|

市场调查报告书

商品编码

1635499

中东和北非的穿孔枪:市场占有率分析、行业趋势和成长预测(2025-2030)Middle East And North Africa Perforating Gun - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

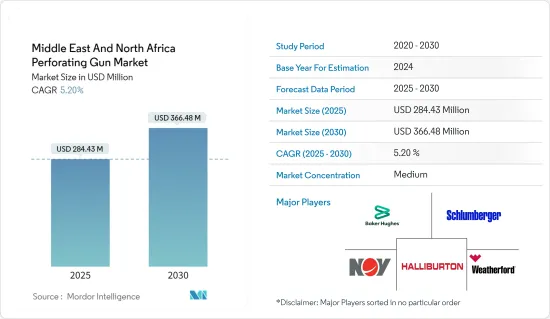

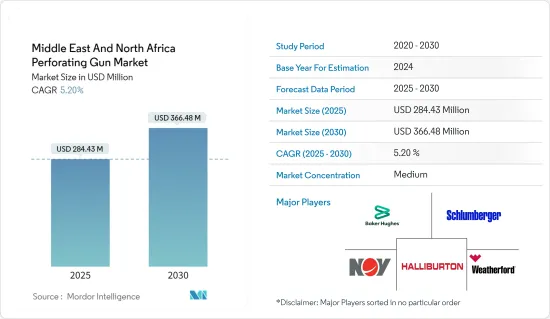

中东和北非穿孔枪市场规模预计2025年为2.8443亿美元,预计2030年将达到3.6648亿美元,复合年增长率为5.2%。

主要亮点

- 从中期来看,包括沙乌地阿拉伯、阿联酋、阿尔及利亚和埃及在内的中东和北非地区石油和天然气钻探活动的活性化以及页岩气探勘的增加,预计将在预测期内推动穿孔枪市场。

- 另一方面,可再生能源预计在未来几十年内将增加其份额,占中东和北非地区约50%的电力。预计这将在未来几年抑制射孔枪市场。

- 中东地区(主要是沙杜恩、谢哈卜、绍尔法、乌姆汗希尔和萨姆纳)新油气天然气田的发现和老井的重新钻探预计将为射孔枪市场创造机会。

- 由于緻密油和页岩蕴藏量的探勘和生产活动增加,沙乌地阿拉伯已成为射孔枪最大的市场之一。

中东和北非射孔枪市场趋势

水平井和分叉井领域预计将显着成长

- 由于技术进步带来的经济效益提高,水平井开发越来越受欢迎。

- 页岩地层钻探涉及定向或水平钻探,以增加与产层的接触并提高产量。因此,对传统型蕴藏量的日益关注预计将成为预测期内穿孔枪市场的关键驱动力。

- 随着分支井的增加趋势,海上地区水平钻井的需求不断增加,带动了市场。由于水平钻井和多级水力压裂技术的技术创新和效率提高,沙乌地阿拉伯正在开采大量非常传统型页岩和緻密碳氢化合物资源。

- 贝克休斯的数据显示,截至 2023 年 11 月,中东地区运作的钻机总数为 345 座,高于 2023 年 1 月的 313 座。钻机数量的增加是由于探勘和钻井活动增加,以实现该地区更多的石油产量。因此,启动和完井需要使用穿孔枪,以达到更好的生产效率。

- 此外,未来的钻井和生产计划将需要在作业中使用穿孔枪。 2023年8月,阿拉伯钻井公司与沙乌地阿美公司签署了10座陆上钻机的附加合约。这份为期五年的合约价值8.1亿美元,用于沙乌地阿美公司在沙乌地阿拉伯的传统天然气计画。这导致全部区域穿孔枪的使用增加。

- 阿联酋、卡达、阿尔及利亚、利比亚和沙乌地阿拉伯等国也开始探索页岩蕴藏量的商业性潜力。因此,随着水平钻井页岩油气探勘产量的增加,穿孔枪市场也有望迎来庞大的需求。

