|

市场调查报告书

商品编码

1635508

北美可携式发电机:市场占有率分析、行业趋势和成长预测(2025-2030)North America Portable Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

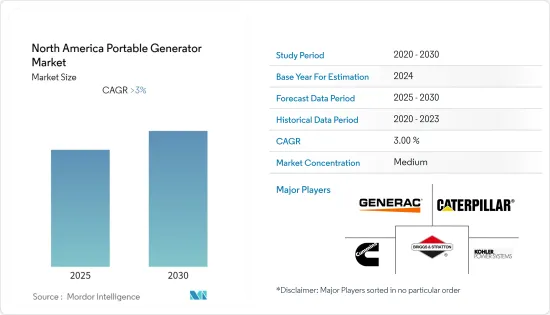

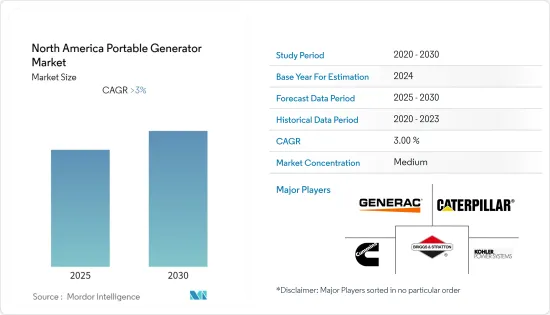

预计北美可携式发电机市场在预测期内的复合年增长率将超过 3%。

2020 年市场受到 COVID-19 的负面影响。但现在市场已经达到疫情前的水准了。

主要亮点

- 从中期来看,不断增长的电力需求、对紧急备用电源解决方案的需求以及对稳定电源的需求等因素正在推动北美可携式发电机市场的发展。此外,停电的发生导致了备用电源和可携式发电机的采用,满足可靠、定期供电的要求,并且易于携带。

- 另一方面,对电池储存系统和其他清洁备用电力源的需求不断增长预计将抑製可携式发电机市场的成长。

- 新兴经济体的商业和工业部门、新兴经济体的住宅部门以及国防行动日益增长的电力需求预计很快将为北美地区的市场参与企业创造巨大的商机。

- 预计在预测期内,美国将主导北美可携式发电机市场。

北美可携式发电机市场趋势

柴油燃料类型预计将显着成长

- 紧凑且易于运输的可携式柴油发电机可被视为某些家庭和车间的多功能备用选项。如果特定房间或机器需要长期备用,可携式柴油发电机可以轻鬆移动并用作直接电源,就像附加的配电盘一样。

- 柴油是发电机最高效的燃料,每单位提供的电力比其他燃料都多。这使得 DG 机组製造商能够设计出比大型 CNG 发电机提供更多电力的紧凑型发电机。因此,製造成本降低,使一般消费者更能负担。

- 柴油引擎比其他引擎更有效地消耗燃料,在相同的燃料容量下可以实现更长的运行时间。可携式发电机必须足够紧凑和轻便,以便便于携带,这限制了任何发电机製造商可以设计到其产品中的燃料容量。因此,柴油发电机是停电期间提供最长电力备份的最佳选择。

- 例如,国家电气规范 517-13 和加州电气规范要求所有医院和严重监护机构都必须配备备用电源系统,该系统必须在停电后 10 秒内自动启动并满载运作。美国,加州的建筑标准要求在灾难发生时紧急设备的运作。一旦发生地震等灾难,燃气管道会立即关闭,以避免爆裂引发火灾或爆炸的风险,从而取消了天然气作为发电机的动力来源。

- 根据您的电力需求,紧急柴油发电机有多种尺寸。这些柴油发电机可以永久安装在医院等固定地点,也可以透过移动拖车运送到灾难现场或停电地区。

- 根据BP《2022年世界能源统计年鑑》显示,2021年该地区初级能源消费量为113.70艾焦耳(EJ),比前一年(108.79EJ)成长约4.8%。

- 因此,由于上述因素,预计在预测期内,北美可携式发电机市场的柴油引擎市场将显着成长。

美国主导市场

- 截至2021年,美国是仅次于中国的全球第二大能源消费国,电力需求庞大。儘管全国拥有复杂的电网基础设施和100%的电力供应,但停电和备用电源需求不断增加等问题预计将推动该国可携式发电机市场的需求。

- 根据美国能源资讯署(EIA)的数据,2021年该国电力消耗量为3,930TWh,比前一年的价值(3,856TWh)增加约2%。

- 停电每年对该国造成的损失平均约为 180 亿美元至 330 亿美元。因此,发电机被认为是保持业务运作不间断运作的最实用的选择。

- 因此,在预测期内,可携式发电机市场的需求将会增加,并且客户将因电力短缺而出现偏差。这使客户能够专注于他们的核心能力和专业知识,而不必担心购买发电机的融资。

- 美国电网主要依赖需量反应系统运作。该国的电价会根据需求而波动。为了节省电费,该国的客户越来越多地转向离网电力系统,例如可携式发电机,以便在需求和电价较高时提供电力。

- 因此,基于上述因素,预计美国在预测期内将主导北美可携式发电机市场。

北美可携式发电机行业概况

北美可携式发电机市场适度细分。市场上的主要企业(排名不分先后)包括 Generac Holdings Inc.、Caterpillar Inc.、Cummins Inc.、Briggs &Stratton Corporation 和 Kohler Power Systems。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 额定输出

- 5kW以下

- 5~10kW

- 10kW以上

- 燃料类型

- 气体

- 柴油引擎

- 其他燃料

- 最终用户

- 住宅

- 商业的

- 工业的

- 地区

- 美国

- 加拿大

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Generac Holdings Inc.

