|

市场调查报告书

商品编码

1635519

中东和非洲太阳能追踪器 -市场占有率分析、行业趋势、统计、成长预测(2025-2030)Middle East and Africa Solar Tracker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

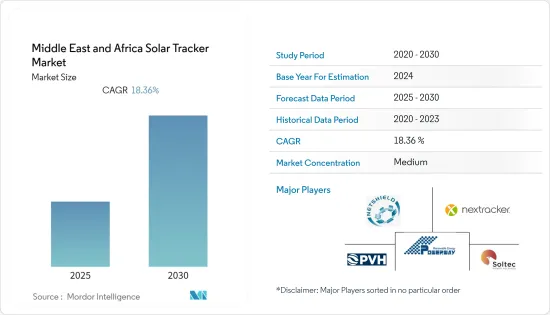

中东和非洲太阳能追踪器市场预计在预测期内复合年增长率为18.36%。

COVID-19 大流行并未对该地区的太阳能追踪器市场产生重大影响。目前市场处于大流行前的水平。

主要亮点

- 中东和非洲的太阳能追踪器市场是由适合太阳能发电工程的高日照地区、低人事费用以及适合公用事业规模太阳能发电工程的高日照地区的低成本沙漠地区推动的。的显着发展。

- 另一方面,氢能、风电等其他可再生能源的竞争激烈,预期近期市场成长困难。

- 建议在公用事业规模的太阳能发电工程中使用太阳能追踪器,以增加太阳能板的发电能力。因此,随着公用事业规模的发电工程在该地区日益受到关注,市场上有充足的机会。

- 由于政府承诺增加太阳能发电份额以及私人投资者的浓厚兴趣,预计沙乌地阿拉伯市场将以更快的速度成长。

中东和非洲太阳能追踪器市场趋势

单轴追踪器有望大幅成长

- 单轴追踪器是一种仅使用一个角度作为旋转轴的设备。这些追踪器可以将发电量提高30%。我们列出了简单、高效且低成本的选项来改善太阳能係统的功能。

- 由于太阳能光电价格下降和 CSP 发电的成功,中东和非洲 (MENA) 地区正在达到太阳能发展的顶峰。经过持续成长,2021年中东地区太阳能发电装置容量达到约796千万瓦。公用事业规模计划的快速增加也是成长背后的原因之一。其投资组合包括阿拉伯联合大公国、沙乌地阿拉伯和南非等国家。

- 例如,2022年5月,阿联酋水电公司(EWEC)公开征集在阿布达比阿吉班区建置发电能力为1,500兆瓦的公用事业规模发电工程。由于成本低且易于安装,单轴追踪器在该地区的公用事业规模计划中需求量很大。

- 此外,2022 年 5 月,Gold Miner运作了南非的一座太阳能发电厂。该发电厂配备了由 Array Technologies 公司 STI Norland 提供的单轴太阳能追踪器。这座 10 兆瓦的发电厂是金矿公司首次运作这种容量的太阳能发电设施。

- 这些新兴市场的发展预计将在不久的将来带动中东和北非地区的单轴太阳能追踪器市场。

沙乌地阿拉伯,预计将出现显着成长

- 沙乌地阿拉伯的太阳能市场在过去十年中显着成长,主要受到两个因素的推动:太阳能发电成本下降以及政府为促进可再生能源领域成长而采取的有利措施。

- 该国在公用事业规模和商业领域拥有大量太阳能装置。截至2022年5月,沙乌地阿拉伯的太阳能装置容量将约为3GW,相当于为60万户家庭供电。沙乌地阿拉伯政府承诺50%的电力来自可再生能源发电,而太阳能在其中扮演核心角色。截至2021年,沙乌地阿拉伯太阳能发电量约0.8TWh,仍有提升空间。

- 由于太阳能发电工程的增加,日本对太阳能追踪器的需求不断增加。例如,2022年,全球领先的太阳能追踪器製造商PV Hardware在沙乌地阿拉伯吉达开设了一家新的太阳能追踪器工厂。该生产设施每年将为太阳能发电厂生产约8吉瓦的太阳能追踪器。

- 此外,该公司还于2022年签署了一份合同,为沙乌地阿拉伯麦加省的Jeddah Nord光伏太阳能计划提供387MWp Monoline 2V双面太阳能追踪器。

- 由于这些发展,预计该国太阳能追踪器市场在预测期内将以更快的速度成长。

中东和非洲太阳能追踪器产业概况

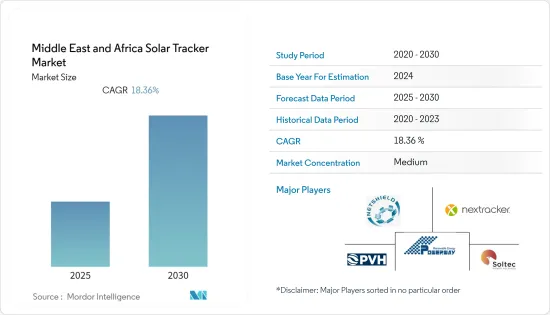

中东和非洲太阳能追踪器市场适度细分。该市场的主要企业包括(排名不分先后)NexTracker Inc.、PV Hardware、Soltec Power Holding SA、Netshield South Africa 和 PowerWay Renewable Energy。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按轴型分

- 单轴

- 两轴

- 按地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- NexTracker Inc.

