|

市场调查报告书

商品编码

1635428

塞阀的全球市场:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Global Plug Valve - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

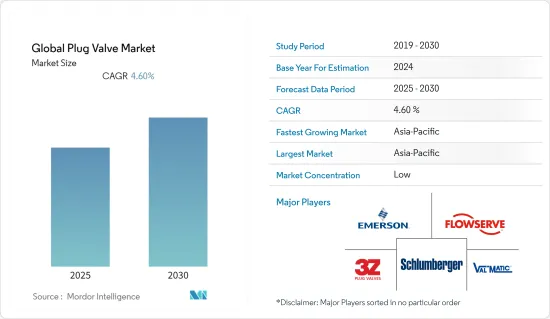

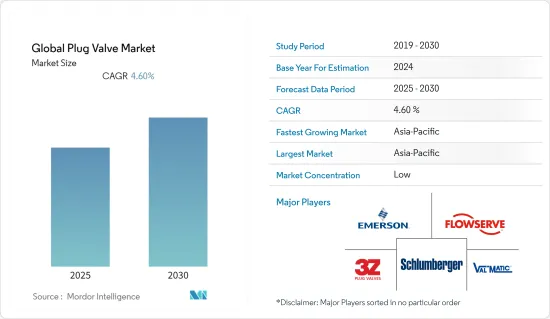

预计全球塞阀市场在预测期间内复合年增长率为 4.6%

主要亮点

- 塞阀是最早使用的阀门之一。这些阀门的主要特点包括结构简单、流体阻力低和快速切换。塞阀是用于调节气体和流体的重要工业部件。此外,这些阀门根据其应用有不同的尺寸和设计。

- 塞阀广泛应用于各个最终用户产业。这些阀门主要用于水和污水处理厂的定向流量控制。世界各国政府为防止水资源浪费而增加的投资正在支持所研究市场的成长。例如,2021 年 7 月,美国农业部 (USDA) 宣布投资 3.07 亿美元,用于对 34 个州和波多黎各的农村饮用水和污水基础设施进行现代化改造。

- 此外,严格的政府法规和解决水资源短缺问题的措施等因素进一步推动了塞阀的需求。例如,2022年3月,沙乌地阿拉伯政府宣布了60多个水利计划,价值350亿沙特里亚尔,以增加该国的战略水储备和海水淡化能力。

- 然而,标准塞阀是透过阀体和机械加工金属塞之间的直接接触来密封的。因此,密封性能比较低,启闭力大,容易磨损。此外,由于高摩擦力,这些阀门的初始运动(打开和关闭)需要很大的力。

- COVID-19 的爆发对所研究的市场产生了显着影响。由于世界各国政府采取严格措施,製造工厂暂时关闭或限产运作。结果,工业阀门的生产受到干扰,造成供需之间的差距。然而,随着世界大多数地区的工业活动和需求恢復到疫情前的水平,预计市场在预测期内将获得牵引力。

塞阀市场趋势

石油和天然气产业占主要市场占有率

- 管道是石油和天然气工业中最重要的元素,因此需要一些可靠的设备来维持管道内石油和天然气的流动。塞阀作为紧密开关阀非常有效,使其适用于涉及自然界中危险液体或腐蚀性气体的应用。

- 在石油和天然气行业,塞阀主要用作泵站中的隔离阀。隔离阀(例如塞阀)可以放置在泵站的两侧,并且可以对止回阀进行维修或跟踪,以防阀门组件或阀门本身需要更换。

- 石油和天然气行业的成长预计将为研究市场创造有利的市场前景。例如,根据美国能源资讯署(EIA)的数据,2022年5月OPEC产量为3,370万桶/日,比2020年第一季的3,340万桶/日高出1%。此外,EIA 预计 2022 年第三季 OPEC 原油和液体燃料总产量将增加至 3,460 万桶/日。

- 研究市场中的多家供应商提供专为满足石油和天然气行业要求而设计的塞阀。例如,Galli&Cassina 是一家义大利公司,主要为石油和天然气产业提供塞阀。 Galli&Cassina的主要产品包括压力平衡润滑塞阀、双密封塞阀、PTFE套筒塞阀。

亚太地区正在经历高速成长

- 由于快速的都市化和工业化,预计亚太地区将成为塞阀的主要需求驱动力。塞阀市场的成长也受到石油和天然气行业、用水和污水等最终用途行业以及该地区几家主要製造商不断增长的需求的推动。

- 中华人民共和国国务院预计,2021年,中国都市化将达64.72%。此外,中国的目标是在「十四五」计画(2021-2025年)期间将都市化提高到65%。由于都市化与环境品质特别是水质直接相关,政府需要增加水资源管理基础设施的投资,以确保工业和住宅用水充足。

