|

市场调查报告书

商品编码

1635444

全球石油和天然气行业阀门市场:市场占有率分析、行业趋势与统计、成长趋势预测(2025-2030)Global Valves in Oil and Gas Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

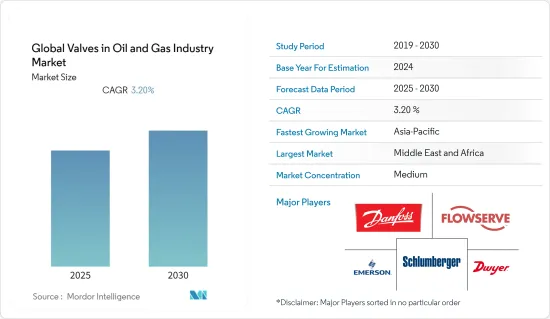

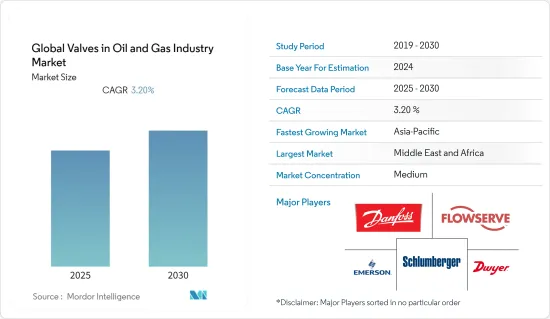

全球石油和天然气行业阀门市场预计在预测期内复合年增长率为 3.2%

主要亮点

- 阀门市场的成长是由多种因素推动的,例如用于监控各种工厂设备的无线/远端基础设施的需求不断增加,以及对推动智慧阀门应用的技术进步的日益关注,特别是在工业领域。石油和天然气等主要行业正在转向具有嵌入式处理器和网路功能的阀门技术,这些技术与透过中央控制站协调的先进监控技术相结合。

- 此外,中东主要国家正在重点维修现有炼油厂和扩建炼油厂,以应对日益增长的原油需求。预计这将增加管道和基础设施开发的投资,从而导致预测期内阀门需求的扩大。

- 专为石油和天然气行业设计的新型阀门符合全球化学强度的 ASME 和 ASTM 材料标准。此外,这些阀门也符合全球公认的 ASME B1.20.1、ASME B16.11 和 ASME B16.34 标准。这些标准保证了石油和天然气行业阀门的品质和使用寿命。

- 然而,阀门面临的主要挑战之一是替代阀门的可用性。例如,截止阀、蝶阀和止回阀被认为是闸阀的替代品,因为它们可以处理高温并控制和调节气体流量。

- 此外,根据国际能源总署(IEA)的数据,2020年3月至4月,OECD国家的油价下跌了40.6%,这引起了石油和燃气公司的担忧。因此,在COVID-19传播期间,石油和天然气行业的公司开始尝试现代技术和工业自动化,以提高效率和收益。这对大流行期间研究的市场产生了积极影响。

石油和天然气市场趋势

球阀预计将获得显着的市场占有率

- 球阀具有密封能力,其密封能力使其成为气体调节的理想选择。此阀门具有气密密封,可承受高达 700 bar 的压力和高达 200°C 的温度。

- 旋转为90度全闭或全开,被认为是更换或新安装最便宜的产品。然而,球阀不适用于腐蚀性流体。腐蚀性液体会损坏产品并导致石油和天然气工厂洩漏。

- 世界各地的天然气计划不断增加,供应商之间的创新也不断增加。例如,根据贝克休斯的数据,截至 2022 年 5 月底,美国正在运作的石油和天然气钻井平台数量为 727 座,高于 2022 年 4 月的 698 座。这种运作数量的增加将增加市场上正在研究的球阀的需求。

- 2021年8月,Dixon宣布推出适用于石油和天然气产业的两片式不锈钢球阀。这些创新减轻了工业和服务业投资再投资的负担,推动了所研究的市场。

中东和非洲主导市场

- 中东地区正在发生重大变化,石油和天然气行业计划不断增加。目前的计划包括Upper Zakum,这是一个耗资218亿美元的产能扩张计划。该计划预计将于2024年完成,届时Zadco的产能将从5万桶/日增加到约100万桶/日。此类案例增加了工业对各种类型阀门的需求。

- 同样,由于投资增加,非洲石油和天然气行业对阀门的需求预计将大幅增长。例如,坦尚尼亚的液化天然气液化计划于2028年完工,投资额为300亿美元,计画于2023年启动。因此,它在非洲市场处于领先地位。

- 对阀门的需求正在推动该地区的伙伴关係。例如,2022 年 1 月,AMPO POYAM VALVES 在第六届王国总增值论坛上与阿美公司签署了企业采购合同,不仅提供工程阀门,还提供专案和附加价值服务。 AMPO 已扩展到沙乌地阿拉伯,并为石油和天然气行业的战略计划提供了 20,000 多个阀门。因此,这些新兴市场的发展正在带动该地区的市场。

石油和天然气行业阀门概述

全球石油和天然气行业阀门市场由众多阀门市场参与企业适度细分。工业自动化和工业4.0的出现等因素,加上全球越来越多的石油和天然气计划扩大产能,正在为阀门製造业创造可观的成长机会。

- 2021年11月,迪克森宣布推出适用于石油天然气产业和其他产业的新型蝶阀B5017系列。新系列包括具有垂直罐驱动、拉手夹紧端和拉手焊接端的阀门。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 全球石油和天然气计划的成长

- 市场问题

- 绿色能源计划增加

第六章 市场细分

- 透过阀门

- 球阀

- 蝶阀

- 闸阀/截止阀/止回阀

- 控制阀

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Emerson Electric Co.

