|

市场调查报告书

商品编码

1635536

北美电池製造设备:市场占有率分析、产业趋势、成长预测(2025-2030)North America Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

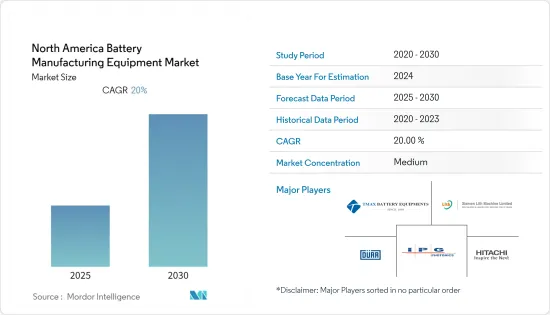

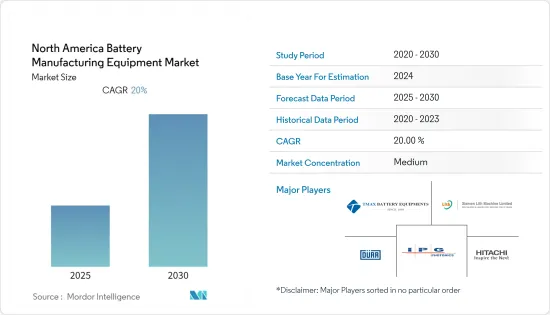

北美电池製造设备市场预计在预测期内复合年增长率为20%

主要亮点

- 从长远来看,电动车的渗透预计将推动市场发展。

- 另一方面,缺乏製造电池製造设备的公司极大地阻碍了市场的成长。

- 更高容量和更低放电率等各种技术的进步预计将使电池设备製造变得更加可行和高效,从而在电池製造设备市场创造巨大的商机。

- 由于该地区对电动车的高需求以及该领域技术的快速发展,预计美国将成为预测期内最大的市场。预计将进一步成长。

北美电池製造设备市场趋势

主导市场的汽车细分市场

- 近年来,北美地区对电动车的需求大幅成长。根据国际能源总署(IEA)预测,2021年北美电动车保有量将比2020年成长18.85%。 2021年电动车销量总合232万辆,高于2020年的195.2万辆。预计在预测期内类似的趋势将持续下去,显示电池设备製造市场的成长不断扩大。

- 此外,随着电动车需求的增加,汽车製造商正在为所有车辆类别开发不同形状和设计的电动车,以增加汽车销售。这种车辆设计的客製化为电池製造提供了巨大的成长机会,以满足汽车製造商的期望。

- 此外,各地区政府对电动车采用的支持措施、法规和政策以及财政奖励也使汽车产业受益。

- 例如,美国联邦政府的目标是到 2030 年销售的新车中有一半是零排放汽车,并创建一个由 50 万个充电桩组成的便捷、公平的网络,以便每个美国都可以购买电动车,目标是使其远距在国内使用。

- 因此,电动车需求的增加和政府的支持措施预计将使汽车产业成为预测期内成长最快的领域。

美国主导市场

- 美国正在努力减少其碳排放。该国已签署了各种绿色倡议,以实现其排放目标。此外,公众意识和多个相关人员要求遵守永续能源计画的压力也越来越大,该国的电池製造设备市场预计将扩大。

- 此外,由于技术不断进步,该地区对电子产品和设备的需求非常高。此外,每年都有许多 IT 公司向该国扩张。由于对电池供电设备的高需求,这些公司也正在推动电池设备製造市场。

- 为了减少对其他国家需求的依赖,美国政府制定了各种制度和财政激励措施来提高国内电池製造能力。这些奖励预计将在预测期内增加美国的製造能力。

- 2022 年 10 月,美国能源部宣布津贴28 亿美元,以促进美国电动车电池及其製造过程中使用的矿物的生产。这些津贴向至少 12 个州的计划提供,是美国政府为打破美国目前在绿色能源革命组成部分方面对中国和其他国家的依赖而采取的最新倡议。

- 因此,由于电池製造设备市场的产量增加、技术进步和政府支持措施,预计美国将在预测期内主导市场。

北美电池製造设备产业概况

北美电池製造设备市场适度细分。该市场的主要企业(排名不分先后)包括厦门力思机械有限公司、IPG Photonics Corporation、Durr AG、日立和厦门天迈电池设备有限公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 机器类型

- 涂料及干燥机

- 日历

- 狭缝

- 混合

- 电极堆迭

- 组装及搬运机

- 成型/检查机

- 最终用户

- 车

- 工业的

- 其他的

- 2028 年之前的市场规模和需求预测(按地区)

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Duerr AG

- Schuler AG

- Xiamen Lith Machine Limited

- IPG Photonics Corporation

- Hitachi Ltd

- Xiamen Tmax Battery Equipments Limited

- ACEY New Energy Technology

- InoBat

- Andritz AG

第七章 市场机会及未来趋势

简介目录

Product Code: 93582

The North America Battery Manufacturing Equipment Market is expected to register a CAGR of 20% during the forecast period.

