|

市场调查报告书

商品编码

1635405

瞬态保护元件:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Transient Protection Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

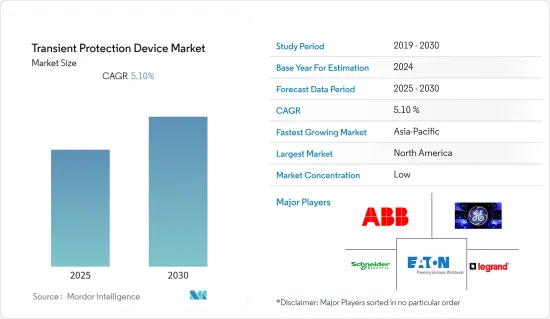

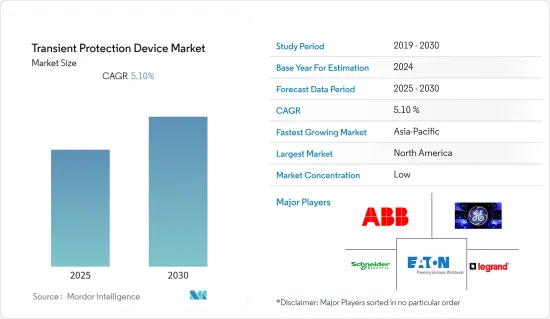

预计瞬态保护元件市场在预测期间内复合年增长率为 5.1%

主要亮点

- 美国、中国、日本和印度等主要经济体致力于在多个产业领域开发节能电气系统,这推动了瞬态保护装置的需求激增。例如,印度铁路部门的研究、开发和标准化组织 (RDSO) 建立了一个名为 CAMTECH(高级维护技术中心)的中心。 CAMTECH 旨在透过将防雷和瞬变保护装置放置在信号设备的整合电源中,升级维护技术和程序,并提高所有铁路资产和员工的生产力和绩效。

- 近年来,为了实现碳中和环境,对可再生能源的需求不断增加,确保电网的可靠性变得重要。此外,还需要加强输变电设备对大规模雷击的容错能力。因此,对瞬态电流保护元件的需求预计将会增加。

- 此外,对智慧电源分接头的需求不断增长也促进了市场的成长。客户对支援 Wi-Fi 的电源分接头需求量很大,因为它们可以自动建立时间表和计时器并监控能源使用情况。这就是为什么多家公司致力于提供支援 Wi-Fi 的电源分接头并为其客户提供全面的解决方案。例如,APC 提供智慧瞬态保护、支援 Wi-Fi 的电源分接头,配备三个雷克萨斯智慧插头、一个 USB 充电器连接埠和 2,160 焦耳的智慧插头瞬态保护。

- 此外,随着智慧设备、智慧家庭技术和智慧城市计划使用的增加,对智慧家庭瞬态保护设备的需求预计也会增加。例如,2021 年 10 月,美国能源局(DOE) 宣布将拨款 6,100 万美元用于 10 个先导计画,这些项目将利用新技术将数千个家庭和企业改造为先进的节能结构。这些互联社区有潜力与电网进行通讯,以优化能源消耗并减少碳排放和能源价格。

- 然而,设计具有更高保护等级的紧凑型瞬态保护元件所面临的挑战可能会限制市场的成长。例如,高效能瞬态保护元件包含许多必须放置在电路中并联阵列中的元件。由于机械设计缺陷,各个抑制组件可能必须比相邻组件承受更多的能量,从而导致理论模型和实际设备之间的性能水平存在差异。

- 此外,COVID-19大流行也严重影响了装置生产的供应,对瞬态保护元件市场的成长产生了负面影响。此外,由于缺乏现场访问和原材料短缺,包括瞬态保护装置在内的各种电子元件製造商面临短期营运挑战。

瞬态保护元件市场趋势

智慧城市对瞬态电流保护元件的需求不断增长预计将推动市场成长

- 作为「一带一路」数位丝路倡议的一部分,中国政府一贯鼓励与智慧城市的合作。 《中国-东协战略伙伴关係2030愿景》加强了东协内部合作,中国致力于支持东协技术转型倡议,例如《2020年东协资讯通信技术总体规划》和《东协智慧城市网路》。

- 此外,美洲地区各国政府也支持智慧城市的实施。例如,拉斯维加斯正在测试三个先导计画,政府已拨款5亿美元探索到2025年连接整个城市的方法。

- 据亚洲开发银行称,东南亚国家联盟 (ASEAN) 国家约有一半人口居住在都市区,预计到 2025 年将有 7,000 万人成为城市居民。因此,东协可持续都市化策略认识到智慧城市计划和智慧建筑等技术进步是应对这些都市化挑战的解决方案。这些倡议得到了国际投资的支持,经合组织估计,2010年至2030年间,所有城市基础设施计划将总共花费约1.8兆美元。数位化基础设施的投资预计将推动需求,增加对资产安全的需求。

