|

市场调查报告书

商品编码

1635403

东协网路安全:市场占有率分析、产业趋势与成长预测(2025-2030)ASEAN Cyber Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

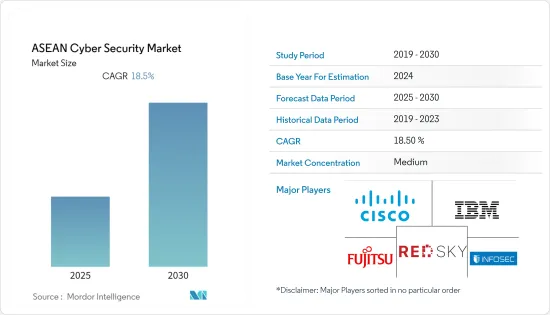

预计东协网路安全市场在预测期间的复合年增长率为 18.5%。

主要亮点

- 由于东协地区网路攻击增多,该地区各国正努力加强防御能力。然而,该地区也是世界其他地区网路攻击的主要来源之一。

- 最近,在 COVID-19主导的情况下,应用程式安全变得越来越重要。此解决方案有助于确保您组织的资讯和资产免受资料外洩、恶意软体、拒绝服务 (DDoS) 攻击和病毒等安全威胁。由于智慧型手机在不同地区的渗透率不断提高以及IT倡议的影响,企业和个人经常使用的应用程式正在迅速流行。

- 此外,5G的到来预计将加速互联设备在已经迈向工业革命4.0的产业中的使用。这场革命透过物联网的兴起支持了跨产业的蜂巢连结。机器对机器的连接已成为应用程式安全的驱动力。

- 据印尼国家网路密码局(BSSN)称,5G技术的发展也造成了网路安全漏洞。由于印尼网站存在许多漏洞,数位经济诈骗和勒索软体攻击预计将会增加。两个民间社会组织谴责 2020 年 4 月针对两个着名机构的网站和批评政府应对 COVID-19 大流行的科学家的社交媒体帐户的网路攻击。

东协网路安全市场趋势

云端预计将获得显着的市场占有率

- 企业越来越意识到透过将资料移至云端而不是建置和维护新的资料储存来节省成本和资源的重要性,这正在推动对云端基础的解决方案的需求,并最终推动需求安全服务的采用。由于其各种优势,云端平台和生态系统预计将成为未来几年数位创新速度和规模爆炸性成长的跳板。

- 随着 IT 交付从本地转移到异地,安全性已成为云端引进週期每个阶段的关键考虑因素。由于网路安全预算有限,中小型企业更喜欢云端部署,这样他们可以专注于自己的核心能力,而不是在安全基础设施上投入资金。

- 此外,公有云服务的采用将信任的边界扩展到组织之外,使安全性成为云端基础设施的重要组成部分。然而,云端基础的解决方案的使用增加极大地简化了企业网路安全工作。

- 随着云端平台服务使用的增加,关键任务数位产业中未受管理的风险数量呈现爆炸性成长。云端安全态势管理 (CSPM) 可实现跨不同云端基础架构的云端安全管理自动化。这导致该领域的收购活动增加。

新加坡可望获得显着的市场占有率

- 据新加坡网路安全局称,勒索软体事件、网路诈骗和与 COVID-19 相关的网路钓鱼活动在 2020 年网路格局中占据主导地位。此外,网路安全局表示,只要 COVID-19 仍然是全球医疗保健危机,恶意网路活动就会持续增加。

- 此外,麦克菲网路弹性报告的调查结果显示,新加坡 92% 的组织计划在 2020 年增加网路安全投资,其中包括解决方案提供商 (68%)、系统整合(58%),他们计划利用外部专业知识,例如供应商(57%)和咨询公司(52%)。

- 有鑑于供应链存在许多网路安全风险,新加坡政府已启动两项倡议,以建立最佳实践,以更好地管理整个供应链的网路安全风险。共有 11 个部门被认为是为国家提供关键服务的关键资讯基础设施的一部分,包括政府、能源、银行和医疗保健。

- 例如,2022 年 3 月,微软宣布了安全解决方案和指南,以降低复杂性,让新加坡的中小企业更容易满足 CSA 的 Cyber Essentials 标誌认证要求。在日益严峻的网路威胁情况下,微软旨在帮助新加坡企业实施适当的网路卫生措施,以保护业务、资料和客户免受常见的网路攻击。

