|

市场调查报告书

商品编码

1635447

云端存取安全仲介(CASB):市场占有率分析、行业趋势和成长预测(2025-2030 年)Cloud Access Security Brokers (CASB) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

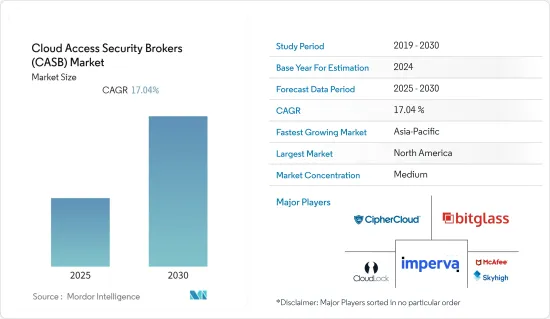

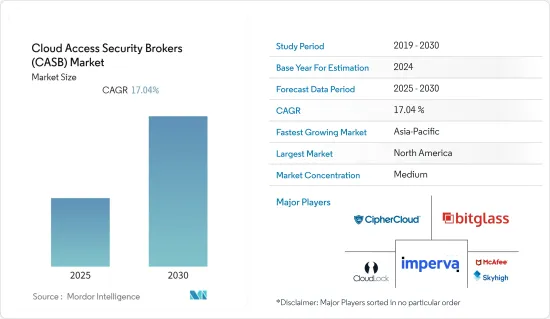

云端存取安全仲介(CASB)市场预计在预测期内复合年增长率为 17.04%。

主要亮点

- 云端存取安全仲介(CASB) 是任何组织网路安全基础设施的重要组成部分。使用云端应用程式来提高生产力、协作和储存的企业面临着云端操作的独特安全要求的挑战。 CASB 透过提供无与伦比的安全性、可见性以及对常见云端应用程式的存取和活动的控制来解决其中的许多挑战。

- 随着组织采用数百个SaaS 平台作为大规模迁移到云端的一部分,使用者在未经IT 许可的情况下使用数千个第三方应用程式和浏览器扩充功能(例如Atlassian Suite、Microsoft 365、Salesforce 等)连结到重要的SaaS 平台。企业 IT 部门认为企业级 SaaS 平台是储存和保护其关键资料资产的地方。事实上,这些资产储存在外部硬碟、电子邮件用户端和聊天机器人上,使 SaaS 供应链面临网路风险。这增加了对云端安全解决方案的整体需求,并显着推动了市场成长。

- CASB 安全性有助于保护储存在 Google G Suite、Microsoft Office 365、Dropbox 和 Slack 等云端应用程式中的资料。在云端储存和存取的资料并不驻留在您的边界内,也不总是从您的边界内存取。 CASB 在资料安全方面解决的三个业务挑战包括防止资料遗失、提供资料存取控制以及审核有风险(和未经授权的)行为。

- 然而,缺乏意识和安全相关的担忧可能会限制整个预测期内的整体市场成长。

- COVID-19 迫使政府关闭办公室并允许员工在家工作。这增加了对云端存取安全仲介(CASB)的需求,这些代理商可以帮助企业保护资料安全并减少风险和诈骗的机会,从而成倍地增加市场成长机会。

云端存取安全仲介(CASB) 市场趋势

越来越多地采用云端基础的应用程式

- 云端基础的服务的快速扩散引发了对资料安全和隐私的各种担忧。企业越来越意识到保护和管理敏感资料的必要性,即使资料是在云端处理和储存的。云端存取安全仲介(CASB)用作云端网路使用者和云端基础的应用程式之间的安全查核点。 CASB监督并执行所有资料安全规则和程序,包括加密、警报、核准和身份验证。

- 此外,云端基础的服务的激增、云端平台的成长以及自带设备 (BYOD) 策略的日益普及正在迅速增加对 CASB 解决方案的需求。这些趋势显着扩大了资料环境,使得IT部门难以监控整体网路使用情况并确保企业资料的安全。此外,随着云端采用的增加,CASB 提供各种网路安全、存取控制和资料保护功能,这使其对企业安全具有吸引力。

- 随着企业迁移到云端,资料安全和法规遵循至关重要。 CASB 透过为云端基础的应用程式提供可见性、控制和安全机制来解决这些问题,使企业能够安全地部署和使用云端服务。

