|

市场调查报告书

商品编码

1635509

法国叶轮:市场占有率分析、产业趋势、成长预测(2025-2030)France Rotor Blade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

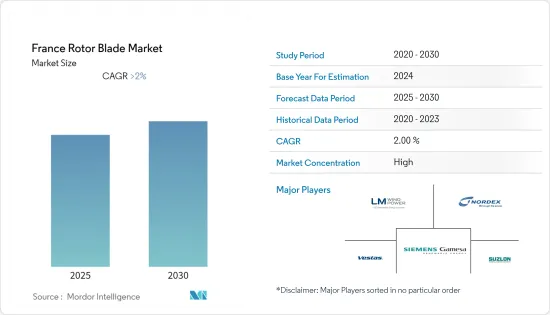

预计法国叶轮市场在预测期内的复合年增长率将超过 2%。

2020 年市场受到 COVID-19 的中等程度影响。目前,市场已达到疫情前水准。

主要亮点

- 从长远来看,政府的支持措施和私人投资将推动该国对叶轮的需求。

- 另一方面,高昂的相关运输成本以及来自太阳能和水力发电等替代清洁能源的成本竞争有可能阻碍市场成长。

- 产品创新和最新叶轮技术的采用预计很快就会为法国叶轮市场创造利润丰厚的成长机会。

法国叶轮市场趋势

土地领域主导市场

- 陆域风电技术在过去五年中不断发展,以最大限度地提高每兆瓦装置容量的发电量,并覆盖更多风速较低的地区。另外,近年来,风力发电机轮毂高度变得更高,直径变得更宽,风力发电机叶片变得更大。截至2021年,法国陆域风电总设备容量为19,131MW。

- 法国是欧洲风电市场的领先国家之一。 2021年新增装置1192兆瓦,达1913万千瓦。该国每台涡轮机的平均额定功率为2MW。该国的风电市场一直受到政府措施(如补贴和上网电价补贴)的推动,以填补核能发电厂关闭而造成的电力缺口。

- 陆上部门主导了法国风电市场。此外,新政府的计画是到2030年将陆上风电容量增加两倍。 2021年排名第三,仅次于德国和瑞典。

- 2022年7月,Falck Renewables在同意区域开发计划的区域效益计画后,正式在法国开设第十个风电场。法尔克再生能源公司 (Falck Renewables) 在伊利诺州、法国马利共和国塞纳省正式开设了一座新风电场。该风电场拥有六台投入商业营运的涡轮机,装置容量为12兆瓦,预计年产量约28吉瓦时,足以为约6,600户家庭供电。

- 2022年9月,Valorem和ENERCON France签署了一份合同,将在法国埃罗省Seil-et-Locoselles安装6台E-82 E4风力发电转换器,总合容量为14.1兆瓦。

- 因此,基于上述因素,由于政府的支持措施和倡议以及陆上风力发电计划的增加,陆上风力发电机的叶轮预计将大幅增长。

政府扶持措施和民间投资拉动市场需求

- 法国政府计划在2030年将可再生能源在电力结构中的份额提高到40%。政府宣布将把再生能源支出从每年 50 亿欧元增加到 80 亿欧元。

- 此外,截至2021年,陆域风电装置容量约为19GW,离岸风力发电为2MW。此外,根据 Pluriannuelle de l'Energie (PPE) 计划,该国的目标是到 2028 年陆上风力发电量达到 34GW,截至 2021 年约为 1,908GW。这种扩张对于能源转型的成功以及促进法国其他能源结构的脱碳至关重要。

- 与德国和英国一样,法国也致力于发展其离岸风力发电市场,儘管2021年没有新增离岸风力发电装置容量。到2022年2月,我们的目标是到2050年拥有40GW的离岸风力发电容量。

- 2022年3月,法国政府签署了法国风电产业和离岸风电领域的协议。该协议承认离岸风电是一个重要的能源和工业机会。该协议承诺大力离岸风力发电,法国承诺在2050年50个风电场建设40GW离岸风电。

- 为了实现这项风电目标,法国计画自2025年起每年竞标至少2吉瓦的新增离岸风力发电。截至2022年3月,政府每年竞标1GW。这意味着到2030年将分配20GW的容量,2035年将有18GW的离岸风力发电投入运作。

- 截至目前,法国已竞标了350万千瓦离岸风力发电,其中500兆瓦为浮体式海上风电。法国沿海深处风力强劲且稳定,适合浮体式海上风力发电。

- 因此,有助于发展风电市场的政府措施和私人投资预计在预测期内将产生积极影响,从而导致风力发电机叶轮市场的成长。

法国叶轮产业概况

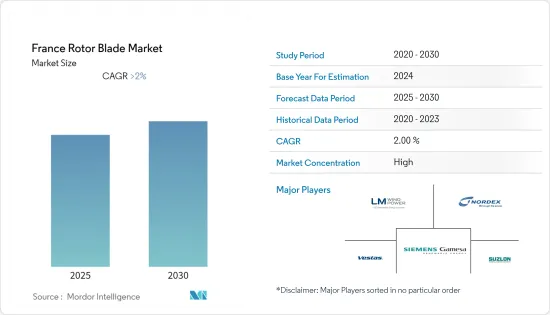

法国叶轮市场具有综合性。市场上的主要企业(排名不分先后)包括 Nordex SE、Siemens Gamesa Renewable Energy, SA、Vestas Wind Systems A/S、Suzlon Energy Limited 和 LM Wind Power(GE 再生能源业务)。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:百万美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 部署地点

- 陆上

- 离岸

- 刀片材质(定性分析)

- 碳纤维

- 玻璃纤维

- 其他刀片材料

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Nordex SE

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems A/S

- Suzlon Energy Limited

- Enercon GmbH

- LM Wind Power(GE 再生能源业务)

第七章 市场机会及未来趋势

简介目录

Product Code: 92934

The France Rotor Blade Market is expected to register a CAGR of greater than 2% during the forecast period.