东协网路安全产业概况

东协网路安全市场较为分散,领先企业采取多种成长策略,例如併购、新产品发布、业务扩张、合资企业和伙伴关係关係,以巩固其在该市场的地位。该市场的主要企业包括 IBM 公司、思科系统公司、富士通泰国公司、Red Sky Digital Ventures Ltd 和 Info Security Consultant。

- 2022 年 4 月 - 数位解决方案供应商 Benchachinda Group 的子公司 Cyber Elite 宣布在 Menlo 推出泰国首个託管云端网路安全平台,以加强企业的网路防御。该公司期待为客户提供简化的网路安全,以实惠的价格实现对网路威胁的保护、侦测和回应,并透过订阅模式适应各种客户预算。

- 2022年4月-新加坡网路安全局(CSA)针对网路安全保全服务供应商推出新的授权规则,以保护消费者利益并解决消费者与供应商之间的资讯不对称问题。 CSA 向两类提供渗透测试和託管安全营运中心监控服务的供应商颁发许可证。这些提供者包括直接从事此类服务的公司和个人、协助此类公司的第三方提供者以及可授权保全服务的经销商。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 价值链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 对数位化和可扩展IT基础设施的需求不断增长

- 需要因应各种趋势带来的风险,包括第三方供应商风险、MSSP 演变以及采用云端优先策略

- 市场限制因素

- 网路安全专家短缺

- 高度依赖传统认证方式且准备不足

- 趋势分析

- 泰国越来越多的组织正在使用人工智慧来加强其网路安全策略

- 向云端基础的交付模式的转变将导致云端安全性呈指数级增长。

第六章 市场细分

- 按服务

- 安全类型

- 云端安全

- 资料安全

- 身分存取管理

- 网路安全

- 消费者安全

- 基础设施保护

- 其他类型

- 按服务

- 安全类型

- 按发展

- 云

- 本地

- 按最终用户

- BFSI

- 卫生保健

- 製造业

- 政府/国防

- 资讯科技/通讯

- 其他最终用户

第七章 竞争格局

- 公司简介

- IBM Corporation

- Cisco Systems Inc

- Fujitsu Thailand Co. Ltd

- Red Sky Digital Ventures Ltd

- Info Security Consultant Co. Ltd

- Dell Technologies Inc.

- Fortinet Inc.

- CGA Group Co. Ltd

- Intel Security(Intel Corporation)

第八章投资分析

第9章市场的未来

The ASEAN Cyber Security Market is expected to register a CAGR of 18.5% during the forecast period.

Key Highlights

- Growing cyberattacks in the ASEAN region have propelled various countries in the region to strengthen its defensive capabilities. However, the region also stands to be a one of the major source of origin for cyberattacks in other parts of the world.

- Application security has gained importance recently amid COVID-19 led situations. The solution helps ensure that an organization's information and assets are protected from security threats such as data breaches, malware, denial of service (DDoS) attacks, and viruses. Applications, which are prominently used in enterprises, as well as for personal use, are witnessing tremendous adoption owing to the IT initiatives coupled with the growing smartphone penetration, regionally.

- In addition, the advent of 5G is expected to expedite the use of connected devices in the industries that are already pushing toward industrial revolution 4.0. This revolution has aided cellular connectivity throughout the industry through the rise of IoT. Machine-to-machine connections are driving the traction of application security.

- According to the National Cyber and Encryption Agency (BSSN), in Indonesia, the development of 5G technology has also created a loophole in cybersecurity, as the technology will enable faster stealing of data. With the existence of many loopholes in Indonesian websites, digital economy fraud and ransomware attacks are expected to rise in the nation. Two civil groups condemned cyberattacks on the websites of two prominent institutions and the social media account of a scientist, all of whom have been critical of the government's handling of the COVID-19 pandemic in April 2020.

ASEAN Cybersecurity Market Trends

Cloud Expected to Witness Significant Market Share

- The increasing realization among enterprises about the importance of saving money and resources by moving their data to the cloud instead of building and maintaining new data storage is driving the demand for cloud-based solutions, and hence, the adoption of on-demand security services. Owing to multiple benefits, cloud platforms and ecosystems are anticipated to serve as a launchpad for an explosion in the pace and scale of digital innovation over the next few years.

- Security has been a critical consideration at each step of the cloud adoption cycle, as IT provision has moved from on-premise to outside of the company's walls. SMEs prefer cloud deployment as it allows them to focus on their core competencies rather than invest their capital in security infrastructure since they have limited cybersecurity budgets.

