|

市场调查报告书

商品编码

1635480

中东和非洲钻井 -市场占有率分析、产业趋势、成长预测(2025-2030)Middle East and Africa Drilling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

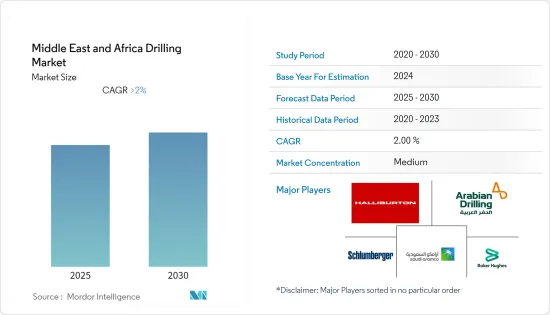

预计中东和非洲钻井市场在预测期内将维持2%以上的复合年增长率。

COVID-19 对 2020 年市场产生了负面影响。目前,市场已达到疫情前水准。

主要亮点

- 短期内,由于国际石油需求增加以及私人公司投资该地区石油和天然气上游产业的兴趣日益浓厚,中东和非洲钻井市场预计将增长。

- 同时,可再生能源的成长势头预计将在未来几年对市场构成挑战。

- 中东、非洲探明油气蕴藏量丰富,钻井市场机会充足。该地区目前也正在确认新的海上石油和天然气发现。

- 由于该国巨大的石油和天然气蕴藏量以及即将在该国开展的新探勘和生产计划,预计沙乌地阿拉伯将在不久的将来主导市场。

中东和非洲钻井市场趋势

海上业务预计将主导市场

- 中东和非洲是重要的海上石油油气生产地区,预计未来几年该地区的海上石油探勘支出将大幅增加。由于其丰富的资源和不断增加的从深海和超深海地区开采石油和天然气的技术可能性,预计将为海上钻井作业提供绝佳的机会。

- 此外,随着世界能源需求的迅速增长,海上石油生产已成为一种有吸引力的能源来源。在该地区拥有主要企业的国家将专注于探勘海上天然气田,特别是在该地区陆上油气蕴藏量劣化的情况下。近年来,由于海上天然气的发现,该地区的天然气产量显着增加。 2021年产量约7,140亿立方公尺。预计这一趋势在未来几年将进一步增长。

- 2022年3月,科威特和沙乌地阿拉伯宣布了开发阿拉伯湾北部多拉海上天然气田的新计画。该计划是在伊朗、沙乌地阿拉伯和科威特这三个国家正在争夺油田之际宣布的。这个计划是在伊朗、沙乌地阿拉伯和科威特三个国家交战时提出的。一旦运作,该地区每天将能够生产约 10 亿立方英尺的干气和 84,000 桶冷凝油。

- 此外,2022 年 2 月,阿布达比国家石油公司 (ADNOC) 启动了工程、采购、施工和安装合约竞标程序,以进一步开发巨型下札库姆海上油田。此外,2021年至2025年,中东和非洲地区已核准77个和超过27个上游计划。

- 总体而言,该地区石油和天然气海上计划的增加预计将支持海上钻井市场。

沙乌地阿拉伯可望主导市场

- 沙乌地阿拉伯是全球第二大原油生产国和全球最大原油出口国。它持有全球整体已探明石油蕴藏量的约17%。截至2021年,沙乌地阿拉伯拥有约2,671.92亿桶原油蕴藏量和8,507立方公尺天然气储量。截至 2021 年,沙乌地阿拉伯的原油产量已达到 10,954,000 桶/日。

- 沙乌地阿拉伯的页岩气蕴藏量估计位居世界第五。因此,它具有复製北美传统型蕴藏量开发成长的巨大潜力。 2021年12月,沙特阿美赢得Jafra计划价值1000亿美元的合同,目标是到2030年成为第三大天然气生产商。此外,该计划的开发预计将提高沙乌地阿拉伯对天然气作为发电来源的重视,并支持其 2060 年净零排放目标。

