|

市场调查报告书

商品编码

1635452

西班牙容器玻璃:市场占有率分析、产业趋势与成长预测(2025-2030)Spain Container Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

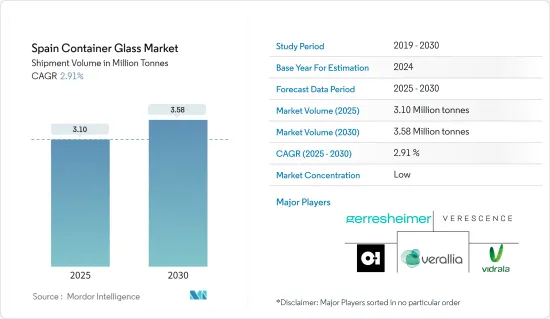

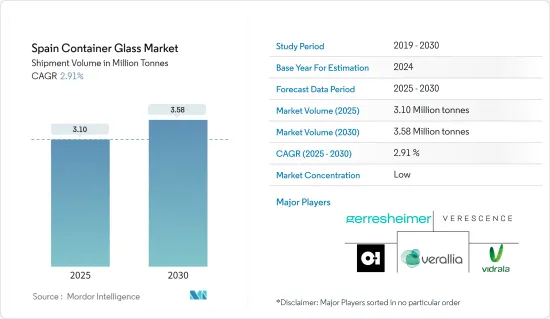

西班牙容器玻璃市场规模(以出货量为准)预计将从2025年的310万吨成长到2030年的358万吨,预测期间(2025-2030年)复合年增长率为2.91%。

主要亮点

- 由于对包装食品和饮料的需求不断增长,对钠钙硅玻璃的需求正在迅速增加,特别是用于保存各种食品成分。这种趋势在果酱、酱汁、腌菜和已调理食品中最为明显,玻璃容器不仅可以延长保质期,还可以增强视觉吸引力。

- 由于食品加工行业对优质包装的需求不断增长,市场正在迅速扩大。玻璃容器越来越受青睐,因为它们可以突出产品品质并增加货架存在感。

- 人们对塑胶污染的认识不断提高以及对永续替代品的呼声正在促使人们转向玻璃包装。消费者对更绿色、更安全、更健康的包装的需求进一步推动了这种转变。玻璃成型、压花和装饰饰面方面的创新使玻璃包装更具吸引力。此类进步不仅促进了独特的设计,还提供了品牌推广机会并确保您的产品在商店脱颖而出。

- 此外,食品和饮料行业对环保产品日益增长的需求正在推动市场成长,特别是玻璃是 100% 可回收的,并且可以无限期地重复使用而不影响品质。

- 根据国际贸易中心统计,西班牙玻璃容器进口额(HS编码-701090)从2022年的808,861,000美元跃升至2023年的1,070,890,000美元。进口量的大幅增加支持了食品和饮料、药品和化妆品等行业对玻璃容器需求的快速增长。消费的成长预示着潜在的市场成长,并要求製造商和供应商相应地扩大业务规模。

- 豪华食品品牌以及酒精和非酒精饮料製造商越来越多地选择玻璃包装,而不是塑胶等替代品。这种偏好是由于玻璃的化学惰性、无孔性和不渗透性。这些特性可确保产品的味道、香气和品质随着时间的推移保持完整,对于奢侈品和保质期长的产品极为重要。

- 容器玻璃是酒精饮料的首选,适合保存其香气和风味。例如,酿酒师经常选择有色玻璃容器来保护他们的葡萄酒免受可能损害其品质的光线的影响。

- 由于葡萄酒消费量的增加以及对精酿啤酒和优质烈酒的日益欣赏,西班牙的容器玻璃市场正在蓬勃发展。鸡尾酒文化的兴起和优质手工饮料的趋势进一步增加了酒精产业对优质玻璃包装的需求。

- 然而,西班牙容器玻璃市场面临替代产品崛起的挑战。随着包装技术的进步,塑胶、金属和纸盒等替代品越来越受欢迎。其重量轻、成本效益和设计灵活性使其具有吸引力。这种趋势在食品和饮料行业尤其明显,因为便利性和永续性至关重要。

西班牙容器玻璃市场趋势

饮料业市场占有率最高

- 玻璃包装市场与金属包装产业竞争激烈,尤其是酒精饮料罐。然而,由于其与奢侈品的联繫,容器玻璃包装预计将在整个预测期内保持市场占有率。非酒精饮料领域预计将成长,其中包括咖啡、果汁、茶、乳类饮料和非乳类饮料。

