|

市场调查报告书

商品编码

1635518

南美洲的电池管理系统:市场占有率分析、产业趋势与成长预测(2025-2030)South America Battery Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

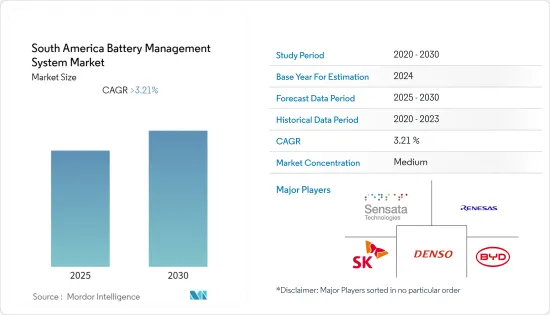

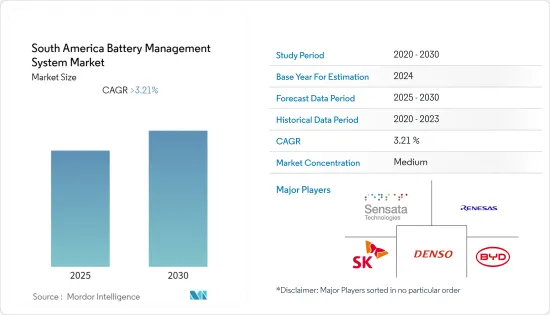

南美洲电池管理系统市场预计在预测期内复合年增长率将超过3.21%。

市场受到 COVID-19 大流行的负面影响。目前市场处于大流行前的水平。

主要亮点

- 从中期来看,电动车的日益普及、对强大充电基础设施的需求以及对提高电池能源效率的关注预计将推动所研究市场的成长。

- 另一方面,现成或标准电池管理系统的技术限制是市场的主要限制因素之一。

- 电池管理系统的技术进步具有降低复杂性、提高效率和提高可靠性等优点,预计将在预测期内提供成长机会。

- 巴西在市场上占据主导地位,并且在预测期内也可能实现最高的复合年增长率。这一增长是由电动车销量的快速增长和可再生能源发电需求的增加所推动的。

南美洲电池管理系统市场趋势

交通运输领域预计将主导市场

- 此前,仅使用内燃机车辆(ICE)。然而,由于人们对环境问题的日益关注,科技正在转向电动车(EV)。 ICE 领域没有电池管理系统市场。

- 锂离子电池由于具有高能量密度、低自放电、重量轻和低维护成本而主要用于电动车。铅基电池广泛应用于内燃机汽车,预计在可预见的未来仍将是唯一可大规模生产的电池系统。作为 SLI 应用的铅酸电池的可大规模生产的替代品,锂离子电池需要进一步降低成本。

- 锂离子电池系统为插电混合动力汽车汽车和电动车提供动力。由于锂离子电池具有高能量密度、快速充电能力和高放电功率,是唯一能够满足OEM对车辆续航里程和充电时间要求的可用技术。铅基动力电池比能量低且重量大,使其在混合动力汽车和电动车中不具竞争力。

- 在拉丁美洲,2021年登记了118,145辆混合动力汽车和电动车,比2020年的57,078辆增加了107.1%。成长最快的细分市场是混合动力汽车,包括插电式混合动力汽车(PHEV)和非插电式混合动力汽车混合动力汽车(HEV),成长110.1%,以及纯电动车(BEV),成长57.3%。

- 根据美国国家永续交通协会 (ANDEMOS) 的数据,2021 年哥伦比亚註册了 17,702 辆电动和混合动力汽车。此外,哥伦比亚政府制定了到 2030 年拥有 60 万辆电动车的目标,预计该国对电池以及电池管理系统 (BMS) 的需求将会增加。