- 未来,随着技术的进步,我们预计射孔枪在水平井和偏置井中的使用将会增加,从而生产出更好、更有效率的穿孔枪。

- 因此,鑑于上述几点,水平井和斜井领域预计在预测期内将出现压倒性增长。

沙乌地阿拉伯主导市场

- 沙乌地阿拉伯是世界主要石油生产国之一。据石油输出国组织预计,2023年该国原油总产量将为960.9万桶/日。儘管产量与去年相比有所下降,但石油业对传统型蕴藏量的关注预计将需要使用穿孔枪来提高这些蕴藏量的产量。

- 作为重要的原油出口国,我国在国际石油上游市场中占据主导地位。凭藉其高生产能力,该国在控製石油价格方面发挥重要作用。这对于穿孔枪市场来说被认为是一个好征兆。

- 该国还拥有世界第五大页岩气蕴藏量,具有复製北美传统型蕴藏量开发成长的巨大潜力。这导致该地区穿孔枪的使用增加。

- 此外,2024年3月,沙乌地阿拉伯国家石油公司(Aramco)宣布将2023财年资本支出增加至497亿美元,进一步增加该国的探勘和生产活动。这种活动的活性化预计最终会增加对穿孔枪的需求,因为它提高了生产率并简化了生产。

- 因此,鑑于上述几点,预计沙乌地阿拉伯在预测期内将主导中东和北非穿孔枪市场。

中东和北非穿孔枪产业概况

中东和北非穿孔枪市场有适度细分。市场主要企业包括(排名不分先后)贝克休斯公司、斯伦贝谢有限公司、Weatherford International PLC、NOV Inc.和哈里伯顿公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 最新趋势和发展

- 市场动态

- 促进因素

- 石油和天然气钻探活动增加

- 页岩气探勘增加

- 抑制因素

- 扩大可再生能源的份额

- 促进因素

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 依运营商类型

- 中空载体

- 膨胀式充电枪

- 其他运营商类型

- 按井型分

- 水平井和偏置井

- 垂直井

- 按地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 阿尔及利亚

- 埃及

- 利比亚

- 摩洛哥

- 苏丹

- 其他中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Baker Hughes Company

- Schlumberger Limited

- Weatherford International PLC

- NOV Inc.

- Halliburton Company

- Hunting PLC

- DMC Global Inc.

- DynaEnergetics GmbH & Co. KG

- China Shaanxi FYPE Rigid Machinery Co. Ltd

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 发现新天然气田

简介目录

Product Code: 92904

The Middle East And North Africa Perforating Gun Market size is estimated at USD 284.43 million in 2025, and is expected to reach USD 366.48 million by 2030, at a CAGR of 5.2% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the rise in oil and gas drilling activities across the Middle East and North Africa, including Saudi Arabia, the United Arab Emirates, Algeria, and Egypt, and increased shale gas exploration are expected to drive the perforating gun market during the forecast period.

- On the other note, renewable energy is likely to increase its share and contribute to around 50% of power in the MENA region in the next few decades. This is expected to restrain the perforating gun market in the coming years.

- Nevertheless, the discovery of new oil and gas fields, particularly in Shadoon, Shehab, Shorfa, Umm Khansir, and Samna in the Middle East, and the reperforation of old wells are expected to provide opportunities for the perforation gun market.

- Saudi Arabia is one of the largest markets for perforating guns due to increased exploration and production activities in its tight oil and shale reserves.

Middle East And North Africa Perforating Gun Market Trends

Horizontal and Deviated Well Segment is Expected to Witness Significant Growth

- Horizontal well development is gaining popularity, owing to the benefits associated with the same technological advancements that have led to increased economic viability.

- Drilling in shale reserves involves directional or horizontal drilling, leading to increased contact with the pay zone and advanced production. Hence, a growing focus on unconventional reserves is expected to be a significant driver for the perforating gun market during the forecast period.

- With a growing trend of multilateral wells, the demand for horizontal drilling activity is increasing in offshore regions, which, in turn, is driving the market. Technological innovations and the increasing efficiency of horizontal drilling and multi-stage hydraulic fracturing technologies are unlocking vast unconventional shale and tight hydrocarbon resources in Saudi Arabia.