- 智慧建筑使用各种互连的自动化系统,例如温度控制、多媒体系统、通讯和安全系统,并且特别容易受到雷暴和照明的影响。因此,透过电源线和资料线进入结构的瞬变会对各种敏感电子设备产生负面影响,例如电脑、警报系统、转换器、PLC 和影音设备。另一方面,网路元件通常特别容易受到雷击和瞬态事件的影响,因为它们依赖连续的电源和资料供应来实现持续的功能和可用性。

- 此外,智慧建筑中的设备故障可能会导致所有互连繫统瘫痪,从而导致建筑和职场环境遭到破坏并产生相关成本。所有这些都可以透过在系统中加入强大的瞬态保护装置来消除或减少。瞬态电流保护元件也用于智慧建筑中使用的智慧型设备的电源管理。

亚太地区预计将经历显着成长

- 由于人们生活水准的提高、可支配收入的增加以及智慧家庭的普及,亚太地区的瞬态电流保护装置市场正在强劲成长。例如,根据统计和规划实施部的数据,印度的可支配个人收入从2020年的199,689,740卢比增加到2021年的238,573,760卢比。此外,根据日本统计局的数据,日本的可支配收入从 2022 年 4 月的 436,850 日圆下降至 5 月的 359,510 日圆。

- 影响该地区智慧家庭市场的关键因素是透过智慧电子产品的应用对节能照明和安全解决方案的需求不断增加,从而推动了瞬态保护装置市场的发展。例如,在中国,住宅城乡建设部和公共安全联合发布关于加快发展数位住宅的建议,指出2022年终前出台数位住宅政策、方法和标准.

- 此外,工业4.0计划正在应用于汽车和电子机械,以实现远端资料收集、远距离诊断和远端维护。这些努力增加了对资料中心、伺服器和通讯系统的需求。例如,在政府当局的支持下,资料中心在中国不断发展。近日,中国政府宣布了一项三年计画(2021-2023),目标是到2023年实现200 exaflops的资料中心运算能力。此外,政府鼓励超大规模资料中心的行动也正在推动资料中心建置。例如,2021年4月,印度电子和资讯技术部(MeitY)计划制定一项计划,奖励该国超大规模资料中心的投资,在短时间内将现有容量增加10倍以上。该地区资料中心的成长间接导致该地区瞬变保护设备的成长。

- 此外,该地区的数位转型也正在推动市场成长。例如,2022年5月举办的华为亚太数位创新大会,来自亚太地区10多个国家的1,500余人齐聚一堂,共同探讨数位创新和数位经济的未来。这项活动由华为和东协基金会共同主办,政府相关人员、专家、研究人员、合作伙伴和分析师出席。该地区的这些倡议显示了亚太地区瞬态电流保护设备市场的成长潜力。

- 此外,中国建筑技术的崛起正在推动该地区的瞬态电流保护设备市场。例如,2021年2月,日立楼宇科技与中国电信广州公司宣布推出更智慧、更有效率、更安全的产品和服务,为中国的建筑和综合体提供统一的安全、能源和设备管理服务,签署了合作谅解备忘录。重点关注基础设施支撑和优化、升级、整合。

瞬态保护设备产业概况

瞬态电流保护元件市场竞争激烈且高度细分,因为它由几个主要参与者组成。市场上竞争公司之间的对抗关係取决于公司的侵略性策略,例如新产品开发、产能扩张、併购、策略联盟、伙伴关係、协议以及研发活动投资。

- 2022 年 5 月 - 瞬态保护装置製造商罗格朗在海得拉巴开设了印度第一家零售店「罗格朗工作室」。这家大型零售店将出售罗格朗印度集团公司的全系列产品,旨在加强罗格朗在印度的足迹。此外,罗格朗在印度拥有 30 多个互动产品展示室,包括 Innova、Studio 和店中店等形式。

- 2022年3月-被誉为高性能扬声器製造商的ELAC宣布计画凭藉Protek系列瞬态保护器进军设备保护产品领域。 ELAC 着手创建具有更现代功能和更高性能水平的设备保护装置产品线。应用程式控制、Wi-Fi、蓝牙和 Alexa/Google Assistant 相容性使其在市场上的许多竞争对手中脱颖而出。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 各国政府对公共法规的不断变化

- 智慧城市对瞬态保护装置的需求不断增长预计将推动市场成长

- 市场限制因素

- 具有增强保护等级的紧凑型瞬变保护装置的开发问题

第六章 市场细分

- 按类型

- 交流瞬变保护系统

- 直流瞬变保护系统

- 按行业分类

- 工业的

- 商业的

- 住宅

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- ABB Ltd

- General Electric Company

- Schneider Electric SE

- Eaton Corporation

- Legrand SA

- Siemens AG

- Emerson Electric Co.

