|

市场调查报告书

商品编码

1635391

北美离心帮浦:市场占有率分析、行业趋势和成长预测(2025-2030)NA Centrifugal Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

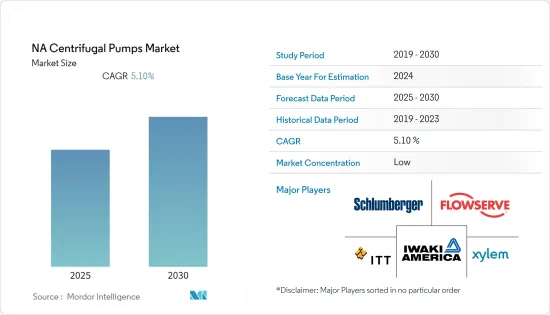

北美离心帮浦市场预计在预测期内复合年增长率为 5.1%。

主要亮点

- 住宅和商业基础设施的快速发展以及製造业的扩张正在推动北美离心帮浦市场的发展。快速都市化也是增加建筑业投资的因素。市场的成长引起了各个领域对此类泵浦的高需求。

- 例如,2021年2月,加拿大政府宣布将在未来八年内投资149亿加元(合120亿美元)用于公共交通计划,提振加拿大建设产业的长期生产。

- 化工、石油和气体纯化及加工产业的扩张预计也将推动市场的显着成长。此外,使深海探勘和超深海探勘成为可能的技术进步预计将在预测期内增加石油产量并提供市场成长机会。

- 例如,根据IEA的数据,2021年至2025年间,北美(加拿大、美国、墨西哥)油气投资将达到约8.1兆美元,其中石油约占4.9兆美元,天然气约占4.9美元。 ,约占3.2 兆美元。石油和天然气需求的成长预计将推动全部区域的离心帮浦需求。

- 此外,自主技术越来越多地被各行业采用。自主技术的日益采用和传统技术的替代等因素也促进了市场的成长。

- 例如,2022 年 4 月,迪尔公司宣布向无人驾驶技术迈出新的一步,与总部位于加州的 GUSS Automation LLC 组成合资企业。该合资企业专注于加州特定的高价值作物系统。 GUSS 也代表全球无人喷涂系统,并采用 Myers 两级离心帮浦。

北美离心帮浦浦市场趋势

石油和天然气产业预计将占据主要市场占有率

- 许多国家出于经济和战略原因依赖石油和天然气。美国等国家拥有大量原油蕴藏量供未来使用。这些石油和天然气蕴藏量测量结果是投资者的指标,石油存量基准的变化反映了生产和消费的趋势。

- 离心帮浦也用于石油和天然气工业,以泵送石油和石油产品、液化气和其他流体。研究地区石油和天然气基础设施开发的快速成长预计将在预测期内显着推动离心帮浦市场的发展。例如,2021 年 11 月,Southern ITS International Inc. 宣布将怀俄明州一家公司 Pure Oil &Gas, Inc. 作为完全子公司成立,以充实其不断扩大的能源解决方案和产品系列。

- 此外,康菲石油公司位于阿拉斯加国家石油储备区的 GMT-2 石油计划于 2021 年 12 月开始生产。此计划预计高峰期产量为 30,000 桶/天。该计划的开发成本总计140万美元。由于上述因素,预计上游产业在预测期内将大幅成长。

- 从北美油气合约的细分领域来看,2021年12月,上游领域的合约数量最多,为63份,其次是中游领域,有10份合同,下游领域有3份合约。

- 例如,2022年2月,BP PLC宣布启动墨西哥湾赫歇尔扩建计划。 Herschel 是 2022 年全球完成的四个重大计划中的第一个。计划的第一阶段涉及开发新的海底生产系统。在第一口井的高峰期,该平台的年总产量预计将增加10,600桶油当量/日。

加拿大预计将出现显着成长

- 离心帮浦的主要行业之一是化学工业。离心帮浦由于能够有效、低成本地处理各种液体、浆料和固态,因此在该行业中得到广泛应用。未来五年,流程重新设计的成长趋势将推动需求,加拿大公司希望优化流程以降低单位生产成本、提供新产品或比以前更有效率地生产。

- 此外,2022 年 1 月,加拿大石油生产商协会 (CAPP) 预测天然气和石油投资将成长 22%。 2021 年,该产业的资本投资预计将从 60 亿美元增至 328 亿美元,总投资为 269 亿美元。

- 此外,加拿大市场得到发达的石油和天然气、食品和饮料行业以及大量政府投资的支持。该国庞大的石油和天然气业务使其成为离心帮浦的主要进口国之一。加拿大的石油工业对北美经济做出了巨大贡献。加拿大也拥有世界第三大石油蕴藏量,是第四大石油生产国和出口国。

- 此外,2021 年 10 月,帝国石油公司加入了亚伯达的锂提取先导计画,利用其能源专业知识从曾经丰富的油藏中回收关键矿物。该公司向 E3 Lithium股票收购权投资了 635 万美元,从而进入许可权了从广阔的 Leduc 地层下方的含水层中抽取富锂盐水的计划。