- According to Baker Hughes, as of November 2023, the total number of active rig counts in the Middle East accounted for 345 units, high from the 313 rig counts in January 2023. The increase in rig count is due to the increase in exploration and drilling activities to achieve more oil production in the region. Thus, to accomplish better production efficiency, the use of perforating guns is required for well activation and well completion.

- Further, upcoming drilling and production projects will demand the use of perforating guns in their operations. In August 2023, Arabian Drilling Company made a contract with Saudi Aramco for ten additional land rigs. The five-year contract, worth USD 810 million, is for Aramco's unconventional gas program in the Kingdom. This, in turn, culminates in the growth in the usage of perforating guns across the region.

- Countries such as the United Arab Emirates, Qatar, Algeria, Libya, and Saudi Arabia have also started exploring the commercial viability of their shale reserves. Hence, with the rising exploration and production of shale oil and gas through horizontal drilling, the perforating gun market is also expected to witness a significant demand.

- In the future, with technological advancements in manufacturing better perforating guns with improved efficiency, its use in horizontal and deviated wells is expected to increase.

- Therefore, owing to the above points, the horizontal and deviated well segment is expected to witness dominant growth during the forecast period.

Saudi Arabia to Dominate the Market

- Saudi Arabia is one of the major global oil producers. According to the Organization of Petroleum Exporting Countries, in 2023, the country's total crude oil production accounted for 9,609 thousand barrels per day. Production decreased compared to last year, but as the petroleum sector is trending to focus on unconventional reserves, the use of perforating guns is expected to be in demand to increase production from these reserves.

- As a significant crude oil exporter, the country has great control over the international upstream market. Due to its high surge capacity, the country plays a crucial role in controlling crude oil prices. This can be considered a good sign for perforating gun markets.

- Also, the country has the world's fifth-largest estimated shale gas reserve, and thus, it has great potential for the country to replicate North America's unconventional reserves development growth. This culminates in the growth in the use of perforated guns in the region.

- Moreover, in March 2024, the state oil company Saudi Aramco's Saudi Arabian Oil Company (Aramco) announced it would boost its capital expenditure to USD 49.7 billion for FY 2023, which further bolstered the country's exploration and production activities. An increase in these activities is expected to eventually increase the demand for perforating guns due to their better and easier production.

- Therefore, owing to the above points, Saudi Arabia is expected to dominate the Middle East and North Africa perforating gun market during the forecast period.

Middle East And North Africa Perforating Gun Industry Overview

The Middle East and North Africa perforating gun market is moderately fragmented. Some of the key players in the market (in no particular order) include Baker Hughes Company, Schlumberger Limited, Weatherford International PLC, NOV Inc., and Halliburton Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Recent Trends and Developments

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 The Rise in Oil and Gas Drilling Activities

- 4.6.1.2 Increased Shale Gas Exploration

- 4.6.2 Restraints

- 4.6.2.1 Increasing Share of Renewable Energy

- 4.6.1 Drivers

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Carrier Type

- 5.1.1 Hollow Carrier

- 5.1.2 Expandable Shaped Charged Gun

- 5.1.3 Other Carrier Types

- 5.2 By Well Type

- 5.2.1 Horizontal and Deviated Well

- 5.2.2 Vertical Well

- 5.3 By Geography

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 South Africa

- 5.3.4 Algeria

- 5.3.5 Egypt

- 5.3.6 Libya

- 5.3.7 Morocco

- 5.3.8 Sudan

- 5.3.9 Rest of Middle East and North Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Baker Hughes Company

- 6.3.2 Schlumberger Limited

- 6.3.3 Weatherford International PLC

- 6.3.4 NOV Inc.

- 6.3.5 Halliburton Company

- 6.3.6 Hunting PLC

- 6.3.7 DMC Global Inc.

- 6.3.8 DynaEnergetics GmbH & Co. KG

- 6.3.9 China Shaanxi FYPE Rigid Machinery Co. Ltd

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Discovery of New Oil and Gas Fields

02-2729-4219

+886-2-2729-4219