|

市场调查报告书

商品编码

1635385

美国空调设备:市场占有率分析、行业趋势、统计和成长预测(2025-2030)United States Air Conditioning Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

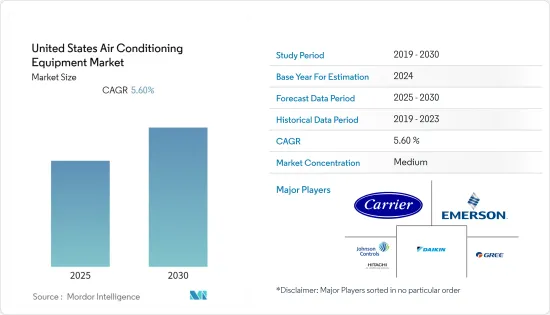

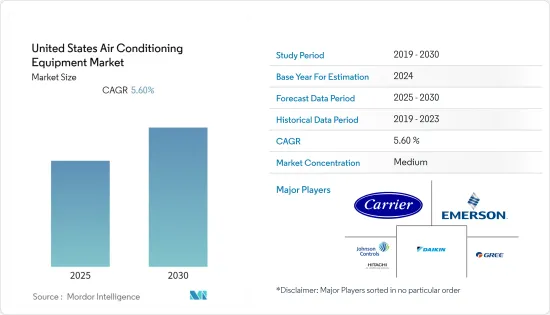

预计美国空调设备市场在预测期内的复合年增长率为 5.6%。

主要亮点

- 经济的快速扩张正在增加人们的可支配收入并增加对住宅和商业住宅的需求。工业应用也推动了空调产业的发展。根据国际货币基金组织的数据,2021年美国人均国内生产总值达到约69,231.4美元。如此庞大的人均国民生产毛额是研究资本的驱动力。

- 旅游业的快速扩张也将刺激市场,各地的饭店和商用车都在考虑可携式空调和其他空调系统。可携式空调市场将由寻求行动冷却设备和节能冷却系统的消费者推动。此外,全部区域政府关注节能空调,公共部门预计将成为该市场的主要驱动力。

- 空气调节机可以去除危险的空气污染物,这些污染物可能导致各种疾病和呼吸系统疾病,包括肺癌、缺血性心臟疾病、气喘和慢性阻塞性肺病。此外,多项技术发展正在对市场扩张产生积极影响,例如经济实惠的 3D 列印设备的开发以及将感测器整合到 AHU 设备中以实现运动启动空调。大量基础设施的开发和智慧城市的建设,特别是在新兴经济体,预计将是推动市场成长的进一步因素。

- 随着 COVID-19 的爆发,工业公司对他们购买的服务和产品对环境的影响表示担忧,并且愿意比其他公司支付更多的钱来购买环保和健康的选择。预计智慧空调系统的需求将会很大。从自我控製到整合感测器、远端温度调节和能源控制,技术为最终用户提供了更多控制权。空调系统对负载条件做出反应,负载条件根据不规则出勤导致的建筑物运转率而变化。需要合理化每位员工的占地面积并发展办公空间的使用模式。

- 对与全球暖化和臭氧层消耗相关的环境问题的担忧导致了全球和区域法规的製定,这些法规对冷媒应用产生了重大影响。购买、设计、安装和维修空调设备的製造商和最终用户应参考现行国家法规、规范和标准,以选择适合其预期用途的冷媒。

美国空调设备市场趋势

商业领域是推动市场的因素之一

- 根据美国能源资讯署的数据,商业建筑占美国能源消费量的近20%和温室气体排放的12%。智慧建筑透过减少浪费和节约能源全球整体的社区提供服务。

- 透过减少建筑物的能源使用,建筑物业主可以节省更多的营运成本。透过将建筑物的机械和电气系统连接到云端,它们可以自动打开和关闭,从而消除浪费。

- 在美国,商业建筑有大量投资。根据Construct Connect和牛津经济研究院的数据,2022年零售建设将达到196.4亿美元,饭店为149.6亿美元,政府建筑为120.5亿美元,体育场馆为96.6亿美元。对商业计划的大量投资正在创造对交流设备的需求。

- 公司正在透过在该地区建立新办事处来扩大其影响力,从而促进市场的成长。例如,2022年5月,作为扩大策略的一部分,克拉克建筑集团宣布在美国维吉尼亚麦克莱恩开设一个占地128,000平方英尺的新办公室。克拉克建筑集团的基础设施、建筑和资产解决方案部门将在这个新办公室设立一个现代化的协作中心。此外,Clark 将在贝塞斯达保留约 29,000 平方英尺的办公空间,并将巴尔的摩市中心体育场广场的办公空间增加一倍。

