|

市场调查报告书

商品编码

1635408

德国POS终端市场:份额分析、产业趋势、成长预测(2025-2030)Germany POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

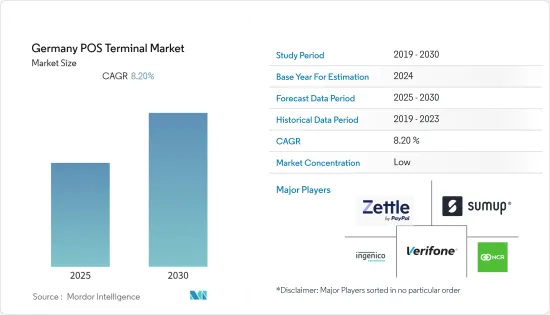

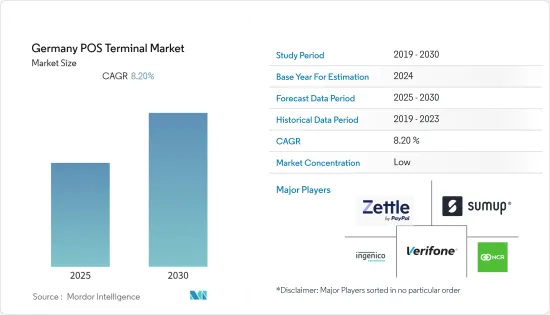

德国POS终端市场预估在预测期间内复合年增长率为8.2%

主要亮点

- 政府法规和措施正在塑造该国的付款场景。多项符合规则的法律已经出台,以促进一体式 POS 终端的各种整合。例如,根据epay.de 报导,2021 年11 月,德国银行委员会(GBIC) 发布了针对POS 系统和非接触式支付的新技术附件(TA) 7.2 或TA7.2 勘误表更新,定义了对非接触式付款的修订。 2022 年 1 月 1 日之后违反此功能的行为将从 2022 年 9 月 30 日起受到 2.9 分(或 29 欧分)的处罚。

- 这些措施指导新终端设备的合规性以及对现有设备进行相应升级的需求。它还定义了网路安全措施,确保所有 POS 终端的普遍行为。 TA和内建增值税(VAT)制度等安全系统也会定期更新设备内核,定义设备与公司提供的软体和付款介面服务之间的关係。

- 由于德国人越来越偏好用于卡片相关和非接触式付款的电子卡,该市场正在不断增长。例如,根据欧洲卡片系统机构的数据,2021 年6 月对1,200 名消费者进行的一项调查发现,47% 的消费者更喜欢在收银台使用Giro 卡(以前的EC 卡)付款,13% 的消费者选择信用卡。这些不断增长的消费者偏好对 POS 终端机产生了巨大的需求。

- 儘管采取了严格的措施,网路安全和资料外洩仍然对系统构成持续威胁,并且仍然影响着保守比例的德国人口。软体不一致会带来问题。例如,根据 hackaday.com 报道,2022 年 5 月,Verifone 的 POS 终端 H5,000 由于其中一个证书已过期而停止处理付款,影响交易数天。证书需要访问该公司的网站,而不是透过无线更新。这些问题也凸显了法律合规的重要性以及更顺畅的技术选择和网路安全措施的必要性。

- 由于COVID-19大流行,随着网路购物和付款方式的使用增加,用户更喜欢使用终端进行实体交易以外的付款方式。然而,透过结合NFC和QC码,用户现在可以透过POS终端提供的非接触式资金转帐方式进行线上付款并製作虚拟卡。此外,意识和卫生意识较强的用户正在使用智慧穿戴装置和智慧型手机在POS终端上进行非接触式付款,推动市场持续成长。

德国POS终端市场趋势

零售业对市场成长贡献显着

- 零售业越来越多地转向付款和线上付款,作为取代现金的新常态。全国各地的大型卖场和零售连锁店都在采用智慧 POS 解决方案,更倾向于集中付款记录和系统。此类系统的实施符合政府标准,以确保付款安全可靠。技术的发展也带来了智慧集成,以提供更好的用户体验。

- 例如,Diebold Nixdorf 和德国麦当劳签署了扩大 IT 服务伙伴关係协议。根据协议,迪堡利多富将为德国麦当劳的新店和升级提供安装、试运行和维护服务,并透过独家 IT 服务合作伙伴 SOS Industriesservice GmbH 进行协调和实施。此次伙伴关係还包括引入自助服务终端和 TSE Connect Box 等付款交易技术,以实施 Kassensicherungsverordnung(KassenSichV:德国 POS 系统安全法规)。