The market was moderately impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, supportive government policies and private investments drive the country's rotor blade demand.

- On the flip side, the associated high cost of transportation and cost competitiveness of alternate clean power sources, like solar power, hydropower, etc., have the potential to hinder the market's growth.

- Nevertheless, product innovation and adaptation of the latest rotor blade technologies are expected to create soon lucrative growth opportunities for the France rotor blade market.

France Rotor Blade Market Trends

Onshore Segment to Dominate the Market

- Onshore wind energy power generation technology has evolved over the last five years to maximize electricity produced per megawatt capacity installed and to cover more sites with lower wind speeds. Besides this, in recent years, wind turbines have become larger with taller hub heights, broader diameters, and larger wind turbine blades. As of 2021, the total onshore installations in the country totaled 19,131 MW.

- France is among the leading countries in the European wind power market. In 2021, it added 1,192 MW, reaching 19.13 GW. The country had an average power rating of 2 MW per turbine. The wind power market in the country has been driven by government policies (such as subsidies and feed-in-tariff) to fill the gap created by the closure of nuclear power plants.

- The onshore sector has dominated the French wind power market. Moreover, under the new government's plans, the onshore wind power capacity is planned to be tripled by 2030. In 2021, the country was third only after Germany and Sweden.

- In July 2022, with a community benefit scheme agreed upon for local development projects, Falck Renewables officially opened its tenth wind farm in France. Falck Renewables officially opened its new wind farm in Illinois, Seine-Maritime department, France. The six-turbine wind farm, which came into commercial operation, has an installed capacity of 12 MW and an estimated annual production of around 28 GWh, sufficient to power approximately 6,600 households.

- In September 2022, Valorem and ENERCON France signed a contract to install six E-82 E4 wind energy converters at Ceilhes-et-Rocozels (Herault, France) with a total capacity of 14.1 MW.

- Therefore, based on the above-mentioned factors, the onshore wind turbine rotor blade is expected to grow significantly due to supportive government policies and initiatives coupled with an increasing number of onshore wind energy projects.

Supportive Government Policies and Private Investments Driving the Market Demand

- The French government planned to increase the share of renewable energy in the power mix to 40% by 2030. The government announced an increase in the expenditure on renewables, from EUR 5 billion to EUR 8 billion annually.

- Moreover, as of 2021, the country's onshore wind energy installation was about 19 GW, and 2 MW of offshore wind energy installation. Further, according to Programmation Pluriannuelle de l'Energie (PPE), the country aims to have 34 GW of onshore wind by 2028, which in 2021 is about 19.08 GW. The expansion is vital for a successful energy transition and to help decarbonize the rest of France's energy mix.

- Though the country had no new offshore capacity added in 2021, like Germany and the United Kingdom, France is also seeking to develop its offshore wind power market. By February 2022, the country aims to have 40 GW of offshore wind power generation capacity by 2050.

- In March 2022, the French government signed an offshore sector deal with France's wind industry. The agreement recognizes that offshore wind is significant energy and industrial opportunity. It commits France to build 40 GW of offshore wind by 2050 spread over 50 wind farms which is expected to see considerable development in offshore wind power.

- To reach the country's wind power target, the country plans to organize auctions for a minimum of 2 GW of new offshore wind capacity each year starting in 2025. As of March 2022, the government is auctioning 1 GW a year. This means 20 GW of capacity is likely to be allocated by 2030, translating into 18 GW of operational offshore wind farms in 2035.

- So far, France has placed 3.5 GW of offshore wind up for auction, 500 MW floating wind. The country is well-suited for floating wind power, due to strong and stable winds in the deep sea, off its coasts.

- Hence, government policies and private investments that are helping in the development of the wind power market are expected to be positive during the forecast period, leading to growth in the wind turbine rotor blades market.

France Rotor Blade Industry Overview

The France rotor blade market is consolidated in nature. Some of the major players in the market (in no particular order) include Nordex SE, Siemens Gamesa Renewable Energy, SA, Vestas Wind Systems A/S, Suzlon Energy Limited, and LM Wind Power (a GE Renewable Energy business).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Blade Material (Qualitative Analysis)

- 5.2.1 Carbon Fiber

- 5.2.2 Glass Fiber

- 5.2.3 Other Blade Materials

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nordex SE

- 6.3.2 Siemens Gamesa Renewable Energy SA

- 6.3.3 Vestas Wind Systems A/S

- 6.3.4 Suzlon Energy Limited

- 6.3.5 Enercon GmbH

- 6.3.6 LM Wind Power (a GE Renewable Energy business)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219