|

市场调查报告书

商品编码

1635493

美国遥控潜水器:市场占有率分析、产业趋势、统计、成长预测(2025-2030)United States ROV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

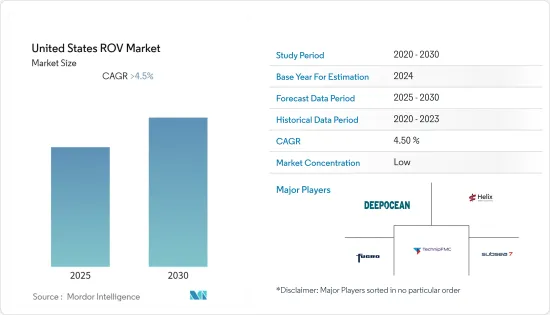

预计美国ROV 市场在预测期内的复合年增长率将超过 4.5%。

从长远来看,主要的市场驱动因素包括海上石油和天然气发现量的增加、离岸风力发电的增加以及石油和天然气除役活动的增加。另一方面,由于石化燃料使用的增加造成的环境破坏日益严重,北美禁止海上石油和天然气探勘。因此,预测期内市场成长预计将放缓,尤其是在美国。美国ROV市场的技术进步预计将为美国ROV部署创造巨大的机会。

美国ROV市场趋势

检查、维修和保养活动将大幅成长

2014年至2017年,油气产业ROV运转率持续下降,导致运作天数减少。检查、维修和保养 (IRM) 部门通常不受油价波动的影响,因为这些活动被认为是必要且不可避免的。然而,海上业务的大幅下降和一些业务的延误对 IRM ROV 服务市场产生了强烈的负面影响。

在预测期内,IRM 领域预计将显着增长,这主要是由老化的海上基础设施推动的,特别是在北美地区,包括美国和墨西哥湾。这些老化的基础设施需要更频繁的监控以及频繁的维修和维护活动。

在海工领域,深水和超深水活动受到油价下跌的严重打击。在经济衰退期间,该行业采取了低成本方案,并透过计划重新设计、提高效率和改进费用管理来应对,导致总营运成本大幅降低。所有这些措施不仅提高了产业营运效率,还降低了海上深水和超深水计划的损益平衡价格。此外,二迭纪盆地拥有美国最多的石油钻机。截至 2022 年 8 月,该盆地有 344 个钻机在运作,其次是 Eagle Ford,有 63 个。这两个盆地主要位于德克萨斯州。在美国,由于俄罗斯和乌克兰战争导致燃料供应紧张,运作的石油和天然气钻机数量在疫情暴跌后再次增加,IRM领域对ROV的需求也增加。

越来越多的公司提供 ROV,用于海上计划的检查、维修和维护 (IRM) 服务。每家公司提供的主要服务包括无人检查、管道维护、海底结构监测和海底工程服务。例如,休士顿机电公司于2021年3月宣布升级其AUV/ROV变压器Aquanaut。 Aquanaut 是一款多用途水下机器人,可将 AUV 转换为无繫绳 ROV,从而无需大型船舶和供应连系管。机器人的新版本 Aquanaut Mk-II 的额定深度比第一个型号更深。这不仅可以收集资料,还可以以相对较低的成本远端控制维护和维修工作。

因此,基于上述因素,预测期内美国的检查、维修和保养活动预计将呈现显着增长。

海上可再生技术的成长推动市场需求

过去十年能源需求显着增加,人们对全球暖化的认识不断增强。这为可再生技术带来了机会。儘管离岸风力发电、潮汐能、水力发电涡轮机和设备等海上技术是相对利基市场,但不断增长的能源需求正在创造利用这些能源的机会。

离岸风力发电机和航海水力发电设备等海洋可再生能源结构的安装需要各种可视化技术来正确测量海底,以进行初始安装、电缆敷设、安装后监测和维护操作。这类活动很困难,因为安装地点会受到涨潮和高水流等不稳定条件的影响。此外,能见度差使得潜水员和相机等传统光学解决方案不可行,需要探勘声纳、雷射成像或类似工具。因此,ROV 系统在这些情况下会派上用场,我们描述了一个可扩展的模组化解决方案和必要的资料。