- 电池管理系统安装在各种电动车、摩托车、乘用车、轻型商用车、重型商用车上。运输业以其温室气体和二氧化碳排放闻名。此外,燃烧石化燃料对环境的净影响历来是汽车製造商的弱点。此外,各国政府也实施了严格的法规来减少内燃机造成的污染。因此,几家主要汽车製造商都专注于开发和製造电动车。

- 因此,由于上述因素,交通运输领域很可能在预测期内主导电池管理系统市场。

巴西可望主导市场

- 巴西是世界第12大经济体,2021年规模约1.62兆美元,也是南美洲最大的经济体。

- 巴西的经济发展带动了商业基础设施的广泛发展。随着国家经济活动的蓬勃发展,资料中心的成长机会也大幅增加,这有望为电池管理系统创造商机。资料中心的电源对于确保连续运作至关重要,这导致在资料中心站点引入电池管理系统。

- 例如,2021年12月,Ascenty在巴西里约热内卢和霍尔特兰迪亚开设了两个新资料中心。该公司最近宣布计划筹集 9.25 亿美元债务,并在该国再建五个资料中心。五个资料中心中的两个预计将于 2022 年竣工,两个于 2023 年竣工,一个于 2024 年竣工。因此,即将到来的资料中心可能会在预测期内增加市场研究。

- 此外,电动车销量的增加也导致对锂离子电池的需求增加。在预测期内,随着单位销售量预计将以更快的速度成长,对电池(尤其是锂离子电池)的需求预计将增加。

- 根据巴西电动车协会(ABVE)统计,2021年巴西电动车註册量达34,839辆,与前一年同期比较成长77%。

- Rota 2030计画旨在提高交通部门的能源效率,对巴西电动车市场产生重大推动作用。电动车采用率的快速成长预计将极大推动预测期内巴西市场的发展。

南美洲电池管理系统产业概况

南美洲电池管理系统市场适度细分。该市场的主要企业包括(排名不分先后)森萨塔科技公司、瑞萨电子公司、SK Innovation、电装公司和比亚迪。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按用途

- 固定式

- 可携式的

- 用于运输

- 按地区

- 巴西

- 阿根廷

- 哥伦比亚

- 智利

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Sensata Technologies Inc.

- Renesas Electronics Corporation

- SK Innovation Co. Ltd

- DENSO Corporation

- BYD Co. Ltd

- Panasonic Corporation

- Bosch Corporation

- Continental Engineering Services

- Intel Corporation

- Saft

第七章 市场机会及未来趋势

简介目录

Product Code: 92957

The South America Battery Management System Market is expected to register a CAGR of greater than 3.21% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing adoption of electric vehicles, the need for robust charging infrastructure, and the focus on increasing the energy efficiency of batteries are expected to drive the growth of the market studied.

- On the other hand, technological limitations on off-the-shelf battery management systems or standard battery management systems are one of the major restraints for the market.

- Nevertheless, technological advancements in battery management systems with advantages, such as reduced complexity, better efficiency, and improved reliability, among others, are expected to provide growth opportunities in the forecast period.

- Brazil dominates the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the rapid rise in sales of electric vehicles and the growing demand for renewable power generation.

South America Battery Management System Market Trends

Transportation Segment is Expected to Dominate the Market

- Vehicles with internal combustion engines (ICE) were the only types used earlier. However, technology has been shifting toward electric vehicles (EVs) due to growing environmental concerns. Battery management systems do not have any market in the ICE sector.

- Lithium-ion batteries are primarily used in EVs as they provide high energy density, low self-discharge, less weight, and low maintenance. For ICE vehicles, the lead-based battery is widely used and is expected to continue to be the only viable mass-market battery system for the foreseeable future. Lithium-ion batteries still require higher cost reductions for use in SLI applications to be considered a viable mass-market alternative to lead-based batteries.

- Lithium-ion battery systems propel plug-in hybrid and electric vehicles. Owing to their high energy density, fast recharge capability, and high discharge power, lithium-ion batteries are the only available technology capable of meeting OEM requirements for the vehicle's driving range and charging time. The lead-based traction batteries are not competitive for use in total hybrid electric vehicles or electric vehicles because of their lower specific energy and higher weight.

