|

市场调查报告书

商品编码

1636103

南美太阳能追踪器 -市场占有率分析、行业趋势、成长预测(2025-2030)South America Solar Tracker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

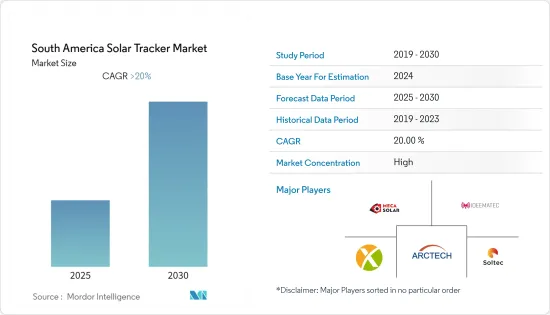

预计南美太阳能追踪器市场在预测期内的复合年增长率将超过 20%。

由于能源需求下降,市场受到 COVID-19 大流行的影响,导致多个计划被推迟。然而,市场已强劲復苏,预计在预测期内将实现稳定成长。

主要亮点

- 从长远来看,为了实现环境目标和满足该地区不断增长的能源需求,对廉价清洁能源的需求不断增长,加上政府的支持措施,预计将在预测期内推动市场发展。

- 另一方面,南美太阳能市场的住宅/商业部分(主要由屋顶安装系统且不包括追踪器)的成长预计将在预测期内抑制市场。

- 实用化人工智慧和物联网追踪太阳的运动并最大限度地提高发电量预计将成为预测期内市场的主要成长机会。

- 预计巴西将成为预测期内最大的市场,大部分需求来自太阳能。

南美洲太阳能追踪器市场趋势

单轴细分市场占据主导地位

- 通常,太阳能追踪系统会透过移动反射表面或太阳能电池板的表面来追踪太阳。太阳能追踪器可以比传统电池板多产生 40% 的太阳能。由于更先进、更有效的太阳能捕获技术,太阳能追踪器被应用于家用和商务用太阳能板。

- 单轴追踪器通常沿着太阳的方向从东向西移动。单轴追踪器是指仅使用一个角度作为旋转轴的追踪器。这种追踪器可以多产生30%以上的功率。这些追踪器描述了一种快速、简单且经济实惠的方法来提高太阳能装置的性能。

- 此外,单轴太阳能追踪器在全球市场上普遍被接受,因为与双轴追踪器相比,单轴太阳能追踪器相对便宜且结构较不复杂。单轴太阳能追踪器根据其倾斜和对准方向有多种不同的配置。

- 增加正在进行和即将进行的计划的电力容量对政府和能源公司来说是一个挑战。单轴太阳能追踪器增加20%-30%的容量是非常有用的。预计这将为预测期内从事单轴太阳能追踪系统生产的企业创造良好的前景。

- 2021年,南美洲太阳能发电总设备容量为3,266千万瓦。与前一年同期比较,年增率约为58%,发电量预计将增加。透过使用单轴太阳能追踪器,可以进一步提高发电能力,从而在预测期内为单轴太阳能追踪器领域创造机会。

- 综上所述,单轴太阳能追踪器市场预计在预测期内将出现显着的市场成长。

巴西预计将成为最大的区域市场

- 巴西是全球成长最快的太阳能市场之一,由于全国对廉价再生能源的需求预计将迅速扩大,该国的太阳能市场也将在预测期内成长。

- 根据国际可再生能源机构(IRENA)预测,截至2022年,太阳能发电装置容量将达到2,407万千瓦,成为巴西第三大电力源。

- 为了透过确保太阳能供应链的安全来推动该国太阳能产业的发展,该国正在对太阳能製造业进行重大投资,其中包括比亚迪于2022 年9 月宣布的投资。 ,包括新建一座巴西太阳能光电模组工厂。

- 此外,在太阳能追踪器等太阳能发电设备的研发方面也进行了大量投资。 2022 年 8 月,NextCracker 与 FIT (Flex Instituto de Tecnologia) 合作推出巴西太阳能卓越中心 (CFSE),这是南美洲最大的太阳能追踪器研发设施。该设施预计将涵盖太阳能追踪系统整个生命週期的研究和开发,包括结构、机械和电气设计、施工、营运和维护。

- 由于日本太阳能发电业务的成长,对太阳能追踪器的需求也在增加。例如,2022年11月,天合光能收到了订单,为巴西圣露西亚太阳能园区提供使用SuperTrac人工智慧优化的520兆瓦Vanguard 1P智慧追踪器。同样,2022年7月,Arctech与Mori Energia签署协议,为巴西168MW Skyline计划供应太阳能追踪器。

- 这些发展表明巴西太阳能业务的快速成长,预计将在预测期内推动太阳能追踪器市场的成长。

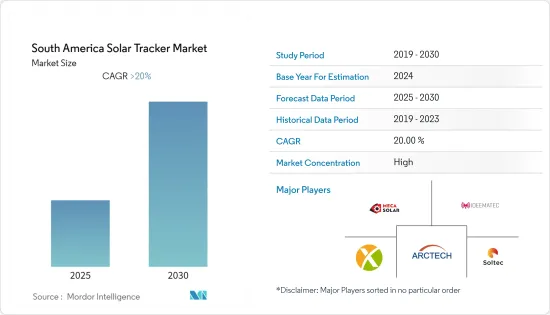

南美洲太阳能追踪器产业概况

南美太阳能追踪器市场正在整合。主要企业(排名不分先后)包括 Arctech Solar Holding、MecaSolar、Ideatec Deutschland GmbH、Soltec Power Holdings SA 和 Nextracker Inc。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按轴型分

- 单轴

- 两轴

- 按国家/地区

- 巴西

- 智利

- 阿根廷

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- Companies Profiles

- Soltec Power Holdings SA

- Arctech Solar Holding Co. Ltd.