风力发电产业的离岸风力发电安装呈现成长趋势。 2021年美国新增离岸风力发电将超过13兆瓦。

此外,2022 年 3 月,TerraSound 宣布计划在马萨诸塞州投资一个新地点,作为其支持 Vineyard Wind 1计划和更广泛的美国离岸风电开发承诺的一部分。 Terrasondo已经在美国东海岸的离岸风力发电行业进行现场检查和运行/维护检查。 Vineyard Wind 1 的电站平衡业务补充了该公司成熟的经验和业绩记录,以及涡轮机基础的远端操作车辆 (ROV) 检查、出口和阵列电缆的海底调查,以及该公司提供的各种其他海底服务。整个Acton 集团。此类海上风力发电领域的计画预计将在预测期内推动美国ROV 市场的发展。

因此,基于上述因素,离岸风力发电装置的增加预计将在预测期内推动美国ROV市场的成长。

美国ROV产业概况

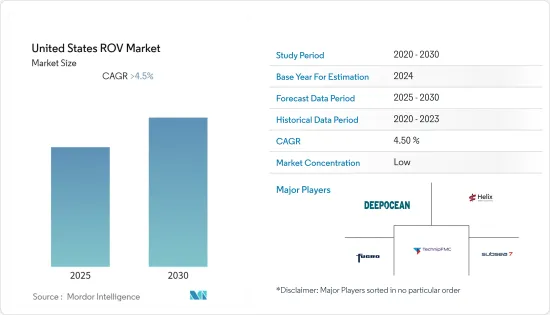

美国ROV市场是细分的。市场的主要企业包括(排名不分先后)Subsea 7 SA、TechnipFMC PLC、DeepOcean AS、Helix Energy Solutions Group 和 Fugro NV。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 类型

- 工作级ROV

- 观察级ROV

- 目的

- 石油和天然气

- 防御

- 其他的

- 活动详情

- 研究

- 检查、维修和保养

- 其他活动

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- DeepOcean AS

- DOF Subsea AS

- Helix Energy Solutions Group

- TechnipFMC PLC

- Fugro NV

- Oceaneering International Inc.

- Saipem SpA

- ROVOP

- Forum Energy Technologies Inc.

- Delta SubSea LLC

第七章 市场机会及未来趋势

The United States ROV Market is expected to register a CAGR of greater than 4.5% during the forecast period.

Over the long term, the major driving factors of the market include increasing offshore oil and gas discoveries, growing offshore wind energy installations, and rising oil and gas decommissioning activities. On the flip side, increasing environmental damage due to the increasing use of fossil fuels has led to the banning of offshore exploration of oil and gas in the North American region. This is expected to slow down the market, especially in the United States, during the forecast period. Nevertheless, technological advancements in the US ROV market are expected to create enormous opportunities for the United States ROV deployment.

US ROV Market Trends

Inspection, Repair, and Maintenance Activity to Witness Significant Growth

The utilization rates for ROV in the oil and gas industry registered a consistent decline during 2014-2017, resulting in declining day rates. Generally, the inspection, repair, and maintenance (IRM) segment is protected from volatility in oil prices, as these operations are considered necessary and unavoidable. However, the combination of a substantial decline in offshore operations and delays in some of the activities had a strong negative impact on the IRM ROV services market.

During the forecast period, the IRM segment is expected to register significant growth, mainly driven by aging offshore infrastructure, particularly in the North American region, which includes the United States and the Gulf of Mexico. These aging infrastructures require more frequent monitoring, along with frequent repair and maintenance activities.

In the offshore sector, deepwater and ultra-deepwater activities were hit harder by the decline in oil prices. During the period of downturn, the industry adopted a lower price scenario and responded with project re-engineering, efficiency gains, and better expense management, which resulted in a significant reduction of the total operating cost. All such steps have not only resulted in improving the operational efficiency in the industry but have also reduced the breakeven price of offshore deepwater and ultra-deepwater projects. Moreover, the Permian basin is the region with the largest number of oil rigs in the United States. As of August 2022, there were 344 active rigs in the basin, followed by Eagle Ford, with 63 rigs. Both basins are mainly located in Texas. The number of operational oil and gas rigs in the United States has increased again from a pandemic-induced slump on the back of tighter fuel supplies due to the Russia-Ukraine war, thus, increasing the demand for ROV in the IRM segment.

