|

市场调查报告书

商品编码

1635388

拉丁美洲离心式帮浦:市场占有率分析、行业趋势和成长预测(2025-2030)Latin America Centrifugal Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

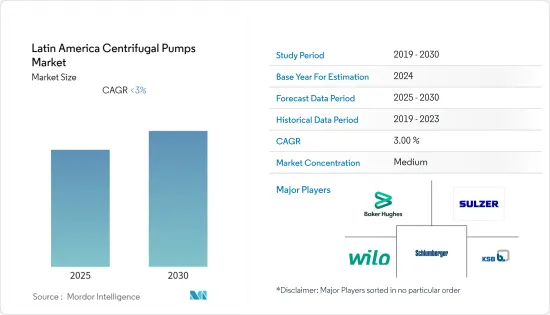

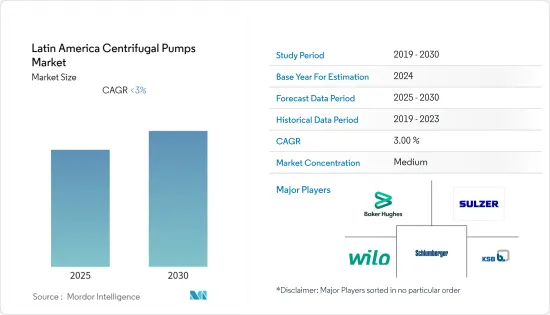

拉丁美洲离心式帮浦市场预计在预测期内复合年增长率将低于3%

主要亮点

- 预计严格的能源和环境监管措施以及法律法规将在预测期内推动拉丁美洲离心式帮浦市场的扩张。根据国际能源总署 (IEA) 2014 年的衡量标准,马达驱动装置理想情况下应达到 20-30% 的节能。

- 由于上游、中游和下游领域的许多不同应用越来越多地使用不同类型的泵,石油和天然气最终用户领域可能会主导离心式帮浦市场。

- 此外,使深海探勘和超深海探勘成为可能的技术发展预计将增加石油产量,并在预测期内为市场成长提供机会。例如,苏利南从国家石油公司管理的陆上油田生产石油,包括加尔各答、坦巴雷霍和坦巴雷霍西北地区,目标是2021年产量为16,500桶/日。除了新许可週期的常规准备外,Statsory 将于明年对 Stabroek 附近的深水区块 58 做出最终投资决定,预计该区块将于 2025 年生产第一批石油。

- COVID-19 大流行对拉丁美洲的石油和天然气活动产生了负面影响。这一下降主要是由于计划建设活动的延误和供应链中断,从而减少了该地区对离心式帮浦的需求。

- 然而,由于勘探和生产公司削减成本和计划延误,石油和天然气价格的剧烈波动也可能影响离心式帮浦市场。

拉丁美洲离心式帮浦市场趋势

石油和天然气领域主导市场

- 离心式帮浦用于石油和天然气领域,用于输送石油和石油产品、液化气和其他流体。石油和天然气基础设施发展的激增预计将在预测期内极大地推动拉丁美洲离心式帮浦市场。

- 拉丁美洲地区智利、苏利南、巴西、乌拉圭、阿根廷、圭亚那、墨西哥、玻利维亚、哥伦比亚和巴拉圭在使用低硫汽油方面继续取得进展。例如,自 2020 年 1 月以来,阿根廷一直在分销和商业化最高硫含量为 10 ppm 的超 3 级汽油。根据将于 2020 年 1 月生效的国际海事组织 (IMO) 2020 年法规,低硫燃料需求的增加将迫使主要炼油厂升级其现有基础设施以生产低硫燃料。由于炼油厂预计将进行维修,未来几年对离心式帮浦的需求可能会增加。

- 根据BP统计,截至2021年,拉丁美洲原油消费量648.8万桶/日。原油需求的成长预计将推动整个拉丁美洲对离心式帮浦的需求。

- 此外,2020年9月,Rystad Energy年度高峰会「拉丁美洲海上活动」宣布将于2021年恢復,仅巴西和圭亚将授权到2025年日产尖峰时段产量超过300万桶。其中超过 80% 的产能的盈亏平衡价格低于每桶 45 美元,无论市场状况如何,预计都会获得许可。未来三年,非洲大陆将推出并获得许可的约30个海上石油计划,由国家石油公司营运这些计划。这意味着对即将到来的石油计划的投资将加强该地区的离心式帮浦销售。预计这将推动拉丁美洲离心式帮浦的成长。

- 鑑于上述情况,预计石油和天然气领域将在预测期内主导拉丁美洲的离心式帮浦市场。

多级离心式帮浦领域占主要市场份额

- 离心式帮浦的叶轮在压力下输送液体。多级泵浦具有更好的压力范围和流量,因为它们包含许多叶轮。

- 在多级离心式帮浦中,每个叶轮的作用类似于泵链中的单级泵。多级离心式帮浦的优点来自于其炼式结构。

- 当液体从一个叶轮移动到另一个叶轮时,压力增加,而流量保持恆定。透过依靠多个叶轮来分配泵浦的压升负载,多级离心式帮浦可以用更小的马达产生更大的功率和更高的压力,从而使用更少的能源。

