|

市场调查报告书

商品编码

1635485

欧洲石油和天然气储存槽:市场占有率分析、产业趋势、成长预测(2025-2030)Europe Oil and Gas Storage Tank - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

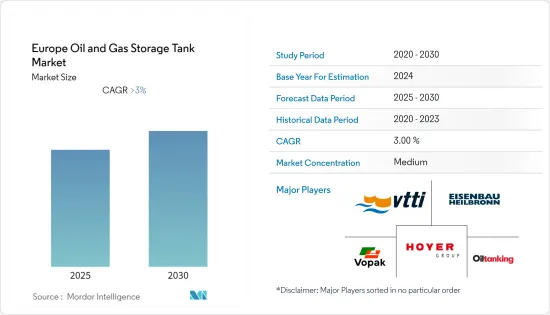

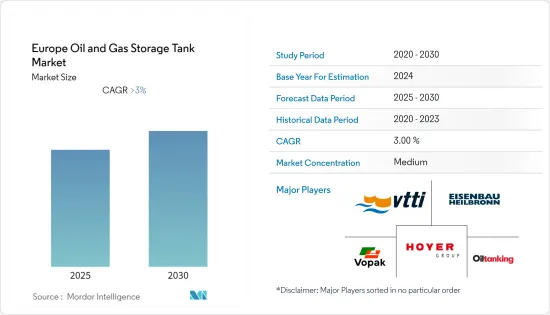

预计欧洲石油和天然气储存槽市场在预测期内的复合年增长率将超过3%。

2020 年市场受到 COVID-19 的负面影响。目前,市场已达到疫情前水准。从中期来看,石油和天然气需求的上升预计将刺激欧洲石油和天然气储存槽市场的成长。此外,天然气消费量的增加预计将推动所研究市场的成长。

另一方面,投资和维护成本的增加预计将阻碍预测期内的市场成长。为提高储罐容量而投资开发仓储设施和新管道预计将在预测期内为欧洲石油和天然气储存槽市场提供利润丰厚的成长机会。预计德国在预测期内将出现强劲成长。这一增长归因于该国投资的增加以及石油和天然气消费的增加。

欧洲油气储存槽市场趋势

中产阶级实现大幅成长

欧洲是世界上一些最古老的石油生产国的所在地。该地区也是世界上最大的海上石油和天然气市场之一。挪威、英国和俄罗斯是该地区石油和天然气产业的主要参与者。

中游部门涉及开采的原油和天然气的运输和储存。这包括原油和天然气管道、天然气加工厂、天然气液化厂以及液化气和再气化储存等基础设施。石油和天然气产量的增加以及基础设施的老化正在推动新的中游基础设施需求以及欧洲对储存槽的需求不断增加。

截至2022年7月,欧盟天然气蕴藏量达到650.4兆瓦时(TWh),约占容量的89.02%。欧盟季度储气蕴藏量于2020年1月达到10年来的峰值,天然气交付量约为986.65太瓦时。

2022年5月,Uniper与德国当局签署协议,建造该国第一个液化天然气(LNG)终端,使该国减少对俄罗斯天然气的依赖。联邦政府还签署了一份意向书,租用四个浮体式储存和再气化装置(FSRU)来进口天然气。

2022年5月,随着欧洲能源危机的加深,Centrica PLC获得了重启英国最大天然气储存设施的权利。取得许可证将使 COUK(Centrica Offshore UK)能够在开始天然气储存营运之前寻求进一步的监管核准。

因此,基于上述因素,预计在预测期内欧洲油气储存槽市场的中游需求将出现巨大需求。

德国正在经历显着的成长

随着德国石油和天然气消费的成长,储存和管道能力得到充分利用。该国正在规划新的石油储存码头,以满足国内最终用户的需求。

截至2022年1月,德国战略原油蕴藏量达2,260万吨原油当量。与 2021 年 3 月底相比略有下降。根据德国的法律体制,政府的目标是确保一定程度的石油储备,以至少暂时应对未来的石油短缺。

2022年7月,德国和奥地利签署协议,加速储气仓储设施充气。随着双边团结协议的签署,两国同意在液化天然气(LNG)基础设施的利用和储存充装方面进行合作。

2022年9月,德国天然气仓储设施达到85%以上,儘管俄罗斯因乌克兰战争导致供应大幅下降,但仍呈现稳定进展。政府设定的10月份储存容量达到85%的目标已在9月初达成。

因此,基于上述因素,预计德国欧洲油气储存槽市场在预测期内将显着成长。

欧洲油气储存槽产业概况

欧洲石油和天然气储存槽市场适度细分。市场主要企业包括(排名不分先后)Royal Vopak NV、Oiltanking GmbH、HOYER GmbH、Vitol Tank Terminals International BV (VTTI) 和 Eisenbau Heilbronn GmbH。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 部门