- 此外,关键组织正在云端基础设施上投入大量资金,以扩大消费群并满足各种应用程式的需求。例如,2023年2月,Oracle宣布计画在沙乌地阿拉伯推出第三个公有云区域,以满足快速扩大的云端服务需求。位于利雅德的新云端区域是Oracle在沙乌地阿拉伯开发云端基础设施能力的 15 亿美元投资计画的一部分。

- Turbonomic 的一项调查显示,到 2022 年,56% 的受访者将使用 Microsoft Azure 进行云端服务,而 51% 的受访者将使用 Amazon Web Services (AWS) 进行云端服务。此类云端服务使用量的整体增加预计将扩大整个市场的成长机会。

北美市场占有率最高

- 各行各业的许多公司正在将应用程式和资料迁移到云端,而北美处于云端采用的最前沿。随着越来越多的公司使用云端服务,对 CASB 等强大安全解决方案的需求不断增加。

- 由于严格的法规、高云端采用率、网路威胁的增加、远端工作趋势、云端安全风险意识的增强、技术的进步以及云端服务供应商的强大存在,北美 CASB 市场正在扩大。

- 在北美,COVID-19 大流行导致了广泛的远端工作规则和使用个人设备进行业务。这种转变增加了云端环境中保护企业资料和应用程式的整体复杂性。因此,为了维护安全的远端工作环境,CASB 在执行安全策略、管理存取控制以及保护可从远端位置和行动装置存取的资料方面发挥关键作用,从而显着推动了市场的发展。

- 重要的公司也在投资、与其他组织合併并资助新计画,以扩大基本客群并更好地满足多样化应用的要求。例如,2023 年 4 月,Skyhigh Security 宣布为其安全服务边缘 (SSE) 产品组合添加多项新功能。资料遗失防护 (DLP) 是全面的 Skyhigh 云端平台的关键功能,已整合到构成 Skyhigh SSE 产品组合的产品中,包括 Skyhigh Secure Web Gateway (SWG)、Skyhigh Cloud Access Security Broker (CASB) 和 Skyhigh Private访问已。

- 2023年2月,云端保全服务供应商Zscaler, Inc.宣布有意收购SaaS应用安全平台先驱Canonic Security。 Canonic 的平台旨在协助企业降低 SaaS 供应链攻击日益增长的风险。 Zscaler 增强了其 CASB(云端存取安全代理)和 SSPM(SaaS 安全态势管理)产品,帮助企业将新的供应链安全功能整合到其资料保护服务中,帮助他们整合单点产品、降低成本并提高管理水平。

云端存取安全仲介(CASB) 产业概述

云端存取安全仲介(CASB)市场竞争激烈,各大厂商纷纷进入该市场。新技术的广泛采用正在推动企业升级安全策略并增加市场需求。大多数公司透过赢得新契约和开发新市场来最大化其整体市场占有率。

例如,2022 年 2 月,SASE 平台供应商 Cato Networks 宣布推出 Cato CASB,这是一种云端存取安全仲介(CASB),可在 60 分钟内提供可操作的价值。 Cato 与云端应用程式目录一起提供了最快、最易于运行的解决方案来管理云端应用程式的资料风险。借助 Cato CASB,Cato 将真正的 SASE 平台的主要优势引入云端应用程式风险管理。

此外,人工智慧驱动的安全网路供应商Juniper Networks将于 2022 年 6 月在其瞻博网路安全边缘解决方案中加入进阶预防资料外泄(DLP) 和云端存取安全仲介(CASB) 功能,并宣布扩展SASE。与瞻博网路由 Mist AI 支援的专有 SD-WAN 解决方案相结合,它提供了具有跨边缘和资料中心可见性的全堆迭 SASE 解决方案。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 限制资料遗失以实现不间断的业务功能

- 即时监控功能

- 越来越多地采用云端基础的应用程式

- 市场限制因素

- 资讯遗失的风险

- 突破炒作週期

- 市场挑战

- 缺乏意识和安全担忧

- 技术概述

- 单一登入 (SSO)

- 安全资讯和事件管理 (SIEM)

第六章 市场细分

- 按服务模式

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

- 按组织规模

- 小型企业

- 大公司

- 按最终用户

- 银行、金融服务和保险 (BFSI)

- 教育机构

- 政府机构

- 医疗保健/生命科学

- 製造业

- 零售/批发

- 资讯科技/通讯

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- Imperva, Inc.

