|

市场调查报告书

商品编码

1635496

欧洲先进生质燃料:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Advanced Biofuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

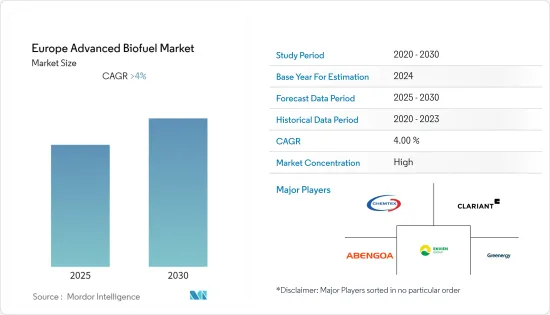

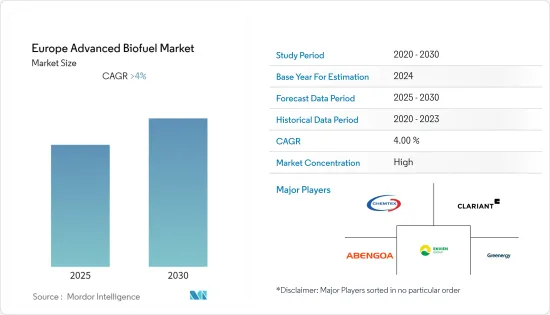

预计欧洲先进生质燃料市场在预测期内复合年增长率将超过 4%。

2020 年市场受到 COVID-19 的负面影响。目前,市场已达到疫情前水准。

主要亮点

- 从长远来看,原材料的容易获得和作为非食品和废弃物的易于利用以及政府支持先进生质燃料生产技术发展的奖励似乎将在预测期内推动市场。

- 另一方面,先进生质燃料的高生产成本可能会限制市场成长,儘管有所有相关的好处。

- 英国、荷兰、瑞典等国鼓励混合生质柴油,以获得纯生质柴油,可作为柴油引擎的燃料来源。这可能为未来的生质燃料市场提供充足的机会。

- 预计德国将在预测期内主导欧洲先进生质燃料市场。

欧洲先进生质燃料市场趋势

生物柴油燃料大幅成长

- 生质柴油是一种可再生燃料,由菜籽油、葵花籽油和大豆油等植物油以及废食用油和动物脂肪生产。事实证明,生物柴油在减少全球暖化影响、减少排放、提高能源独立性以及对农业产生积极影响方面具有显着的环境效益。

- 生物柴油用于配备柴油引擎的汽车、卡车和巴士等车辆,以及固定热电应用。大多数的生物柴油是透过化学加工植物油(例如棕榈油、大豆油、菜籽油和一些动物脂肪)来生产脂肪酸甲酯(FAME)而製成。

- 据美国农业部称,生物柴油以及生物柴油和石化燃料的混合物可以帮助减少碳排放,特别是在交通运输领域。欧盟委员会计划修订可再生能源指令,预计将提高交通运输领域的可再生能源目标。

- 近年来,由于人们对气候变迁的担忧日益增加以及对清洁运输燃料的需求,欧洲的生物柴油消费量大幅增加。例如,根据英国能源统计文摘,交通运输领域的生质柴油消费量已从 2015 年的 559 公升飙升至 2021 年的约 1,238 公升。

- 因此,对新的生物柴油生产设施的需求不断增长,以满足该地区不断增长的需求。例如,2022年6月,嘉吉在比利时根特建成了第一座先进的生物柴油工厂,将废油和残渣转化为可再生燃料。该工厂生产的先进生质柴油将用于海运和卡车运输领域,帮助客户减少与海运和道路运输相关的碳排放。

- 因此,由于上述因素,预计在预测期内,欧洲先进生质燃料市场的生物柴油燃料类型将显着成长。

德国主导市场

- 德国是世界领先的生质燃料生产国之一。该国正在鼓励在道路运输中使用生质燃料,以减少温室气体排放。

- 根据BP《2022年世界能源统计回顾》,德国生质燃料产量为121.2拍焦,相当于全球生质燃料产量的3.1%。德国是欧盟 (EU) 生物柴油的主要生产国之一。根据美国农业部(USFDA)统计,2020年德国生质柴油产量约35.42亿公升,较2012年的31.06亿升成长约14.33%。