- 西班牙充满活力的夜生活不仅吸引了游客,也吸引了对奢侈品有胃口的高端客户。玻璃以其卓越的保质期和美观性而闻名,是优质饮料包装的首选。随着夜总会的兴起,对专门存放此类奢侈品的高品质玻璃容器的需求预计将会增加。

- 根据国际夜生活协会的报告,西班牙将在 2023 年领先全球,拥有 27 家顶级夜总会。美国拥有世界上五分之一的精英俱乐部,但此后却年久失修。

- 夜总会是葡萄酒、啤酒和烈酒等瓶装饮料的主要消费者,其需求正在激增。这一增长表明餐旅服务业的蓬勃发展,也证实了玻璃容器市场对优质玻璃包装的需求不断增长。

- 玻璃容器具有保鲜特性,是包装优质乳製品(从优格和奶油到风味牛奶和甜点)的完美选择。随着乳製品产业的扩张,对玻璃包装的需求也随之增加,尤其是来自奢侈品和手工生产商的需求。

- 西班牙食品饮料工业联合会(FIAB)的资料突显了乳製品产业的成长:西班牙乳製品价值将从2018年的95.63亿美元上升到令人瞩目的168.62亿美元,2023年将快速成长。

化妆品产业可望带动成长

- 公司越来越多地将其营运与联合国 17 个永续发展目标 (SDG) 结合起来。这项倡议可能有利于西班牙化妆品容器玻璃市场并推动成长。透过实现永续发展目标,企业可以突显其对永续性和社会责任的奉献精神。因此,具有这些目标的西班牙化妆品公司可能会提高消费者的信任和忠诚度,为增加市场占有率铺平道路。

- 在评估公司时,投资者和业务合作伙伴越来越多地关注环境、社会和管治(ESG) 因素。透过与永续发展目标保持一致,西班牙化妆品公司可以增强对寻求永续业务的投资者的吸引力。此外,此类合作可以为与其他永续性意识的公司伙伴关係铺平道路,并促进刺激化妆品玻璃容器市场创新和成长的合作。

- 随着化妆品消费量的增加,对包装材料尤其是玻璃容器的需求也不断增加。特别是香水、护肤品和奢华化妆品等高檔化妆品通常选择玻璃包装,因为它们具有美观性和保护作用。玻璃容器不仅可以保持香气的完整性并防止污染,还可以延长产品的保质期。

- 据Cosmetic Europe称,西班牙化妆品市场预计到2023年将达到112.6亿美元,高于2018年的75.8亿美元。

- 随着市场的扩大,对优质包装解决方案的需求不断增加,特别是在奢侈品和高端领域。玻璃以其奢华的外观、透明度和环保特性而闻名,是高品质化妆品的完美选择。其高可回收性与消费者对永续包装日益增长的偏好产生了共鸣。此外,玻璃设计的多功能性使品牌能够创造出独特的形状,并在拥挤的市场中脱颖而出。

西班牙容器玻璃产业概况

西班牙的容器玻璃市场较为分散,地区和全球的企业都在争夺市场占有率。这种多元化的竞争格局包括现有製造商和新进业者,每个製造商都在争夺关键的市场地位。

在这个市场上经营的公司正在积极寻求策略性收购,以扩大其产品阵容、提高市场占有率并提高市场盈利。此外,一些公司正专注于创新和永续倡议,以在这个竞争环境中脱颖而出。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 容器玻璃进出口资料

- PESTEL分析-西班牙容器玻璃产业

- 包装玻璃容器产业标准及法规

- 包装玻璃的原料分析及材质考虑

- 容器和包装玻璃的永续性趋势

- 西班牙货柜玻璃熔炉的容量和位置

第五章市场动态

- 市场驱动因素

- 对环保产品的需求不断成长

- 食品饮料市场需求快速成长

- 市场挑战

- 扩大替代产品的使用

- 欧洲容器玻璃市场西班牙市场状况分析

- 贸易概览 - 西班牙容器玻璃产业进出口模式的历史与现况分析

第六章 市场细分

- 按最终用户产业

- 酒精(定性分析分段分析)

- 啤酒和苹果酒

- 葡萄酒/烈酒

- 其他酒精饮料

- 非酒精类(细分市场的定性分析)

- 碳酸饮料

- 牛奶

- 水/其他非酒精饮料

- 食物

- 化妆品

- 医药产品(不包括管瓶和安瓿)

- 其他最终用户产业

- 酒精(定性分析分段分析)

第七章 竞争格局

- 公司简介

- Verallia Group

- BA GLASS GROUP

- OI Glass, Inc.