- MecaSolar

- Ideematec Deutschland GmbH

- Nextracker Inc.

- DCE Solar

- Valmont Industries Inc.

- PV Hardware

- Solar Flexrack

- Array Technologies Inc.

第七章 市场机会及未来趋势

The South America Solar Tracker Market is expected to register a CAGR of greater than 20% during the forecast period.

The market was moderately affected by the COVID-19 pandemic due to falling energy demand, which led to several projects being delayed. However, the market has rebounded strongly and is expected to grow steadily during the forecast period.

Key Highlights

- Over the long term, rising demand for cheap, clean energy to achieve environmental targets and cater to the region's growing energy demands, combined with supportive government policies, is expected to drive the market during the forecast period.

- On the flip side, the growth of the residential and commercial segments in the South American solar PV market, which are almost exclusively rooftop-mounted systems with no trackers, is expected to restrain the market during the forecast period.

- Nevertheless, the commercialization of the usage of artificial intelligence and the Internet of Things to track the sun's movement and maximize power output is expected to be a significant growth opportunity for the market during the forecast period.

- Brazil is expected to be the largest market during the forecast period, with the majority of the demand coming from solar photovoltaic energy.

South America Solar Tracker Market Trends

Single-Axis segment to dominate the market

- Typically, a solar tracking system moves reflecting surfaces or the solar panel's face to track the sun. Solar trackers can produce up to 40% more energy from the sun compared to conventional panels. Due to more advanced and effective sun-trapping technology, solar trackers are being employed in both household and commercial-grade solar panels.

- Single-axis trackers typically follow the sun's direction and travel from east to west. Single-axis trackers only use one angle as the rotational axis. More than 30% more electricity can be produced with this kind of tracker. These trackers offer a quick, easy, and affordable approach to enhancing the performance of solar installations.

- Moreover, due to their relatively low cost and less sophisticated construction than dual-axis trackers, single-axis solar trackers are generally accepted on the global market. Single-axis solar trackers are offered in several different configurations, depending on their tilt and alignment direction.

- Increasing the electricity capacity for ongoing and upcoming projects is challenging for governments and energy firms. The 20%-30% capacity increase on single-axis solar trackers can be very helpful. This, in turn, is anticipated to generate sizable prospects for businesses engaged in the production of single-axis solar tracking systems during the forecast period.

- In 2021, the total solar PV installed capacity in South America accounted for 32.66 GW. With an annual growth rate of around 58% as compared to the previous year, the generation is expected to grow. Using the single-axis solar trackers can increase the generation capacity further, thus creating an opportunity for the single-axis solar trackers segment in the forecast period.

- Hence, owing to the above points, the single-axis solar trackers segment will likely see significant market growth during the forecast period.

Brazil expected to be the largest geographical segment

- Brazil is one of the fastest-growing solar PV markets globally, and as the demand for cheap renewable power increases across the country rapidly, the country's solar PV market is also expected to expand rapidly during the forecast period.

- According to the International Renewable Energy Agency (IRENA), as of 2022, solar PV installed capacity reached 24.07 GW and became the 3rd largest source of Brazilian electricity.

- To drive the country's solar sector by securing the solar supply chain, the country witnessed large investments in the solar manufacturing sector, with significant investments in the solar PV module manufacturing facilities, such as BYD's new solar PV module factory in Brazil, announced in September 2022.

- Additionally, significant investments are being made in the R&D of solar equipment, such as solar trackers. In August 2022, Nextracker partnered with FIT (Flex Instituto de Tecnologia) to launch South America's largest solar tracker R&D facility, the Brazil Center for Solar Excellence (CFSE). The facility is expected to encompass R&D across the full lifecycle of solar tracker systems, including structural, mechanical, and electrical design, construction, operation, and maintenance.

- Due to such growth in the utility solar segment in the country, the demand for solar trackers has also increased. For instance, in November 2022, Trina Solar received a contract for 520 MW of its Vanguard 1P smart trackers, optimized with SuperTrack artificial intelligence, for Brazil's Santa Luzia solar parks. Similarly, in July 2022, Arctech signed an agreement with Mori Energia for the supply of solar PV trackers for the 168 MW Skyline project in Brazil.

- Such developments demonstrate the rapid growth of the Brazilian utility solar segment, which is expected to drive the growth of the solar tracker market during the forecast period.

South America Solar Tracker Industry Overview

The South American solar tracker market is consolidated. Some of the major players (in no particular order) include Arctech Solar Holding Co. Ltd., MecaSolar, Ideematec Deutschland GmbH, Soltec Power Holdings SA, and Nextracker Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 By Axis Type

- 5.1.1 Single-Axis

- 5.1.2 Dual-Axis

- 5.2 By Country

- 5.2.1 Brazil

- 5.2.2 Chile

- 5.2.3 Argentina

- 5.2.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Companies Profiles

- 6.3.1 Soltec Power Holdings SA

- 6.3.2 Arctech Solar Holding Co. Ltd.

- 6.3.3 MecaSolar

- 6.3.4 Ideematec Deutschland GmbH

- 6.3.5 Nextracker Inc.

- 6.3.6 DCE Solar

- 6.3.7 Valmont Industries Inc.

- 6.3.8 PV Hardware

- 6.3.9 Solar Flexrack

- 6.3.10 Array Technologies Inc.