- 2018年,欧盟通过了2021-2030年可再生能源指令II(RED II),设定到2030年可再生能源总体目标为32%,交通运输领域目标为14%。此外,欧盟也设定了生质燃料的最低使用水平,以实现可再生能源指令 II。因此,继RED II倡议之后,德国政府设定了2025年先进生质燃料混合比例达到0.5%的目标,以推广可再生燃料用于交通运输。德国也制定了2025年将交通运输部门温室气体排放减少6%的目标。预计此类政府措施将在预测期内支持德国先进的生物柴油市场。

- 直到2019年,棕榈油一直是德国的主要原料。然而,2019 年颁布的《生质燃料间接土地利用变化影响(ILUC) 授权法案》限制在2023 年之前在生物柴油生产中使用棕榈油(唯一的「高ILUC 风险」原料)。被逐步淘汰到2030年。德国设定了2023年逐步淘汰棕榈油的目标,并为减少温室气体排放做出贡献。

- 此外,2022年7月,德国德国邮政敦豪集团旗下的空运和海运专业公司DHL全球货运与班轮运输公司赫伯罗特签署了一项使用先进生质燃料的协议。作为第一步,赫伯罗特将使用先进的生质燃料运输 DHL 的 18,000 TEU 货物,这相当于减少 14,000 吨的二氧化碳排放。两家公司共用货柜运输和物流脱碳的共同愿景。预计此类协议将在预测期内为德国先进生质燃料市场产生积极的需求。

- 因此,由于上述因素,德国预计将在预测期内主导欧洲先进生质燃料市场。

欧洲先进生生质燃料产业概况

欧洲先进的生质燃料市场因其性质而得到巩固。市场的主要企业包括(排名不分先后)Abengoa Bioenergy、Chemtex Group、Clariant Produkte GmbH、Greenergy International Ltd 和 Envien Group。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 欧洲先进生质燃料市场规模及2027年预测(单位:十亿美元)

- 截至 2021 年欧洲现有和即将开展的主要先进生质燃料计划

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 原料

- 麻风树

- 木质纤维素

- 藻类

- 其他原料

- 生质燃料类型

- 纤维素乙醇

- 生质柴油

- 沼气

- 生物丁醇

- 其他生质燃料

- 科技

- 生化

- 热化学

- 地区

- 德国

- 法国

- 西班牙

- 英国

- 欧洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Abengoa Bioenergy

- Chemtex Group

- Clariant Produkte GmbH

- Greenergy International Ltd

- Envien Group

- DuPont Industrial Biosciences

- INEOS Bio

第七章 市场机会及未来趋势

简介目录

Product Code: 92881

The Europe Advanced Biofuel Market is expected to register a CAGR of greater than 4% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, the ease in the availability of raw materials and their use being non-food and wastes, along with governmental incentives supporting the development of technologies for producing advanced biofuels, are expected to drive the market during the forecast period.

- On the flip side, the high cost of production of advanced biofuels, even with all the associated benefits, is likely to restrain the market's growth.

- Nevertheless, countries such as Germany, the United Kingdom, the Netherlands, and Sweden are encouraging biodiesel blending to obtain pure biodiesel, which can be used as a fuel source in diesel engines. This will likely provide ample opportunities for the biofuel market in the future.

- Germany is expected to dominate the advanced biofuel market in Europe during the forecast period.

Europe Advanced Biofuel Market Trends

Biodiesel Fuel Type to Witness Significant Growth

- Biodiesel is a renewable fuel produced from vegetable oils, such as rapeseed oil, sunflower seed oil, and soybean oil, and used cooking oils or animal fats. Biodiesel has been demonstrated to have significant environmental benefits in terms of decreased global warming impacts, reduced emissions, greater energy independence, and a positive impact on agriculture.

- Biodiesel is used in diesel engine-based cars, trucks, buses, and other vehicles and in stationary heat and power applications. Most biodiesel is made by chemically treating vegetable oils and fats (such as palm, soy, and canola oils, and some animal fats) to produce fatty acid methyl esters (FAME).

- According to the United States Department of Agriculture, biodiesel and a mixture of biodiesel in fossil fuels help to reduce carbon dioxide emissions, especially in the transport sector. The European Commission plans to revise the Renewable Energy Directive, which is expected to increase renewable energy targets in the transport sector.

