|

市场调查报告书

商品编码

1635529

英国建筑幕墙:市场占有率分析、产业趋势与成长预测(2025-2030)UK Facade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

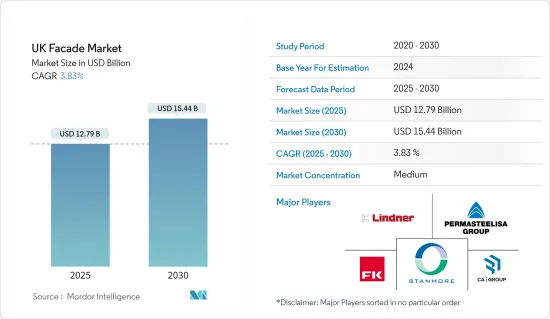

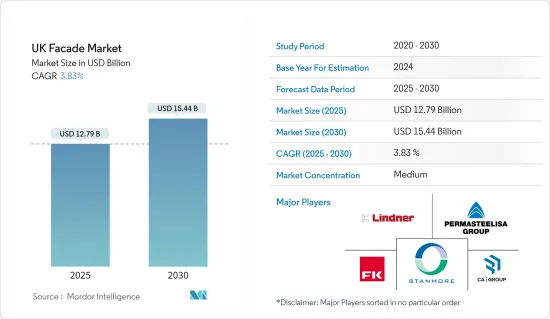

英国建筑幕墙市场规模预计到 2025 年为 127.9 亿美元,预计到 2030 年将达到 154.4 亿美元,预测期内(2025-2030 年)复合年增长率为 3.83%。

主要亮点

- 在都市化、现代化和对永续性的关注的推动下,英国建筑幕墙市场正在经历强劲成长。这种快速成长反映了政府加强基础设施发展的倡议。特别是,英国政府累计10 亿英镑(12.7 亿美元),以促进住宅建筑中不安全包层的修復。此举突显了我们对提高建筑安全标准的坚定承诺,特别是在格伦菲尔大厦火灾悲剧发生后。此类资金对于继续努力确保住宅遵守安全法规至关重要,同时增加全国范围内对更安全的建筑幕墙材料的需求。此措施解决了紧迫的安全问题,同时引导建筑幕墙市场在建筑设计中采用高性能、相容的材料。

- 市场成长的另一个关键驱动力是英国政府对永续性和能源效率坚定不移的承诺。例如,截至2024年10月,英国政府推出了新的建筑法规,要求新建商业建筑将二氧化碳排放减少27%。此举突显了政府对建筑幕墙市场永续性的坚定承诺。此类法规支援采用先进的建筑幕墙材料,以提高热性能并减少对环境的影响。因此,对环保建筑幕墙的需求不断增加,例如由回收材料製成的建筑幕墙或带有整合式太阳能电池板的建筑幕墙。透过这些永续倡议,政府旨在减少建筑业的碳排放,并实现 2050 年实现净零排放的宏伟目标。

- 商业领域正在蓬勃发展,充满了引人注目的计划,所有这些都需要最先进的建筑幕墙解决方案。例如,该行业机构报告称,2024年第三季度,英国商业房地产投资12个月累计值连续第二季成长。这些商业项目,包括建造新车站和设施,为建筑幕墙製造商提供了利润丰厚的机会。这些发展不仅扩大了对建筑幕墙的需求,也鼓励建筑师和建筑幕墙专家之间的合作,并推动创造独特设计的愿望。

- 创新正在英国建筑幕墙市场掀起波澜。将智慧技术融入建筑幕墙设计中,为更大的客製化和功能打开了大门,将美学吸引力与性能相结合。自清洁表面和发电建筑幕墙等尖端功能的兴起标誌着支持永续性的建筑外墙的转向。此外,数位工具允许建筑师创建复杂的设计,无缝地融合功能和视觉吸引力。

英国建筑幕墙市场趋势

英国建筑幕墙市场在商业繁荣中蓬勃发展

英国的智慧城市运动正在迅速加速,人们对复杂的建筑幕墙解决方案的需求日益增长。城市中心优先考虑提高生活品质的环境,同时限制其生态足迹。根据《建筑新闻》报道,Permasteelisa 最近收购了位于伦敦舰队街的索尔兹伯里广场开发项目的建筑幕墙套件,这就是这一趋势的证明。这些倡议凸显了商业企业对建筑幕墙永续性的集体承诺,开发商的目标是打造将功能性和环境管理无缝融合的建筑。

一项由政府主导的支持永续建筑的倡议正在重塑建筑幕墙景观。英国政府正式报告称,严格的建筑法规要求新建商业建筑大幅减少二氧化碳排放。这项监管措施刺激了对节能帷幕建筑幕墙系统的投资,符合英国政府的永续性议程。因此,开发商被能够提高热性能和降低能源消耗的创新材料和技术所吸引,从而加强了国家的整体永续性目标。