- CG Power and Industrial Solutions

- Littelfuse

第八章投资分析

第九章 市场未来展望

简介目录

Product Code: 91664

The Transient Protection Device Market is expected to register a CAGR of 5.1% during the forecast period.

Key Highlights

- The focus of major economies like the United States, China, Japan, India, etc., on developing energy-efficient electrical systems across multiple industrial sectors is adding to the upsurge in demand for transient protection devices. For instance, the Research Designs and Standards Organization (RDSO), a unit of the Indian Railways has developed a center called CAMTECH (Centre for Advanced Maintenance Technology). CAMTECH aims to increase the productivity and performance of all railway assets and workforce by upgrading maintenance technologies and procedures by including lightning and transient protection device arrangements in integrated power supply for signalling installations.

- In recent years, to achieve carbon neutral environment, the demand for renewable energy has increased, and ensuring the reliability of power grids has become more important. In addition, there is a requirement to enhance the resilience of transmission and substation equipment for large-scale lightning strikes. Resultantly, the demand for transient protection devices is expected to witness an uptick.

- Additionally, the rising demand for smart power strips is also contributing to boost the market's growth. Customers are in great demand for Wi-Fi-enabled power strips due to their ability to automatically create schedules, timers, and monitor energy usage. Therefore, several businesses are working towards offering Wi-Fi-enabled power strips, to serve as a comprehensive solution to their customers. For instance, APC is offering a smart transient protection WI-FI enabled Power strip with 3 Alexa Smart Plugs, USB Charger Ports, and 2160 Joules of Smart Plug transient Protection.

- Further, the need for smart home-enabled transient protection devices is predicted to rise with the rise in smart gadget use, smart home technology, and smart city projects. For instance, in October 2021, the US Department of Energy (DOE) announced the allocation of USD 61 million to ten pilot projects that would use new technologies to turn thousands of homes and businesses into advanced, energy-efficient structures. These Connected Communities may communicate with the electrical grid to optimize their energy consumption, lowering carbon emissions and energy prices.

- However, the challenges in designing compact transient protection devices with enhanced protection levels will likely restrain the market's growth. For example, high functional transient protection devices include numerous components that must be placed in parallel arrays in the circuit. Individual suppression components may have to endure greater energy than the adjacent due to poor mechanical design, and this is causing fluctuations in the performance level between the theoretical model and real devices.

- Moreover, the COVID-19 pandemic also has had a negative impact on the Transient Protection Device market's growth by severely impacting the supply for the device production. Further, due to a lack of site access and deficiencies in raw materials, manufacturers of various electronic components, including transient protection devices, faced short-term operational challenges.

Transient Protection Device Market Trends

An Increase in the Need for Transient Protection Devices in Smart Cities is Expected to Drive the Market's Growth

- The Chinese government routinely encourages smart city collaboration as part of the Belt and Road Initiative's Digital Silk Road Initiative. Cooperation within ASEAN is strengthened by the ASEAN-China Strategic Partnership Vision 2030, whereby China has vowed to support ASEAN's initiatives for technological transformation, such as the ASEAN ICT Master Plan 2020 and the ASEAN Smart City Network.

- Furthermore, various governments in the American region are also boosting the adoption of smart cities. For instance, Las Vegas is testing three pilot projects, with the government allocating USD 500 million to find ways to connect the entire city by 2025.

- According to Asian Development Bank, about half of the population in the countries making up the Association of Southeast Asian Nations (ASEAN) live in urban areas, and 70 million more people are expected to become urban dwellers by 2025. Hence, the ASEAN Sustainable Urbanization Strategy recognizes technological advancements such as smart city projects and smart buildings as a solution to tackle these urbanization challenges. These initiatives are supported by international investments, which the OECD estimates will total around USD 1.8 trillion for all urban city infrastructure projects between 2010 and 2030. The demand is anticipated to be driven by the investment in digitized infrastructure, which would increase the need for asset security.

- A broad variety of interconnected automatic systems such as temperature control, multimedia systems, telecommunications, and security systems are used in smart buildings that are particularly sensitive to the effects of thunderstorms and lighting. As a result, any transient that enters the structure, not only through the power supply lines but also through the data lines, might harm a wide range of sensitive electronic equipment, including computers, alarm systems, transducers, PLCs, and audio-visual equipment. Networked components, on the other hand, are particularly vulnerable to lightning strikes and transients in general since they rely on a continual supply of power and data for their continued functioning and availability.