- 由于塞阀是用水和污水和废水管以及泵站中使用的重要部件,因此预计这将对所研究市场的成长产生积极影响。该地区的几家供应商为污水行业提供塞阀。例如,AVK 中国提供适用于双向流动的偏心塞阀以及泵浦控关闭和节流服务,适用于废水受到颗粒物和碳氢化合物残留物污染的应用。

- 此外,全部区域不断增长的石油和天然气需求也推动了塞阀的需求。例如,根据 IBEF 的数据,印度的原油进口额从 2017 财年的 707.2 亿美元增加到 2022 财年(4 月至 1 月)的 943 亿美元。此外,印度2021年的石油消费量从2020年的465万桶/日增加到490万桶/日。

塞阀产业概况

由于多个参与企业的存在,塞阀的全球市场呈现碎片化。为了进一步扩大在市场上的影响力,供应商主要致力于开发创新功能并提高产品效率。现有参与企业也专注于併购,以进一步扩大其市场份额。全球塞阀市场的一些知名公司包括艾默生电气公司、福斯公司、3Z 公司和斯伦贝谢有限公司。

- 2022 年 2 月 - 领先的塞阀和其他阀门维修解决方案供应商NYNE 宣布将把艾默生的最终控制生命週期服务部门整合到其机械服务部门。 NYNE 的扩张是 NECI 工厂服务计划的一部分,该计划为客户提供全面的单一来源工厂维护和优化解决方案。

- 2022 年 1 月 - United Valve 宣布收购位于洛杉矶硫磺市的 Global Service & Repair (GSR)。 GSR为上升/旋转金属塞阀和其他锥形塞阀提供维修和改装服务。收购GSR的特种研磨设备将使联合阀门能够更好地维修和服务各类金属塞阀。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 用水和污水产业对塞阀的需求不断增加

- 加大管道基础建设投资

- 市场问题

- 替代品的可用性

第六章 市场细分

- 按类型

- 无润滑塞阀

- 润滑塞阀

- 偏心塞阀

- 膨胀塞阀

- 按设计

- 二通塞阀

- 三通塞阀

- 按最终用户产业

- 石油和天然气

- 化工/石化

- 用水和污水

- 活力

- 其他的

- 按地区

- 北美洲

- 亚太地区

- 欧洲

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Emerson Electric Company

- Flowserve Corporation

- 3Z Plug Valve

- Schlumberger Limited

- Val-Matic Valve & Mfg. Corporation

- Henry Pratt Company(Muller Co. LLC)

- Norgas Controls Inc.

- Galli & Cassina Spa

- NTGD Valve (China) Co. LTD

- Crane ChemPharma & Energy

- AZ Armaturen

- FluoroSeal Group

- Clow Valve Company

- Fujikin Incorporated

- ZheJiang YuanDong Valve Co., Ltd

- GA Industries

第八章投资分析

第九章 市场未来展望

The Global Plug Valve Market is expected to register a CAGR of 4.6% during the forecast period.

Key Highlights

- The plug valves are among the earliest used valves. These valves' key features include a simple structure, low fluid resistance, and fast switching. Plug valves are important industrial components used to regulate gases and fluids. Furthermore, these valves can be available in different sizes and designs depending on their application.

- Plug valves are widely used across various end-user industries. These valves are mainly used for directional flow control in water supply and wastewater treatment plants. The increasing investment being made by the governments across various parts of the world to prevent wastage of water is supporting the growth of the studied market. For instance, in July 2021, the United States Department of Agriculture (USDA) announced an investment of USD 307 million to modernize rural drinking water and wastewater infrastructure in 34 states and Puerto Rico.

- Additionally, factors such as strict government restrictions and measures to address the problem of water scarcity are further driving the demand for plug valves. For instance, in March 2022, the Saudi Arabian government announced over 60 water projects worth SR35 billion to increase water desalination capacity as well as strategic water reserves of the country.

- However, Standard plug valves are sealed by direct contact between the valve body and machined metal plug. As a result, the sealing is relatively poor, the opening and closing force is large, and it is easy to wear. Additionally, because of high friction, these valves' first movement (opening-closing) requires a large amount of force.

- The outbreak of COVID-19 had a notable impact on the studied market. Owing to the strict measures taken by governments across the world, manufacturing plants were either temporarily closed or were operating with limited capacity. Hence, the production of industrial valves was disrupted, resulting in a gap between demand and supply. However, with the industrial activities and demand returning to the pre-pandemic level across the majority of the world, the market is expected to gain traction during the forecast period.

Plug Valve Market Trends

Oil & Gas Sector to Hold Significant Market Share

- As pipelines are the most crucial component of the oil and gas industry, several reliable equipment are required to keep the flow of oil and gas in pipelines. As plug valves are highly effective as tight shut-off & on valves, they are better suited for applications that involve hazardous liquids & gas corrosive in nature.

- In the oil and gas industry, plug valves are used at pump stations primarily as isolation valves. An isolation valve such as a plug valve could be placed on either side of the pump station, allowing for servicing or following a check valve in case valve components or the valve itself need to be replaced.

