 Tsurumi Manufacturing Co. Ltd

- 7.1.10 Wilo SE

- 7.1.11 Xylem Inc.

- 7.1.12 KSB SE & Co. KgaA