|

市场调查报告书

商品编码

1635440

全球闸阀市场:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Global Gate Valve - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

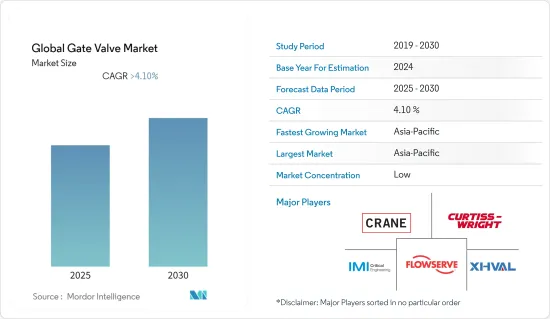

预计全球闸阀市场在预测期内的复合年增长率将超过 4.1%。

闸阀属于多迴转阀门,是工业上使用最多的阀门之一。闸阀广泛用于石油和天然气(管道服务和井口)、发电(包括采用刀闸设计的泥浆服务)、船舶和采矿以及一般工业的开/关/分离应用。闸阀适用于液体、气体和泥浆(包括夹带固态的流体)。

主要亮点

- 闸阀是应用最广泛的阀门类型。这是因为它们有多种尺寸,从大约 1 英寸到超过 60 英寸,并可选择端部连接和压力额定值。美国、德国、俄罗斯、中国、日本、英国、法国、印度和巴西等主要化学品生产国预计将推动对闸阀的需求,因为它们比其他阀门类型具有许多优势。

- 亚太地区对闸阀的需求较多。该地区的成长主要归功于快速的都市化和人口成长。例如,根据中华人民共和国国务院的预测,2021年中国常住人口都市化将达64.72%。水和用水和污水阀门也是亚太地区的重要市场发展点。

- 製造商正专注于技术开发和产品创新,以满足全球各区域市场不断增长的需求。在预测期内,闸阀市场预计将受到减少摩擦和压力管理等闸阀功能的改进以及阀门效率的不断提高的刺激。

- 同时,世界各地的製造工厂也纷纷加入数位转型的潮流。智慧闸阀让企业能够根据实际情况对阀门及相关设备进行细緻的监控、分析和管理。这也适用于闸阀维护。智慧闸阀可以对其健康状况做出回应,并在潜在问题或阀门故障发生之前向您提供建议。因为预防性护理对于维持工厂正常运作非常重要,并且对闸阀市场做出了重大贡献。多家公司正在转向这种智慧阀门,这种趋势也影响着市场的成长。

- 然而,原材料价格波动的加剧和闸阀的高维护成本预计将在预测期内抑制市场成长。原材料价格波动加剧影响製造商根据其特定要求生产闸阀的能力。同时,企业正加大对高性价比技术的研发投入,以降低闸阀的成本。

- 此外,COVID-19 大流行对闸阀产业产生了重大影响。由于工业製造公司努力应对疫情的明显影响,而且石油和天然气行业的产能也有限,各行业的经济活动放缓,闸阀的需求也放缓。然而,随着经济和工业活动的认真恢復,市场预计将逐渐获得牵引力。

闸阀市场趋势

快速工业化推动市场成长

- 此后,世界各地的生产基地越来越多地采用闸阀。它们通常具有大容量,可有效处理重质、高黏度浆料、油脂、油、纸浆、清漆和污水流。此外,由于现有的石油和天然气行业大多处于维护工作状态,维护工作的需求增加了石油和天然气行业维护服务供应商的机会,从而带动了闸阀的需求。

- 自工业革命开始以来,工业部门在世界各地显着扩张。造成这种成长的因素有很多,包括都市化和工业产品消费量的增加。根据美国联邦的数据,2022 年 6 月美国工业总产值下降 0.2%,但第二季年化成长率为 6.1%。