- Vidrala, SA

- VERESCENCE FRANCE

- Gerresheimer AG

- SAVERGLASS Group

- ALGLASS SA

- Quadpack Industries SA

- Berlin Packaging

第八章补充报导-西班牙主要玻璃容器主要加热炉供应商分析

第九章 市场未来展望

The Spain Container Glass Market size in terms of shipment volume is expected to grow from 3.10 million tonnes in 2025 to 3.58 million tonnes by 2030, at a CAGR of 2.91% during the forecast period (2025-2030).

Key Highlights

- Driven by the rising demand for packaged food and beverages, the need for soda-lime-silica-based glass has surged, especially for storing diverse food ingredients. This trend is notably seen in items like jams, sauces, pickles, and ready-to-eat meals, where glass containers not only preserve but also enhance visual appeal.

- The market is witnessing rapid expansion, fueled by a growing appetite for premium packaging in the food processing sector. Glass containers are increasingly preferred for their ability to highlight product quality and boost shelf presence.

- Heightened awareness of plastic pollution and a collective push for sustainable alternatives have spurred a shift towards glass packaging. This shift is further bolstered by consumer demand for eco-friendly, safe, and healthier packaging. Innovations in glass shaping, embossing, and decorative finishes have amplified the allure of glass packaging. Such advancements not only facilitate unique designs but also present branding opportunities, ensuring products capture attention on store shelves.

- Furthermore, the food and beverage sector's rising demand for eco-friendly products propels market growth, especially given glass's 100% recyclability and infinite reusability without quality loss.

- According to the International Trade Centre, Spain's container glass imports (HS Code-701090) surged to USD 10,70,890 thousand in 2023, up from USD 8,08,861 thousand in 2022. This notable uptick in imports underscores a burgeoning demand for container glass, likely spurred by sectors like food and beverage, pharmaceuticals, and cosmetics. Such heightened consumption signals potential market growth, prompting manufacturers and suppliers to scale operations accordingly.

- Premium food brands and producers of both alcoholic and non-alcoholic beverages are increasingly gravitating towards glass containers over alternatives like plastic. This preference stems from glass's chemical inertness, non-porosity, and impermeability. Such attributes ensure that a product's taste, aroma, and quality remain intact over time, a crucial factor for high-end items and those with extended shelf lives.

- Container glass is a favored choice for alcoholic beverages, adept at preserving their aroma and taste. For instance, wine manufacturers often opt for tinted container glass, shielding the wine from light exposure that could compromise its quality.

- Spain's container glass market has been buoyed by rising wine consumption and a burgeoning appreciation for craft beers and premium spirits. The cocktail culture's ascent and a trend towards premium, artisanal beverages further amplify the demand for top-tier glass packaging in the alcoholic sector.

- However, the Spain container glass market faces challenges from the rising adoption of substitute products. Thanks to advancements in packaging technology, alternatives such as plastic, metal, and carton materials are gaining traction. Their lighter weight, cost-effectiveness, and design flexibility make them appealing. This trend is especially pronounced in the food and beverage industry, where convenience and sustainability are paramount.

Spain Container Glass Market Trends

Beverage Industry to Hold the Highest Market Share

- The container glass packaging market contends fiercely with the metal packaging segment, particularly in the form of cans used for alcoholic beverages. Yet, due to its association with premium products, container glass packaging is poised to retain its market share throughout the forecast period. Growth is anticipated in the non-alcoholic beverage sector, encompassing coffee, juices, tea, and both dairy and non-dairy drinks.

- Spain's vibrant nightlife not only draws tourists but also an upscale clientele with a penchant for premium products. Glass, celebrated for its superior preservation and aesthetic allure, is the preferred choice for high-end beverage packaging. As the nightclub sector flourishes, the demand for specialized luxury glass containers for these premium offerings is set to rise.

- Spain led the world in 2023, boasting 27 top-rated nightclubs, as reported by the International Nightlife Association. The U.S. trailed, hosting one-fifth of the globe's elite clubs.

- Nightclubs, major consumers of bottled beverages like wine, beer, and spirits, are witnessing a surge in demand. This uptick, indicative of a thriving hospitality sector, underscores the rising need for premium glass packaging in the container glass market.