- 2021 年 2 月,大金应用材料公司将与 Elita Air 合作,利用全球现有的零件经销商和分销商。作为大金集团的成员,Elitire 将成为大金应用材料公司的官方服务和技术提供商,为客户提供商务用供暖和製冷设备的整个生命週期的支援。这些伙伴关係关係有望扩大大金客自订空气处理器在每个地区商务用领域的使用。

冷媒用量波动是推动市场的因素之一

- 大多数商业机构都使用 VRF 系统,从小型商店和咖啡馆到大型办公大楼和公共区域。透过 VRF 分区,能源仅在办公室运作中用于冷却或加热。 VRF 系统具有安静的室内机和保持精确温度控制的能力,可确保最舒适和高效的职场环境。

- VRF 系统提供同步加热和冷却服务、精确的温度控制和高能源效率。这些优势提供了相对于传统方法的竞争优势,并且是产业扩张的主要驱动力。建设产业的扩张、房地产和建筑业的放鬆管制、巨大的节能潜力、对 VRF 系统低且易于维护的需求等是推动 VRF 系统市场的主要因素。

- 为了满足客户需求,该地区的公司正在提供各种产品以增加其市场占有率。例如,Bosch VRF 空调系统不仅在一个中央系统中提供高达 270kW 的大容量范围,而且还采用模组化设计,具有节省空间的室外单元、时尚的室内单元和复杂的控制设备方法。此高效产品系列适用于饭店、企业、医院、餐厅、别墅、学校等空调设备。 VRF 系统的优点包括与楼宇管理系统的连接、每个房间的控制和集中控制。

- COVID-19 的疫情对 VRF 系统业务以及其他行业产生了重大负面影响。一方面,VRF 系统製造商必须处理所有问题,例如采购生产 VRF 系统所需的原材料和组件、交付成品以及吸引偏远地区的工人。然而,各种製造组织自动化程度的提高以及用于调度和警报的楼宇自动化系统 (BAS) 的整合正在对市场成长产生积极影响。

- VRF 通常与能源回收通气结合使用。各种通风增加和 VRF 提供最佳的室内环境舒适度 (IEC) 和室内空气品质 (IAQ)。为了实现这一目标,需要使用标准能源回收通风或特殊的室外空气系统 (DOAS)。透过在不同位置安装多个 VRF 室内机,可以实现多个过滤点。由于这些小调节点,空气可以更频繁地循环和过滤。

美国空调设备产业概况

美国空调设备市场适度整合,拥有多家大公司。公司不断投资于策略联盟和产品开发,以占领更多的市场占有率。近期市场趋势如下:

- 2022 年 5 月 - 江森自控 - 日立有限公司宣布推出一款壁挂式室内迷你分体装置,作为其高效单区商务用迷你分离式系统 PRIMAIRY P300 系列的最新成员。这种无管道供暖和製冷系统的开发是为了满足零售店、餐厅和教育设施等中小型空间的独特要求。新的壁挂式装置更小、更轻,日立的全系列 PRIMAIRY 迷你分离式系统具有多种安装选项,使承包商的安装更加容易。长管道长度提供更大的布局自由度,大容量范围确保为每种应用提供精确尺寸的系统。满足客户需求和应用

- 2021 年 12 月 - 减少零售对环境的影响变得越来越重要,主要目标之一是建筑基础设施的脱碳。大金的新型壁挂式室内机将先进技术与优雅设计融为一体,极具吸引力。易于安装、操作且经济实惠的节能热泵技术现在可以取代所有商店中的传统锅炉系统。透过与SkyAir α系列室外机结合,此室外机最大管路长度为85m,工作范围低至-20℃,安装人员和设计师可以最大限度地提高设计和安装位置的自由度。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 更换现有设备并提高性能

- 政府支持法规,包括透过税额扣抵计划激励节能

- 市场限制(持续战争对供应链和原材料的影响)

- 取决于宏观经济经济状况

第六章 市场细分

- 按设备

- 空调/通风设备

- 类型

- 单分体/多分体

- VRF

- 空气调节机

- 冷却器

- 风机盘管

- 室内包和屋顶包

- 其他类型

- 空调/通风设备

- 按销售管道

- 专卖店

- 在线的

- 多品牌商店

- 按最终用户

- 住宅

- 商业的

- 产业

第七章 竞争格局

- 公司简介

- Daikin Industries, Ltd.

- Gree Electrical Appliances Inc.