- Caterpillar Inc.

- Cummins Inc.

- Briggs & Stratton Corporation

- Kohler Power Systems

- Wacker Neuson SE

- Atlas Copco AB

- Eaton Corporation PLC

- Yamaha Motor Co. Ltd

- General Electric Company

第七章 市场机会及未来趋势

The North America Portable Generator Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. However, currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as the ever-increasing demand for power, the need for emergency backup power solutions, and the demand for a steady power supply are driving the portable generator market in North America. Moreover, power outages have led to the adoption of standby power sources and portable generators, which can meet the requirements for reliable and regular electricity supply and be transported easily.

- On the flip side, increasing demand for battery storage systems and other cleaner sources of standby power is expected to restrain the growth of the portable generators market.

- Nevertheless, the commercial and industrial sectors of emerging economies, the residential sector of developed economies, and the increasing need for power in defense operations are expected to create significant opportunities for market participants in the North American region soon.

- During the forecast period, the United States is expected to dominate the portable generator market in the North American region.

North America Portable Generator Market Trends

Diesel Fuel Type Expected to Witness Significant Growth

- Compact and easily movable, a portable diesel generator can be considered a multipurpose backup option for specific house or workshop applications. When you need a long-time backup for particular rooms or machinery, portable diesel gensets can be easily moved and used as a direct power source, like an extra switchboard.

- Diesel is the most efficient fuel option for gensets as it offers a higher power output than any other fuel per unit. This also allows DG set manufacturers to design a compact generator that provides more power than a larger CNG Genset. Hence, the cost of production is reduced, making it more affordable for the general public.

- Diesel engines consume fuel more efficiently than others, allowing longer runtime with the same fuel capacity. Portable generators must be compact and lightweight enough to be movable, limiting the fuel capacity any generator manufacturer can design in their product. For this reason, a diesel generator is the best option to have the most extended power backup during power outages.

- For instance, the National Electrical Code 517-13 and the California Electrical Code require all hospitals and critical care facilities to have backup power systems that start automatically and are up and running at full capacity within 10 seconds after power failure. Moreover, the California Building Code in the United States requires emergency facilities to operate during disasters. This eliminates natural gas as a power source for generators because, during a disaster, such as an earthquake, gas lines are immediately turned off to avoid the risk of fire and explosion during a rupture.

- Emergency diesel generators are available in various sizes based on the electricity demand. These diesel generator units can be permanently installed at fixed locations, such as hospitals, or brought on a mobile trailer to disaster sites or outage areas.

- According to BP Statistical Review of World Energy 2022, the region's primary energy consumption in 2021 totaled 113.70 exajoules (EJ), i.e., an increase of about 4.8%, compared to the previous year's value (108.79 EJ).

- Therefore, based on the above-mentioned factors, the diesel segment is expected to witness significant growth for the portable generator market in North America during the forecast period.

United States to Dominate the Market

- As of 2021, the United States is the 2nd largest energy consumer in the world after China and has a huge electricity demand. Despite a complex electricity grid infrastructure and 100% electricity access across the country, problems like power outages and increasing demand for standby power sources are expected to drive the demand for the portable generator market in the country.

- According to the United States Energy Information Administration (EIA), electricity consumption in the country totaled 3,930 TWh in 2021, i.e., an increase of about 2% compared to the previous year's value (3,856 TWh).

- Power outages cost an average of about USD 18 billion to USD 33 billion annually in the country. Therefore, generators are considered the most viable options for making business operations run continuously without interruption.

- This, in turn, increases the demand for the portable generator market during the forecast period, making customers more biased toward electricity shortages. This allows them to focus on their core competencies and expertise instead of worrying about managing finances for purchasing the machine.

- The United States national grid largely operates based on a demand response system. The electricity prices in the country fluctuate based on demand. To save money on electricity, customers in the country are increasingly using off-grid power systems, like portable generators, to provide electricity when demand and power tariffs are high.

- Therefore, based on the above-mentioned factors, the United States is expected to dominate the portable generator market in North America during the forecast period.

North America Portable Generator Industry Overview

The North America portable generator market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Generac Holdings Inc., Caterpillar Inc., Cummins Inc., Briggs & Stratton Corporation, and Kohler Power Systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Power Rating

- 5.1.1 Below 5 kW

- 5.1.2 5-10 kW

- 5.1.3 Above 10 kW

- 5.2 Fuel Type

- 5.2.1 Gas

- 5.2.2 Diesel

- 5.2.3 Other Fuel Types

- 5.3 End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Generac Holdings Inc.

- 6.3.2 Caterpillar Inc.

- 6.3.3 Cummins Inc.

- 6.3.4 Briggs & Stratton Corporation

- 6.3.5 Kohler Power Systems

- 6.3.6 Wacker Neuson SE

- 6.3.7 Atlas Copco AB

- 6.3.8 Eaton Corporation PLC

- 6.3.9 Yamaha Motor Co. Ltd

- 6.3.10 General Electric Company