- Glass containers are the go-to choice for packaging premium dairy items, from yogurt and cream to flavored milk and desserts, thanks to their freshness-preserving qualities. As the dairy sector expands, so too will the demand for glass packaging, especially from high-end and artisanal producers.

- Data from the Spanish Federation of Food and Beverage Industries (FIAB) highlights the dairy sector's growth: Spain's dairy product value surged from USD 9,563 million in 2018 to a notable USD 16,862 million in 2023.

Cosmetic Industry is Expected to Bolster Growth

- Companies are increasingly aligning their operations with the United Nations' 17 Sustainable Development Goals (SDGs). This alignment stands to benefit Spain's cosmetic container glass market, potentially fueling its growth. By committing to the SDGs, companies underscore their dedication to sustainability and social responsibility. As a result, Spanish cosmetic firms that embrace these goals could see a boost in consumer trust and loyalty, paving the way for an expanded market share.

- Environmental, social, and governance (ESG) factors are gaining prominence among investors and business partners when assessing companies. By aligning with the SDGs, Spanish cosmetic firms can enhance their appeal to investors on the lookout for sustainable ventures. Furthermore, this alignment can pave the way for partnerships with other sustainability-driven businesses, fostering collaborations that spur innovation and growth in the cosmetic container glass market.

- As cosmetic consumption rises, so does the demand for packaging materials, notably glass containers. Premium cosmetics, especially perfumes, skincare items, and luxury makeup, often opt for glass packaging, valuing its aesthetic charm and protective benefits. Glass containers not only preserve fragrance integrity and prevent contamination but also extend the product's shelf life.

- According to Cosmetic Europe, the Spanish cosmetic market is projected to reach a value of USD 11.26 billion in 2023, up from USD 7.58 billion in 2018.

- With the market's expansion, particularly in the luxury and high-end segments, the demand for premium packaging solutions is on the rise. Glass, favored for its premium look, transparency, and eco-friendly attributes, is the go-to choice for high-quality cosmetics. Its recyclability resonates with the growing consumer preference for sustainable packaging. Moreover, glass's versatility in design allows brands to craft unique shapes, setting them apart in a crowded marketplace.

Spain Container Glass Industry Overview

The container glass market in Spain is characterized as fragmented, with a mix of regional and global players competing for market share. This diverse competitive landscape includes both established manufacturers and newer entrants, each vying for a significant position in the market.

Companies operating in this market are actively pursuing strategic acquisitions to expand their product offerings, increase their market presence, and improve profitability within the market. Additionally, some firms focus on technological innovations and sustainable practices to differentiate themselves in this competitive environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Export-Import Data of Container Glass

- 4.3 PESTEL ANALYSIS - Container Glass Industry in Spain

- 4.4 Industry Standard and Regulation for Container Glass Use for Packaging

- 4.5 Raw Material Analysis and Material Consideration for Packaging

- 4.6 Sustainability Trends for Glass Packaging

- 4.7 Container Glass Furnace Capacity and Location in Spain

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Eco-friendly Products

- 5.1.2 Surging Demand from the Food and Beverage Market

- 5.2 Market Challenges

- 5.2.1 Growing Usage of Substitute Products

- 5.3 Analysis of the Current Positioning of Spain in the European Container Glass Market

- 5.4 Trade Scenerio - Analysis of the Historical and Current Export Import Paradigm for Container Glass Industry in Spain

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Alcoholic (Qualitative Analysis For Segment Analysis)

- 6.1.1.1 Beer and Cider

- 6.1.1.2 Wine and Spirits

- 6.1.1.3 Other Alcoholic Beverages

- 6.1.2 Non-Alcoholic (Qualitative Analysis For Segment Analysis)

- 6.1.2.1 Carbonated Soft Drinks

- 6.1.2.2 Milk

- 6.1.2.3 Water and Other Non-alcoholic Beverages

- 6.1.3 Food

- 6.1.4 Cosmetics

- 6.1.5 Pharmaceutical (Excluding Vials and Ampoules)

- 6.1.6 Other End-user Verticals

- 6.1.1 Alcoholic (Qualitative Analysis For Segment Analysis)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Verallia Group

- 7.1.2 BA GLASS GROUP

- 7.1.3 O-I Glass, Inc.

- 7.1.4 Vidrala, S.A.

- 7.1.5 VERESCENCE FRANCE

- 7.1.6 Gerresheimer AG

- 7.1.7 SAVERGLASS Group

- 7.1.8 ALGLASS SA

- 7.1.9 Quadpack Industries SA

- 7.1.10 Berlin Packaging