|

市场调查报告书

商品编码

1635488

印度可携式发电机:市场占有率分析、行业趋势和成长预测(2025-2030)India Portable Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

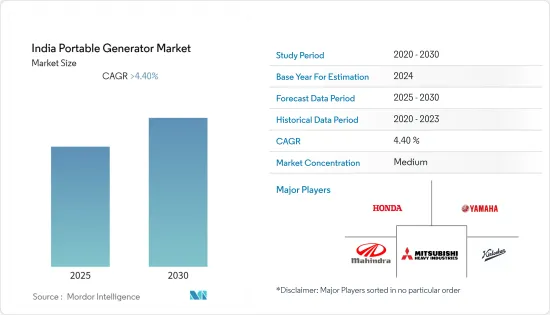

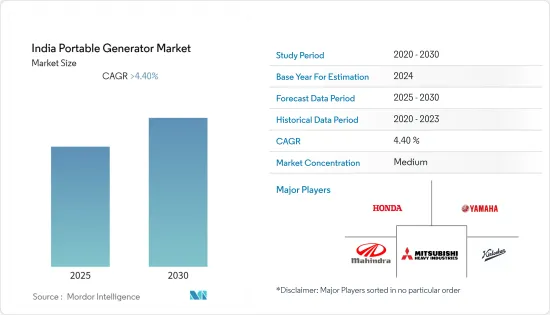

印度可携式发电机市场预计在预测期内复合年增长率将超过 4.4%。

COVID-19 对 2020 年市场产生了负面影响。目前市场处于大流行前的水平。

主要亮点

- 预计在预测期内,各种因素将推动市场发展,包括政府为减少评级柴油发电机组排放气体而製定的有利法规。

- 另一方面,由于可再生能源发电的成长趋势,特别是在旨在减少温室气体排放的行业中,正在调查的市场可能很快就会面临障碍。

- 也就是说,可携式混合发电机的日益普及和混合动力系统可靠性的提高可能为该行业带来机会。可携式发电机可能会降低成本并减少对单一燃料的依赖。预计这将在不久的将来为可携式发电机製造商创造重大商机。

印度可携式发电机市场趋势

工业部门预计将显着成长

- 工业部门,包括中小型製造设备、农业和建设业,是所有终端用户产业中能源消费量最高的。因此,它是印度发电机的重要终端用户部门。

- 根据联合国经济和社会事务部预测,到2022年,印度将成为成长最快的经济体之一。预计 2022 年全球经济仅成长 3.1%。同时,印度经济预计将成长6.4%。

- 由于最近的COVID-19危机,印度工业生产年增长率下降了8.4%。不过,2022年工业生产呈现显着成长。预计这将影响中小型工业发电机的使用增加,以确保高效的燃料供应。

- 同样,可携式气体发生器正在成为许多小型工业应用的首选解决方案。燃气发电机的运作时间明显更长,更容易获得许可证,使用天然气的机组的排放气体量比柴油发电机少 90%。

- 2022年2月,中央污染控制委员会(CPCB)宣布了一项三管齐下的措施:报废超过15年的柴油发电机,要求发电机安装废气控制装置,并对新发电机实施更严格的废气提案。这些措施将有助于扩大便携式气体发生器的使用,以减少全国范围内的污染。

- 此外,2021 年 12 月,政府市场 (GEM) 对新德里工商部办公室的柴油发电机组安装计划进行了竞标。竞标需要至少五台可携式发电机组作为备用电源。

- 鑑于上述情况,印度可携式发电机市场预计在预测期内工业领域将显着成长。

有利的政府法规推动市场

- 柴油发电机是印度商业、住宅和工业用途中最常用的发电机。由于污染、噪音和维护成本等缺点,消费者正在寻找备用电源替代品,例如燃气发电机。

- 2022年2月,印度环境、森林和气候变迁部修订了自2023年7月起所有发电机必须遵守的排放标准。印度发电机排放标准 IV+ 适用于运作所有燃料(包括氢气)的发电机。

- 此外,人们对使用天然气(一种清洁可靠的燃料)发电的认识不断增强,加上对柴油发电机的维护和负面环境影响的日益担忧,导致全国范围内便携式燃气发电机的使用量增加。它会变得更受欢迎。

- 此外,五年后的2022年4月,为了遏制柴油发电,政府修改规定,要求配电公司在地铁和大城市每年365天、每天24小时供电。因此,可携式发电机可能很快就会在全国范围内使用。

- 鑑于上述情况,预计强有力的政府法规将在预测期内主导印度可携式发电机市场。

印度可携式发电机产业概况

印度可携式发电机市场较为分散。市场的主要企业包括(排名不分先后)本田印度动力产品有限公司、雅马哈汽车、三菱重工有限公司、Mahindra & Mahindra Limited 和 Kirloskar Oil Engines Ltd。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:十亿美元)

- 政府法规政策

- 最新趋势和发展

- 市场动态

- 促进因素

- 抑制因素

- PESTLE分析

第五章市场区隔

- 按额定功率

- 小于5kW

- 5~10 kW

- 10kW以上

- 按燃料类型

- 气体

- 柴油引擎

- 其他燃料

- 按最终用户

- 产业

- 业务

- 住宅

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Honda India Power Products Ltd

- Yamaha Motor Co. Ltd

- Mitsubishi Heavy Industries Ltd

- Mahindra & Mahindra Limited

- Kirloskar Oil Engines Ltd

- Generac Holdings Inc.