- The growth of the oil and gas industry is expected to create a favorable market scenario for the studied market. For instance, according to the U.S Energy Information Administration (EIA), in May 2022, OPEC production was 33.7 million b/d, 1% higher than the first quarter of 2020 OPEC production of 33.4 million b/d. Furthermore, EIA expects that OPEC crude oil and total liquid fuel production will increase to 34.6 million b/d in the third quarter of 2022.

- Several vendors operating in the studied market are offering plug valves that are designed specifically according to the requirements of the oil & gas industry. For instance, Galli&Cassina is an Italian company that supplies plug valves primarily to the oil and gas industry. Some of the key products in its portfolio include Pressure balanced lubricated plug valves, dual seal plug valves, PTFE Sleeved plug valves, etc.

Asia Pacific to Witness Highest Growth

- The Asia Pacific region is expected to become the major demand driver for plug valves owing to the rapid urbanization and industrialization happening across the region. The growth of the plug valve market is also driven by the increasing demand from end-use industries, such as the petroleum and natural gas industry, water and wastewater, and several key manufacturers in this region.

- According to the State Council of the People's Republic of China, in 2021, China's urbanization rate of permanent residence hit 64.72 percent. Furthermore, China aims to raise its urbanization rate to 65 percent during its 14th Five-Year Plan (2021-2025). As urbanization is directly linked to environmental quality, especially water quality, the government will have to increase its investment in water management infrastructure to ensure sufficient availability of clean water for industrial as well as residential consumption.

- This, in turn, will positively impact the growth of the studied market as plug valves are an important component used in water and wastewater pipelines and pumping stations. Several vendors operating in the region are offering plug valves for the wastewater industry. For instance, AVK China offers Eccentric plug valves that are adapted for pump control shut-off and throttling service with the bi-directional flow in applications where wastewater is contaminated with particles or hydrocarbon residues.

- Furthermore, the increasing demand for oil &gas across the region is also driving the demand for plug valves. For instance, according to IBEF, crude oil imports from India rose to USD 94.3 billion in FY22 (April to January) from USD 70.72 billion in FY17. Additionally, the oil consumption of India in 2021 increased to 4.9 million barrels per day (b/d) in 2021, from 4.65 million b/d in 2020.

Plug Valve Industry Overview

The Global Plug Valve Market is fragmented due to several players in the market. To further strengthen their market presence, vendors primarily focus on developing innovative functionality for the product and making it highly efficient. Established players are also focusing on mergers & acquisitions to expand their market presence further. Some prominent global plug valve market players include Emerson Electric Co., Flowserve Corporation, 3Z Corporation, and Schlumberger Limited.

- February 2022 - NYNE, a leading valve repair solution provider for plugs and other valves, announced the merger of Emerson's Final Control Lifecycles Services Business Unit into their Mechanical Services Division. The NYNE expansion is part of the NECI Plant Services plan to provide customers with a comprehensive, single-source solution for all plant maintenance and optimization solutions.

- January 2022 - United Valve announced the acquisition of Global Service & Repair (GSR) of Sulphur, LA. GSR was a provider of repair and modification services on rising/rotating metallic plug valves and other tapered plug valve designs. The acquisition of GSR's special grinding equipment will enable United Valve to better perform repair and service on all types of metallic plug valve designs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Plug Valves in Water & Wastewater Industry

- 5.1.2 Increasing investment in Pipeline Infrastructures

- 5.2 Market Challenges

- 5.2.1 Availability of Alternatives

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Non-Lubricated Plug Valve

- 6.1.2 Lubricated Plug Valve

- 6.1.3 Eccentric Plug Valve

- 6.1.4 Expanding Plug Valve

- 6.2 By Design

- 6.2.1 Two-Way Plug Valves

- 6.2.2 Three-Way Plug Valves

- 6.3 By End-User Industry

- 6.3.1 Oil & Gas

- 6.3.2 Chemical & Petrochemical

- 6.3.3 Water & Wastewater

- 6.3.4 Energy

- 6.3.5 Other End-User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Asia Pacific

- 6.4.3 Europe

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Company

- 7.1.2 Flowserve Corporation

- 7.1.3 3Z Plug Valve

- 7.1.4 Schlumberger Limited

- 7.1.5 Val-Matic Valve & Mfg. Corporation

- 7.1.6 Henry Pratt Company (Muller Co. LLC)

- 7.1.7 Norgas Controls Inc.

- 7.1.8 Galli & Cassina Spa

- 7.1.9 NTGD Valve (China) Co. LTD

- 7.1.10 Crane ChemPharma & Energy

- 7.1.11 AZ Armaturen

- 7.1.12 FluoroSeal Group

- 7.1.13 Clow Valve Company

- 7.1.14 Fujikin Incorporated

- 7.1.15 ZheJiang YuanDong Valve Co., Ltd

- 7.1.16 GA Industries