Key Highlights

- Over the long term, the increasing adoption of electric vehicles is expected to drive the market.

- On the other hand, the shortage of companies manufacturing battery equipment significantly hinders the market's growth.

- Nevertheless, the increasing technological advancements in various technologies like higher capacity and low discharge rate is expected to make the manufacturing of battery equipment more feasible and efficient and create enormous opportunities for the battery manufacturing equipment market.

- The United States is expected to be the largest market in the forecast period due to the region's high demand for electric vehicles and rapidly developing technology in the segment. It is expected to facilitate further growth.

North America Battery Manufacturing Equipment Market Trends

Automotive Segment to Dominate the Market

- In recent years the demand for electric vehicles in North America has grown significantly. According to International Energy Agency, the number of electric vehicles in North America increased by 18.85 % in 2021 compared to 2020. In 2021 a total of 2320,000 units of electric vehicles were sold, compared to 1952,000 in 2020. A similar trend is expected to be followed during the forecast period, which indicates the increasing growth of the battery equipment manufacturing market.

- Additionally, as the demand for electric vehicles grows, automakers are developing electric vehicles of various forms and designs for all car categories to increase vehicle sales. This customization in automotive design presents a substantial growth opportunity for battery manufacturing to fulfill automobile manufacturers' expectations.

- Furthermore, the government's supportive policies, regulations, and financial incentives for adopting electric vehicles in their regions have benefited the automobile sector.

- For instance, The Federal Government of the United States has set a goal to make half of all new vehicles sold in the U.S. in 2030 zero-emissions vehicles and to build a convenient and equitable network of 500,000 chargers to help make EVs accessible to all Americans for both local and long-distance trips.

- Hence, the automotive sector is expected to be the fastest-growing segment in the forecast period due to increased demand for electric vehicles and supportive government policies.

United States to Dominate the Market

- The United States has been working on reducing its carbon emission. The country has signed various green initiatives in order to meet its emissions target. Additionally, awareness amongst the public and pressure from multiple stakeholders has also increased weighed in to follow the sustainable energy programs, which is expected to increase the battery manufacturing equipment market in the country.

- Moreover, the region has a significantly high demand for electronic gadgets and devices due to increasing technological advancements. Also, the country has a high number of information technology companies expanding every year. It is also driving the battery equipment manufacturing market as these companies have a high demand for battery-operated devices.

- The United States government has launched various schemes and financial incentives to boost its domestic battery manufacturing capacity to reduce its dependency on other countries to meet their demands. These incentives are expected to increase the manufacturing capacity of the United States during the forecasted period.

- In October 2022, the Department of Energy announced that it is awarding USD 2.8 billion in grants to boost U.S. production of electric vehicle batteries and the minerals used to build them. The grants, which are going to projects across at least 12 states, mark the latest push by the United States administration to help reduce the country's dependence on China and other nations for the building blocks of the green energy revolution.

- Hence, the United States is expected to dominate the market in the forecast period due to increased production, technological advancements, and supportive government policies in the battery equipment manufacturing market.

North America Battery Manufacturing Equipment Industry Overview

The North America Battery Manufacturing Equipment Market is moderately fragmented. Some of the key players in this market (in no particular order) are Xiamen Lith Machine Limited, IPG Photonics Corporation, Durr AG, Hitachi Ltd, and Xiamen Tmax Battery Equipments Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Machine Type

- 5.1.1 Coating & Dryer

- 5.1.2 Calendaring

- 5.1.3 Slitting

- 5.1.4 Mixing

- 5.1.5 Electrode Stacking

- 5.1.6 Assembly & Handling Machines

- 5.1.7 Formation & Testing Machines

- 5.2 End User

- 5.2.1 Automotive

- 5.2.2 Industrial

- 5.2.3 Other End Users

- 5.3 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Duerr AG

- 6.3.2 Schuler AG

- 6.3.3 Xiamen Lith Machine Limited

- 6.3.4 IPG Photonics Corporation

- 6.3.5 Hitachi Ltd

- 6.3.6 Xiamen Tmax Battery Equipments Limited

- 6.3.7 ACEY New Energy Technology

- 6.3.8 InoBat

- 6.3.9 Andritz AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219