|

市场调查报告书

商品编码

1635436

北美交流 (AC) 驱动器:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Alternating Current (AC) Drive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

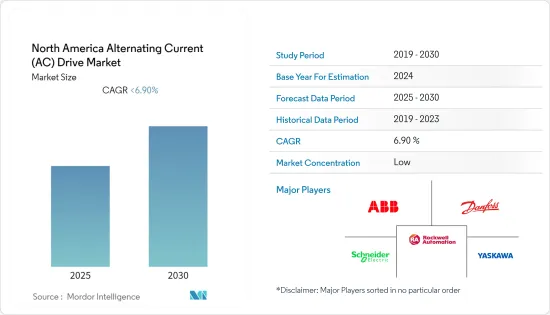

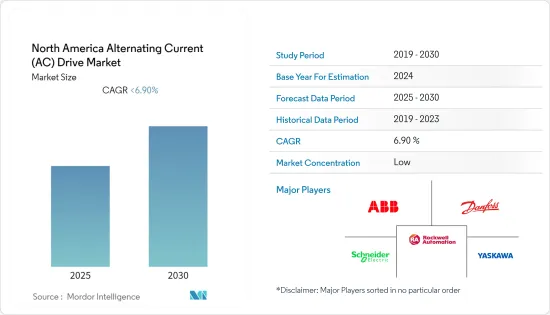

预计北美交流 (AC) 驱动器市场在预测期内的复合年增长率将略低于 6.9%。

全球化正在推动世界各地先进自动化和节能设备的使用。这种用途导致交流变频器,广泛应用于製程、消费和基础设施产业,例如北方的建筑自动化、化学、石油和天然气、食品和饮料、纺织、公共产业、用水和污水和废水以及金属。

主要亮点

- 交流变频器提供平稳、准确的马达速度和扭矩控制,以保护皮带和其他机械设备,延长输送机使用寿命,同时降低营运和维护成本。交流变频器可平稳、精确地控制马达速度,使您能够有效运作设备并调整速度以满足您的製程需求。您也可以将变频器连接到工厂自动化系统以监控负载。

- 此外,北美交流变频器市场依赖当地的製造能力,以避免对其他国家的原材料和许多其他零件的依赖。现在,一些国家的冠状病毒感染率正在下降,製造商正在采取应急计划,以应对不断变化的消费者模式和不可预测的需求。公司利用併购(M&A)来增加其产品的附加价值。

- 交流变频器还为一般应用提供高效的速度和扭矩控制,维护成本低,并且尺寸紧凑。全球工业化和都市化进程迅速推进,电力消耗量不断增加。这些趋势将推动北美地区对低电压交流交流变频器的需求。

- 然而,交流变频器主要应用于工业机械。 COVID-19 的爆发严重阻碍了对交流变频器的需求。由于政府为遏制疫情蔓延而采取的停工措施,许多这些产品的製造商已经永久关闭了工厂。

北美交流 (AC) 驱动器市场趋势

电动帮马达和马达采用交流变频器,提高能源效率

- 交流变频器能够创造和开发更节能的马达技术。据能源部称,北美有两个主要的交流电网和三个较小的交流电网,交流变频器正在迅速被采用。该技术越来越多地被包含在新产品中,提供附加功能并允许交流变频器在系统中发挥更大的作用。

- 根据 IEA 的数据,电动帮浦和马达约占全球电能消耗的 50%。在工业应用中,这个比例甚至更高。根据地区和工业领域的不同,工业中65-75%的电能用于马达。因此,电驱动技术尤其是交流驱动技术在降低全球能源消耗方面具有巨大潜力。

- 交流变频器也适用于大多数应用中的速度控制(约 60-70%),因此可以快速轻鬆地实现高节能。特别是,由于具有显着节能的潜力,风扇和泵浦使用交流变频器已成为主要趋势。

- 随着北美工业自动化水准的不断提高,人们不断需要具有更多自动化控制和稳定提高生产速度的交流变频器,从而提高生产工厂的效率,并且不断开发出更好的方法。

- 此外,几乎所有马达都可以使用专门适合每种马达类型的控制演算法来运作。北美的一些交流变频器製造商将其设计与一小部分马达技术联繫起来。在这方面,机器人正在快速部署交流变频器,以更精确地协调它们与马达的运动。机器人正在迅速应用于新的自动化领域。因此,这将提振北美交流变频器市场的需求。

石油和天然气产业显着成长

- 在北美,电力驱动器用于石油和天然气行业的各种应用,以改变驱动泵、风扇和压缩机等马达部件的马达速度,并且交流驱动装置用于许多应用中。交流变频器产业受到越来越多用于陆上和海上钻井作业的钻机中交流马达的推动,这些钻机用于从石油和天然气领域的储存中提取石油和天然气。