- Moreover, failure of equipment in a smart building could bring all interconnected systems to a halt, resulting in the breakdown of buildings and work environments, as well as the related expenses. These all can be eliminated or can be reduced by integrating powerful transient protection devices into the systems. Transient protection devices are also used in power management for smart equipment used in smart buildings.

Asia-Pacific is Expected to Witness a Significant Growth

- The APAC region is witnessing a robust growth in the transient protection devices market owing to the enhanced living standards of the population, rising disposable income, and increasing adoption of smart homes. For instance, according to the Ministry of Statistics and Programme Implementation, Disposable Personal Income in India increased to INR 23,85,73,760 Million in 2021 from INR 19,96,89,740 INR Million in 2020. Furthermore, According to the Statistics Bureau of Japan, Disposable Personal Income in Japan decreased to JPY 359.51 Thousand in May from JPY 436.85 Thousand in April 2022

- The key element impacting the market for smart homes in the region is the increased desire for energy-efficient lighting and security solutions through the application of smart electronic products, boosting the transient protection device market. For example, in China, the Ministry of Housing and Urban-Rural Development and the Ministry of Public Security jointly released recommendations on speeding the development of digital houses, stating that policies, methods, and standards for digital homes should be in place by the end of 2022.

- Additionally, the Industry 4.0 initiative is being applied to vehicles and electrical machinery to enable remote data capture, remote diagnostics, and remote maintenance. Such initiatives have augmented the need for data centers, servers, and communication systems. For Instance, China has been growing in data centers with support from governmental authorities. Recently, the Chinese government issued a three-year plan (2021-2023) which calls for 200 exaflops of data center computing by 2023. Furthermore, The government bodies' steps to incentivize hyper-scale data centers are also driving their construction. For instance, in April 2021, the Indian Ministry of Electronics and Information Technology (MeitY) announced that it plans to develop a scheme to incentivize investments in hyper-scale data centers in the country and increase the current capacity over ten-fold in a short period. Rising of Data Centers in the region is indirectly causing the growth of Transient protection devices in the region.

- In addition, the digital transformation in the region is also driving the market growth. For instance, in May 2022 the Huawei APAC Digital Innovation Congress brought together over 1500 people from over ten nations in APAC to discuss the future of digital innovation and the digital economy. The event is co-hosted by Huawei and the ASEAN Foundation, with government officials, specialists, researchers, partners, and analysts among the attendees. These initiatives in the region show the potential for growth of the transient protection device market in the APAC region.

- Moreover, the rising of building technology in China is driving the transient protection device market in the region. For instance, in February 2021, Hitachi Building Technology and China Telecom Guangzhou signed an MOU to work cohesively to develop smart building solutions to provide smarter, more efficient, and secure products & services that will provide unified security, energy, and device management services to buildings and complexes in China. With a focus on infrastructure support and optimization, upgrading, and integration of infrastructure.

Transient Protection Device Industry Overview

The Transient Protection Device market is highly fragmented, as the market is highly competitive and consists of several major players. The competitive rivalry in the market depends on the company's aggressive strategies in new product development, capacity expansion, mergers and acquisitions, strategic collaborations, partnerships, and agreements, as well as investment in R&D activities.

- May 2022 - Legrand a manufacturer of transient protection devices opened its first retail shop in India, the Legrand Studio in Hyderabad. This mega retail store would house all of Legrand's India group company's products with the goal of strengthening Legrand's footprints in the country. In addition, Legrand has over 30 interactive product showrooms in India, including Innova, Studio, and Shop-in-Shop formats.

- March 2022 - ELAC, a well-known high-performance speaker manufacturer announced its plans to enter the equipment protection product area with the Protek line of transient protectors. ELAC set out to create a line of equipment protection devices with more modern features and greater performance levels. App control, Wi-Fi, Bluetooth, and Alexa / Google Assistant compatibility set it apart from much of the competition in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Ongoing Changes That Various Governments Are Making to Their Public Safety Regulations

- 5.1.2 An Increase in the Need for Transient Protection Devices in Smart Cities is Expected to Drive the Market's Growth

- 5.2 Market Restraints

- 5.2.1 Design Challenge to Develop Smaller Size Transient Protection Devices With Enhanced Protection Level

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 AC Transient Protection System

- 6.1.2 DC Transient Protection System

- 6.2 By End-user Verticals

- 6.2.1 Industrial

- 6.2.2 Commercial

- 6.2.3 Residential

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 General Electric Company

- 7.1.3 Schneider Electric SE

- 7.1.4 Eaton Corporation

- 7.1.5 Legrand S.A.

- 7.1.6 Siemens AG

- 7.1.7 Emerson Electric Co.

- 7.1.8 CG Power and Industrial Solutions

- 7.1.9 Littelfuse

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219