总之,在大型基础设施计划、智慧城市计画和严格的永续性法规的推动下,英国建筑幕墙市场正在经历一段变革时期期。这些因素正在推动建筑幕墙开发的创新和成长,将市场定位为国家建筑和环境策略的关键要素。

英国政府措施推动建筑幕墙市场成长

英国政府透过一系列资助计画积极支持先进建筑幕墙解决方案的开发。特别是,2024 年 9 月更新的公共部门脱碳计画为旨在提高能源效率和减少碳排放的公共机构提供财政支持。此举不仅激励市政当局和公共机构采用可提供更好的热性能和永续性的现代建筑幕墙系统,而且还创造了一个接受创新建筑幕墙设计的环境。

同时,英国政府正在透过绿色家园津贴住房升级津贴(HUG) 等倡议支持建筑幕墙开发,作为永续城市成长的一部分,这些计画将于 2024 年 6 月实施。这些计划鼓励住宅维修建筑幕墙,以改善隔热效果并减少能源使用。这些措施直接促进了建筑幕墙技术的进步,符合国家永续性目标并振兴建筑幕墙市场。节能建筑幕墙维修需求的快速成长将刺激建筑幕墙製造商之间的创新并加剧竞争。

总而言之,英国政府的针对性倡议正在为建筑幕墙市场的发展提供重大推动力。透过鼓励对节能和永续建筑幕墙解决方案的投资,这些计划不仅可以实现环境目标,还可以为市场创新和成长创造机会。

英国建筑幕墙产业概况

由于市场上存在多个参与者,英国建筑幕墙市场本质上是分散的,没有主要参与者占据重要的市场占有率。 Permasteelisa、Lindner Exteriors、FK Group、Stanmore、CA Group 是市场上的主要企业。商业建筑中建筑幕墙的日益普及可能会为新进入者创造机会。然而,这些小企业必须面对现有大企业的激烈竞争。

市场上的主要参与者提供多样化的产品以超越竞争对手。同时,新兴企业也带着尖端产品和技术整合进入市场。此外,一些公司正在投资研发,开发建筑幕墙建筑新材料,增加市场占有率。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 目前的市场状况

- 市场驱动因素

- 建设活动增加

- 技术进步

- 市场限制因素

- 经济波动

- 供应链中断

- 市场机会

- 模组化和预製建筑幕墙

- 智慧建筑幕墙

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 洞察市场中不断变化的消费行为

- 市场中政府监管的见解

- 市场技术进步的见解

- 地缘政治与疫情如何影响市场

第五章市场区隔

- 按类型

- 通风的

- 不通风

- 其他的

- 按材质

- 玻璃

- 金属

- 塑胶纤维

- 石材

- 其他的

- 按用途

- 商业的

- 住宅

- 其他的

第六章 竞争状况

- 市场集中度概况

- 公司简介

- Permasteelisa

- Lindner Exteriors

- FK Group

- Stanmore

- CA Group

- McMullen Facades

- Yuanda

- Lee Marley

- Swift Brickwork

- Alucraft Systems

- EAG*

第七章英国建筑幕墙市场的未来

第8章附录

The UK Facade Market size is estimated at USD 12.79 billion in 2025, and is expected to reach USD 15.44 billion by 2030, at a CAGR of 3.83% during the forecast period (2025-2030).

Key Highlights

- The UK facade market is witnessing robust growth, fueled by urbanization, modernization, and an intensified emphasis on sustainability. This surge mirrors government initiatives designed to bolster infrastructure development. Notably, the UK government has earmarked Pound 1 billion (USD 1.27 billion) in 2024 to expedite the remediation of unsafe cladding on residential buildings. This move underscores a deep-seated commitment to elevating building safety standards, especially in the wake of the Grenfell Tower fire tragedy. Such funding is integral to ongoing endeavors ensuring residential buildings adhere to safety regulations, simultaneously amplifying the demand for safer facade materials nationwide. While addressing pressing safety concerns, this initiative also steers the facade market towards the adoption of high-performance, compliant materials in architectural designs.

- Another pivotal driver of the market's growth is the UK government's unwavering dedication to sustainability and energy efficiency. For instance, as of October 2024, the UK government has rolled out new building regulations mandating a 27% reduction in CO2 emissions for new commercial structures. This move underscores the government's robust commitment to sustainability within the facade market. Such regulations champion the adoption of advanced facade materials, bolstering thermal performance and curtailing environmental impact. Consequently, there's an uptick in demand for eco-friendly facades, including those crafted from recycled materials or equipped with integrated solar panels. Through these sustainable initiatives, the government aspires to slash the construction sector's carbon footprint, aligning with its ambitious target of achieving net-zero emissions by 2050.

- The commercial sector is bustling, with a slew of high-profile projects in the pipeline, all necessitating cutting-edge facade solutions. For instance, as reported by Industry Associations, in Q3 2024, the rolling 12-month value of commercial real estate investments in the UK saw a rise for the second straight quarter. These commercial undertakings, including the construction of new stations and facilities, present lucrative opportunities for facade manufacturers. Such developments not only amplify the demand for facades but also foster collaboration between architects and facade specialists, driving unique design aspirations.