- The European region witnessed significant growth in biodiesel consumption in recent years, with a rising concern regarding climate change and a need for clean transportation fuel. For instance, according to the Digest on the United Kingdom Energy Statistics, biodiesel consumption in the transport sector increased rapidly from 559 liters in 2015 to about 1,238 liters in 2021.

- This, in turn, is increasing the demand for new biodiesel production facilities to meet the growing regional demand. For instance, in June 2022, Cargill completed its first advanced biodiesel plant in Ghent, Belgium, which converts waste oils and residues into renewable fuel. The advanced biodiesel produced at the facility will be used by the maritime and trucking sectors, enabling customers to lower the carbon footprint associated with their marine and road transport activities.

- Therefore, based on the aforementioned factors, biodiesel fuel type is expected to witness significant growth in Europe's advanced biofuel market during the forecast period.

Germany to Dominate the Market

- Germany is one of the largest producers of biofuel in the world. The country encourages biofuel usage in road transportation to reduce greenhouse gas emissions.

- According to the BP Statistical Review of World Energy 2022, Germany produced 121.2 petajoules of biofuel, equivalent to 3.1% of the world's biofuel production. Germany is one of the largest biodiesel producers in the European Union. According to the United States Department of Agriculture (USFDA), in 2020, Germany produced approximately 3,542 million liters of biodiesel, witnessing an increase of roughly 14.33% compared to 3,106 million liters of biodiesel in 2012.

- In 2018, the European Union adopted the Renewable Energy Directive II (RED II) for the period 2021-2030, which indicated to set a new overall renewable energy target of 32% by 2030 and a 14% target for the transport sector. Furthermore, the European Union has set some minimum biofuel use to achieve the Renewable Energy Directive II. Thus, in accordance with the RED II initiative, the German Government has set a blending target of 0.5% for advanced biofuels by 2025 to foster renewable fuels for transport purposes. Furthermore, Germany has also set a target to reduce GHG emissions by 6% in the transport sector by 2025. Thus, such government initiatives are likely to support the market for advanced biodiesel in Germany during the forecast period.

- Palm oil was used as the primary feedstock in Germany till 2019. However, indirect land use change impacts of biofuels (ILUC) delegated act limits palm oil (the only 'high ILUC risk' feedstock) launched in 2019 limits the use of palm oil in the production of biodiesel till 2023 and then would phase out the use of palm oil entirely by 2030. Germany has set a target of phasing out palm oil by 2023 and helping in reducing GHG emissions.

- Furthermore, in July 2022, DHL Global Forwarding, the air and ocean freight specialist of Germany's Deutsche Post DHL Group, signed an agreement with compatriot liner shipping company Hapag-Lloyd for the use of advanced biofuels. As an initial step, Hapag-Lloyd will ship 18,000 TEU of DHL's volume using advanced biofuels, equivalent to a reduction of 14,000 tons of Well-to-Wake CO2 emissions. The two companies share the vision of decarbonizing container shipping and logistics. Such agreements are likely to create positive demand for the advanced biofuels market in Germany during the forecast period.

- Therefore, based on the above factors, Germany is expected to dominate Europe's advanced biofuel market during the forecast period.

Europe Advanced Biofuel Industry Overview

The Europe advanced biofuel market is consolidated in nature. Some of the major players in the market (in no particular order) include Abengoa Bioenergy, Chemtex Group, Clariant Produkte GmbH, Greenergy International Ltd, and Envien Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Europe Advanced Biofuel Market Size and Forecast, in USD billion, till 2027

- 4.3 Key Existing and Upcoming Advanced Biofuel Projects, Europe, as of 2021

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Raw Material

- 5.1.1 Jatropha

- 5.1.2 Lignocellulose

- 5.1.3 Algae

- 5.1.4 Other Raw Materials

- 5.2 Biofuel Type

- 5.2.1 Cellulosic Ethanol

- 5.2.2 Biodiesel

- 5.2.3 Biogas

- 5.2.4 Biobutanol

- 5.2.5 Other Biofuel Types

- 5.3 Technology

- 5.3.1 Biochemical

- 5.3.2 Thermochemical

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 Spain

- 5.4.4 United Kingdom

- 5.4.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Abengoa Bioenergy

- 6.3.2 Chemtex Group

- 6.3.3 Clariant Produkte GmbH

- 6.3.4 Greenergy International Ltd

- 6.3.5 Envien Group

- 6.3.6 DuPont Industrial Biosciences

- 6.3.7 INEOS Bio

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219