- 工业工业的成长使其成为任何国家GDP的主要支柱之一。例如,根据世界银行的预测,2021年製造业增加价值占欧盟GDP的比重将达到15%。此外,各种工业设施的存在进一步支持了该行业的成长。德国拥有世界上最大的化学工业之一。到 2021 年,大约有 3,500 家化学公司将投入营运。由于化学工业是闸阀的主要消费者之一,预计该国的需求将会成长。

- 工业部门的成长反过来又推动能源需求。例如,美国能源资讯署 (EIA) 估计,2022 年 7 月,全球消耗了约 9,880 万桶石油和液体燃料。由于石油和天然气行业是闸阀的主要消费者,这种趋势预计将支持所研究市场的成长。

亚太地区实现显着成长

- 石油和天然气领域管道基础设施的投资可能会增加印度、中国和日本等亚太国家闸阀的安装量。由于能源需求的增加,近海地区的石油和天然气探勘活动迅速成长,这也是闸阀市场的关键成长动力。

- 支持石油和天然气探勘活动的跨部门活动的活性化进一步支持了这一点。例如,2021年6月,中国首个生产海上天然气和石油钻井平台的智慧工厂开始运作。

- 2022年2月,俄罗斯和中国签署协议,给予俄罗斯一份为期30年的合同,透过一条新管道向中国供应天然气。根据协议,俄罗斯国有能源公司俄罗斯天然气工业股份公司将每年向中国国有能源巨头中石油供应100亿立方公尺天然气。

- 此外,水和用水和污水是推动该地区闸阀需求的另一个主要产业。各国都市化不断提高,管道基础设施投资显着增加。例如,2020年,印度政府向Jal Jeevan Mission拨款3.6兆印度卢比(500亿美元),该计画将在2024年之前为该国每个家庭提供自来水。

- 同样,其他亚洲国家也出现了类似的需求,预计将在预测期内推动亚太地区研究市场的扩张。例如,澳洲国家水网连接公司于 2022 年 1 月宣布,将支持约 40 个水利计划,包括开发下游蓄水坝和再生水养殖系统。这种扩张预计将增加该地区对闸阀的需求。

闸阀产业概况

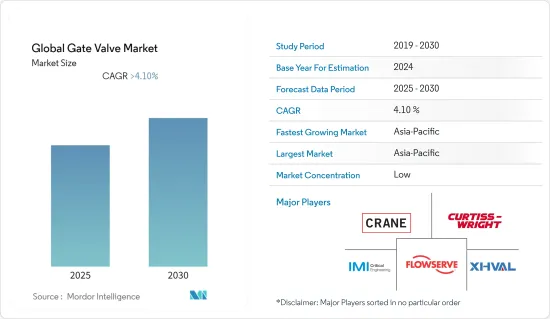

全球闸阀市场竞争激烈,主要参与企业包括 XHVAL、Crane Co.、Curtiss-Wright Corporation、Flowserve Corporation、IMI Critical Engineering、ITT INC. 和 KITZ Corporation。公司正在透过建立多个伙伴关係关係并将新产品推向市场来扩大市场占有率。

- 2022 年 7 月 - AVK UK 推出新型 PE 尾弹性阀座楔形闸阀。 AVK 系列 36 聚氨酯 (PE) 尾部弹性阀座闸阀可让客户设计长达 630 毫米的全焊接 PE 管路系统。这一概念在欧洲得到了广泛应用,并在英国天然气行业中得到了广泛应用。此阀门提供的整合阀门设备100%无洩漏。

- 2021 年 9 月 - 杜拜领先的系统化抽水与压力控制设备及服务供应商 SPM Oil & Gas 宣布推出新型 KOP AM20 系列闸阀。根据该公司介绍,KOP AM20系列闸阀显着降低了NPT,降低了井灾损失的风险,同时降低了库存成本。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对闸阀市场的影响

第五章市场动态

- 市场驱动因素

- 快速工业化带动市场

- 海水淡化活动需求增加

- 技术进步促进智慧阀门应用

- 市场问题

- 缺乏标准化措施

第六章 市场细分

- 按最终用户产业

- 电力

- 用水和污水管理

- 化学

- 石油和天然气

- 食品加工

- 矿业

- 海洋

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- XHVAL

- Crane Co.