- Technological innovations are making waves in the UK facade market. The infusion of smart technologies into facade designs paves the way for heightened customization and functionality, marrying aesthetic allure with performance. Cutting-edge features like self-cleaning surfaces and energy-generating facades are on the rise, signaling a pivot towards building envelopes that champion sustainability. Furthermore, digital tools empower architects to craft intricate designs that seamlessly blend functionality with visual appeal.

UK Facade Market Trends

UK's Facade Market Thrives Amidst Commercial Boom

The UK's burgeoning smart city movement further amplifies the appetite for sophisticated facade solutions. Urban centers are prioritizing environments that uplift quality of life while curbing ecological footprints. A testament to this trend is Permasteelisa's recent acquisition of the facade package for the GBP 300 million (USD 382.77 million) Salisbury Square development on Fleet Street, London as reported by Construction News. Such moves underscore a collective commitment to facade sustainability in commercial ventures, with developers aiming for buildings that seamlessly blend functionality with environmental stewardship.

Government-led initiatives championing sustainable construction are reshaping the facade landscape. Stringent building regulations now mandate significant CO2 emission reductions for new commercial edifices as reported officially by the UK Government. This regulatory push has catalyzed heightened investments in energy-efficient facade systems, aligning with the UK Government's sustainability agenda. Consequently, developers are gravitating towards innovative materials and technologies that bolster thermal performance and curtail energy consumption, reinforcing the nation's overarching sustainability objectives.

In conclusion, the UK's facade market is undergoing a transformative phase, driven by large-scale infrastructure projects, smart city initiatives, and stringent sustainability regulations. These factors collectively foster innovation and growth in facade development, positioning the market as a critical component of the nation's construction and environmental strategies.

UK Government Initiatives Propel Facade Market Growth

The UK government is actively backing the development of advanced facade solutions through a series of funding programs. Notably, the Public Sector Decarbonisation Scheme, updated in September 2024, offers financial aid to public entities aiming to boost energy efficiency and cut carbon emissions. This move not only motivates local authorities and public institutions to adopt modern facade systems for better thermal performance and sustainability but also cultivates an environment ripe for innovative facade designs.

In a parallel effort, the UK government, through initiatives like the Green Homes Grant and Home Upgrade Grant (HUG) schemes rolled out in June 2024, is championing facade development as part of sustainable urban growth. These programs incentivize homeowners to undertake facade upgrades that enhance insulation and curtail energy use. Such efforts directly contribute to the advancement of facade technologies, aligning with the nation's sustainability objectives while invigorating the facade market. As the demand for energy-efficient facade renovations surges, it spurs heightened innovation and competition among facade manufacturers.

In conclusion, the UK government's targeted initiatives are significantly driving the development of the facade market. By fostering investments in energy-efficient and sustainable facade solutions, these programs are not only addressing environmental goals but also creating opportunities for innovation and growth within the market.

UK Facade Industry Overview

The UK facade market is fragmented in nature considering the presence of several players in the market, with the major players not holding significant market share. Permasteelisa, Lindner Exteriors, FK Group, Stanmore, and CA Group are some of the major players in the market. The increasing popularity of facades in commercial construction will create opportunities for new players to enter the market. Still, these small players have to face fierce competition from established major players.

Major players in the market offer diverse products to outpace competitors. Meanwhile, start-ups are entering the fray with cutting-edge products and tech integration. Additionally, some players are channeling investments into R&D, aiming to develop novel materials for facade construction, seeking to bolster their market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Drivers

- 4.2.1 Increasing Construction Activities

- 4.2.2 Technological Advancements

- 4.3 Market Restraints

- 4.3.1 Economic Fluctuations

- 4.3.2 Supply Chain Disruptions

- 4.4 Market Opportunities

- 4.4.1 Modular and Prefabricated Facades

- 4.4.2 Smart Facades

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Changes in Consumer Behavior in the Market

- 4.8 Insights on Government Regulations in the Market

- 4.9 Insights on Technological Advancements in the Market

- 4.10 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Ventilated

- 5.1.2 Non-ventilated

- 5.1.3 Others

- 5.2 By Material

- 5.2.1 Glass

- 5.2.2 Metal

- 5.2.3 Plastics and Fibres

- 5.2.4 Stone

- 5.2.5 Others

- 5.3 By Application

- 5.3.1 Commercial

- 5.3.2 Residential

- 5.3.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Permasteelisa

- 6.2.2 Lindner Exteriors

- 6.2.3 FK Group

- 6.2.4 Stanmore

- 6.2.5 CA Group

- 6.2.6 McMullen Facades

- 6.2.7 Yuanda

- 6.2.8 Lee Marley

- 6.2.9 Swift Brickwork

- 6.2.10 Alucraft Systems

- 6.2.11 EAG*