- Bitglass

- Cloudlock

- Ciphercloud

- Skyhigh Networks

- Netskope

- Protegrity

- Adallom

- Perspecsys

- Cloudmask

- Elastica

- Palerra

- Vaultive

- Firelayers

- Palo Alto Networks

第八章投资分析

第9章市场的未来

The Cloud Access Security Brokers Market is expected to register a CAGR of 17.04% during the forecast period.

Key Highlights

- The cloud access security broker (also referred to as a CASB ) is an essential piece of any organization's cybersecurity infrastructure. Businesses using cloud applications for productivity, collaboration, and storage are challenged by the unique security requirements of operating in the cloud. Using a CASB solves many of these challenges by providing unmatched security, visibility, and control over access to and behavior within popular cloud applications.

- Without the permission of IT, users are connecting thousands of third-party applications and browser extensions to crucial SaaS platforms like Atlassian Suite, Microsoft 365, Salesforce, Google Workspace, and Slack as organizations adopt hundreds of SaaS platforms as part of the massive migration to the cloud. Corporate IT believes that enterprise-ready SaaS platforms are where its crucial data assets are stored and secured. In reality, these assets are kept in external drives, email clients, and chatbots, which exposes their SaaS supply chain to cyber danger. This drives the overall need for cloud security solutions, driving the market's growth significantly.

- CASB Security helps to protect data stored in cloud applications, such as Google G Suite, Microsoft Office 365, Dropbox, Slack, etc. This is because data stored and accessed in the cloud does not exist within the user's perimeter, nor is it always accessed from inside the user's perimeter. Three business challenges that a CASB solves in terms of data security include data loss prevention, providing data access controls, and auditing risky (and unauthorized) behavior.

- However, the lack of awareness and security-related concerns could limit the market's overall growth throughout the forecast period.

- COVID-19 pushed the governments to shut the office spaces, enabling employees to work from home. This helped grow demand for cloud access security brokers that help companies keep their data safe and decrease the chances of risks and fraud, driving the market's growth opportunities exponentially.

Cloud Access Security Brokers (CASB) Market Trends

Increasing Adoption of Cloud-Based Applications

- The quick adoption of cloud-based services has raised various concerns regarding data security and privacy. Even when sensitive data is handled and kept in the cloud, organizations are becoming increasingly aware of the need to secure that data and retain control over it. As a security checkpoint between cloud network users and cloud-based applications, a cloud access security broker (CASB) is used. They oversee and implement all data security rules and procedures, including encryption, alerts, authorization, and authentication.

- Also, due the proliferation of cloud-based services, the growth of cloud platforms, and the rising popularity of bring-your-own-device policies are creating the demand for CASB solutions exponentially. Due to these trends, the data environment has grown significantly, making it more difficult for the IT department to monitor overall network usage and guarantee company data security. Moreover, with increased cloud adoption, CASBs have become attractive to enterprise security for their various cybersecurity, access control, and data protection functions.

- Data security and regulatory compliance are essential when businesses migrate to the cloud. By supplying visibility, control, and security mechanisms for cloud-based applications, CASBs address these issues and enable companies to adopt and use cloud services securely.

- Moreover, significant organizations are investing a hefty sum of money in the cloud infrastructure to increase their consumer base and meet their demands across various applications. For instance, in February 2023, Oracle declared its plans to launch a third public cloud region in Saudi Arabia to address the fast-expanding demand for its cloud services. The new cloud region, which will be based in Riyadh, is a component of an anticipated USD 1.5 billion investment from Oracle to develop cloud infrastructure capabilities in the Kingdom.

- According to a survey by Turbonomic, in 2022, 56% of those surveyed used Microsoft Azure for cloud services, whereas 51% of respondents stated that they are using Amazon Web Services (AWS) for their cloud services. A rise in the overall usage of such cloud services is expected to amplify the market's total growth opportunities.

North America to Hold the Highest Market Share

- Numerous companies across various industries have moved their applications and data to the cloud, placing North America at the forefront of cloud adoption. The demand for robust security solutions like CASBs rises as more businesses use cloud services.

- The CASB market in North America is expanding due to strict regulations, high cloud adoption, growing cyber threats, remote work trends, increased awareness of cloud security risks, technological improvements, and the significant presence of cloud service providers.