- 此外,由于建设投资增加,国内需求也增加。例如,根据加拿大统计局的数据,2021 年 12 月建筑工程投资(包括住宅和非住宅领域)成长 1.9%,达到 184 亿美元。

北美离心帮浦产业概况

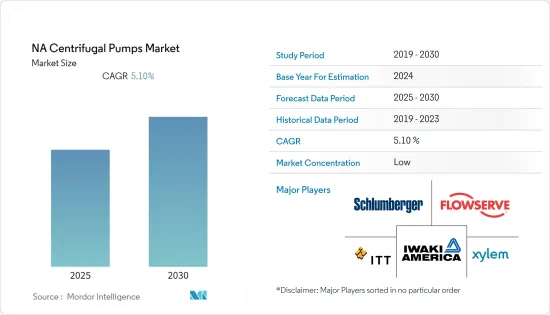

北美离心帮浦市场竞争激烈,有许多公司提供产品。公司推出新产品并与其他製造商结成策略联盟,以扩大产品系列併满足最终用户不断增长的需求。 Flowserve Corporation、Xylem, Inc.、Schlumberger Ltd 和 ITT Inc. 等公司是该市场的主要企业。

- 2021 年 4 月 - IDEX Corporation 以 4.7 亿美元现金收购 Airtech Group Inc.、 美国 Valve Corporation 以及 EagleTree Capital 管理的投资基金的相关营业单位。 Airtech 製造和设计各种压力技术,包括离心帮浦、再生式鼓风机、压缩机系统和阀门。

- 2021 年 2 月 - 总部位于德克萨斯州休士顿的工业泵销售和服务供应商ABET Distributing USA, Inc. 宣布推出 CRANE 3" X 3" 自吸离心泵改造。自吸离心帮浦的独特之处在于它可以在吸水头条件下进行自吸。它们从地下储槽或坑中吸取液体,这使得它们比地下储槽更容易、更安全。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 化工、食品和食品饮料行业的需求不断增长

- 能源效率日益重要

- 市场限制因素

- 离心帮浦的气蚀问题

第六章 市场细分

- 按流量类型

- 轴流式

- 径向

- 混合物

- 依阶段数

- 单级

- 多级

- 按最终用户产业

- 石油和天然气

- 化学

- 饮食

- 用水和污水

- 製药

- 发电

- 建造

- 金属/矿业

- 其他最终用户产业

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Xylem, Inc.

- Schlumberger Limited

- Flowserve corporation

- ITT Inc

- Iwaki America Inc.

- Magnatex Pumps, Inc.

- Titan Manufacturing, Inc.

- Hayward Flow Control

- Finish Thompson Inc

- Zoeller Company, Inc.

- Premier Fluid Systems Inc.

- John Blue Company

- Westpower

第八章投资分析

第9章 市场的未来

简介目录

Product Code: 91640

The NA Centrifugal Pumps Market is expected to register a CAGR of 5.1% during the forecast period.

Key Highlights

- The rapidly developing residential and commercial infrastructure and the expansion of the manufacturing sector are propelling the North American centrifugal pump market. In addition, The rapid urbanization is attributed to increased investment in the construction industry. The growing market is responsible for the high demand for these types of pumps in various sectors.

- For instance, in February 2021, the Canadian government's announced to invest CAD 14.9 billion (USD 12 billion) in public transportation projects over the next eight years will promote long-term output in the Canadian construction industry.

- The expansion of chemical, oil, and gas refining and processing industries is also expected to generate significant growth in the market. Moreover, technological advancements that have enabled deep-water and ultra-deep-water explorations are expected to increase oil production and provide market growth opportunities during the forecast period.

- For instance, according to the IEA, oil and gas investment in North America (Canada, the United States, and Mexico) is expected to lead the way at nearly USD 8.1 trillion between 2021 and 2025, with oil accounting for almost USD 4.9 trillion and gas accounting for almost USD 3.2 trillion. The increasing demand for oil and gas is expected to drive the demand for centrifugal pumps across the region.

- Moreover, autonomous technologies are increasingly being adopted across various industries. The factors such as the increasing adoption of autonomous technologies and the replacement of traditional ones are also augmenting the market growth.

- For instance, in April 2022, Deere & Company announced to make a new move toward unmanned technologies and formed a joint venture with California-based GUSS Automation LLC. The joint venture focuses on specific California high-value crop systems. Also, the GUSS, which stands for Global Unmanned Spray System, utilizes Myers two-stage centrifugal pump.

North America Centrifugal Pumps Market Trends

Oil & Gas Industry is Expected to Hold a Significant Market Share

- Many nations rely on oil and gas for economic and strategic reasons. Countries such as the United States keep large reserves of crude oil for future use. The measurement of these oil and gas reserves is an indicator for investors; changes in oil stock levels reflect trends in production and consumption.

- Moreover, centrifugal pumps are used in the oil and gas industry to pump oil and petroleum products, liquefied gases, and other fluids during operations. The surge in oil and gas infrastructure development in the studied region is expected to boost the centrifugal pump market during the forecast period significantly. For instance, in November 2021, Southern ITS International Inc. announced the launch of Pure Oil & Gas, Inc., a Wyoming corporation, as a wholly owned subsidiary to add to their growing family of energy solutions and products.