- 此外,泵浦是市场上交流变频器的主要应用。石油和天然气行业中的泵浦用于各种最终应用。在北美,高功率帮浦驱动器主要用于使用高功率马达的石油探勘目的。在中游应用中,大型主泵输送石油和天然气。对节能解决方案不断增长的需求正在推动北美交流变频器市场的成长。

- 具有危险操作条件(例如化学环境)的重工业受益于变频器的紧凑设计和强大的可靠性。交流变频器在各种应用中用作感测器,用于及早检测製程故障和异常。提前安排维护任务,以减少非计划性停机时间和成本,延长应用程式的使用寿命,并确保您的系统面向未来。

- 许多大型能源用户(例如炼油厂)在工厂超过预设限製或基本负载功率时收取高峰值需求电费。当马达在跨线启动时消耗大电流峰值时,通常会发生这些尖峰需求费用。变频驱动器透过逐渐提高马达速度来帮助降低功率峰值。因此,整个石油和天然气产业的交流变频器需求将推动北美交流市场的发展。

北美交流驱动器产业概况

北美交流传动市场竞争激烈,参与者众多,包括丹佛斯、WEG、西门子、富士电机、Schneider Electric、艾默生电气、罗克韦尔自动化、ABB 和安川电机。公司正在透过建立多个伙伴关係关係、投资计划以及将新产品推向市场来扩大市场占有率。

- 2022 年 5 月 - 工业自动化和数位转型解决方案供应商罗克韦尔自动化公司宣布推出适用于工业马达控制应用的新型 Allen-Bradley Armor PowerFlex交流变频器。机上驱动器可实现快速安装、轻鬆试运行和预测性维护。

- 2021 年 7 月 - ABB 收购 ASTI 行动机器人集团,透过自主移动机器人为下一代灵活自动化提供动力。 ASTI 是高速成长的自主移动机器人 (AMR) 市场的全球领导者,拥有广泛的车辆和软体产品组合。此次收购将使ABB能够增加对交流变频器的需求。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对北美交流 (AC) 驱动器市场的影响

第五章市场动态

- 市场驱动因素

- 放宽能效实施法规

- 无感测器驱动器的需求不断增长

- 市场挑战

- 交流变频器价格上涨

第六章 市场细分

- 按电压

- 低电压

- 中压

- 按最终用户产业

- 石油和天然气

- 化学/石化

- 饮食

- 用水和污水

- 发电

- 金属/矿业

- 纸浆/造纸製造

- HVAC

- 离散製造业

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- ABB

- Danfoss

- Schneider Electric

- Rockwell Automation, Inc.

- Yaskawa Electric Corporation

- Mitsubishi Electric Corporation

- Siemens

- Fuji Electric Co., Ltd.

- Emerson Electric Co.

- WEG Industries

第八章供应商市场占有率分析

第九章投资分析

第10章市场的未来

The North America Alternating Current Drive Market is expected to register a CAGR of less than 6.9% during the forecast period.

Globalization is driving the use of advanced automation and energy-saving equipment worldwide. The usage will directly result in increased use of AC drives, widely employed across the process, discrete, and infrastructure industries such as building automation, chemicals, oil & gas, food & beverage, textiles, utilities, water & wastewater, and metals in North America.

Key Highlights

- AC drives help to protect belts and other mechanical equipment by offering smooth and accurate motor speed and torque control, prolonging conveyor life while lowering operational and maintenance costs. AC drives provide efficient operation of the equipment by offering smooth and precise control of motor speed, allowing adjustment of the rate to suit the needs of the process. The drives can also be connected to the plant's automation system to monitor the load.

- Moreover, the AC drive market in North America relies on local manufacturing capabilities to lessen reliance on other countries for raw materials and many other components. Manufacturers are embracing contingency planning to react to shifting consumer patterns and unpredictable demand now that coronavirus infection rates are dropping in several nations. Mergers and acquisitions (M&A) are being used by businesses to add value to their products.

- Also, AC drives offer highly efficient speed and & torque controls for common purposes, little maintenance, and are compact size. A significant rate of industrialization and urbanization across the globe has led to a rise in electricity consumption. These trends will boost the demand for low voltage AC drives in North America.

- However, AC drives have the application primarily in industrial machinery. The COVID-19 outbreak has significantly hampered the demand for AC drives. Many manufacturers of these products have completely shut their plants owing to lockdowns imposed by governments to curb the spread of the pandemic.

North America Alternating Current (AC) Drive Market Trends

Electric Pumps and Motors will Become more Energy Efficient with AC Drives

- AC drives allow for the creation and advancement of more energy-efficient motor technology. According to the Department of Energy, North America has two major and three minor alternating current (AC) power grids or "interconnections," implying that AC drives are being rapidly adopted. The technology is increasingly being implemented in new products, providing additional features and allowing the AC drive to play a larger part in the system.