- Furthermore, the deployment of public cloud service extends the boundary of trust beyond the organization, which makes security a vital part of the cloud infrastructure. However, the increasing usage of cloud-based solutions has significantly simplified enterprises' adoption of cybersecurity practices.

- As cloud platform services see an increase in use, there has been an explosion in the number of unmanaged risks in the mission-critical digital industry. Cloud Security Posture Management (CSPM) automates cloud security management across the diverse cloud infrastructure. Due to this, there has been an increased acquisition activities in the segment.

Singapore Expected to Witness Significant Market Share

- According to the Cybersecurity Agency of Singapore, ransomware incidents, online scams, and Covid-19-related phishing activities dominated the cyber landscape of 2020. Moreover, the Cyber Security Agency stated that the malicious cyber activities would continue to rise so long as COVID-19 remains a global healthcare crisis.

- Further, According to McAfee Cyber Resilience Report findings, 92% of Singaporean organizations revealed plans to invest more in cybersecurity in 2020, with plans in place to leverage external expertise such as solution providers (68%), system integrators (58%), vendors (57%) and consulting firms (52%).

- The Singapore government launched two initiatives to establish best practices to better manage cybersecurity risks across the supply chain, after recognizing that the supply chain carries many cybersecurity risks. A total of 11 sectors were considered part of the critical information infrastructure responsible for delivering the country's essential services, such as government, energy, banking, and healthcare.

- Various companies have also been introducing cybersecurity solutions in the country, For instance, in March 2022, Microsoft announced security solutions and guidance to reduce complexity and make it easier for Singapore SMEs to address certification requirements of the Cyber Essentials mark by CSA. Microsoft aims to help Singapore companies put in place good cyber hygiene practices to protect their operations, data, and customers against common cyber-attacks in an increasingly challenging cyber threat landscape.

ASEAN Cybersecurity Industry Overview

The ASEAN Cybersecurity Market is fragmented and has some major players who have adopted various growth strategies, such as mergers and acquisitions, new product launches, expansions, joint ventures, partnerships, and others, to strengthen their position in this market. The major players in the market are IBM Corporation, Cisco Systems Inc, Fujitsu Thailand Co. Ltd, Red Sky Digital Ventures Ltd, Info Security Consultant Co. Ltd, among others.

- April 2022 - Cyber Elite, a subsidiary of digital solutions provider Benchachinda Group, has enlisted Menlo Security Inc to launch the first managed cloud cybersecurity platform in Thailand to strengthen enterprises' cyber defence. The company is looking forward to provide simplified cybersecurity for customers to enable them to protect, detect, and respond to cyberthreats which can serve different customer budgets with reasonable prices through subscription models.

- April 2022, - The Cyber Security Agency of Singapore (CSA) has launched new licensing rules for cybersecurity service providers, to protect consumers' interests and solve the information asymmetry between consumers and providers. The CSA will provide licenses to two types of providers, providing penetration testing and managed security operations center monitoring services. They include companies or individuals who are directly engaged for such services, third-party providers that support such companies, and resellers of the licensable cybersecurity services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Digitalization and Scalable IT Infrastructure

- 5.1.2 Need to tackle risks from various trends such as third-party vendor risks, the evolution of MSSPs, and adoption of cloud-first strategy

- 5.2 Market Restraints

- 5.2.1 Lack of Cybersecurity Professionals

- 5.2.2 High Reliance on Traditional Authentication Methods and Low Preparedness

- 5.3 Trends Analysis

- 5.3.1 Organizations in Thailand increasingly leveraging AI to enhance their cyber security strategy

- 5.3.2 Exponential growth to be witnessed in cloud security owing to shift toward cloud-based delivery model.

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Security Type

- 6.1.1.1 Cloud Security

- 6.1.1.2 Data Security

- 6.1.1.3 Identity Access Management

- 6.1.1.4 Network Security

- 6.1.1.5 Consumer Security

- 6.1.1.6 Infrastructure Protection

- 6.1.1.7 Other Types

- 6.1.2 Services

- 6.1.1 Security Type

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By End User

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Manufacturing

- 6.3.4 Government & Defense

- 6.3.5 IT and Telecommunication

- 6.3.6 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Cisco Systems Inc

- 7.1.3 Fujitsu Thailand Co. Ltd

- 7.1.4 Red Sky Digital Ventures Ltd

- 7.1.5 Info Security Consultant Co. Ltd

- 7.1.6 Dell Technologies Inc.

- 7.1.7 Fortinet Inc.

- 7.1.8 CGA Group Co. Ltd

- 7.1.9 Intel Security (Intel Corporation)