- 因此,此类发展预计将有助于沙乌地阿拉伯的「2030 年愿景」计划,实现经济多元化,摆脱原油依赖,并显着减少沙乌地阿拉伯的碳足迹。此外,沙乌地阿拉伯的发展可能会支持沙乌地阿拉伯更多地依赖国内天然气消费来增加原油出口。

- 2022年3月,为因应油价飙升和2021年获利翻倍的情况,沙乌地阿拉伯国家石油公司沙乌地阿美计画在2022年增加投资约50%。根据沙乌地阿美公司公告,该公司计划2022年投资近400亿美元至500亿美元,预计将持续成长至2030年中期。透过这些投资计划,该公司预计在2027年将原油产能提高到1,300万桶/日,并希望在2030年将天然气产量提高50%以上。这些计划直接支持钻井市场。

- 2022年,Marjan油田将由沙乌地阿美公司开发、营运和拥有。作为马里安原油增产计划的一部分,该海上油田将扩大。该扩建计划预计到2025年将产能从每天30万桶增加到每天约80万桶。

- 由于石油和天然气计划以及碳氢化合物价格上涨,中东和非洲的石油和天然气钻探市场预计将扩大。

中东和非洲钻井产业概况

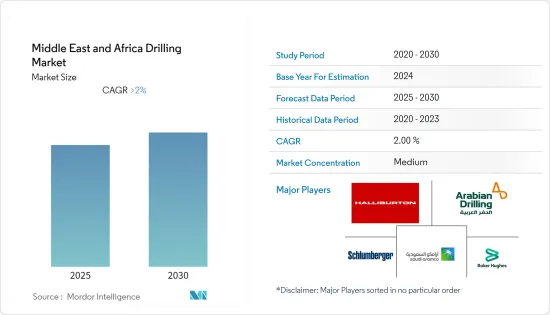

中东和非洲钻井市场适度整合。主要企业(排名不分先后)包括沙乌地阿美石油公司、阿拉伯钻井公司 (ADC)、斯伦贝谢有限公司、贝克休斯公司、Weatherford International PLC 和 Transocean Ltd。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:十亿美元)

- 计划现有与未来的计划

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 部署地点

- 陆上

- 离岸

- 地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他的

第六章 竞争状况

- 合併、收购、联盟和合资企业

- 主要企业策略

- 公司简介

- Arabian Drilling Company (ADC)

- Schlumberger Limited

- Baker Hughes Company

- Weatherford International PLC

- Transocean Ltd.

- Saudi Aramco Oil Co.

- Volgaburmash Middle East & Africa

- ADES International Holding

- CNOOC International Ltd.

- VALLOUREC

第七章 市场机会及未来趋势

The Middle East and Africa Drilling Market is expected to register a CAGR of greater than 2% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the short term, the Middle East and African drilling markets are forecasted to grow due to the increasing oil demand at the international level and the rising interest of private companies to invest in the regional oil and gas upstream industry.

- On the other hand, the growing momentum toward renewable energy sources is expected to pose an uphill challenge for the market in the coming years.

- Nevertheless, the abundance of proven oil and gas reserves in the Middle East and Africa region creates ample opportunities for the drilling market. The region has also witnessed new offshore oil and gas discoveries in the current scenario.

- Saudi Arabia is expected to dominate the market in the near future due to massive oil and gas reserves in the country and the new upcoming exploration and production projects in the country.

MEA Drilling Market Trends

Offshore Segment Expected to Dominate the Market

- The Middle East and Africa are prominent offshore oil and gas-producing regions, and offshore oil and gas exploration spending in the region is set to grow significantly over the next few years. With abundant resources and increased technological potential to recover oil and gas from deep water and ultra-deep water areas, it is expected to provide an excellent opportunity for offshore drilling operations.