- In Latin America, 118,145 hybrid and electric vehicles were registered in 2021, an increase of 107.1% over 2020, when 57,078 units were registered. The fastest-growing segment was hybrid vehicles, including plug-in hybrids (PHEV) and non-plug-in hybrids (HEV), with 110.1% growth, while fully electric vehicles (BEV) grew by 57.3%.

- According to the National Association of Sustainable Mobility (ANDEMOS), in 2021, 17,702 electric cars and hybrid vehicles were registered in Colombia. The Colombian government has also set a target of getting 600,000 EVs on the road by 2030, which is expected to lead to an increase in the demand for batteries in the country and, in turn, increase the demand for battery management systems (BMS).

- The battery management systems are deployed in various electric vehicles, two-wheelers, passenger vehicles, light commercial vehicles, and heavy commercial vehicles. The transportation industry is known for its greenhouse gas and carbon emissions. Furthermore, the net environmental impact of burning fossil fuels has historically been the weak spot for manufacturers of motor vehicles. Moreover, governments implemented stringent regulations to reduce the pollution caused by internal combustion engines. As a result, several large automotive manufacturers focus on moving toward electric vehicle development and manufacturing.

- Hence, based on the factors mentioned above, the transportation segment is likely to dominate the battery management system market during the forecast period.

Brazil is Expected to Dominate the Market

- Brazil is the world's twelfth-largest economy, with a size of about USD 1.62 trillion in 2021, and is the largest economy in South America.

- The economic development in Brazil is leading to the widespread development of commercial infrastructure. As the country's economic activity is booming, it is witnessing a considerable increase in the growth of data centers, which is expected to create opportunities for battery management systems. The electricity supply at data centers is of paramount importance to ensure continuous operations, which leads to the deployment of battery management systems at data center sites.

- For instance, in December 2021, Ascenty opened two new data centers in Rio de Janeiro and Hortolandia, Brazil. The company recently raised USD 925 million in credit and announced its plans to build five more data centers in the country. Two of the five data centers are expected to be completed in 2022, two in 2023, and one in 2024. Thus, such upcoming data centers are likely to increase the market studied during the forecast period.

- Furthermore, the increase in sales of electric vehicles has also helped in the increasing demand for lithium-ion batteries. With the sales expected to increase at a much faster rate during the forecast period, the demand for batteries, specifically lithium-ion batteries, is expected to increase.

- According to the Brazilian Association of Electric Vehicles (ABVE), EV registrations in Brazil reached 34,839 in 2021, a 77% increase year over year.

- The Rota 2030 program is aimed at improving energy efficiency in the transportation sector, which is a big boost for the Brazilian electric vehicle market. The surge in the deployment of electric vehicles is likely to provide a significant impetus to the Brazilian segment of the market studied during the forecast period.

South America Battery Management System Industry Overview

The South American battery management system market is moderately fragmented. Some of the major players in the market (in no particular order) include Sensata Technologies Inc., Renesas Electronics Corporation, SK Innovation Co. Ltd, DENSO Corporation, and BYD Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Stationary

- 5.1.2 Portable

- 5.1.3 Transportation

- 5.2 By Geography

- 5.2.1 Brazil

- 5.2.2 Argentina

- 5.2.3 Colombia

- 5.2.4 Chile

- 5.2.5 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Sensata Technologies Inc.

- 6.3.2 Renesas Electronics Corporation

- 6.3.3 SK Innovation Co. Ltd

- 6.3.4 DENSO Corporation

- 6.3.5 BYD Co. Ltd

- 6.3.6 Panasonic Corporation

- 6.3.7 Bosch Corporation

- 6.3.8 Continental Engineering Services

- 6.3.9 Intel Corporation

- 6.3.10 Saft

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219