- 消费者偏好的显着变化也是现金支付转变为电子付款的促成因素,从而创造了对 POS 终端的巨大需求。例如,根据Worldpay 2022年5月发布的《2022年全球支付报告》显示,2021年现金交易占比为40%,而2020年为55%,签帐金融卡交易占2017年为25%。 ,现金交易占比为25%。同样,信用卡交易也略有成长,从 2021 年的 1% 增加到 2021 年的 7%。

- 自COVID-19以来,出于卫生考虑而避免现金付款导致市场发生巨大变化,增加了对POS终端的需求。此外,透过将 POS 终端集成为檯面选项和资料主导的交易结果的一体化解决方案,零售商可以更方便地追踪付款以及税收和其他要求。手持终端和自助服务站预计将利用德国发达的零售基础设施来推动市场的未来。

非接触式付款的普及正在推动市场

- 在这个市场中,「触碰支付」等非接触式付款的采用比 NFC 的采用更为先进。用户采用率正在显着增加。例如,根据 Postbank 发布的研究,大多数新的 POS 终端都配备了 NFC,作为促进非接触式付款的选项以及替代方案。

- COVID-19 大流行后的采用是明确的,德国公民转向非接触式付款。例如,根据邮政银行 2022 年数位研究,59% 的德国人认为数位付款方式比现金更快、更方便,而 2021 年这一比例为 50%。调查也显示,32%的参与者仅使用卡片进行支付,7%的行动电话进行付款。此外,49% 的参与者赞成使用非接触式付款,并透过携带智慧型手机进行支援。

- 德国拥有完善的网路基础设施,这导致了互联网的广泛使用,甚至在德国的偏远地区也引入了 POS 终端。根据Postnord《2021年欧洲电子商务报告》调查显示,德国网路使用者比例为96%。调查也强调,94% 的人曾在网路上购物。这反映出该公司准备透过 POS 终端扩大和引入非接触式付款,包括在尚未实施的地区。

- 具有 NFC 功能的终端由于其易用性而在德国得到广泛应用,普及了非接触式付款。使用 NFC 的 POS 因其简单快速的付款而越来越受欢迎。据 Verifone 称,已有 2700 万张付款卡和 600 万部智慧型手机支援 NFC,「一触即走」等选项越来越受欢迎。因此,POS终端市场预计将大大受惠于发展和消费行为的进步,大幅推动德国POS终端设备的成长。

德国POS终端产业概况

德国POS终端市场中度至高度细分,服务供应商之间竞争激烈。此外,服务供应商正在策略性地投资收购和合作伙伴关係。

- 2022 年 2 月 - SumUp 和 PrestaShop 建立伙伴关係,以支持中小企业并让商家更轻鬆地在欧洲发展业务。用户可以将 PrestaShop 平台直接连接到他们的 SumUp 帐户,使 SumUp 作为网路商店的付款方式,并自动将所有资料与 SumUp 交易历史同步。透过此次伙伴关係,PrestaShop 商家将受益于 SumUp 为商家提供的其他产品,例如卡片终端、申请、带有 SumUp 卡的 SumUp 商业帐户,以及为微型和奈米细分市场的零售商量身定制的 POS 解决方案。我们的服务。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 评估 COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 非接触式付款在德国的普及

- 使用支援 NFC 的智慧型手机和智慧卡进行付款增加

- 零售业越来越多地采用 NFC POS 解决方案

- 市场问题

- 敏感资讯的资料和安全性问题

- 交易限制问题安装费用

- 市场机会

- 非接触式付款的采用率增加

- POS终端主要法规及申诉标准

- 说明非接触式付款的普及及其对产业的影响

- 重大案例分析

第六章 市场细分

- 按类型细分

- 固定POS系统

- 行动/可携式POS 系统

- 按最终用户

- 零售

- 款待

- 医疗保健

- 其他的

第七章 竞争格局

- 公司简介

- Ingenico Group(Worldline)

- NCR Corporation

- Zettle(PayPal)

- VeriFone, Inc.

- SumUp Limited

- DATECS Ltd.

- Pax Technology

- Dspread Technology(Beijing)Inc.

- Sharp Electronics

- myPOS World Ltd.