- Moreover, with the rapidly increasing global energy needs, offshore oil production has become an attractive energy source. The countries with major regional players focus on exploring offshore oil and gas fields, particularly when running out of onshore oil and gas reserves in the region. The region has witnessed remarkable growth in natural gas production due to the offshore gas discoveries that happened in recent years. The production was around 714 billion cubic meters in 2021. The trend is expected to get upscaled in the coming years.

- In March 2022, Kuwait and Saudi Arabia announced new plans to develop the Dorra offshore gas field in the northern Arabian Gulf. The plan came out when the field was contentious among three countries: Iran, Saudi Arabia, and Kuwait. The area, once operational, will be able to produce around 1 billion cubic feet of dry gas per day and 84,000 barrels per day of condensate.

- Additionally, in February 2022, Abu Dhabi National Oil Company (ADNOC) kicked off a bid process for an engineering, procurement, construction, and installation contract for further development at its huge Lower Zakum offshore oilfield. Furthermore, there are more than 77 and 27 approved upstream projects in the Middle East and Africa for the 2021-2025 period.

- Overall, the increasing offshore oil and gas projects in the region would aid the offshore drilling market.

Saudi Arabia Expected to Dominate the Market

- Saudi Arabia is the second-largest crude oil producer globally and the world's largest crude oil exporter. The country holds around 17% of the total proven petroleum reserves globally. As of 2021, the country has around 267,192 million barrels of crude oil and 8507 cubic meters of natural gas. The crude oil production of Saudi Arabia was recorded as 10,954 thousand barrels per day in the year 2021.

- Saudi Arabia is estimated to have the world's fifth-largest estimated shale gas reserves. Thus, it has great potential to replicate North America's unconventional reserves' development growth. In December 2021, Saudi Aramco was awarded USD 100 billion in contracts on the Jafurah project to place itself as the third-largest natural gas producer by 2030. Further, the project's development is expected to help the country incline more towards natural gas as a source of electricity generation, thus supporting its 2060 net-zero target.

- Hence such developments are expected to serve the country's Vision 2030 program to diversify the economy from crude oil and sharply would reduce the carbon footprint in Saudi Arabia. Moreover, the country's development would support the nation in increasing its crude oil export by depending more on domestic natural gas consumption.

- In March 2022, with soaring crude oil prices and doubling profit in 2021, the country's state oil company, Saudi Aramco, planned to increase its investment by around 50% in 2022. As per Saudi Aramco, the company plans to invest nearly USD 40-50 billion in 2022 and is expected to continue its growth until mid-2030. With such investment plans, the company is expected to increase its crude oil production capacity to 13 million barrels per day by 2027 and wants to increase natural gas production by more than 50% by 2030. Such plans will directly aid the drilling market.

- In 2022, the Marjan Oil field will be under development, operated, and owned by Saudi Aramco. The offshore field is being expanded as part of the Marjan Crude Increment program. The expansion project is expected to increase the production facility from 300,000 barrels per day to about 800,000 barrels per day by 2025.

- The oil and gas drilling market is expected to increase in the Middle East and Africa due to rising oil and gas projects and hydrocarbon prices.

MEA Drilling Industry Overview

The Middle East and Africa Drilling market are moderately consolidated. The major companies (in no particular order) include Saudi Aramco Oil Co, Arabian Drilling Company (ADC), Schlumberger Limited, Baker Hughes Company, Weatherford International PLC, and Transocean Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Kew Existing and Upcoming Project

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography

- 5.2.1 Saudi Arabia

- 5.2.2 United Arab Emirates

- 5.2.3 South Africa

- 5.2.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1

Arabian Drilling Company (ADC)

- 6.3.2 Schlumberger Limited

- 6.3.3 Baker Hughes Company

- 6.3.4 Weatherford International PLC

- 6.3.5 Transocean Ltd.

- 6.3.6 Saudi Aramco Oil Co.

- 6.3.7 Volgaburmash Middle East & Africa

- 6.3.8 ADES International Holding

- 6.3.9 CNOOC International Ltd.

- 6.3.10 VALLOUREC