- Emerson Electric Company

- Hitachi-Johnson Controls Air Conditioning Inc.

- Carrier

- LG Electronics Inc.

- Panasonic Corporation

- Toshiba Corporation

- Haier Group Corporation

- Electrolux

第八章投资分析

第9章市场的未来

简介目录

Product Code: 91614

The United States Air Conditioning Equipment Market is expected to register a CAGR of 5.6% during the forecast period.

Key Highlights

- Rapid economic expansion assists in raising people's disposable incomes and driving up demand for housing for both residential and commercial uses. Industrial uses also fuel the air conditioner industry. According to International Monetory fund, In 2021, the gross domestic product per capita in the United States amounted to around USD 69,231.4 . Such huge per capital will drive the studied capital.

- The market will also be fueled by the tourism sector's rapid expansion, as hotels and commercial vehicles around the region will soon consider a range of portable and other AC systems. The portable air conditioner market will be driven by consumers seeking on-the-go cooling devices and energy-efficient cooling systems. Additionally, the public sector will be a key driver in this market as governments throughout the region focus on energy-efficient air conditioning.

- The Air Handling Units can remove hazardous air pollutants that can lead to various illnesses and respiratory conditions, such as lung cancer, ischemic heart disease, asthma, and chronic obstructive pulmonary disease. Additionally, several technological developments, like the creation of affordable 3D printed units and the integration of sensors in AHU units for movement-activated air conditioning, are favorably affecting the market's expansion. The development of vast infrastructure and the creation of smart cities, particularly in emerging economies, are further drivers that are anticipated to fuel market growth.

- With the outbreak of COVID-19, industrial companies are expressing concerns about the environmental impact of the services and products they buy and are willing to pay more for more environmentally and health-friendly options than others. Smart Air Conditioner systems are expected to have significant demand. Technology gives end-users more control, from self-regulation to sensors to remote temperature adjustment to integrating energy controls. The Air Conditioner systems deal with varied load conditions depending on the occupancy rate in the buildings due to irregular attendance. Rationalizing square foot occupancy per employee and evolving office space usage patterns will be necessary.

- Environmental concerns regarding global warming and ozone depletion have led to the development of evolving global and regional regulations, which have had significant implications for refrigerants across applications. Manufacturers and end-users who purchase, design, install, and service air conditioning equipment should consult their country's current regulations, codes, and standards to aid refrigerant selection for each intended use.

US Air Conditioning Equipment Market Trends

Commercial Segment is one of the Factor Driving the Market

- According to the United States Energy Information Administration, Nearly 20% of the country's energy consumption and 12% of its greenhouse gas emissions are attributed to commercial buildings. Smart buildings serve the entire world community by lowering waste and preserving energy.

- Reducing energy use in buildings can save building owners to save more on their operational costs. By connecting mechanical and electrical systems in buildings to the cloud, they can automatically switch on and off, reducing waste.

- The investments in commercial buildings are massive in the United States. According to Construct Connect and Oxford Economics, in 2022, the value of commercial construction by retail will account for USD 19.64 billion, USD 14.96 billion for hotels, USD 12.05 billion for government, and USD 9.66 billion for sports stadiums. The robust investments directed toward commercial projects create a need AC equipment.

- The companies are expanidng thier presence by constructing new offices in the region which will enable the market to grow. For instance, May 2022, As part of its expansion strategy, Clark Construction Group has announced the inauguration of a new 128,000ft2 office in McLean, Virginia, US. The organization's infrastructure, construction, and asset solutions departments will have a modern, collaborative hub in this new office space. Additionally, Clark is maintaining almost 29,000ft2 of its office space in Bethesda and increasing its office space at Stadium Square in downtown Baltimore by a factor of two.

- In February 2021, Daikin Applied collaborated with ElitAire, to utilize its existing parts distributor and sales representative globally. ElitAire, which is now part of the Daikin Group, is likely to be Daikin Applied's authorized service and technology provider, supporting customers throughout the lifecycle of their commercial heating and cooling equipment. Such partnerships are poised to increase the usage of custom air handlers of Daikin in the commercial sector of that respective region.

Variable Refrigerant Volume is one of the Factor Driving the Market

- Most commercial structures, from little stores and cafes to big office complexes and public areas, use VRF systems. VRF zoning ensures that energy is only used to cool or heat occupied offices. Due to their quiet indoor units and ability to maintain precise temperature control, VRF systems guarantee the most comfortable and productive work environment.