- 多级离心式帮浦因其更高的效率和在更高压力下泵送流体的能力而被用于各种工业应用。例如,多级离心式帮浦用于消防作业,对水加压以帮助灭火。

- 当需要大量高压流体时,通常使用大容量、多段离心式帮浦。这包括油砂SAGD 设施、工业冷凝系统、炼油厂、管道、逆渗透水生产等中的加热水。例如,2010年至2021年,拉丁美洲原油精製能力预计将增加86%,这将带动拉丁美洲多层离心式帮浦的投资。

拉丁美洲离心式帮浦产业概况

拉丁美洲离心式帮浦帮浦市场由贝克休斯公司、荏原公司、ITT Inc.、KSB SE &Co.KGaA、Ruhrpumpen Group、Schlumberger Ltd、Sulzer Ltd、Weir Group PLC、GRUNDFOS、Wilo SE 等知名参与企业主导。

- 2021 年 7 月 - 伟尔矿业推出 Multiflo 和 Mudflo 液压潜水渣浆泵。这些泵浦具有专为尾矿池再处理和搬迁、蓄水坝维护以及煤泥和污泥池高效安全管理而设计的液压水场工段。此创新解决方案结合了 Warman MGS 泵端、Multiflo CB32 液压刀具和 ESCO 钻齿,可在高压下高效泵送磨料浆料。 Weir Minerals 独有的 Ultrachrome A05 铬合金叶轮确保高耐磨性。专门设计的吸入过滤器可防止较大的固态和碎片进入泵,从而最大限度地降低堵塞风险。基于 Warman 数十年泵浦设计经验,Multiflo 和 Mudflo 泵浦可抽水 150 至 1,200m3/h,最大扬程为 82m。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 供应链分析

- 政府法规和措施

第五章市场动态

- 促进因素

- 已开发国家对用水和污水管理的需求不断增加

- 抑制因素

- 空化对离心式帮浦的影响

第六章 市场细分

- 按阶段

- 单级泵浦

- 多级泵浦

- 潜水泵

- 无密封泵浦

- 轴流/混流泵

- 最终用户

- 石油和天然气

- 化学处理

- 饮食

- 用水和污水

- 建造

- 其他的

- 依叶轮类型(定性)

- 开放式

- 半开式

- 封闭式

第七章 公司简介

- Baker Hughes Company

- Ebara Corporation

- ITT Inc.

- KSB SE & Co. KGaA

- Ruhrpumpen Group

- Schlumberger Ltd

- Sulzer Ltd

- Weir Group PLC

- GRUNDFOS

- Wilo SE

第八章投资分析

第九章 市场机会及未来趋势

简介目录

Product Code: 91629

The Latin America Centrifugal Pumps Market is expected to register a CAGR of less than 3% during the forecast period.

Key Highlights

- The Stringent energy and environmental regulatory policies and legislation are projected to drive expansion in the Latin America centrifugal pumps market during the forecast period. According to the International Energy Agency's (IEA) 2014 policy, a motor-driven unit should ideally be built to produce 20-30% energy savings.

- The oil and gas end-user segment is likely to dominate the centrifugal pumps market, owing to the increased use of different types of pumps in the upstream, midstream, and downstream sectors for a number of distinctly different applications.

- Furthermore, technological developments that have enabled deep-water and ultra-deep-water explorations are likely to increase oil production and give market growth opportunities during the forecast period. for instance, Suriname produces oil from onshore fields managed by Staatsolie, including Calcutta, Tambaredjo, and Tambaredjo North West, with a target output of 16,500b/d in 2021. In addition to the usual preparations for a new licensing cycle, Staatsolie is planning to make a final investment decision for deepwater block 58, near Stabroek, next year to produce the first oil in 2025.

- The COVID-19 pandemic has negatively impacted oil and gas activities in Latin America region. The decline was caused mainly due to delays in project construction activities and supply chain disruptions, which reduced demand for centrifugal pumps in this region.

- However, volatile crude oil and gas prices are also likely to affect the centrifugal pumps market due to cost-cutting and delayed projects by the Exploration & Production companies.

Latin America Centrifugal Pumps Market Trends

Oil and Gas Segment to Dominate the Market

- Centrifugal pumps are used in the oil and gas sector to pump oil and petroleum products, liquefied gases, and other fluids during operations. The surge in the development of oil and gas infrastructure is expected to provide a huge thrust to the centrifugal pump market in latin america during the forecast period.

- The Latin American region continues to advance toward the usage of lower sulfur gasoline within the respective countries of Chile, Suriname, Brazil, Uruguay, Argentina, Guyana, Mexico, Bolivia, Colombia, and Paraguay. Argentina, for example, has been distributing and commercializing Ultra Grado 3 gasoline with a maximum sulfur content of 10 ppm beginning January 2020. According to IMO 2020 International (Maritime Organization) regulation implemented in January 2020, the increasing demand for low sulfur fuel will likely force major refiners to upgrade the existing infrastructure to produce low sulfur fuels. With refineries expecting renovation, the need for centrifugal pumps will likely increase over the next few years.