- Furthermore, in December 2021, ConocoPhillips began production at its GMT-2 oil project in Alaska's National Petroleum Reserve. At its peak, the project is anticipated to produce 30,000 b/d. The project's development costs totaled USD 1.4 million. As a result of the mentioned factors, the upstream segment is expected to grow significantly during the forecast period.

- Staring at oil & gas contracts in North America by segment, the upstream segment contributed the most in contracts awarded, with 63 in December 2021, followed by midstream and downstream, with ten and three arrangements, respectively.

- For instance, in February 2022, BP PLC announced opening the Herschel Expansion project in the Gulf of Mexico. Herschel is the first of four significant projects to be completed globally in 2022. Phase 1 of the project entails developing a new subsea production system. At its peak, the first well is expected to increase platform annual gross production by an estimated 10,600 barrels of oil equivalent per day.

Canada is Expected to Register Significant Growth

- One of the key industries for centrifugal pumps is the chemical industry. Centrifugal pumps are widely used in this industry because they handle a wide range of liquids, slurries, and solids at high efficiencies and low costs. Over the next five years, demand will be driven by the growing trend of process re-engineering, allowing Canadian companies to offer new products or produce them more efficiently than before by lowering unit production costs through process optimization.

- Furthermore, in January 2022, the Canadian Association of Petroleum Producers (CAPP) forecasted a 22% increase in natural gas and oil investment. Capital investment in the sector is expected to increase from USD 6.0 billion to USD 32.8 billion, up from a total investment of USD 26.9 billion in 2021.

- Further, the Canadian market is supported by well-developed oil & gas, food & beverage industries, and significant government investments. Because of the country's extensive oil and gas operations, it is one of the key importers of centrifugal pumps. The Canadian petroleum industry contributes significantly to the North American economy. Also, Canada has the world's third-largest oil reserves and the fourth-largest oil producer and exporter.

- Moreover, in October 2021, Imperial Oil Ltd. joined an Alberta lithium extraction pilot project, lending its energy expertise in the quest to recover the critical mineral from a once-prolific oil formation. It has invested USD 6.35 million in E3 Lithium Ltd. warrants, giving it access to plans to pump what the companies hope will be lithium-rich brine from the aquifer beneath the sprawling Leduc formation.

- Additionally, the demand in the country is also witnessing an increase due to the rising construction investments. For instance, according to Statistics Canada, the investment in building construction (including residential and non-residential sectors) increased by 1.9% to USD 18.4 billion in December 2021.

North America Centrifugal Pumps Industry Overview

The Centrifugal Pumps Market in North America is significantly competitive, with various companies offering their products in the region. Companies to launch new products and form strategic alliances with other manufacturers to expand their product portfolios and meet the increasing demands of the end-users. Companies including Flowserve Corporation, Xylem, Inc., Schlumberger Ltd, and ITT Inc, among others, are the key players in this market.

- April 2021- IDEX Corporation acquired Airtech Group Inc., US Valve Corporation, and related entities for a cash consideration of USD 470 million from investment funds managed by EagleTree Capital. Airtech produces and designs various engineered pressure technology, such as centrifugal pumps, regenerative blowers, compressor systems, and valves.

- February 2021- ABET Distributing USA, Inc., a significant industrial pump sales and service provider based in Houston, Texas, has announced the release of CRANE 3" X 3" SELF-PRIMING CENTRIFUGAL PUMPS REBUILT. Self-priming centrifugal pumps are unique in that they can prime themselves under suction lift conditions. They draw fluid up from below-ground tanks or pits, making them easier and safer to work on than those below ground.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand From the Chemical, Food, and Beverage Industry

- 5.1.2 Rising Significance in Energy Efficiency

- 5.2 Market Restraints

- 5.2.1 Cavitation Problem in Centrifugal Pumps

6 MARKET SEGMENTATION

- 6.1 By Flow Type

- 6.1.1 Axial

- 6.1.2 Radial

- 6.1.3 Mixed

- 6.2 By Number of Stages

- 6.2.1 Single Stage

- 6.2.2 Multi Stage

- 6.3 By End-user Industries

- 6.3.1 Oil & Gas

- 6.3.2 Chemicals

- 6.3.3 Food & Beverage

- 6.3.4 Water & Wastewater

- 6.3.5 Pharmaceutical

- 6.3.6 Power Generation

- 6.3.7 Construction

- 6.3.8 Metal & Mining

- 6.3.9 Other End-user Industries

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Xylem, Inc.

- 7.1.2 Schlumberger Limited

- 7.1.3 Flowserve corporation

- 7.1.4 ITT Inc

- 7.1.5 Iwaki America Inc.

- 7.1.6 Magnatex Pumps, Inc.

- 7.1.7 Titan Manufacturing, Inc.

- 7.1.8 Hayward Flow Control

- 7.1.9 Finish Thompson Inc

- 7.1.10 Zoeller Company, Inc.

- 7.1.11 Premier Fluid Systems Inc.

- 7.1.12 John Blue Company

- 7.1.13 Westpower

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219