- PV Hardware

- Soltec Power Holdings SA

- Netshield South Africa

- PowerWay Renewable Energy Co Ltd.

- Trina Solar Co Ltd.

- Caracel Engineering

- Arctech Solar Holding Co Ltd.

- Valmont Industries Inc.

- Array Technologies Inc.

第七章 市场机会及未来趋势

The Middle East and Africa Solar Tracker Market is expected to register a CAGR of 18.36% during the forecast period.

The COVID-19 pandemic did not have any major effect on the solar tracker market in the region. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, the solar tracker market in the Middle East and African region is expected to have remarkable progress due to the availability of highly sun-drenched regions for solar projects, low labor costs, and availability of cheap and sunny desert land for utility-scale solar projects.

- On the other hand, the aggressive competition from other renewable energy sources, like hydrogen and wind, is expected to challenge the market's growth in the near future.

- Nevertheless, as solar trackers increase the solar power generating capacity of solar panels, they are recommended for utility-scale solar power projects. Thus, the growing focus of the region on utility-scale solar projects results in ample opportunities for the market.

- The market in Saudi Arabia is expected to grow at a faster rate due to the government's efforts to expand the solar power share and the interest from private investors.

MEA Solar Tracker Market Trends

Single-Axis Trackers Expected to Witness Significant Growth

- Single-axis trackers are devices in which only one angle is used as the axis of rotation. These trackers can increase the power production capacity by 30%. They provide simple, efficient, and low-cost options to improve the functioning of solar energy systems.

- The solar energy progress is reaching a zenith in the Middle East and African (MENA) region due to the dropping solar PV prices and success in CSP power generation. The solar PV capacity in the Middle East was around 7.96 GW in 2021 after crossing consistent growth. The proliferation of utility-scale projects was also one of the reasons behind the growth. Countries like the UAE, Saudi Arabia, and South Africa were beaming in that portfolio.

- For example, in May 2022, Emirates Water and Electricity Company (EWEC) called for applications for a utility-scale solar project in the Al-Ajban area of Abu Dhabi, with a power-generating capacity of 1,500 MW. Utility-scale projects highly demand single-axis trackers in the region due to the low cost and simple installation.

- Additionally, in May 2022, a solar power plant in South Africa got commissioned by Gold Miner, which features single-axis solar trackers supplied by STI Norland, which is owned by the Array Technologies company. The 10 MW power plant is the first solar PV facility of this capacity to be commissioned by the gold mining company.

- Such developments are expected to steer the single-axis solar trackers market in the MENA region in the near future.

Saudi Arabia Expected to Witness Significant Growth

- The Saudi Arabia solar PV market has grown substantially in the last decade, primarily due to two factors, the falling solar PV costs and the favorable government policies for an augmented growth of the renewable energy sector.

- The country has witnessed a huge number of solar PV installations on a utility-scale and in the commercial segment. In May 2022, the solar PV installed capacity was around 3 GW in the country, which is enough to power 600,000 homes. The Saudi government has pledged to generate 50% of its electricity from renewable sources, with solar energy playing the central role. As of 2021, the solar energy generation in the country was around 0.8 TWh, which still needs to improve a lot.

- The growing solar PV projects have led to the demand for solar trackers in the country. For example, in 2022, PV Hardware, the leading global solar tracker manufacturing company, opened a new solar tracker factory in Jeddah, Saudi Arabia. The production facility is expected to produce around 8 GW of solar trackers per year for solar plants.

- Furthermore, in 2022, the same company clinched a contract for the supply of 387 MWp of its Monoline 2V bifacial solar trackers for the Jeddah Noor PV solar project located in the Makkah province of Saudi Arabia.

- Owing to such developments, the country is expected to grow at a faster rate in the solar tracker market during the forecast period.

MEA Solar Tracker Industry Overview

The Middle East and African solar tracker market is moderately fragmented. Some of the key players in the market (in no particular order) include NexTracker Inc., PV Hardware, Soltec Power Holding SA, Netshield South Africa, and PowerWay Renewable Energy Co Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Axis Type

- 5.1.1 Single Axis

- 5.1.2 Dual Axis

- 5.2 By Geography

- 5.2.1 United Arab Emirates

- 5.2.2 Saudi Arabia

- 5.2.3 South Africa

- 5.2.4 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 NexTracker Inc.

- 6.3.2 PV Hardware

- 6.3.3 Soltec Power Holdings SA

- 6.3.4 Netshield South Africa

- 6.3.5 PowerWay Renewable Energy Co Ltd.

- 6.3.6 Trina Solar Co Ltd.

- 6.3.7 Caracel Engineering

- 6.3.8 Arctech Solar Holding Co Ltd.

- 6.3.9 Valmont Industries Inc.

- 6.3.10 Array Technologies Inc.