- According to BP Statistics, as of 2021, crude oil consumption reached 6488 thousand barrels per day in Latin America. The increasing demand for crude oil is expected to drive the demand for centrifugal pumps across Latin America.

- Moreover, in September 2020, Rystad Energy's Annual Summit, Offshore activity in Latin America, is projected to resume in 2021, with over 3 million barrels per day of peak production sanctioned in Brazil and Guyana alone by 2025. More than 80% of this capacity has a breakeven price of less than USD 45 per barrel and is expected to be sanctioned regardless of market conditions. Over the next three years, around 30 offshore oil projects will be launched and permitted across the continent, with national oil firms operating these projects. This means that investments in coming oil projects will enhance sales of centrifugal pumps in this region. This is expected to drive growth for centrifugal pump in Latin America.

- Owing to the above points, the oil and gas segment is expected to dominate the centrifugal pumps market during the forecast period in latin america.

Multi Stage Centrifugal Pump Segment to have Significant Share in the Market

- The impeller of a centrifugal pump is pressurizes and transports the liquid. Multistage pumps have considerably superior pressure ranges and flow rates since they contain many impellers.

- Within a multistage centrifugal pump, each impeller acts like a single-stage pump within a chain of pumps. The benefits of multistage centrifugal pumps derive from their chain-like construction.

- As the liquid moves from one impeller to the other, its pressure boosts while the flow rate remains constant. By relying on multiple impellers to spread the pressure-building load of the pump, multistage centrifugal pumps can generate tremendous power and higher pressure with smaller motors, therefore using less energy.

- Multistage centrifugal pumps are used in various industrial applications because of their increased efficiency and ability to pump fluids at higher pressures. For example, Multistage centrifugal pumps are used in firefighting to pressurize water to help extinguish fires.

- High-capacity multi-stage centrifugal pumps are commonly employed when huge amounts of high-pressure fluids are needed. This includes heating water for SAGD installations in the oilsands, industrial condensate systems, refineries, pipelines, and reverse osmosis water desalination. For instance, the crude oil refinery capacity was grown 86% from 2010 to 2021 in Latin America which is expected to drive investments in multi-stage centrifugal pumps in Latin America.

Latin America Centrifugal Pumps Industry Overview

The Latin America Centrifugal Pumps Market is Fragmented with the presence of prominent players like: Baker Hughes Company, Ebara Corporation,ITT Inc., KSB SE & Co. KGaA, Ruhrpumpen Group, Schlumberger Ltd, Sulzer Ltd, Weir Group PLC, GRUNDFOS, Wilo SE.

- July 2021 - Weir Minerals has introduced the Multiflo and Mudflo hydraulic submersible slurry pumps. These pumps have a hydraulically powered wet end specifically designed to reprocess and relocate tailings ponds, maintain water retention dams, and manage slimes and sludge ponds efficiently and safely. The innovative solution combines the Warman MGS pump-end, Multiflo CB32 hydraulic cutters, and ESCO excavation teeth to pump highly charged and abrasive slurries efficiently. Weir Minerals' unique Ultrachrome A05 chrome alloy impeller ensures high wear resistance. The specially engineered suction strainer minimizes the risk of clogging by preventing large solids & debris from entering the pump. Drawing on decades of Warman pump design experience, the Multiflo, Mudflo pump can pump between 150 and 1,200m3/h, up to 82m head.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Supply Chain Analysis

- 4.4 Government Policies and Regulations

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Increased demand in developed countries for water and wastewater management

- 5.2 Restraints

- 5.2.1 The effect of cavitation in centrifugal pumps

6 MARKET SEGMENTATION

- 6.1 By Stage

- 6.1.1 Single-stage Pumps

- 6.1.2 Multi-stage Pumps

- 6.1.3 Submersible Pumps

- 6.1.4 Seal less & Circular flow Pumps

- 6.1.5 Axial & Mixed Flow Pumps

- 6.2 End User

- 6.2.1 Oil and Gas

- 6.2.2 Chemical Processing

- 6.2.3 Food and Beverage

- 6.2.4 Water and Wastewater

- 6.2.5 Construction

- 6.2.6 Other End Users

- 6.3 By Impeller Type (Qualitative)

- 6.3.1 Open

- 6.3.2 Partially Open

- 6.3.3 Enclosed

7 COMPANY PROFILES

- 7.1 Baker Hughes Company

- 7.2 Ebara Corporation

- 7.3 ITT Inc.

- 7.4 KSB SE & Co. KGaA

- 7.5 Ruhrpumpen Group

- 7.6 Schlumberger Ltd

- 7.7 Sulzer Ltd

- 7.8 Weir Group PLC

- 7.9 GRUNDFOS

- 7.10 Wilo SE

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219