- The adoption of remote work rules and the use of personal devices for work purposes in North America has been pushed by the COVID-19 pandemic. This shift has thus increased the overall complexity of securing corporate data and applications in the cloud environments. Hence, to maintain secure remote work environments, CASBs play a significant role in terms of assisting organizations in enforcing security policies, managing access controls, and protecting data accessible from distant and mobile devices, driving the market significantly.

- Significant corporations are also investing, merging with other organizations, and funding new projects to broaden their customer base and better satisfy their requirements across diverse applications. For instance, in April 2023, Skyhigh Security announced adding several new features to its Security Service Edge (SSE) portfolio. The comprehensive Skyhigh Cloud Platform's Data Loss Prevention (DLP) as a key capability is integrated into the Skyhigh Secure Web Gateway (SWG), Skyhigh Cloud Access Security Broker (CASB), Skyhigh Private Access, and other products that make up the Skyhigh SSE Portfolio.

- In February 2023, Zscaler, Inc., a cloud security service provider, declared its intent to acquire Canonic Security, a pioneer in SaaS application security platforms. Canonic's platform is designed to reduce the rising risks of SaaS supply chain attacks for businesses. Zscaler strengthens its CASB (Cloud Access Security Broker) and SSPM (SaaS Security Posture Management) offerings, enabling enterprises to consolidate point products, reduce cost, and streamline management by incorporating the new supply chain security capabilities into their data protection services.

Cloud Access Security Brokers (CASB) Industry Overview

The Cloud Access Security Brokers market is moderately competitive and has various significant players. The extensive adoption of new technologies has pushed businesses to upgrade their security policies, thus increasing the market demand. Most companies maximize their overall market presence by securing new contracts and tapping new markets.

For instance, in February 2022, Cato Networks, a provider of the SASE platform, launched Cato CASB, the Cloud Access Security Broker (CASB), to provide actionable value in under 60 minutes. Along with the Cloud Application Catalog, Cato offers the quickest-to-deliver and easiest-to-run solution for managing cloud application data risk. With Cato CASB, Cato brings the key benefits of a true SASE platform to managing cloud application risk.

Furthermore, in June 2022, Juniper Networks, a provider of secure, AI-driven networks, declared the expansion of its SASE offering with the addition of advanced Data Loss Prevention (DLP) as well as Cloud Access Security Broker (CASB) capabilities to its Juniper Secure Edge solution. Combined with a unique SD-WAN solution by Juniper, driven by Mist AI, the company offers a full-stack SASE solution with visibility into both the edge and the data center.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Control Data Loss to Enable Uninterrupted Business Functions

- 5.1.2 Real-Time Monitoring Capabilities

- 5.1.3 Increasing Adoption of Cloud-Based Applications

- 5.2 Market Restraints

- 5.2.1 Risk of Information Loss

- 5.2.2 Surviving the Hype Cycle

- 5.3 Market Challenge

- 5.3.1 Lack of Awareness and Security Concerns

- 5.4 Technology Overview

- 5.4.1 Single Sign-On (SSO)

- 5.4.2 Security Information and Event Management (SIEM)

6 MARKET SEGMENTATION

- 6.1 By Service Model

- 6.1.1 Infrastructure as a Service

- 6.1.2 Platform as a Service

- 6.1.3 Software as a Service

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By End-User

- 6.3.1 Banking, Financial Services and Insurance (BFSI)

- 6.3.2 Education

- 6.3.3 Government

- 6.3.4 Healthcare and Life Sciences

- 6.3.5 Manufacturing

- 6.3.6 Retail and Wholesale

- 6.3.7 Telecommunication and It

- 6.3.8 Others

- 6.4 By Region

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Imperva, Inc.

- 7.1.2 Bitglass

- 7.1.3 Cloudlock

- 7.1.4 Ciphercloud

- 7.1.5 Skyhigh Networks

- 7.1.6 Netskope

- 7.1.7 Protegrity

- 7.1.8 Adallom

- 7.1.9 Perspecsys

- 7.1.10 Cloudmask

- 7.1.11 Elastica

- 7.1.12 Palerra

- 7.1.13 Vaultive

- 7.1.14 Firelayers

- 7.1.15 Palo Alto Networks