- Concardis GmbH(Nets Group)

- Vectron Systems AG

- AURES Group

- Nayax Ltd.

- CCV GmbH

- Bluebird Inc.

第八章投资分析

第九章 市场未来展望

简介目录

Product Code: 91673

The Germany POS Terminal Market is expected to register a CAGR of 8.2% during the forecast period.

Key Highlights

- The government regulations and measures shape the payment scenario in the country. Several laws are introduced to promote different incorporations in the all-in-one POS terminals, complying with the rules. For instance, according to epay.de, in November 2021, the German Banking Industry Committee (GBIC) issued a new Technical Annex (TA) 7.2, or TA7.2 Errata update for POS systems, which defined amendments for the "single tap" functionality for requesting PIN in case of contactless payment. The incompliance of the same post 1st January 2022 would incur 2.9 points (or EUR 29 cents) after 30th September 2022.

- Such measures guide the compliance of the new terminal devices and the need for upgrading the existing devices accordingly. This also defines the cyber security measures, ensuring universal conduct across all POS terminals. The security systems like TA and incorporation of Value Added Tax (VAT) regimes also define the relationship of the device and the software and payment interface services provided by the companies, updating the device kernels regularly.

- The market is seeing a rise due to the increasing preference for electronic cards for card-related and contactless payments among the German crowd. For instance, according to Euro Card System Institution, a recent survey conducted among 1,200 consumers in June 2021 highlighted that 47% of the consumers indicated they preferred to pay at the register with a giro card (formerly known as an EC card), followed by 13% of the consumers selecting a credit card, and 10% to chose another method. The increasing preference among the crowd generates huge significant demand for POS terminals.

- Despite the strict measures, cyber security and data breaches are constant threats to the system, still affecting the conservative share of the German population. The inconsistency of the software raises concerning questions. For instance, in May 2022, according to hackaday.com, Verifone's POS Terminal, H5000, stopped processing payments as one of its certificates expired, affecting the transactions for days. The certificate was not an over-the-air update and required visiting the company's website. Such issues also emphasize the importance of compliance with the law and the requirement for smoother technological options and cybersecurity measures.

- The increased use of online shopping and payment modes through the COVID-19 pandemic has encouraged users to prefer payment modes other than physical transactions through terminals. However, incorporating NFC and QC codes has enabled users to use their online payment and virtual cards through contactless fund transfer methods provided by the POS terminals. The aware and hygiene-conscious users also use their smart wearables and smartphones for contactless payments at the POS terminals, providing constant growth to the market.

Germany POS Terminal Market Trends

Retail Industry to Significantly Help Grow the Market

- The retail sector is shifting towards electronic and online payment modes for the new norm, replacing cash. Introduction of hyper stores and retail chains operating throughout the country prefer centralized payment records and systems, implementing intelligent POS solutions. Such systems are implemented by complying with the government norms, ensuring safe and reliable payments. The evolution of technology is also witnessing smart integrations for a better user experience.

- For instance, Diebold Nixdorf and McDonald's Germany signed an expanded IT service partnership agreement. According to the agreement, Diebold Nixdorf will provide installation, commissioning, and maintenance services for all new McDonald's Germany restaurant openings or upgrades, coordinating and implementing through its exclusive IT-service partner, SOS Industrieservice GmbH. The partnership also included the deployment of self-service terminals and payment transaction technology like the TSE Connect Box to implement the Kassensicherungsverordnung (KassenSichV; a German security regulation for POS systems).

- The significant shift in consumers' preferences is another factor supporting the change in payments from cash to electronic media, creating considerable demands for POS terminals. For instance, in May 2022, according to the Global Payment Report 2022 presented by Worldpay, cash transactions accounted for 40% in 2021, compared to 55% in 2020, along with 25% of the transactions to be debit card transactions in 2017, compared to 38% in 2021. Similarly, Credit Card transactions too registered a slight growth from 1% in 20217 to 7% in 2021.

- The widescale shift after the Covid-19 to avoid cash payments for hygiene has resulted in drastic changes in the market, creating more demand for POS terminals. Moreover, integrations of POS terminals as all-in-one solutions for counter-top options, providing data-driven results for the transactions, has helped retail businesses track their payments better, along with tax and other requisites conveniently. The hand-held form factor and self-service stations will drive the market's future, leveraging Germany's developed retail infrastructure.