- Caterpillar Inc.

- Mitsubishi Heavy Industries Engine & Turbocharger Ltd

- Yanmar Holdings Co. Ltd

- Kohler Co. Inc.

- Wartsila Corporation

第七章 市场机会及未来趋势

简介目录

Product Code: 92850

The India Portable Generator Market is expected to register a CAGR of greater than 4.4% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Various factors, such as favorable government regulations to reduce emissions generated from high-rated diesel-generated sets, are expected to drive the market during the forecast period.

- On the other hand, the market studied may face hurdles shortly due to the growing trend of renewable power generation, particularly in industries that have targeted reducing greenhouse gas emissions.

- Nevertheless, the increasing popularity of portable hybrid generators and the rising reliability of the hybrid system may be an opportunity for the industry. Portable generators will reduce costs and dependence on a single fuel. This, in turn, is expected to provide a significant opportunity for portable generator manufacturers in the near future.

India Portable Generator Market Trends

Industrial Sector Expected to Witness Significant Growth

- The industrial sector, which includes small & medium scale manufacturing units, agriculture, and construction, accounts for the most energy consumption of any end-user industry. Thus, it is an important end-user segment for generators in India.

- According to the United Nations Department of Economic and Social Affairs, by 2022, India will be one of the fastest-growing economies. The global economy was projected to incline by only 3.1% in 2022. At the same time, India was expected to grow by 6.4%.

- Due to the recent Covid-19 crisis, the annual growth rate of industrial production in India declined by 8.4%. However, in the year 2022, industrial production witnessed significant growth. This is expected to impact the growth in the usage of generators across small & medium-sized industries, as they ensure efficient fuel supply.

- Similarly, portable gas generators are becoming the preferred solution in many small-scale industrial applications. They provide much longer runtimes, permitting is more accessible, and units with natural gas have 90% fewer emissions than diesel generators.

- In February 2022, the Central Pollution Control Board (CPCB) proposed a strategy to reduce pollution from old diesel gensets via a 3-pronged approach: scrapping diesel gen-sets older than 15 years, mandating the retrofitting of gensets with emission control devices, and imposing tighter emission standards for newer gensets. Such measures will aid the growth in the usage of portable gas generators to reduce pollution across the country.

- Also, in December 2021, Government E-Marketplace (GEM) floated a tender for the installation project of diesel generator sets at the Ministry of Commerce & Industry office in New Delhi. The tender required at least five portable DG sets for the backup power supply.

- Owing to the above points, the industrial sector is expected to witness significant growth in the Indian portable generator market during the forecast period.

Favorable Government Regulations to Drive the Market

- Diesel generators are India's most used generators in commercial, residential, and industrial applications. Disadvantages, such as pollution, noise, and maintenance costs, are making consumers look for alternatives for backup power supply, such as gas generators.

- In February 2022, The Ministry of Environment, Forest and Climate Change revised the emission norms in India, effective from July 2023, with which all generators must comply. The India Genset Emission Standards- IV+ will apply for generators running on all fuels, including hydrogen.

- Also, increasing awareness regarding the use of natural gas in power generation, as it is a clean and reliable fuel, coupled with increased concerns over diesel generator maintenance and its negative impact on the environment, is expected to drive portable gas generators across the country.

- Moreover, in April 2022, in order to dissuade diesel generation in five years, the government amended rules mandating power distribution companies to supply 24x7 electricity in metros and large cities. This may, in turn, result in the utilization of portable generators across the country shortly.

- Owing to the above points, strong government regulations are expected to dominate the Indian portable generator market during the forecast period.

India Portable Generator Industry Overview

The Indian portable generator market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Honda India Power Products Ltd, Yamaha Motor Co. Ltd, Mitsubishi Heavy Industries Ltd, Mahindra & Mahindra Limited, and Kirloskar Oil Engines Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope Of The Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size And Demand Forecast In USD Billion, Till 2027

- 4.3 Government Policies And Regulations

- 4.4 Recent Trends And Developments

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 By Power Rating

- 5.1.1 Below 5 kW

- 5.1.2 5-10 kW

- 5.1.3 Above 10 kW

- 5.2 By Fuel Type

- 5.2.1 Gas

- 5.2.2 Diesel

- 5.2.3 Other Fuel Types

- 5.3 By End-user

- 5.3.1 Industrial

- 5.3.2 Commerial

- 5.3.3 Residential

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, And Agreements

- 6.2 Strategies Adopted By Leading Players

- 6.3 Company Profiles

- 6.3.1 Honda India Power Products Ltd

- 6.3.2 Yamaha Motor Co. Ltd

- 6.3.3 Mitsubishi Heavy Industries Ltd

- 6.3.4 Mahindra & Mahindra Limited

- 6.3.5 Kirloskar Oil Engines Ltd

- 6.3.6 Generac Holdings Inc.

- 6.3.7 Caterpillar Inc.

- 6.3.8 Mitsubishi Heavy Industries Engine & Turbocharger Ltd

- 6.3.9 Yanmar Holdings Co. Ltd

- 6.3.10 Kohler Co. Inc.

- 6.3.11 Wartsila Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219