- Schlumberger Limited

- Alfa Laval Corporate AB

- Flowserve Corporation

- Crane Co.

- Rotork Plc

- Metso Oyj

- KITZ Corporation

- IMI Critical Engineering

- Samson Controls Inc.

第八章投资分析

第9章 市场的未来

简介目录

Product Code: 91842

The Global Valves in Oil and Gas Industry Market is expected to register a CAGR of 3.2% during the forecast period.

Key Highlights

- The growth of the valves market is driven by factors such as the increasing need for wireless/remote infrastructure to monitor equipment in various plants, along with an augmented focus on technology advancements propelling the application of smart valves, especially in the industrial sector. Major industries such as oil and gas are moving toward valve technology with embedded processors and networking capability to work alongside sophisticated monitoring technology coordinated through a central control station.

- Moreover, major countries in the Middle East have increased focus on the renovation of existing refineries and also the expansion of their oil refineries to meet the growing demand for crude oil. This is expected to result in increased investments in the pipeline and infrastructural development, which is expected to augment the demand for valves over the forecast period.

- The new valves designed in the market for the oil and gas industry comply with ASME and ASTM material standards for chemical strength across the globe. In addition, the valves also comply with ASME B1.20.1, ASME B16.11, and ASME B16.34, which are accepted across the globe. The standards ensure the quality and longevity of the valves life for the Oil and Gas industries.

- However, one of the major challenges for valves is the availability of alternate valves. For instance, globe, butterfly, and check valves are considered alternatives to gate valves as these valves control and regulate the flow of gasses by also handling high temperatures.

- Additionally, according to the International Energy Agency (IEA), in the OECD countries, the oil price was reduced by 40.6% from March to April 2020, nurturing concerns for oil and gas firms. Therefore, during the spread of COVID-19, companies in the oil and gas sector started experimenting with contemporary technologies and industrial automation to increase efficiency and revenue. This brought a positive impact on the market studied during the pandemic.

Valves in Oil and Gas Market Trends

Ball Valves is Expected to gain significant market share

- The Ball valve has a sealing ability and is ideal for regulating gases due to its sealing ability. The valves provide airtight seals for gas under pressure upto700 bars and temperatures up to 200 degrees Celcius.

- The rotation is provided with 90 degrees for full close or fully open and is considered the most inexpensive product for replacements and fresh installments. However, the ball valves are not used for corrosive fluids as it damages the product and brings in leaks in the oil and gas plants.

- The rising gas projects across the globe have increased innovations among vendors. For instance according to Baker Huges the number of US gas and oil rigs in operation at the end of May 2022 accounted to 727 compared to 698 in April 2022. Such growth in opeartions increases the demand for ball valves studied in the market.

- In August 2021, Dixon announced the launch of 2-piece stainless steel ball valves for the oil and gas industry that can replace 6 different common ball valve ranges. Such innovations reduce the burden of re-investments or service investments from the industries and drive the market studied.

Middle East and Africa to Dominant the Market

- The Middle Eastern region has been through massive changes and has landed more projects for the oil and gas industry. Some of the ongoing projects are Upper Zakum, a production capacity enhancement project that costs USD 21.8 billion. The project is expected to be complete by 2024, when Zadco increases the production capacity from 50,000 b/d to around 1 million b/d. Such instance increases the need for different types of valves in the industry.

- Similarly, Africa is also expected to gain huge demand for valves in its oil and gas industries owing to increased investments. For instance, in Tanzania, a Liquefied Natural Gas Liquefaction project is aimed to be completed by 2028 with an investment of USD 30 billion and is expected to begin in 2023. the project is expected to have a capacity to produce 10 million tons of LNG per year. Therefore driving the market in Africa.

- The demand for valves is driving partnerships in the region. For instance, in January 2022, AMPO POYAM VALVES signed a corporate procurement agreement with Aramco in the 6th edition of the In-Kingdom Total Value Add Forum to supply engineered valves as well as ad-hoc and added value services. AMPO has been in Saudi Arabia and has supplied more than 20,000 valves for strategic projects in the oil and gas industries. Therefore such developments are driving the market in the region.

Valves in Oil and Gas Industry Overview

The global Valves in the Oil and Gas Industry Market are moderately fragmented due to many valve market players. Factors such as industrial automation and the advent of integrated Industry 4.0 with rising oil and gas projects to expand the production capacity worldwide are providing considerable growth opportunities to valve manufacturing industries.

- In November 2021, Dixon announced the launch of the new B5017 series butterfly valve for the oil and gas industry and other industries. The new series consists of valves with Vertical Canister Actuation, pull handle clamp end, and pull handle weld end.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing projects in Oil and Gas Projects across the World

- 5.2 Market Challenges

- 5.2.1 Growing projects on Green Energy

6 MARKET SEGMENTATION

- 6.1 By Valve

- 6.1.1 Ball Valve

- 6.1.2 Butterfly Valve

- 6.1.3 Gate/Globe/Check Valve

- 6.1.4 Control Valve

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Schlumberger Limited

- 7.1.3 Alfa Laval Corporate AB

- 7.1.4 Flowserve Corporation

- 7.1.5 Crane Co.

- 7.1.6 Rotork Plc

- 7.1.7 Metso Oyj

- 7.1.8 KITZ Corporation

- 7.1.9 IMI Critical Engineering

- 7.1.10 Samson Controls Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219