- VRF systems offer simultaneous heating and cooling services, accurate temperature control, and high energy efficiency. These benefits give these systems a competitive edge over conventional methods and are the main drivers of industry expansion. The expanding construction industry, loosening regulations in the real estate and construction sectors, significant potential for energy savings, and low and simple maintenance needs of VRF systems are all major factors propelling the market for VRF systems.

- To meet the demands of the customers the firms in the region are providing different products to enhance their market share. For example, In addition to providing a large capacity range of up to 270 kW in a single central system, Bosch VRF Air Conditioning Systems also employs a modular design approach with space-saving outside units, fashionable indoor units, and sophisticated controls. This high-efficiency product line is appropriate for air-conditioning facilities, including hotels, businesses, hospitals, restaurants, villas, and schools. The advantages of a VRF system include connecting to building management systems and providing individual room control and centralized control.

- The COVID-19 epidemic significantly negatively impacted the VRF systems business, just like in any other industry. On the one hand, procuring the raw materials and components needed to produce VRF Systems, delivering finished goods, and luring workers out of quarantines were all issues that VRF system makers had to deal with. However, the market growth has been positively impacted by increasing automation in various manufacturing organizations and integrating the Building Automation System (BAS) for schedules and alarms.

- VRF is frequently used in combination with energy recovery ventilation. A variety of increased ventilation and VRF provides the best indoor environmental comfort (IEC) and indoor air quality (IAQ). Standard energy recovery ventilators or specialized outdoor air systems are used to achieve this (DOAS). Multiple filtration points are possible with numerous indoor VRF units placed in various locations. The air can circulate and filter more often thanks to these tiny conditioning points.

US Air Conditioning Equipment Industry Overview

The United States Air Conditioning Equipment market is moderately consolidated, with the presence of a few major companies. The companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- May 2022 - Johnson Controls-Hitachi has introduced a new Wall Mount indoor mini-split unit as the latest addition to its PRIMAIRY P300 line of high-efficiency, single-zone commercial mini-split systems. This ductless heating and cooling system are developed to address the particular requirements of small to medium-sized spaces, such as retail establishments, dining establishments, and educational facilities. The new Wall Mount unit is small and light, and the entire series of Hitachi PRIMAIRY mini-split systems have several mounting possibilities, making installation for contractors easier. Long pipe adds to the layout freedom, and a large capacity range ensures a system that is precisely the right size for any application. To satisfy client needs and application

- December 2021 - Reducing the environmental impact of the retail industry is becoming increasingly crucial, with one of the main objectives being the decarbonization of building infrastructure. The new wall-mounted indoor unit from Daikin delivers an enticing combination of advanced technology and elegant design. All retail establishments can now use energy-saving heat pump technology to replace conventional boiler systems since it is simple to install, operate, and affordable. When coupled with the Sky Air Alpha-series outdoor unit, which has lengthy piping lengths up to 85 meters and a wide operation range down to -20°C, the new model offers installers and designers the most flexibility in design and location.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitute Products

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Assessment Of The Impact Of Covid-19 On The Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Replacement Of Existing Equipment With Better Performing Ones

- 5.1.2 Supportive Government Regulations Including Incentives For Saving Energy Through Tax Credit Programs

- 5.2 Market Restraint (impact Of Ongoing War On Supply Chain And Raw Material)

- 5.2.1 Dependence On Macro-economic Conditions

6 MARKET SEGMENTATION

- 6.1 Equipment

- 6.1.1 Air Conditioning/Ventilation Equipment

- 6.1.1.1 Type

- 6.1.1.1.1 Single Splits/Multi-Splits

- 6.1.1.1.2 VRF

- 6.1.1.1.3 Air Handling Units

- 6.1.1.1.4 Chillers

- 6.1.1.1.5 Fans Coils

- 6.1.1.1.6 Indoor Packaged And Roof Tops

- 6.1.1.1.7 Other Types

- 6.1.1 Air Conditioning/Ventilation Equipment

- 6.2 Distribution Channel

- 6.2.1 Exclusive Stores

- 6.2.2 Online

- 6.2.3 Multi Brand Stores

- 6.3 End User

- 6.3.1 Residential

- 6.3.2 Commercial

- 6.3.3 Industrial

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin Industries, Ltd.

- 7.1.2 Gree Electrical Appliances Inc.

- 7.1.3 Emerson Electric Company

- 7.1.4 Hitachi-Johnson Controls Air Conditioning Inc.

- 7.1.5 Carrier

- 7.1.6 LG Electronics Inc.

- 7.1.7 Panasonic Corporation

- 7.1.8 Toshiba Corporation

- 7.1.9 Haier Group Corporation

- 7.1.10 Electrolux

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219