- Curtiss-Wright Corporation

- Flowserve Corporation

- IMI Critical Engineering

- ITT INC.

- KITZ Corporation

- KLINGER Holding

- NIBCO INC.

- Xylem

第八章投资分析

第9章市场的未来

The Global Gate Valve Market is expected to register a CAGR of greater than 4.1% during the forecast period.

Gate valves are multi-turn valves, among the industry's most used valves. Gate valves find wide usage in on/off/isolation applications in oil & gas (pipeline service and wellhead), power generation (including slurry service with knife gate designs), marine and mining, and general industry. Gate valves perform well for liquids, gases, and slurries, including fluids with entrained solids.

Key Highlights

- In specific valves, gate valves are the most widely used because they are available in a range of sizes from approximately 1-inch to more than 60-inches, with a wide selection of end connections and pressure ratings. The leading chemical-producing countries, including the United States, Germany, Russia, China, Japan, United Kingdom, Italy, France, India, Brazil, etc., are expected to drive the demand for gate valves owing to these valves to offer numerous advantages as compared to other valve types.

- The demand for gate valves is more in the Asia-Pacific region. The growth in the area is mostly due to a rapid push for urbanization and rising populations. For instance, according to the State Council of the People's Republic of China, the urbanization rate of permanent residents in China will reach 64.72% in 2021. Also, Valves designed for water and wastewater are another significant market development in the Asia Pacific region.

- To meet the growing demand in various regional markets around the world, manufacturers are concentrating on technological development and product innovation. During the forecast period, the gate valve market is anticipated to be stimulated by improvements in gate valve features such as friction reduction and pressure management, as well as ongoing improvements in valve efficiency.

- Along with this, manufacturing plants globally are also joining the digital transformation trend. With smart gate valves, companies can carefully monitor, analyze, and manage valves and related equipment based on actual conditions. This may also show promise for gate valve maintenance. A smart gate valve could respond to its health, advising of potential issues or valve failure before it happens because preventative care is important to keep plants online and contributes significantly to the gate valve market. With multiple companies switching to these smart valves, such trends also impact the market's growth.

- However, increasing volatility in raw material prices and high gate valve maintenance costs are expected to restrain market growth during the forecast period. The increasing volatility of raw material prices has an impact on manufacturers' ability to produce gate valves based on specific requirements. Companies, on the other hand, are increasing their investment in R&D for cost-effective technology to reduce the cost of gate valves.

- Moreover, the COVID-19 pandemic hugely impacted the gate valve industry. As industrial manufacturing companies were grappling with the remarkable effect of the pandemic and the oil and gas industry was also operating at limited capacity, the demand for gate valves slowed down due to slow economic activity across various sectors. However, the market is expected to gain traction gradually with the resumption of economic and industrial activities at a full pace.

Gate Valve Market Trends

Rapid Industrialization is Driving the Market Growth

- The adoption of gate valves has subsequently risen across all production sites globally. These are often available in large capacities to efficiently handle heavy and viscous slurries, grease, oil, paper pulp, varnish, and wastewater flows. Moreover, as most of the existing oil and gas industries are running short on maintenance operations, the requirements for maintenance operations are creating more opportunities for maintenance service providers in the oil and gas industries, thereby boosting the demand for gate valves.

- The industrial sector has expanded significantly worldwide since the start of the industrial revolution. Numerous factors, such as urbanization and the rising consumption of goods produced industrially, are responsible for this growth. According to the Federal Reserve, total industrial production in the United States decreased by 0.2% in June 2022 but advanced at an annual rate of 6.1% for the second quarter.