Increasing Adoption of Contactless Payments Driving the Market

- The market is witnessing heavy adoption of contactless modes of payments like "tap-to-pay" with the introduction of NFC. The adoption of users is increasing at a considerable rate. For instance, according to the survey results presented by Postbank, most of the new POS terminals are equipped with NFC as an option to facilitate contactless payments, along with alternatives.

- The adoption post the COVID-19 pandemic is evident, shifting the German population toward contactless payments. For instance, according to the Postbank Digital Study 2022, 59% of Germans believed digital payment methods to be faster and easier than cash, compared to 50% in 2021. The survey also highlights that 32% of the participants use cards only, and 7% use mobile phones for making payments. Further, 49% of the participants admitted using contactless payment supported by carrying their smartphone with them.

- The well-established networking infrastructure in the country leads to internet penetration, facilitating the adoption of POS terminals even in remote areas of Germany. According to a survey from "E-Commerce Report in Europe 2021" by Postnord, the proportion of internet users in Germany is 96%. The survey also highlighted that 94% of the citizens had shopped online. This reflects the readiness to expand and adopt contactless payments through POS terminals, including the unreached locations.

- The widescale introduction of NFC-enabled devices in Germany is what popularized contactless payments for its ease of action. The POS with NFC is gaining popularity for easy and fast payments, leveraging NFC. According to Verifone, 27 million payment cards and 6 million smartphones are enabled for NFC, with options like "tap and go" gaining popularity. Hence, the POS terminal market will benefit significantly from the developments and advancing consumer behavior, considerably driving the growth of POS Terminal devices in Germany.

Germany POS Terminal Industry Overview

The Germany POS terminal market is moderate to highly fragmented, with intense competition among the service providers. Further, the service providers invest strategically in acquisitions and partnerships.

- February 2022 - SumUp and PrestaShop enter a partnership to support SMEs and easily enable merchants to grow their business in Europe. The users can connect the PrestaShop platform directly to their SumUp account, which activates SumUp as a payment method for online stores, synchronizing all data automatically with their SumUp transaction history. As a result of the partnership, PrestaShop merchants benefit from several additional products and services that SumUp offers its merchants, including card terminals, invoices, the SumUp business account with the SumUp Card, and point-of-sale solutions customized for retailers from the micro and nano segment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power Of Suppliers

- 4.3.2 Bargaining Power Of Buyers

- 4.3.3 Threat Of New Entrants

- 4.3.4 Threat Of Substitutes

- 4.3.5 Intensity Of Competitive Rivalry

- 4.4 Assessment of the Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Contactless Payment Gaining Popularity in Germany

- 5.1.2 Increased Payments from NFC-Compatible Smartphones and Smart Cards

- 5.1.3 Retail Sector Adopting the NFC POS Solutions Considerably

- 5.2 Market Challenges

- 5.2.1 Data and Security Concerns for Sensitive Information

- 5.2.2 Problems With Transaction Limit Installation Costs

- 5.3 Market Opportunities

- 5.3.1 Rising Adoption of Contactless Payment

- 5.4 Key Regulations and Complaince Standards of PoS Terminals

- 5.5 Commentary on the Rising Use of Contactless Payment And its Impact on the Industry

- 5.6 Analysis of Major Case Studies

6 MARKET SEGMENTATION

- 6.1 Segmentation - By Type

- 6.1.1 Fixed Point-of-Sale Systems

- 6.1.2 Mobile/Portable Point-of-Sale Systems

- 6.2 Segmentation - By End-User

- 6.2.1 Retail

- 6.2.2 Hospitality

- 6.2.3 Healthcare

- 6.2.4 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ingenico Group (Worldline)

- 7.1.2 NCR Corporation

- 7.1.3 Zettle (PayPal)

- 7.1.4 VeriFone, Inc.

- 7.1.5 SumUp Limited

- 7.1.6 DATECS Ltd.

- 7.1.7 Pax Technology

- 7.1.8 Dspread Technology (Beijing) Inc.

- 7.1.9 Sharp Electronics

- 7.1.10 myPOS World Ltd.

- 7.1.11 Concardis GmbH (Nets Group)

- 7.1.12 Vectron Systems AG

- 7.1.13 AURES Group

- 7.1.14 Nayax Ltd.

- 7.1.15 CCV GmbH

- 7.1.16 Bluebird Inc.

8 INVESTMENT ANALYSIS

9 MARKET FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219