- According to the IEA, electric pumps and motors account for about 50% of global electrical energy consumption. In industrial applications, the ratio is even higher. Depending on the region and the industrial area, 65-75% of the electrical energy in industry is used for electric motors. Therefore, electrical drive technology, especially AC drive technology, has great potential for reducing worldwide energy consumption.

- Also, AC drives can lead to high energy savings being quickly and easily realized as most applications (approximately 60-70%) are suitable for speed control. In particular, the usage of AC drives for fans and pumps is primarily main trend due to its advantage of the huge saving potential.

- Due to the ever-increasing level of automation in the industry in North America, there is a continuing need for AC Drives with more automated control and a steady increase in production speeds, thus better methods to improve the efficiency of production plants are constantly being developed.

- Moreover, nearly all motors can operate with control algorithms specially adapted to each motor type. Some manufacturers of AC Drives across North America relate the design to a narrow group of motor technologies. Amongst this Robots are rapidly deploying AC drives to regulate motion more precisely in electric motors. Robots are rapidly being adopted by segments that are new to automation. Therefore, it will boost the demand for AC drive market in North America.

Oil & Gas Industry to Witness Significant Growth

- In North America, electric drives are used in various applications in the oil and gas industry for varying motor speeds driving critical components, including pumps, fans, and compressors, and the AC drive units are used across many applications. The AC drive industry will develop owing to the increase in AC motors used in drilling rigs for both onshore and offshore drilling operations to extract oil and natural gas from reservoirs in the oil and gas sector.

- Moreover, pumps are the major application for AC drives in the market. Pumps in the oil and gas industry are used across all end-user applications. In North America, mostly high-power-rated pump drives are used for oil exploration purposes where high-powered motors are used. In midstream applications, large mainline pumps transport oil and gas. The rising demand for an energy-efficient solution is driving the growth of the North American AC Drive Market.

- Heavy industries with hazardous operating conditions, such as chemical environments, benefit from the drive's compact design and robust reliability. The AC drive is used as a sensor in various applications as it detects faults or irregularities in the processes early. The maintenance operations can be scheduled in advance, reducing unexpected downtime and costs, extending the lifetime of the applications and helping to future-proof the system.

- Many large energy users, such as refineries, will charge higher peak-demand electricity prices when the plant exceeds a preset limit or base load of electricity. These peak demand charges typically occur when motors draw large current peaks when started across the line. Variable frequency drives help reduce power peaks by gradually ramping the motor up to speed. Therefore the demand for AC drives across Oil & Gas Industry will boost the North America Alternating Current AC Market.

North America Alternating Current (AC) Drive Industry Overview

The North American Alternating Current (AC) Drive Market is competitive and consists of several players like Danfoss, WEG, Siemens, Fuji Electric Co., Ltd., Schneider Electric, Emerson Electric Co., Rockwell Automation, Inc., ABB, Yaskawa Electric Corporation, and many more. The companies are increasing their market share by forming multiple partnerships, investing in projects, and launching new products into the market.

- May 2022 - Rockwell Automation, Inc., a provider of industrial automation and digital transformation solutions, has announced the availability of its new Allen-Bradley Armor PowerFlex AC drives for industrial motor control applications. On-machine drives enable faster installation, easier commissioning, and predictive maintenance.

- July 2021 - ABB acquired ASTI Mobile Robotics Group to drive the next generation of flexible automation with autonomous mobile robots. ASTI is a global leader in the high-growth AMR ( Autonomous Mobile Robot ) market with a broad portfolio of vehicles and software. Thus, this accquisition will allow ABB to boost the demand for AC drives.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the North America Alternating Current (AC) Drive Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Ease of Regulation on Energy Efficiency Implementation

- 5.1.2 Emerging Demand for Sensorless Drives

- 5.2 Market Challenges

- 5.2.1 Increasing Prices of AC Drives

6 MARKET SEGMENTATION

- 6.1 By Voltage

- 6.1.1 Low

- 6.1.2 Medium

- 6.2 By End-User Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical & Petrochemical

- 6.2.3 Food & Beverages

- 6.2.4 Water & Wastewater

- 6.2.5 Power Generation

- 6.2.6 Metal & Mining

- 6.2.7 Pulp & Paper

- 6.2.8 HVAC

- 6.2.9 Discrete Industries

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB

- 7.1.2 Danfoss

- 7.1.3 Schneider Electric

- 7.1.4 Rockwell Automation, Inc.

- 7.1.5 Yaskawa Electric Corporation

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Siemens

- 7.1.8 Fuji Electric Co., Ltd.

- 7.1.9 Emerson Electric Co.

- 7.1.10 WEG Industries