A growing number of companies are offering ROV for inspection, repair, and maintenance (IRM) services for offshore projects. Some of the major services being offered by the companies include driverless inspection, pipeline maintenance, subsea structure monitoring, and subsea engineering services. For instance, in March 2021, Houston Mechatronics Inc. announced that it had upgraded its self-developed AUV/ROV transformer, Aquanaut, a multi-purpose subsea robot that can transform an AUV into a tetherless ROV, eliminating the need for large vessels and umbilicals. The new version of this robot, Aquanaut Mk-II, has a deeper depth rating than the first model. It enables the collection of data as well as the remote operation of maintenance and repair tasks at a comparatively lower cost.

Therefore, based on the above-mentioned factors, inspection, repair, and maintenance activity is expected to witness significant growth in the United States during the forecast period.

Growing Offshore Renewable Technologies Driving the Market Demand

There has been a significant increase in energy demand over the past decade and a constant rise in awareness about global warming. This has been opening opportunities for renewable technologies. Though offshore technologies, such as offshore wind power, tidal energy, and hydrokinetic turbines or device,s are relatively niche markets, the increasing energy demand has created opportunities for harnessing these energies.

The installation of marine renewable energy structures, such as offshore wind turbines and navigational hydrokinetic devices, is expected to require a variety of visualization and monitoring equipment to appropriately survey the seafloor for initial installation, cable lay, post-installation monitoring, and maintenance tasks. Such activities can be challenging due to unstable conditions such as high tides or high ocean currents where these installations are located. In addition, the visibility is such that traditional optical solutions such as divers or cameras are not feasible, necessitating forward-looking sonars, laser imaging, or similar tools. Therefore, ROV systems come in handy in such situations and offer scalable, modular solutions and the necessary data required.

The wind energy industry is witnessing an increasing trend toward offshore wind farm installations. The new offshore wind power in the United States accounted for more than 13 MW capacity in 2021.

Moreover, in March 2022, TerraSound announced plans to invest in a new base in Massachusetts as part of its commitment to support the Vineyard Wind 1 project and wider US offshore wind developments. TerraSond is already committed to the US East Coast offshore wind industry through its site investigation surveys and operating and maintenance inspections. The Vineyard Wind 1 balance of plant work, which will add to the company's solid experience and track record, covers turbine foundation remotely operated vehicle (ROV) inspections and export and array cable seabed surveys alongside a range of other subsea integrity and operational services from across the Acteon group. Such plans for the offshore wind energy sector are expected to drive the US ROV market during the forecast period.

Therefore, based on the above-mentioned factors, the increase in offshore wind power installations is expected to drive the US ROV market during the forecast period.

US ROV Industry Overview

The US ROV market is fragmented. Some of the major players in the market (in no particular order) are Subsea 7 SA, TechnipFMC PLC, DeepOcean AS, Helix Energy Solutions Group, and Fugro NV.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Work Class ROV

- 5.1.2 Observatory Class ROV

- 5.2 Application

- 5.2.1 Oil and Gas

- 5.2.2 Defense

- 5.2.3 Other Applications

- 5.3 Activity

- 5.3.1 Survey

- 5.3.2 Inspection, Repair, and Maintenance

- 5.3.3 Other Activities

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 DeepOcean AS

- 6.3.2 DOF Subsea AS

- 6.3.3 Helix Energy Solutions Group

- 6.3.4 TechnipFMC PLC

- 6.3.5 Fugro NV

- 6.3.6 Oceaneering International Inc.

- 6.3.7 Saipem SpA

- 6.3.8 ROVOP

- 6.3.9 Forum Energy Technologies Inc.

- 6.3.10 Delta SubSea LLC