- The growth of the industrial sector has made it one of the major pillars of any country's GDP. For instance, according to the World Bank, the value added by the manufacturing sector to the GDP of the European Union stood at 15% in 2021. Also, the presence of various industrial establishments is further supporting the growth of the industry. Germany is characterized by one of the world's largest chemical industries. In 2021, the country recorded around 3500 chemical companies operating. As the chemical industry is among the major consumer of gate valves, the demand is expected to grow in the country.

- The growth of the industrial sector, in turn, is driving the energy demand. For instance, according to Energy Information Administration (EIA) estimates, in July 2022, about 98.8 million barrels of petroleum and liquid fuels was consumed globally. As the oil & gas industry is among the major consumer of gate valves, such trends are expected to support the growth of the studied market.

Asia Pacific to Witness the Significant Growth

- Investments in pipeline infrastructure in the oil and gas sector in downstream applications will likely increase the installation of gate valves across Asia Pacific countries such as India, China, and Japan. Oil and gas exploration activities in offshore areas are fast-growing in tandem with rising energy demand, another important growth driver for the gate valve market.

- This is further supported by increased activity across the sectors that support oil and gas exploration activities. For instance, the operation of China's first intelligent factory for producing offshore gas and oil extraction equipment started in June 2021.

- In February 2022, Russia and China signed an agreement according to which Russia was awarded a 30-year contract to supply gas to China via a new pipeline. As per the agreement, Gazprom, the state-owned energy corporation of Russia, will supply Chinese state energy major CNPC with 10 billion cubic meters of gas annually.

- Moreover, water and wastewater are another major industry driving the demand for gate valves in the region. The increasing urbanization rate in various countries significantly investments in the pipeline infrastructure. For instance, in 2020, the government of India allocated INR 3.6 trillion (USD50 billion) to the Jal Jeevan Mission to provide piped water to all households in the country by 2024.

- Similarly, the same demand has been observed in other Asian countries, which is projected to fuel the expansion of the studied market in the Asia Pacific region throughout the forecast period. For instance, Australia's National Water Grid Connections announced in January 2022 that it will support approximately 40 water projects, including the development of off-stream storage dams and recycled water agricultural systems. Such expansion will boost the demand for gate valve in the region.

Gate Valve Industry Overview

The Global Gate Valve Market is competitive and consists of several players like XHVAL, Crane Co., Curtiss-Wright Corporation, Flowserve Corporation, IMI Critical Engineering, ITT INC., KITZ Corporation, and many more. The companies are increasing their market share by forming multiple partnerships and launching new products into the market.

- July 2022 - AVK UK launched its new PE tail resilient seated wedge gate valve. The AVK Series 36 polyurethane (PE) tailed Resilient Seated Gate Valve enables customers to design a fully welded PE pipe system up to 630mm. The concept is widely applied in Europe and is well-established in the UK gas industry. The integrated valve installations provided by the valve can be 100% leak-free.

- September 2021 - SPM Oil & Gas, a leading systematized pressure pumping and pressure control equipment and services provider in Dubai, announced the availability of its new KOP AM20 Series Gate Valves. According to the company, the KOP AM20 Series Gate Valves significantly reduce NPT and the risk of catastrophic Well loss while lowering inventory costs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Gate Valve Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Industrialization will Drive the Market

- 5.1.2 Increase in Demand for Desalination Activity

- 5.1.3 Technological Advancements Propelling Application of Smart Valves

- 5.2 Market Challenges

- 5.2.1 Lack of Standardized Policies

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Power

- 6.1.2 Water and Wastewater Management

- 6.1.3 Chemicals

- 6.1.4 Oil and Gas

- 6.1.5 Food Processing

- 6.1.6 Mining

- 6.1.7 Marine

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 XHVAL

- 7.1.2 Crane Co.

- 7.1.3 Curtiss-Wright Corporation

- 7.1.4 Flowserve Corporation

- 7.1.5 IMI Critical Engineering

- 7.1.6 ITT INC.

- 7.1.7 KITZ Corporation

- 7.1.8 KLINGER Holding

- 7.1.9 NIBCO INC.

- 7.1.10 Xylem