- 川上

- 在河里

- 下游

- 地区

- 德国

- 英国

- 挪威

- 西班牙

- 欧洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Royal Vopak NV

- Oiltanking GmbH

- HOYER GmbH

- Vitol Tank Terminals International BV(VTTI)

- Eisenbau Heilbronn GmbH

- Lapesa Grupo Empresarial SL

- GLS Tanks International GmbH

- ROSEN Group

- Dyer Gas GmbH

- Virtor Oy

第七章市场机会与未来趋势

The Europe Oil and Gas Storage Tank Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels. Over the medium term, the growing demand for oil and gas is expected to stimulate the growth of the European oil and gas storage tank market. Furthermore, increasing consumption of natural gas is expected to drive the growth of the market studied.

On the other hand, increased investment and maintenance costs are expected to hamper the growth of the market studied during the forecast period. Nevertheless, investment in the development of storage facilities and new pipelines for improving the storage capacity of tanks is likely to create lucrative growth opportunities for the European oil and gas storage tank market in the forecast period. Germany is expected to witness significant growth during the forecast period. This growth is attributed to the increasing investments, coupled with increasing consumption of oil and gas in the country.

Europe Oil & Gas Storage Tank Market Trends

Midstream to Witness Significant Growth

Europe is home to some of the oldest oil-producing countries in the world. The region is also one of the largest offshore oil and gas markets worldwide. Norway, the United Kingdom, and Russia are some of the major countries in the region's oil and gas industry.

The midstream sector pertains to the transport and storage of crude oil and natural gas extracted. It includes infrastructure such as crude oil and natural gas pipelines, gas treatment plants, natural gas liquefaction plants, and liquefied gas and regasification storage. The growing oil and gas production and aging infrastructure drive the demand for new midstream infrastructure, increasing the demand for storage tanks in Europe.

As of July 2022, the European Union's gas storage volume amounted to 650.4 terawatt-hours (TWh), accounting for approximately 89.02% of its capacity. The quarterly gas storage volume in the European Union reached a decade-peak in January 2020, with nearly 986.65 TWh of natural gas in supply.

In May 2022, Uniper signed an agreement with German authorities to build the country's first liquefied natural gas (LNG) terminal to enable the country to reduce its reliance on Russian gas. The federal government also signed a letter of intent to charter four floating storage and regasification units (FSRUs) to import gas.

In May 2022, Centrica PLC acquired the rights to restart Britain's largest natural gas storage site as Europe's energy crisis intensifies. The award of a license allows COUK (Centrica offshore UK) to seek further regulatory approvals before gas storage operations can commence.

Therefore, based on the above-mentioned factors, the midstream segment is expected to witness significant demand in the European oil and gas storage tank market during the forecast period.

Germany to Witness Significant Growth

Growing oil and gas consumption in Germany has resulted in the complete utilization of storage and pipeline capacities. New oil storage terminals have been planned in the country to cater to the demand from domestic end users.

As of January 2022, Germany had 22.6 million tons of oil equivalent in strategic crude oil reserves. This was a slight decrease compared to the end of March 2021. According to the legal framework in Germany, the government aims to ensure a certain level of crude oil reserves to be able to combat future shortages, at least temporarily.

In July 2022, Germany and Austria signed a deal to accelerate the filling of gas storage facilities. With the signing of a bilateral solidarity agreement, the two countries agreed to cooperate on the use of liquefied natural gas (LNG) infrastructure and storage filling.

In September 2022, Germany's natural gas storage facilities reached more than 85%, showing steady progress despite a drastic reduction in deliveries from Russia amid the war in Ukraine. The government's target to reach 85% storage capacity by October was achieved at the beginning of September.

Therefore, based on the above-mentioned factors, Germany is expected to witness significant growth in the European oil and gas storage tank market during the forecast period.

Europe Oil & Gas Storage Tank Industry Overview

The European oil and gas storage tank market is moderately fragmented in nature. Some of the major players in the market (in no particular order) are Royal Vopak NV, Oiltanking GmbH, HOYER GmbH, Vitol Tank Terminals International BV (VTTI), and Eisenbau Heilbronn GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sector

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

- 5.2 Geography

- 5.2.1 Germany

- 5.2.2 United Kingdom

- 5.2.3 Norway

- 5.2.4 Spain

- 5.2.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Royal Vopak NV

- 6.3.2 Oiltanking GmbH

- 6.3.3 HOYER GmbH

- 6.3.4 Vitol Tank Terminals International BV (VTTI)

- 6.3.5 Eisenbau Heilbronn GmbH

- 6.3.6 Lapesa Grupo Empresarial SL

- 6.3.7 GLS Tanks International GmbH

- 6.3.8 ROSEN Group

- 6.3.9 Dyer Gas GmbH

- 6.3.10 Virtor Oy